On Friday it was reported in the Providence Journal that Speaker Mattiello’s budget priorities include reducing the estate tax by increasing the threshold for paying the tax from $1.5 to $2 million at an estimated cost of $4.3 million, as well reducing the corporate minimum tax from $450 to $400 at an estimated cost of $3.2 million. Reducing the estate tax and corporate minimum tax will provide little benefit to the overwhelming majority of Rhode Islanders and are not a good use of public funds.

On Friday it was reported in the Providence Journal that Speaker Mattiello’s budget priorities include reducing the estate tax by increasing the threshold for paying the tax from $1.5 to $2 million at an estimated cost of $4.3 million, as well reducing the corporate minimum tax from $450 to $400 at an estimated cost of $3.2 million. Reducing the estate tax and corporate minimum tax will provide little benefit to the overwhelming majority of Rhode Islanders and are not a good use of public funds.

“We hope that lawmakers will not reduce state revenues by over $7 million for tax changes that would benefit a handful of Rhode Islanders and businesses,” said Rachel Flum, Executive Director. “There are many wiser ways to use $6 million to support thousands of working Rhode Islander and to ensure that businesses have the workforce they need to succeed.”

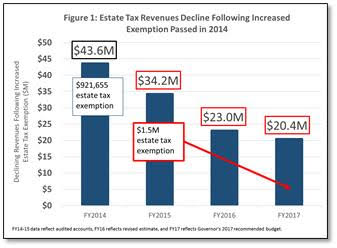

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

Further increasing the exemption to $2 million would benefit approximately 100 estates, of which 35 would not have to pay any tax at all.

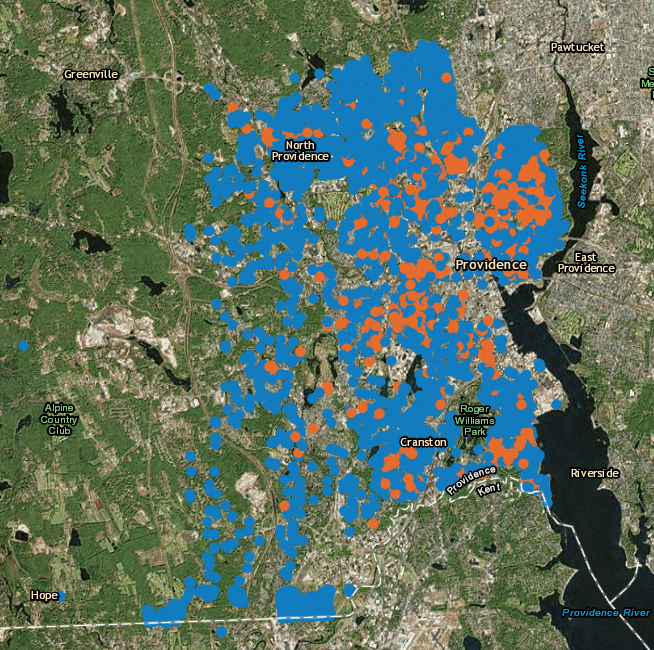

In stark contrast, increasing the EITC to 15% of the federal credit, as proposed in the governor’s budget would put $4.4 million into the pockets of 83,000 working Rhode Islanders. Increasing it to 20% as proposed by bills pending in the house and senate would provide an additional economic boost of $8 million to the direct care workers, servers, salespeople and other Rhode Islanders who earn low to moderate wages. These state investments are then recycled directly into local economies.

“The estate tax is a vital tool for broadly shared prosperity,” added Douglas Hall, Director of Economic and Fiscal Policy at the Institute. “Our analysis shows there is no good public policy reason to reduce state revenue by reducing the tax that is paid by only a small number of heirs of large estates. The state’s priority should be to help struggling working families.”

One such priority is to help working families pay for child care assistance so they can enroll their young children in quality early learning programs and know that their older children are in a safe place after school. A pilot program allowing working families who are receiving child care assistance (income below 180% FPL) to remain eligible as their income rises to over twice the poverty level is set to expire in September, 2016.

As of March 2016, just over 400 children are enrolled in the pilot. Trend data since the onset of the program in October 2013 shows that the pilot has allowed parents to have a glide path to earning higher wages since around half of the families have income between 200 and 225% FPL and half have income between 180 and 200% FPL. It is estimated that making this “exit income” permanent would cost $1.6 million for FY 2016, an investment that not only helps working families but supports the child care sector. And with the lowest eligibility limit for child care assistance in New England, policymakers should also consider increasing the “entry income limit” from 180% FPL to at least 200%.

Just as there are far wiser ways to invest in our workforce, there are wiser ways to help businesses. The Statistics of Income for 2014 shows that 91% of Rhode Island businesses paid the minimum corporate tax, including 8,000 companies with gross receipts that total more than $10 million. Last year companies were given a break – a reduction of the minimum corporate tax by $50, from $500 to $450, taking revenue the state needed to pay for the public services and infrastructure that businesses use and rely on. Another $50 reduction is unlikely to significantly impact individual businesses, while a $3 million investment in workforce training for the 83,000 Rhode Islanders who lack a high school diploma and/or are in need of English language services would benefit all businesses who are looking for workers with basic skills.

According to the

According to the