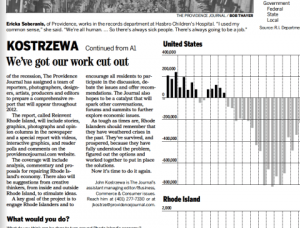

A new report from the Rhode Island Public Expenditure Council confirms an idea that RI Future has been reporting on for a month now, namely that state cuts to cities and towns are a big factor in the state’s struggling cities inabilities to balance their budgets.

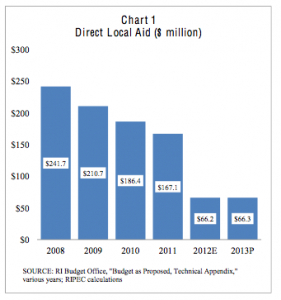

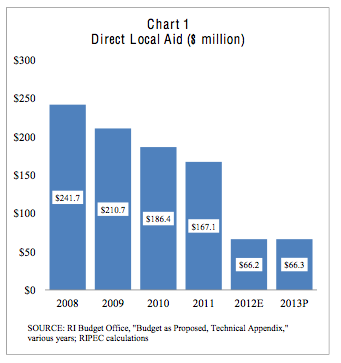

Since 2008, says the report, state aid to cities and towns has been slashed by more than $175 million, a reduction of 72.6 percent.

“Policy choices made by the state – specifically without accompanying mandate relief, and a provision for increasing state intervention for fiscally-stressed communities – increased the responsibility of municipalities to make changes to their fiscal structure,” reads the report. “In some cases, municipalities were able to effectively balance their budgets despite cuts to local aid. In other cases, however, municipalities made policy decisions to bridge budgetary gaps that did not result in long-term structural change.”

Ted Nesi reports this morning that the report backs up what RI Future has been reporting since early March.

“It lends credence to the argument made by Governor Chafee and others that much of the immediate crisis stemmed from the 73% reduction in non-education aid to cities and towns the General Assembly approved between 2007 and 2011.”

We first reported on this dynamic on March 5. A little more than a week later, we asked Governor Chafee about it, and he confirmed our theory. Here’s an excerpt from that story:

Governor Chafee said former Governor Don Carcieri and the General Assembly put struggling communities in peril when they cut some $195 million in state aid to cities and towns.

“It’s no wonder Providence is in trouble, it’s no wonder Pawtucket is having a trouble making payroll, it’s no wonder Central Falls went into bankruptcy,” he said after speaking at a conference on the state’s economy at Bryant University today. “They just couldn’t sustain those kinds of cuts. There is no property tax base to transfer those kinds of cuts onto.”

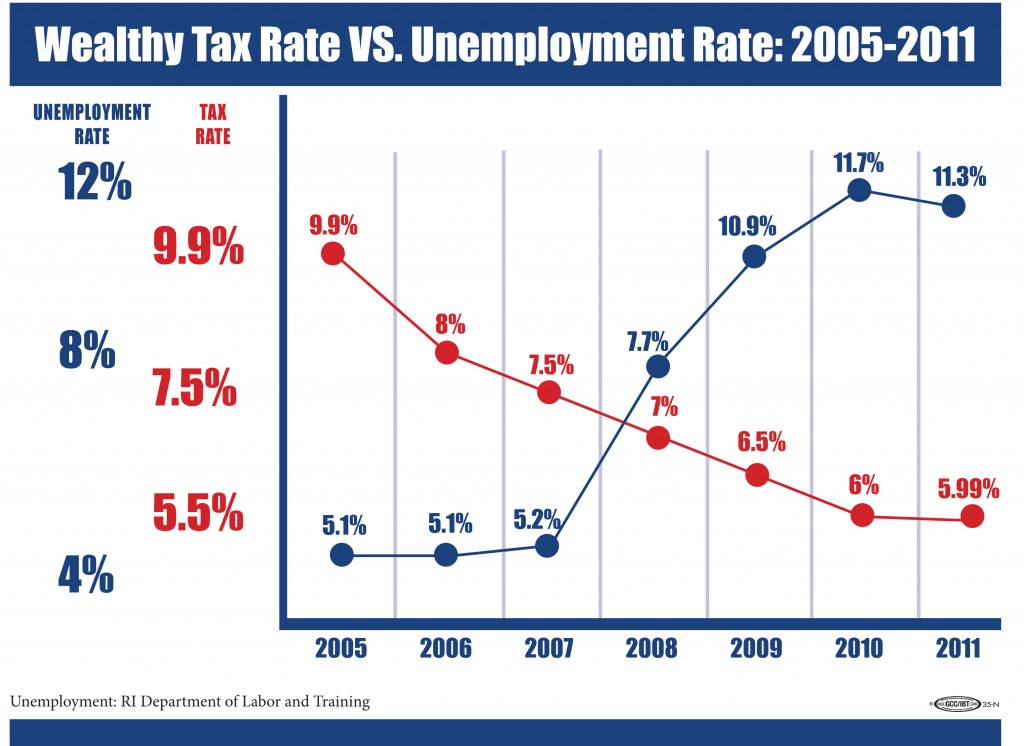

Chafee said Carcieri and the General Assembly essentially balanced the state’s budget by taking money away from cities and towns – a move that he said the state’s wealthy communities could withstand but the poorer communities could not.

“I thought it was the path of least resistance,” he said. “That way they could go and say we didn’t raise taxes but at the same time they did raise taxes on the property tax payers of those communities. It was a little disingenuous to say we’re not raising taxes when you are passing it down to the property tax payers of the distressed communities.”

But no one put it more bluntly than RI Future’s Libby Kimzey, who is running for a seat in the House of Representatives to represent Providence. At a Pecha Kucha event in February said, “Right now the State of Rhode Island is being a jerk to Providence. Those are decisions that state lawmakers have made that put the city in the position of closing schools and we’re having this whole conversation about cutting retirees benefits and it just gets me really worked up.”

Here’s the video from that:

For too long in Rhode Island, we’ve allowed the right-wing to portray struggling cities’ budget problems as exclusively the result of unfunded pension liabilities. The reality is top-own cuts from the state are far more a factor in why cash-strapped municipalities are having a hard time paying their bills.

Heard of South by Southwest, but can’t be in Austin yourself? Pop in daily to “Take 5 with Reza Rites” on RIFuture.org for photos and live updates about her adventures at the annual festival – or follow her on Twitter and Facebook @rezaclif. Besides blogging for RI Future, Reza will be recording interviews and footage for an election-year multimedia project being released in June, “Rhode 2 Africa: Elect the Arts 2012.”

Heard of South by Southwest, but can’t be in Austin yourself? Pop in daily to “Take 5 with Reza Rites” on RIFuture.org for photos and live updates about her adventures at the annual festival – or follow her on Twitter and Facebook @rezaclif. Besides blogging for RI Future, Reza will be recording interviews and footage for an election-year multimedia project being released in June, “Rhode 2 Africa: Elect the Arts 2012.”