In volume II of the budget, you’ll find there the Executive Office of Health and Human Services (EOHHS), which contains the Departments of Children Youth and Families (DCYF), Health (DoH), Human Services (DHS), and Behavioral Healthcare, Developmental Disabilities, and Hospitals (BHDDH).

In volume II of the budget, you’ll find there the Executive Office of Health and Human Services (EOHHS), which contains the Departments of Children Youth and Families (DCYF), Health (DoH), Human Services (DHS), and Behavioral Healthcare, Developmental Disabilities, and Hospitals (BHDDH).

Collectively these departments spend over $3 billion, about 40% of the overall budget. In the Governor’s budget, only about 40% of that is actual tax dollars, and the rest is either federal money or restricted receipts, such as fees for service.

The big kahuna in the Human Services budget is, of course, Medicaid, so we may as well begin there. The expense for Medicaid has been moved from the DHS budget to the umbrella EOHHS. This, of course, means nothing to the budget’s bottom line, only that the accounting for that expense appears on page B2-118 for years before FY12 and before, and on B2-12 for FY13 and beyond.

So much for where to find it. How much is it? The Medicaid budget for next year is projected to be $1.66 billion, approximately the same as was originally budgeted for this year.

The same as this year? But what about the skyrocketing medical inflation? It’s there, but masked by offsetting cuts in service. The “Managed Care” portion of Medicaid that you see in the breakdown of the Medicaid costs is also known as RIte Care, and it has more than doubled in ten years, though it still amounts to only about a third of all the Medicaid. The annual cost increase for Managed Care has been about 7.5% each year. Eligibility rules tightened, but demand increased, so that includes a very minor decrease in enrollment over that time. What’s worse, federal reimbursement paid for 55 cents of every dollar in 2003, almost 64 cents in 2010 (part of the stimulus package) and only 51 cents in 2013.

In order to control these costs, the state has added or increased co-pays and restricted eligibility several times in recent years. Apart from that, there has been little more than some studies and planning from Lt. Governor Elizabeth Roberts in response to this ongoing disaster—remember, this affects everybody, not just the state budget—and this year is no different. The Governor’s 2013 budget will cut all dental care for adults to save $2.7 million. “Refinements to Medicaid managed care programs” will save another $2.5 million [ES-56]. Lots of these refinements involve cutting services, though some, like providing more care through “Patient-Centered Medical Homes” are potentially good ideas, depending on how they’re implemented.

One problem with the push for managed care is that in some cases it may well insert a new layer of bureaucracy where none is needed. A director of a residential care provider pointed out to me that his agency is already providing managed care for most of their residents. That is, with the advice of a consistent array of medical professionals, the agency selects care options for its residents. This is pretty much what the medical home concept suggests. If new requirements simply force them to add a layer of doctors to what they’re already doing, it won’t necessarily reduce any costs or improve any care. (It also calls into question the cost savings estimates for the managed care push.)

The other big component of cost saving in Medicaid is a proposal to save another $14 million by simply paying 4% less for the care.

Paying less? Who knew you could just solve the health care cost problem so easily. Why didn’t we think of this years ago? But yes, the Governor’s budget proposes paying 4.14% less for all Medicaid coverage that require a monthly per-person fee (“capitation”). This is mostly Neighborhood Health Plan, though United Health also has a share of that market. Neighborhood, though, has the misfortune of being in the business of serving the Medicaid population almost exclusively, so they will be much harder hit than the other two. Obviously any cost cutting reform has to start somewhere, but it’s hard to see how this will do the trick.

It’s worth an aside here to mention one of the factors in health care cost inflation that seems never to come up in serious discussions of the rising cost of health care. After all, what’s the fastest-growing component of a medical practice’s expenses? More likely than not, it’s health insurance for its employees. For all the fancy machinery of modern medicine, it’s still a labor-intensive business. A giant facility like Rhode Island Hospital puts more than half its budget towards salaries, and a small practice will see an even higher fraction, 70% or more.

A physician’s assistant earning $65,000 a year is probably receiving a health benefit worth around 20% of that if he or she has a family. What’s more, all those pharmaceutical firms, medical device manufacturers, and bandage makers also have to deal with rising health care costs. In other words, a significant part of what an increase in health care costs pays for is… an increase in health care costs.

This sounds like a dopey little irony, but engineers call this a feedback loop, and electronic systems with less feedback than this also spiral out of control. Obviously there are plenty of factors driving health care inflation—not least the vast number of people who see health care as a way to get rich—but at root, linking health care and employment creates an unstable system, prone to amplify increases. Could that not be worth some attention?

Next: Food inspection dereliction

Read more from this series

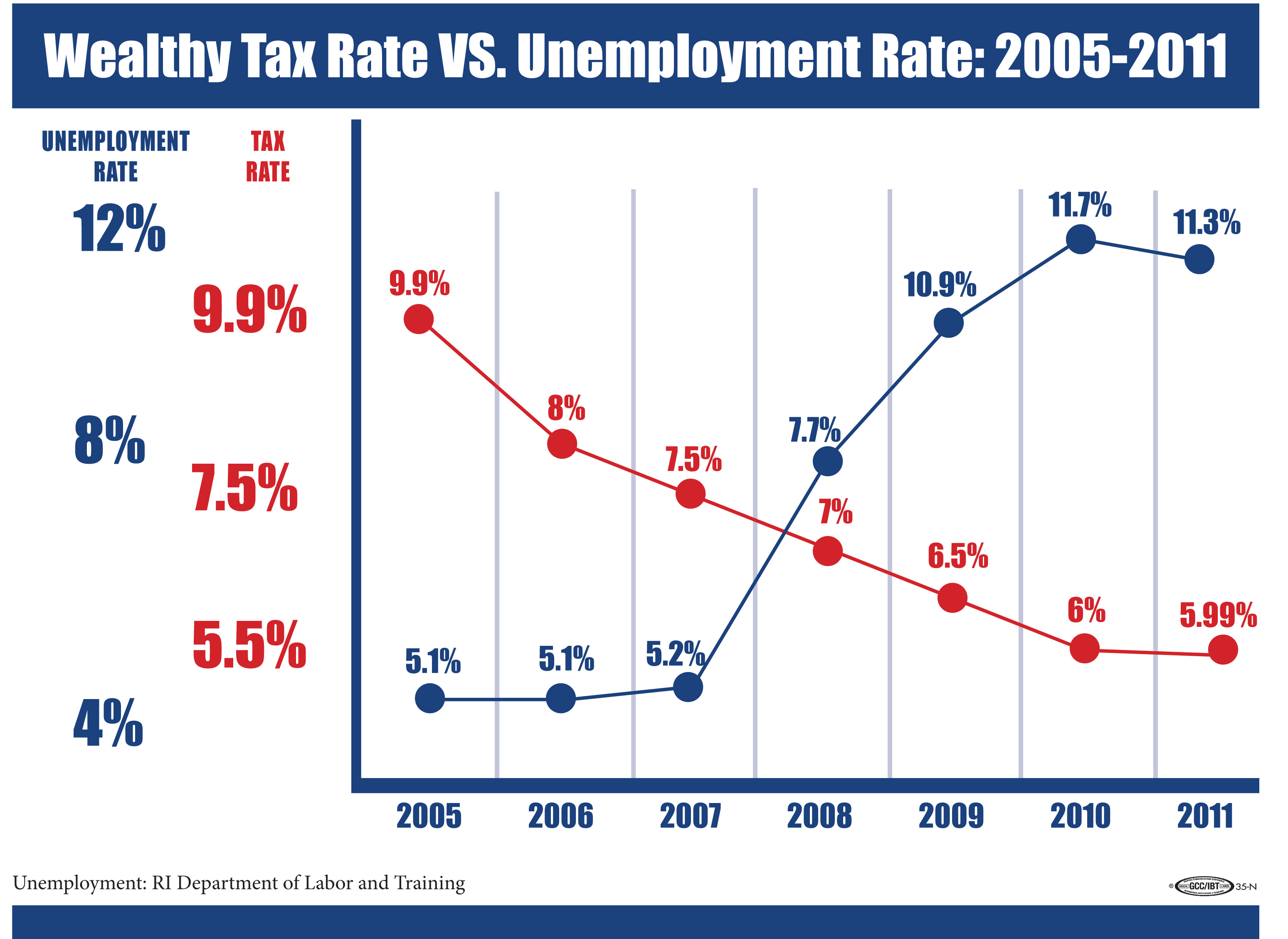

As some legislative leaders continue to balk at rolling back income tax cuts as a way to correct Rhode Island’s budget deficit, saying they still need to let the flatter taxes play out to see if they stimulate the economy, maybe there’s something they should consider.

As some legislative leaders continue to balk at rolling back income tax cuts as a way to correct Rhode Island’s budget deficit, saying they still need to let the flatter taxes play out to see if they stimulate the economy, maybe there’s something they should consider.