What is so sad about the mess Rhode Island has fallen into is that it was completely avoidable.

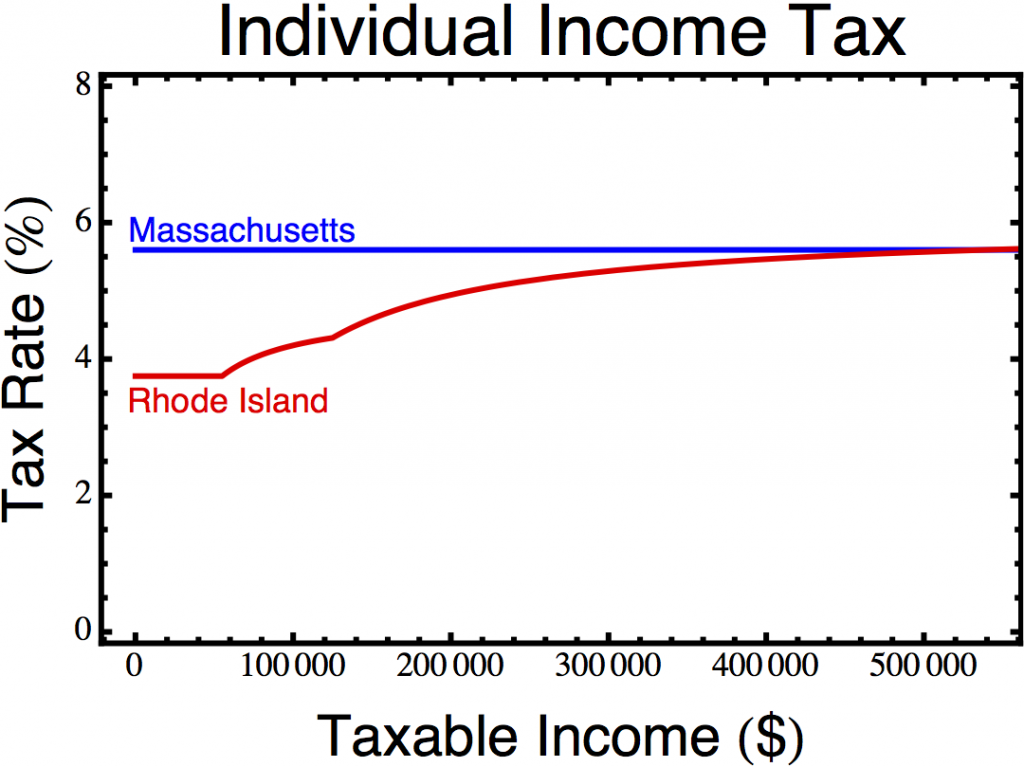

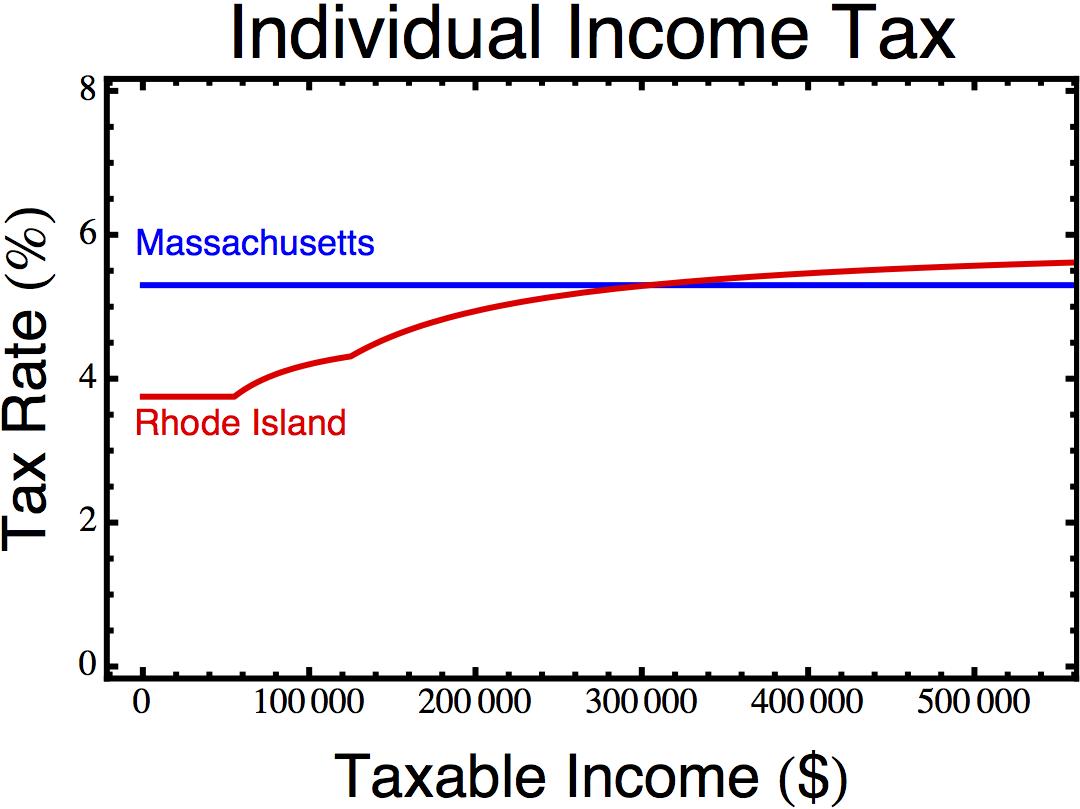

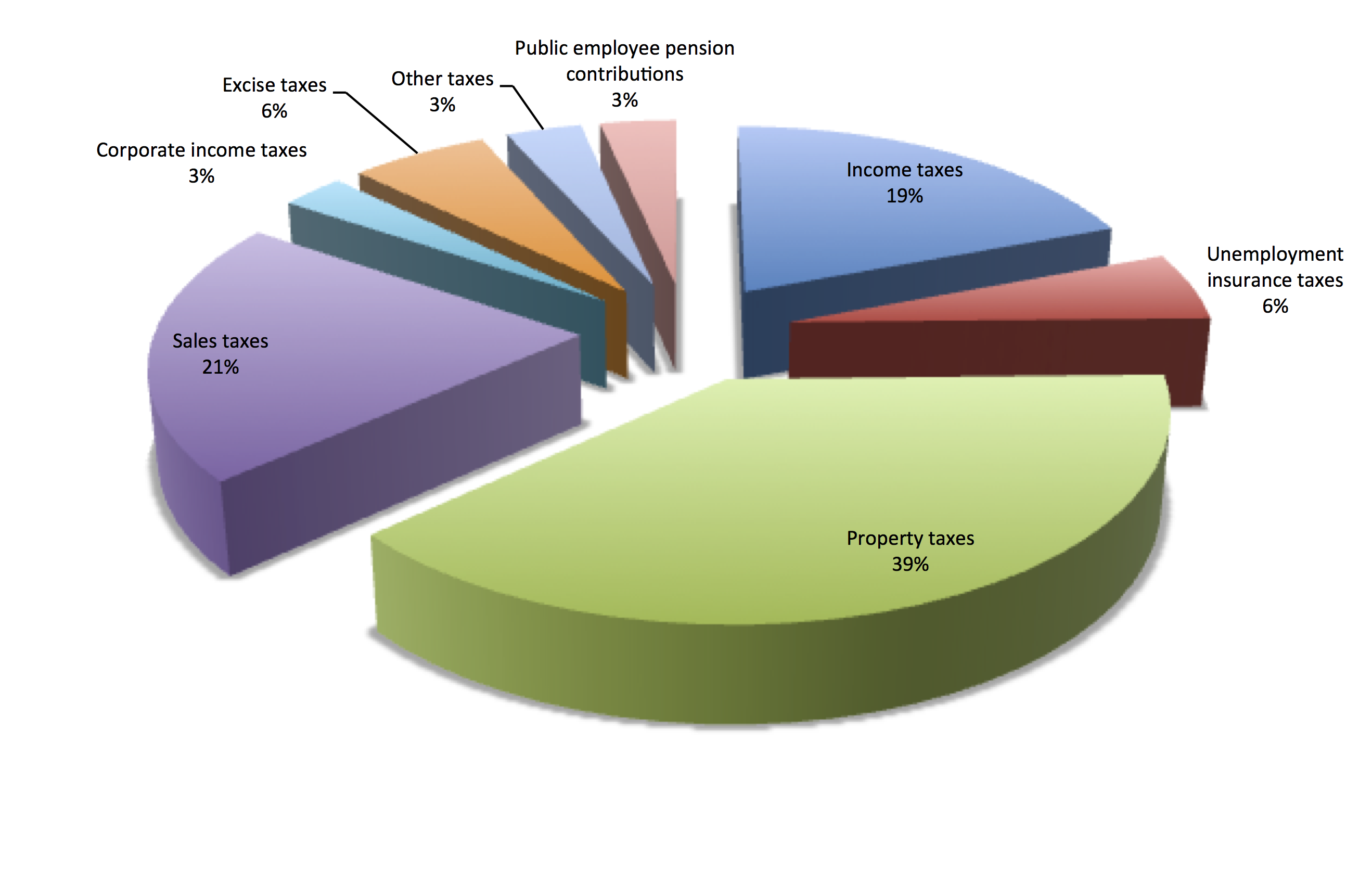

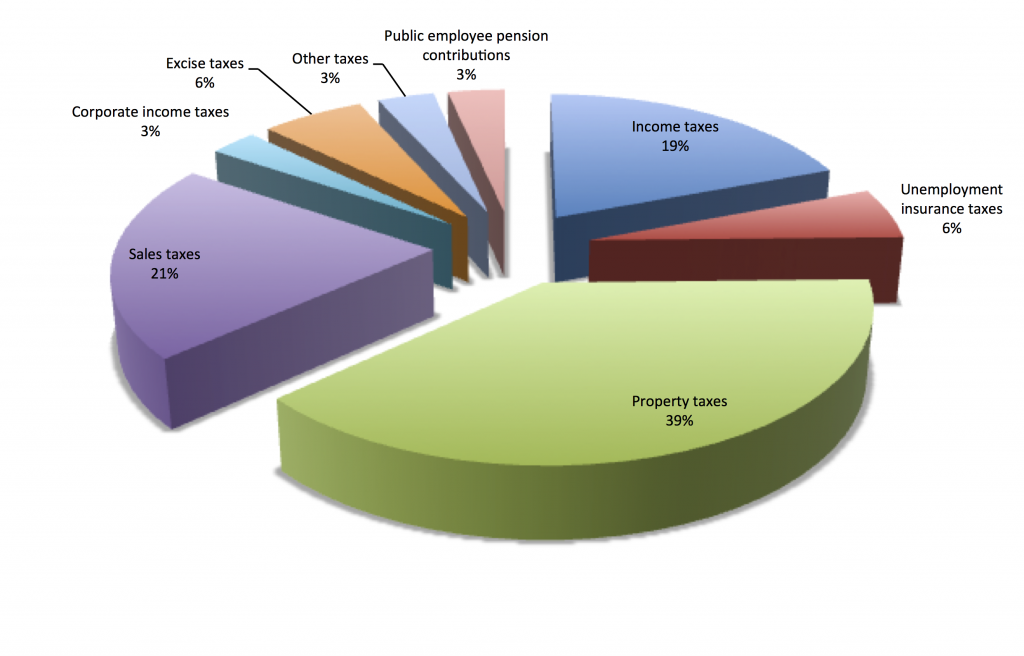

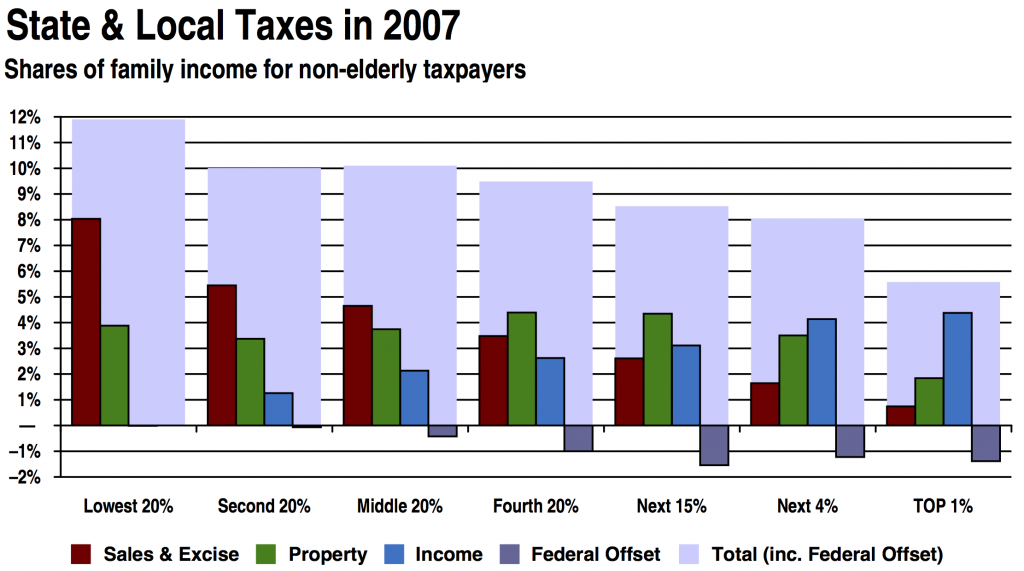

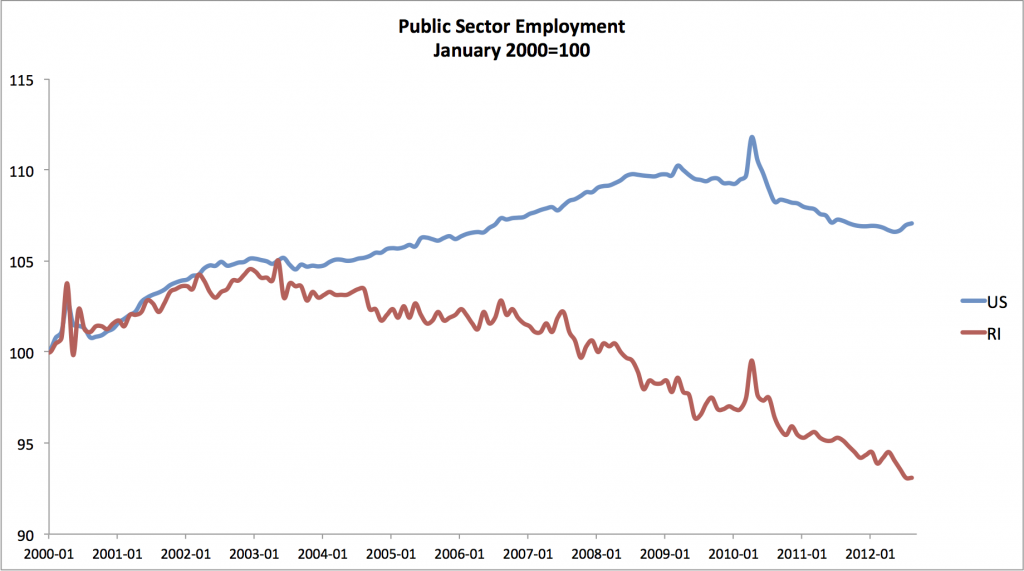

Governor Carcieri did not have to launch a jihad against public sector employment. Nor was it necessary to hand massive tax breaks to the wealthy. Had we avoided those tax breaks, we wouldn’t have had to slash municipal aid and send property taxes through the roof. Had we not raised property taxes, we would have a stronger housing market, and had we not engaged in massive austerity, the rest of our economy would be doing better as well. If our unemployment insurance tax rate were less punitive, then fewer businesses would have gone under. None of this had to happen.

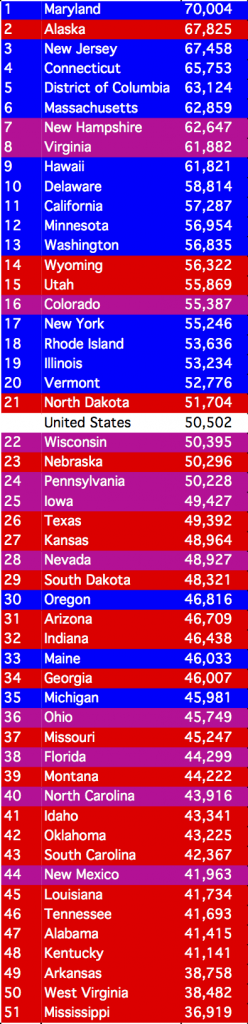

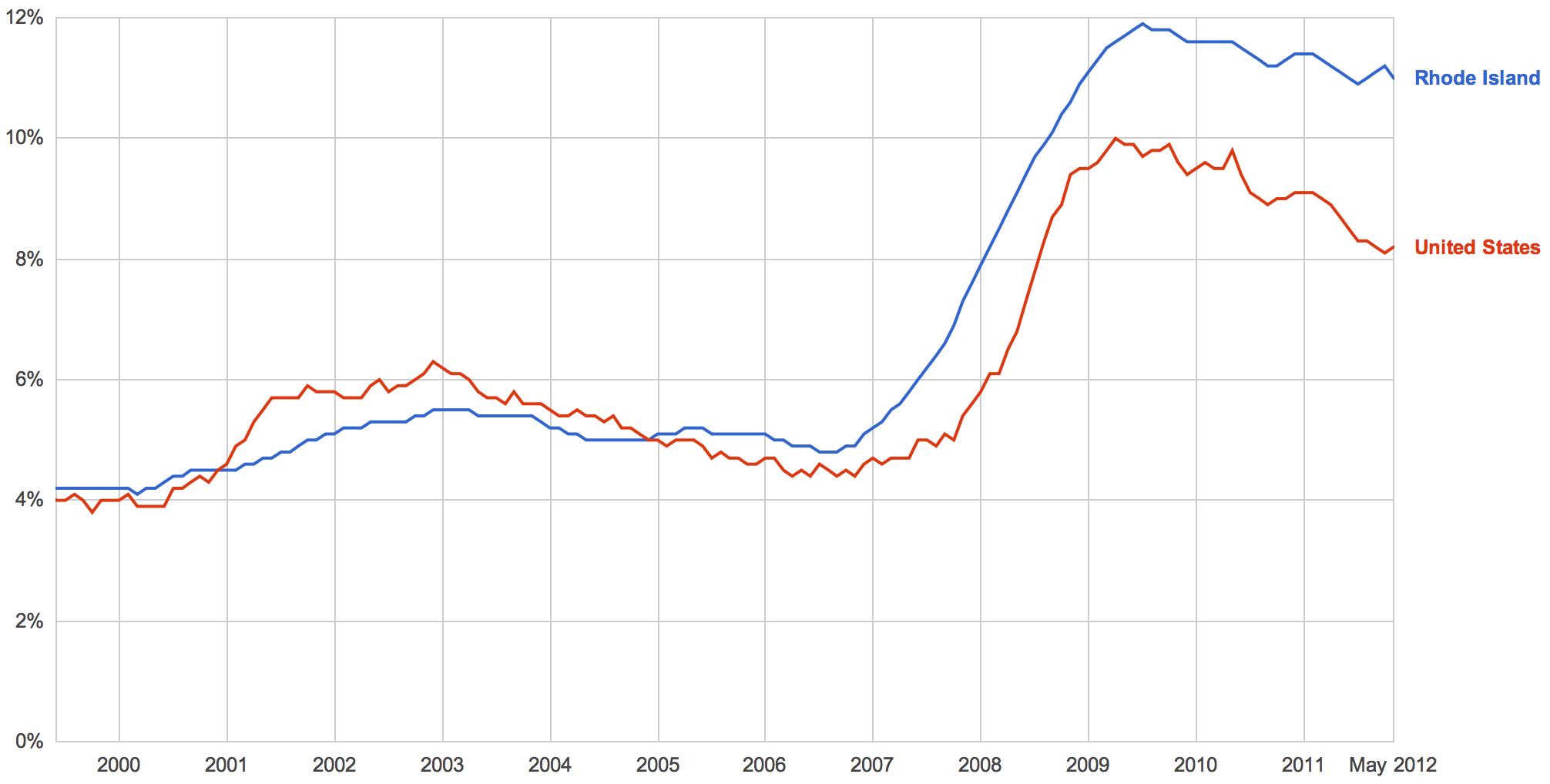

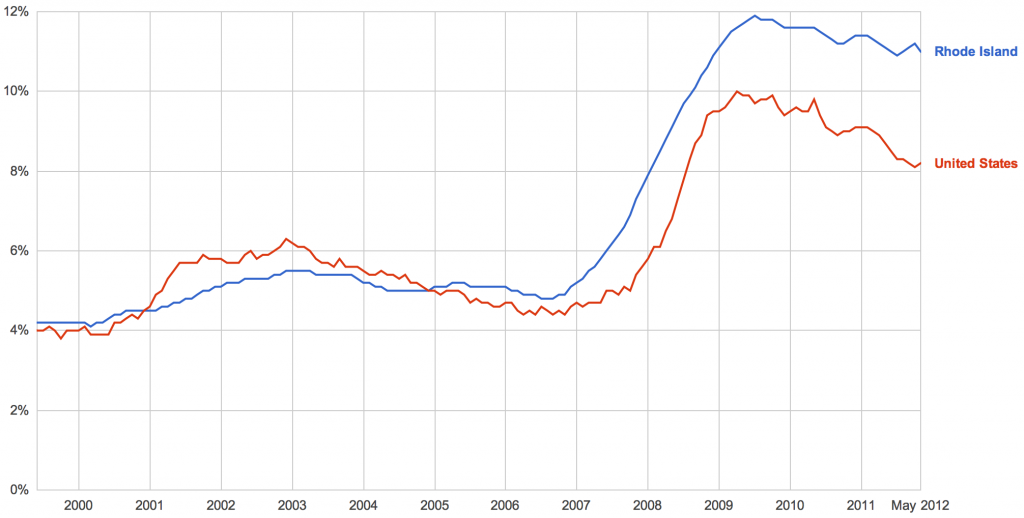

It seems that things are finally looking up for the Rhode Island economy. Unemployment is falling, despite a regional recession, and numerous other economic indicators are showing positive signs.

There remain many road blocks ahead for our economy, as we deal with the aftermath of 38 Studios, municipal budget disasters, and other legacies of the Carcieri era, so it is by no means clear that these positive trends will continue, but there is certainly more cause for optimism now than we have had for quite some time.

As Leonard Lardaro, an economist at URI, puts it, we’re “in a recovery the magnitude of which almost nobody in this state seems to fully comprehend.” But we should not take this as evidence that the economy of the Ocean State is suddenly being managed well. Rhode Island is a severely depressed economy with relatively strong fundamentals. If you don’t keep kicking it, it will recover, even if the transition is only from terrible to mediocre leadership.

Carcieri is gone, it is true. But the very conservative General Assembly was fully complicit in Carcieri’s blunders, earning them effusive praise from the Wall St. Journal. As Dan Lawlor puts it, “it is remarkable how much of his vision was enacted, sometimes excitedly, by the Democratic General Assembly and its leaders, specifically Gordon Fox and Theresa Paiva Weed.”

There is much truth to this. Although it is hard to argue that pro-choice, pro-marriage Fox isn’t at least a moderate improvement over his predecessors, as House Majority Leader, he was a major proponent of the income tax cuts at the heart of Rhode Island’s problems.

After a bruising reelection battle, Fox made mild noises about potentially being more open to sensible tax reform, but given his past record, it is unclear whether anything will come of this. Nominally a Democrat, Paiva Weed shares Fox’s rather extreme economic conservatism, but she does not share Fox’s more moderate social views. Indeed, she is probably the primary obstacle to marriage equality passing in 2013.

Although Chafee is pushing for some distinctly insufficient reforms, they will probably mostly fail, and it is hard to imagine the General Assembly putting together anything remotely up to the task.

What must be done is actually quite straightforward. We need a jobs bill and tax reform: We need to reverse Carcieri’s austerity by rehiring the teachers, firefighters, and policemen whose jobs he cut. We should also make new investments in critical areas, restoring our crumbling roads and bridges, creating bicycle infrastructure and commuter rail lines, expanding and improving URI, and building tons of medical schools to take advantage of the extreme demand for new doctors. We should begin paring back property taxes and fixing budgets by restoring aid to cities and towns and allowing them to levy local income taxes to offset property taxes.

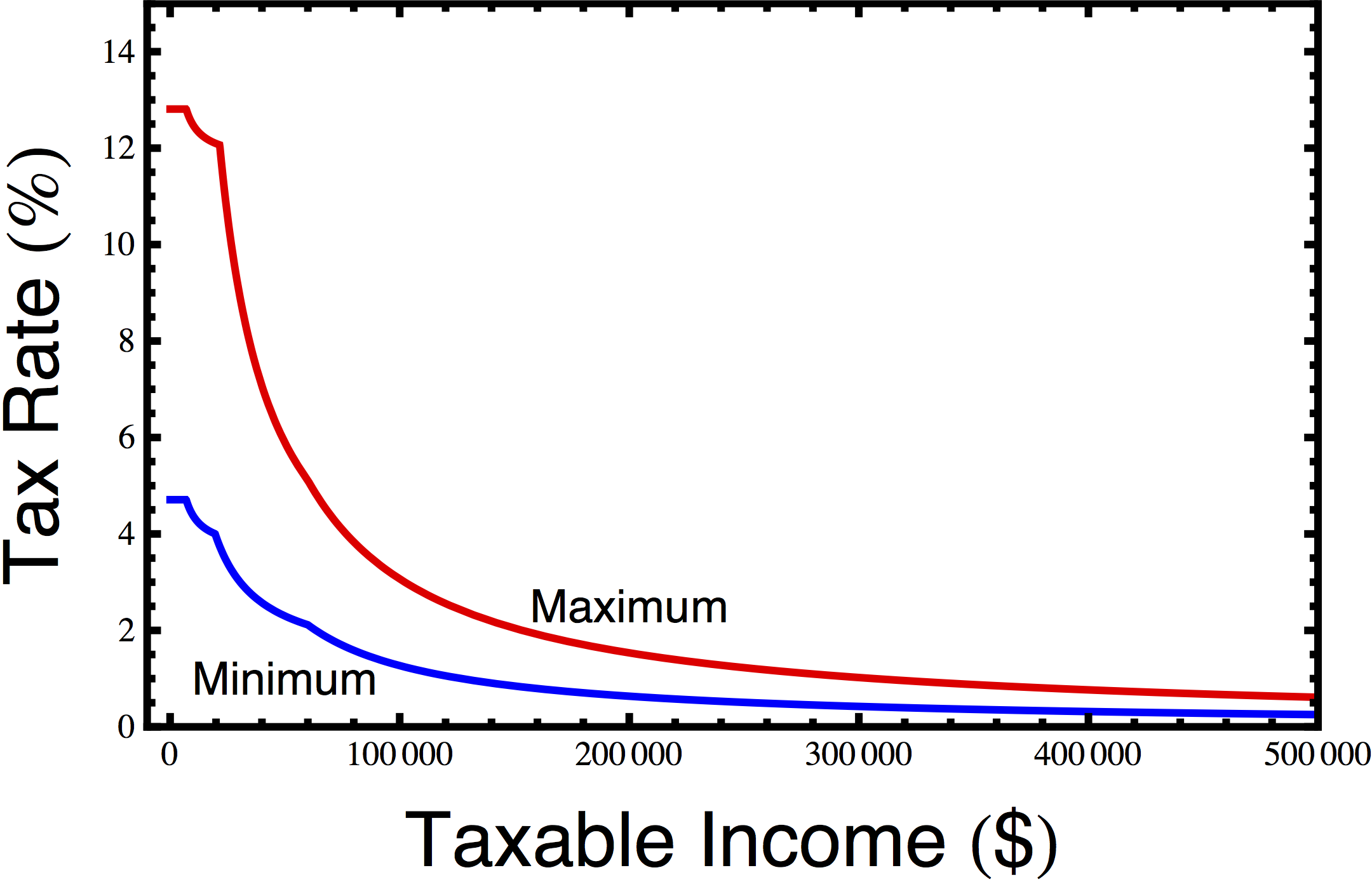

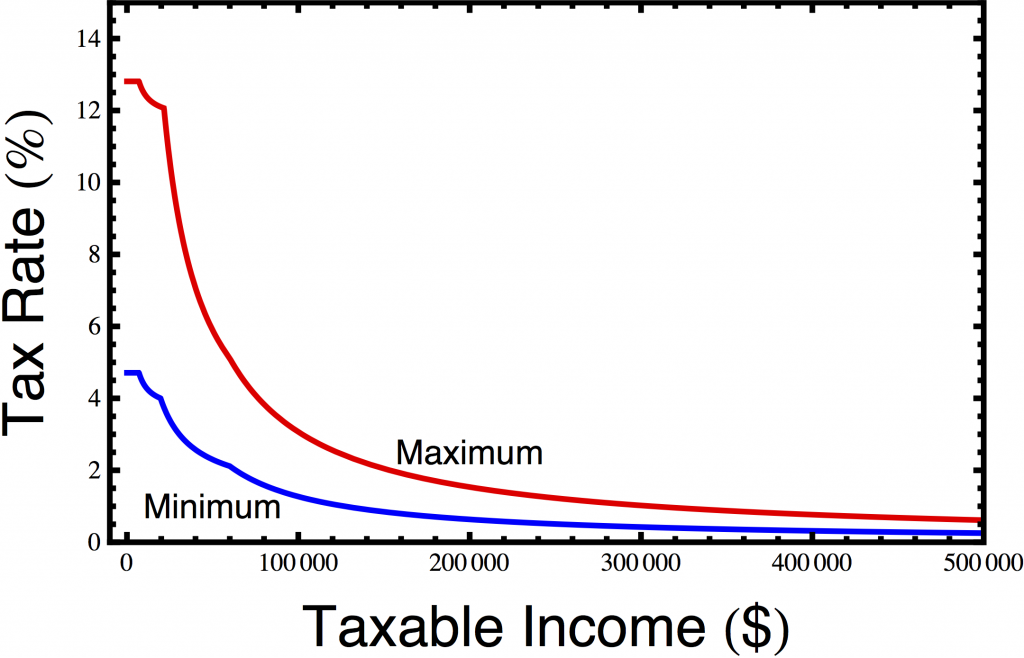

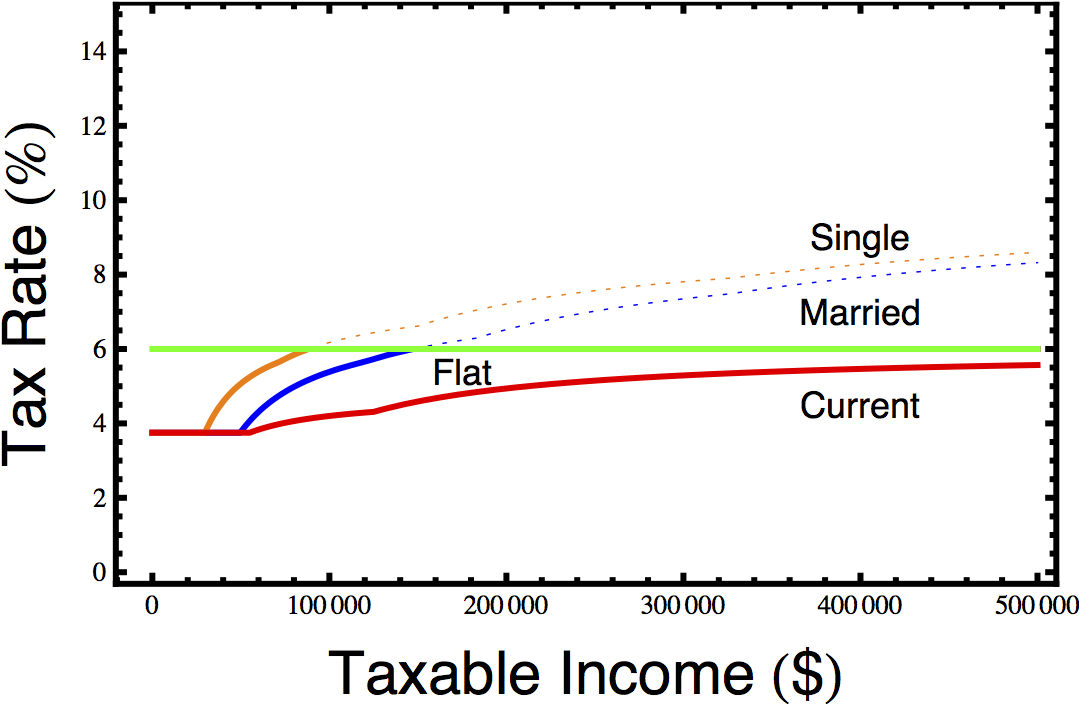

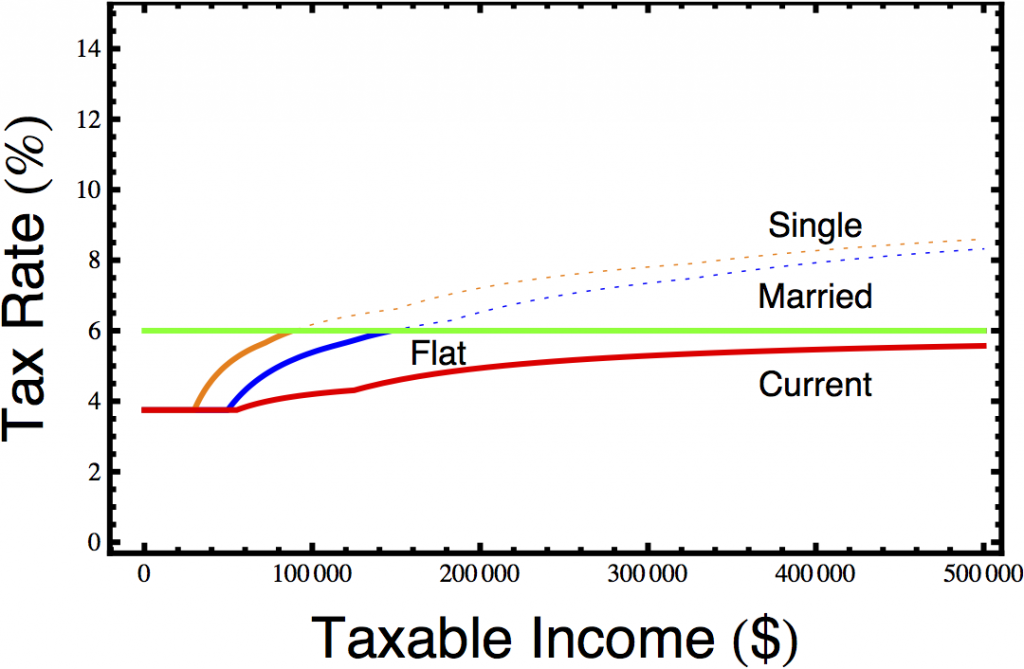

To pay for all this, we should restore the pre-2006 income tax rates and create new brackets for the wealthy, with a top marginal rate of at least 13%. We also need to restructure the hugely regressive unemployment insurance tax as a simple and constant flat, low rate, a reform that could easily raise revenue while making the tax code much less regressive and much more business-friendly.

With the current conservatives in office, almost none of this will happen. But it is definitely worth fighting for.