In the previous installment I discussed the devastation wrought by massive austerity, which was the principle cause of Rhode Island’s terrible jobs picture. The traditional justification from austerity apologists is that those public sector cuts were necessary, and Rhode Island was forced to make those layoffs. Of course, this argument makes no sense in Rhode Island not just because the cutbacks began before the second Bush recession but also because the government found the money for a huge income tax cut for the rich, cutting the top rate from 9.9% to 5.99%. This brings me to the subject of today’s column: taxes.

As I noted in the first column, the bottom fell out of the Rhode Island economy in late 2007, nearly a year before the second Bush recession began. Perhaps it is just a curious coincidence that this happened as the effect of the income tax cuts for the wealthy passed in 2006 began to kick in, but I suspect not. Indeed, there is considerable evidence that it was these tax cuts that triggered the collapse of our economy.

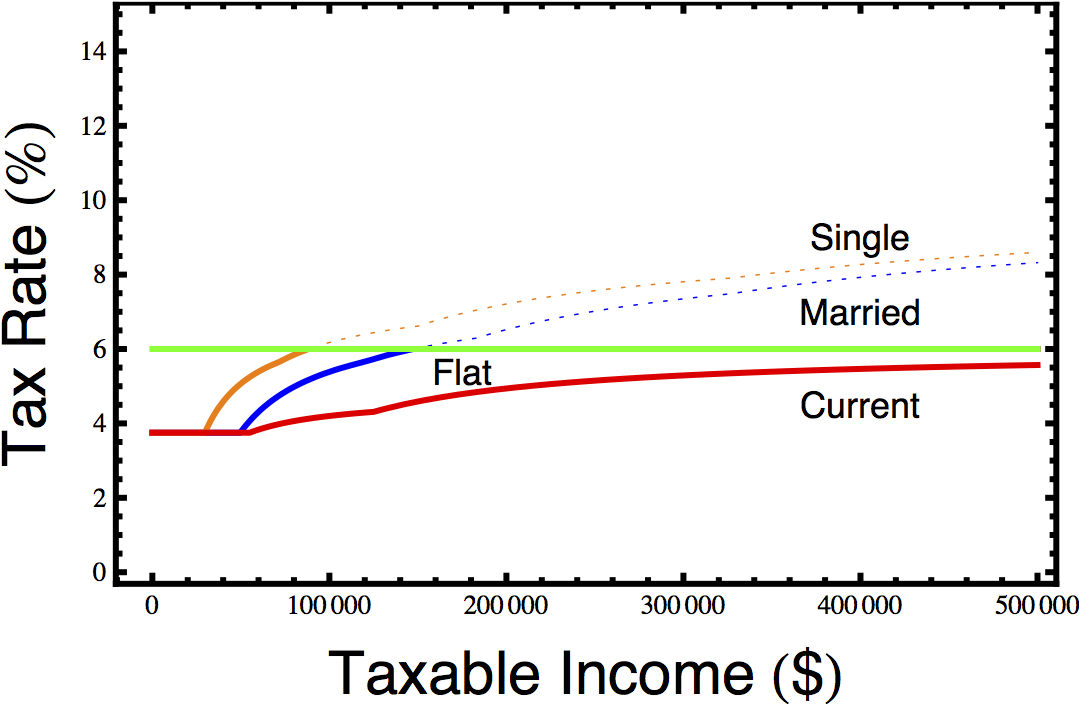

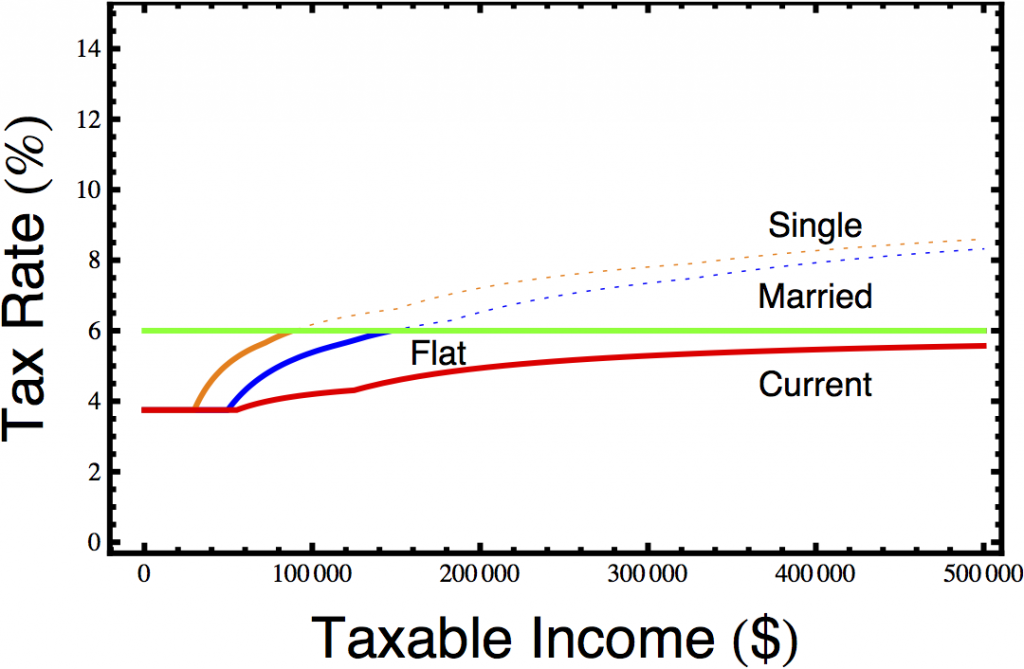

The details of the tax cuts are slightly complicated. The original tax cut passed in 2006 and imposed an alternate flat tax rate that you could choose to pay instead of the traditional tax brackets. This rate started at 8% and fell by 0.5 percentage per year, hitting 6% in 2010, but in 2010, the government overhauled the tax code again in a tax cut aimed primarily at the upper middle class. You can see the three different rate schemes in the graph below.

Perhaps the most troubling aspect of these tax cuts is that they were pushed largely by Democrats, an act of conservatism that elated the Wall St. Journal’s editorial board. Although they are often called the Carcieri tax cuts, and he vigorously supported them, much of the impetus came from General Assembly Democrats like Speaker of the House William Murphy (D-West Warwick) and Majority Leader Gordon Fox (D-Providence). Fox predicted that “this new tax rate, as it did in Massachusetts, is certain to create new jobs, spur economic development, put money back in taxpayers’ pockets, and otherwise bring Rhode Island to a position of twenty-first century economic leadership in the region and, indeed, in the country.” To say that did not happen is a severe understatement.

Income tax cuts for the wealthy at the national level provide mild, if inefficient, stimulus for the economy because they are offset by increasing the national debt. (Of course, there are much better ways to spend our nation’s money.) At the state level, however, it’s a different story. Because state taxes are deductible from national taxes, which tax the wealthy at a higher marginal rate, state level income tax cuts for the wealthy result in increasing national income taxes. The tax cuts also made it harder for Rhode Island to capture revenue from Rhode Island residents who have income in other states. Because so many wealthy Rhode Islanders work in Massachusetts, this is a serious issue. States can only tax out of state income if their tax rate is higher than the tax rate in the other state. So lowering Rhode Island’s income tax rate for the wealthy results in Rhode Island collecting less revenue from other states and other states collecting more revenue from Rhode Island, on top of sending more taxes to Washington. The net result is a considerable flow of capital out of the state, which is not good for the economy.

The real devastation from income tax cuts for the rich, though, comes from the spending cuts and property tax hikes that offset them. The previous section discussed the spending cuts, and how they accelerated after the tax cuts. The next section deals with the property tax hikes.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387