Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

After its untimely death last year, carbon tax is back in the Rhode Island legislature. On March 7, the Energize RI sent out an email:

The Energize RI Act is about to take a big step forward: the hearing in front of the House Environment and Natural Resources Committee is planned for March 10th at the Rise of the House (details below). We need you to support the bill alongside over fifteen expert witnesses who will be demonstrating why carbon pricing is a win-win solution. Read on to learn more about the hearing, or shoot us an email, and we’ll help you draft your own testimony for the bill.

The goals of the bill are admirable:

(4) Reduce public health, public safety, economic, and natural resource impairment risks associated with climate change; and

(5) Meet the state emissions goals for 2035 as set by the “Resilient Rhode Island Act” in 2014.

Fortunately, the bill has various provisions that will address the problem that Camus summed up as: “It is no more immoral to directly rob citizens than to slip indirect taxes into the price of goods that they cannot do without.” To put it differently: we should be taxing the upper income brackets at the 1950s level of more than 90%.

The carbon tax collected under the Energize RI Act will be used as follows:

- 25% will be used for climate resilience, energy efficiency and conservation, and renewable energy programs that benefit low-income residential and small business properties.

- 30% is to be used to provide direct dividends to employers.

- 40% shall be used to provide direct dividends to residents.

- There will be 5% for administrative overhead.

Item #1 is an attempt to deal with the well-known criticism of a revenue neutral carbon tax:

If you want to maximize the economic benefit of those carbon tax revenues, it is widely known that public spending/investment is a better approach. Multipliers for public investment are much higher than for tax cuts.

One may wonder whether, as is the case in Connecticut, installing more natural gas will be counted as part of item #1: “Switching to natural gas couldn’t be easier,” Evensource advises its customers and then refers them to the Green Bank for financing. Would you put something like that past Governor Raimondo’s step-on-the-natural-gas Office of Energy Resources?

It’s wonderful to see that we are having this discussion and that our legislators continue to think seriously about how to deal with climate change. I certainly appreciate the efforts of the sponsors of the Energize RI Act, Representatives Regunberg, Handy, Carson, Tobon, and Bennett.

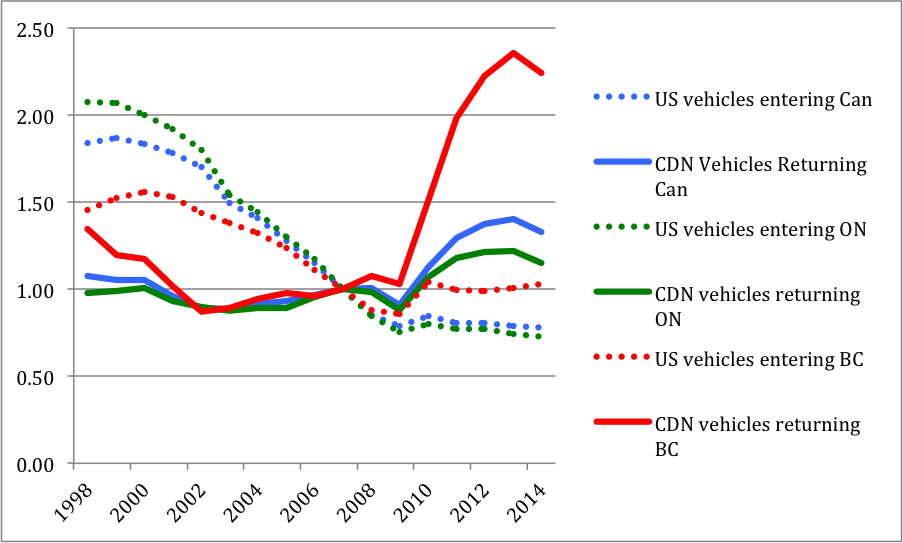

Undoubtedly, experts will testify about the success of British Columbia’s carbon neutral tax bill. Before we get too excited about an attempt to duplicate the BC success story in RI, it might help to look at the following graph, which is from a post with the ominous title “British Columbia’s Carbon Tax and ‘Leakage’ Into the U.S.”

As the post states:

The chart makes it clear that there was a giant surge in Canadian vehicles crossing from British Columbia into the United States (solid red line) starting shortly after introduction of the BC carbon tax (in mid-2008).

If this kind of leakage occurs in British Columbia, what do you expect for a small state like Rhode Island? The only feature of the bill that might avoid this problem is the tax itself: $15 per ton of CO2e. That boils down to ¢13 per gallon of gas. No sane person would believe that such a minimal tax will even remotely phase out fossil fuels. The bill may start a trend that might be followed by neighboring states, which indeed is the only way to avoid the “leakage” problem.

But, if setting a trend is the idea, it better be the right trend and this is the major problem with this bill. It contains a tax for methane that escapes unburned even out of state. That the bill recognizes this problem is a majors step forward, but the details matter. Getting so-called fugitive methane completely wrong is precisely why the national Clean Power Plan is a disaster.

According to the latest estimates, 12% of natural gas escapes and this is what is responsible for the fact that natural gas is worse for climate change than coal and oil for the next 50-100 years. Read more about this in Methane Leaks Erase Climate Benefit Of Fracked Gas, Countless Studies Find.)

To tax fugitive methane, the Energize RI Act will rely on numbers provided by the Energy Information Administration (EIA). The RI Office of Energy Resources, which will be responsible for the implementation of this part of the Energize RI Act, will rely on bad EIA numbers.

Even this February’s EPA publication (see page E13, line 13) still uses outdated numbers for the global warming potential of methane and amortizes its effect over next century. We only have about a decade, if even, to avoid a climate catastrophe. For more about time scales and the fugitive methane problem see Precaution the new aggression.

The EPA has a long history of underestimating fugitive methane. The upshot of these errors is that the Energize RI Act might set a trend of under-taxing fugitive methane by roughly a factor ten. Exxon Mobil —#ExxonKnew, our nation’s biggest fracker— undoubtedly loves this trend! None of this should come as a surprise: the head of EPA has been a political appointee since its inception in 1970. The good news is that I’ve been told that, if the Act is passed this year, its sponsors will try to amend it to fix the flaw in the present act.

Here are a couple of thoughts to end with. Ponder Wendell Berry observation:

Whether we and our politicians know it or not, Nature is party to all our deals and decisions, and she has more votes, a longer memory, and a sterner sense of justice than we do.

Let’s put in the context of climate science. As Hansen and Sato reiterate in their latest publication, Regional climate change and national responsibilities:

- Humanity must reduce its emissions by 5-7% per year as of today to stop the wild dash off the climate cliff.

- We, the industrialized carbon-debtor nations, have already outspent our greenhouse gas budget.

Finally, to add to your sense of reality, watch Hansen’s latest video, but don’t share it with the kids!

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387