T oday’s Morning Joe program on MSNBC featured a typically brain-dead discussion of oil prices. I’ll summarize…

oday’s Morning Joe program on MSNBC featured a typically brain-dead discussion of oil prices. I’ll summarize…

Joe Scarborough: We’re producing more oil, but the price is still high. That’s un-possible!

Time Mag’s Richard Stengel: I know. Can you believe it?

What’s missing from this discussion – and all the blather we’ve heard and will hear from the GOP during the 2012 election – is a fundamental understanding of what it means to produce petrochemical liquid fuels.

Oil Pumping Basics

Since before the Macondo explosion and leak, I’ve been a fan of The Oil Drum, a peak-everything blog that focuses on the oil patch. You really can learn quite a bit from the authors and the commenters, who tend to be oil field vets. Here’s what’s most important to this discussion:

It costs money to get oil.

The photo above is from the opening credits of the classic TV show The Beverly Hillbillies in which Jed Clampett is “shootin’ at some food, when up from the ground comes a-bubblin’ crude.” Half a century ago, that was a plausible scenario – oil deposits almost on the surface could be breached with virtually zero effort. Dig a hole anywhere in Texas, and you’re rich!

Those days are long, long gone. Hence peak oil. Peak oil does not necessarily mean that there’s no more oil in the ground; it means that we’ve reached (and surpassed) the point of diminishing returns in terms of the cost of getting oil.

Think about this: the Macondo well – referred to by workers as ‘the well from hell’ – required sending robotic submersibles a mile down in the ocean and then drilling a hole an additional two miles into the earth. So you’re reaching down a total of three miles just to get to the “discovered” deposit before you find out what’s actually down there. (Satan, as it turned out…)

That kind of engineering doesn’t come cheap.

If there were an easier and cheaper place to get oil, don’t you think BP would have opted for that? Of course they would have, but the fact is that there isn’t an easier place to get oil. Hence Macondo.

“Economic” Oil Extraction

It’s silly to criticize Obama or any part of the US government for restricting off shore oil production because the oil companies are already sitting on a giant number of leases. The reason that these leases aren’t being used is that it’s not “economic” to go get the oil – the price doesn’t justify the cost of extraction.

There’s a clear correlation between the price of oil and the amount of production, and this confirms the basic peak oil argument. The cheap and easy oil is all gone, so prices have to reach certain thresholds before it’s worth the effort to go get the oil we know is in the ground.

This is why 2008 was a banner year for deep water oil. Prices sky-rocketed, and suddenly it was worth the effort to drill down three miles to get to a deposit. Drilling platforms were double- and triple-booked. Even though prices fell by half from their peak as a result of the financial meltdown, they quickly rebounded to the $70 – $80 region.

After a brief hiatus, it was back to work for the rigs. A prime driver of BP’s foolish haste capping Macondo was that the drilling rig was already late for its next assignment. They also wanted to skip a step and turn the exploratory well into a production well to get the oil to market quickly.

With the current price of oil (NYMEX) over $100, seriously whacky oil sources become profitable – shale oil and even drilling in the Arctic Ocean. That is insane!

So, we know that we can get more oil if the price is high enough. Therefore, producing more oil won’t make prices go down to what they have been in the past; it will only make prices pull back from their highs.

So, sorry Newt. $2.50 per gallon gas is exactly as plausible as you becoming President of the United States.

The Two Main Drivers of Oil Extraction Costs

Obviously, the simple costs of getting labor and machinery out to the oil deposit’s location and then drilling, lining and capping the well represent the primary factor in the equation that determines if an oil well is economic to drill. Equally obvious is the fact that the market price – and no other factor – influences the decision to produce or not to produce. There are likely a few exceptions of deposits close to population centers or very close to coastlines, but there are so many leases on known deposits that fights over the exceptions are political shenanigans and little more.

Here’s what’s not obvious and what’s really behind the peak oil equation – the amount of energy it takes to produce energy. Deep sea submersible, massive mud-pumping ships and floating cities called “drilling platforms” don’t run on unicorn tears. They mostly run on oil.

As oil gets harder and harder to reach, it takes more and more energy to pump that next barrel. And even within a single deposit, the first barrels come out on their own but as pressure drops it takes more and more energy to get each successive barrel. Pumping the bottom of a well that’s three miles below the earth’s surface requires a lot of suction!

Compare the easy Texas drilling of the Jed Clampett days to the process of separating oil from Canadian tar sands or shale. It takes a lot of money and energy just to get the crude. Then you need to include the costs and energy inputs of distillation. That doesn’t come for free either.

The bottom line is that high gasoline prices are here to stay, and there’s nothing that any politician can do about it. Anybody who says otherwise is either a liar or a fool.

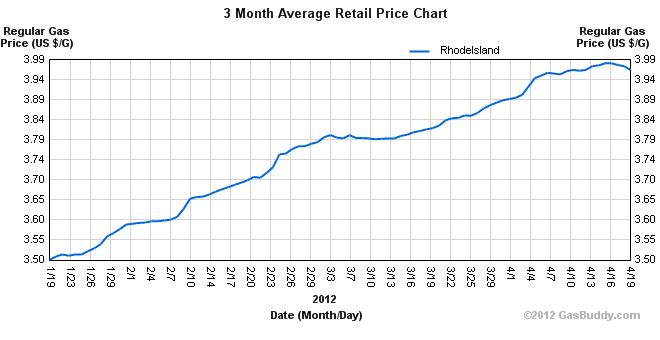

Congressman David Cicilline introduced a bill today that would curb rampant speculation in the oil markets, which would both drive down the price at the pump and put the petroleum economy back in line with the laws of supply and demand, he said.

Congressman David Cicilline introduced a bill today that would curb rampant speculation in the oil markets, which would both drive down the price at the pump and put the petroleum economy back in line with the laws of supply and demand, he said.