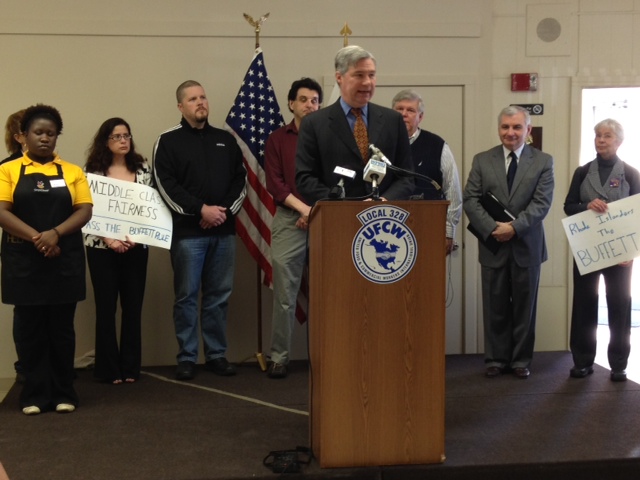

Senator Sheldon Whitehouse plans to introduce a trifecta of progressive tax bills this session including the Buffett Rule bill, the Offshore Prevention Act and the Stop Tax Haven Abuse Act, he told reporters at his Providence office Monday.

Senator Sheldon Whitehouse plans to introduce a trifecta of progressive tax bills this session including the Buffett Rule bill, the Offshore Prevention Act and the Stop Tax Haven Abuse Act, he told reporters at his Providence office Monday.

“I think the pressure is on to do something on tax reform,” Whitehouse said. “Now that the Republicans are in the majority they need to prove to the American people they can govern, that they are not just a bomb-throwing obstructive minority, so that changes their motivation on something like tax reform.”

Whitehouse has introduced the first two bills before. He inherits the third piece of legislation from former Michigan Senator Carl Levin the so-called “Stop Tax Haven Abuse Act” that would prevent corporations from shielding profits from tax responsibility.

“It would help us here in Rhode Island because here’s CVS, which like most of the retail industry pays the full freight, they pay the full 35 percent tax rate,” explained Whitehouse. “Meanwhile here’s Carnival Cruise Lines pays virtually zero because they pretend they exist only in offshore Caribbean destinations.”

The three bills would net more than $300 billion in ten years, Whitehouse said.

The Buffett Rule bill, or the Paying A Fair Share Act, would tax at 30 percent all annual income over $2 million and would net $70 million over ten years of missing revenue for the American people. The Offshore Prevention Act would end the corporate practice of deferring tax payments when a company moves jobs overseas and would net $20 million in 10 years. The Stop Tax Haven Abuse Act would net $220 billion over 10 years and prevents corporations from creating overseas tax shelters.

Despite the GOP’s reluctance to help level the tax-paying field, Whitehouse thinks he’s in a good position because he envisions Republicans having to make some concessions with Democrats if they hope to get tax legislation passed this year.

“I don’t think they have 60 votes for their plan and I’m sure they don’t have 67 votes for their plan so if they want to actually have something that gets signed into law by the president and actually changes the tax code they are going to have to work with Democrats,” he said.

Whitehouse handed out this one-pager to reporters to explain the three bills.

Here’s the contents:

THE PROBLEM

Right now America’s tax code is riddled with costly loopholes that benefit some of the highest earners and largest corporations. These special interest provisions have created two sets of tax rules: one for middle-class families and small businesses, and one for wealthy interests and multi-national corporations. With President Obama and Republican Leaders in Congress indicating that they plan to make tax reform a priority in the 114th Congress, Senator Sheldon Whitehouse is introducing a package of bills that would make the current system fairer while also raising billions of dollars in new revenue. This revenue could provide substantial resources for investments in infrastructure and education, or could serve as a fairer way to fund new Republican initiatives than cuts to benefits that people rely on.

SHELDON’S PLAN

Implement the Buffett Rule.

- Thanks to a number of tax loopholes, America’s top earners often pay a lower effective tax rate than middle-class workers. Billionaire investor Warren Buffett has famously lamented he pays a lower tax rate than his secretary.

- Senator Whitehouse’s Paying a Fair Share Act would require multi-million-dollar earners to pay a minimum 30 percent effective federal tax rate, regardless of the number of special credits, deduction, and rates they claim.

- The bill would generate an estimated $71 billion over ten years.

End tax giveaway for sending jobs offshore.

- Currently, U.S. companies that manufacture goods abroad for sale here at home are allowed to defer payment of federal income tax – waiting to pay taxes on foreign income in years that minimize their tax liability.

- Senator Whitehouse’s Offshoring Prevention Act would require companies that send factories and jobs overseas to play by the same rules as ones supporting jobs in the U.S., removing an offshoring incentive and helping local businesses compete.

- The bill would generate an estimated $19.5 billion in revenue over ten years.

Close loopholes that allow multi-national corporations to avoid taxes.

- Some of America’s biggest corporations are able to dramatically reduce their taxes by funneling assets and profits through complex networks of offshore corporations.

- The Stop Tax Haven Abuse Act, which was originally championed by former-Senator Carl Levin, closes these loopholes and requires large multinational corporations to pay a fair share in taxes.

- The bill would generate at least $220 billion in revenue over ten years.