Kansas’s tax cuts for the rich were one of the biggest state policy stories of 2014. Sam Brownback, an ambitious conservative Republican, swept into the Governor’s office in 2010 and pushed for massive tax cuts for the rich. And he got them. By 2014, the top marginal income tax rate had fallen by 1.65 points, and by 2018, if the law isn’t repealed, the rate will have fallen a full 2.55 points.

Kansas’s tax cuts for the rich were one of the biggest state policy stories of 2014. Sam Brownback, an ambitious conservative Republican, swept into the Governor’s office in 2010 and pushed for massive tax cuts for the rich. And he got them. By 2014, the top marginal income tax rate had fallen by 1.65 points, and by 2018, if the law isn’t repealed, the rate will have fallen a full 2.55 points.

The results, predictably, were disastrous. The revenue promised from miraculous economic growth never materialized, and Kansas’s credit rating got cut. Moderate Republicans were livid. And Democrats came within four points of unseating Brownback in the middle of the 2014 red wave.

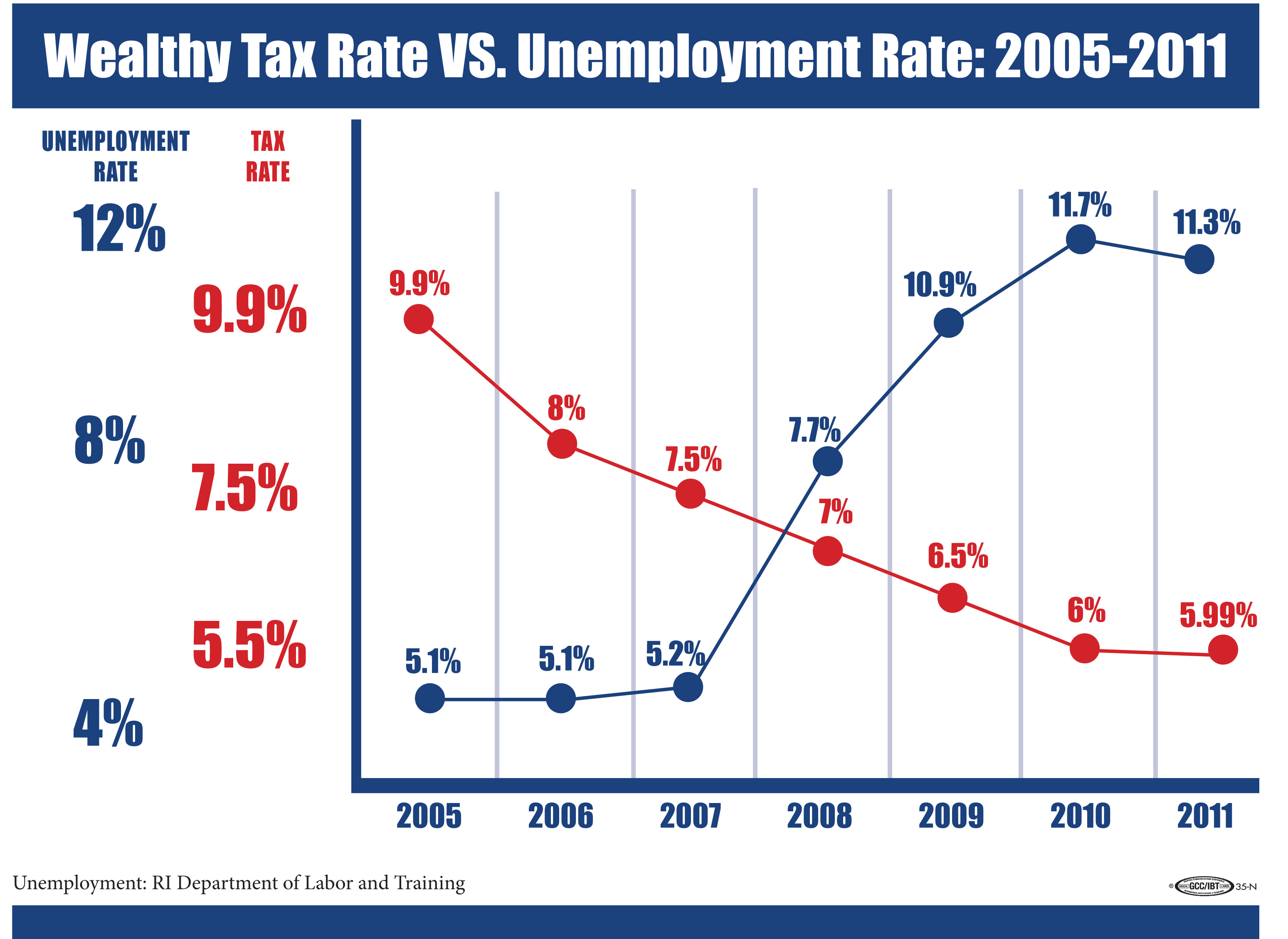

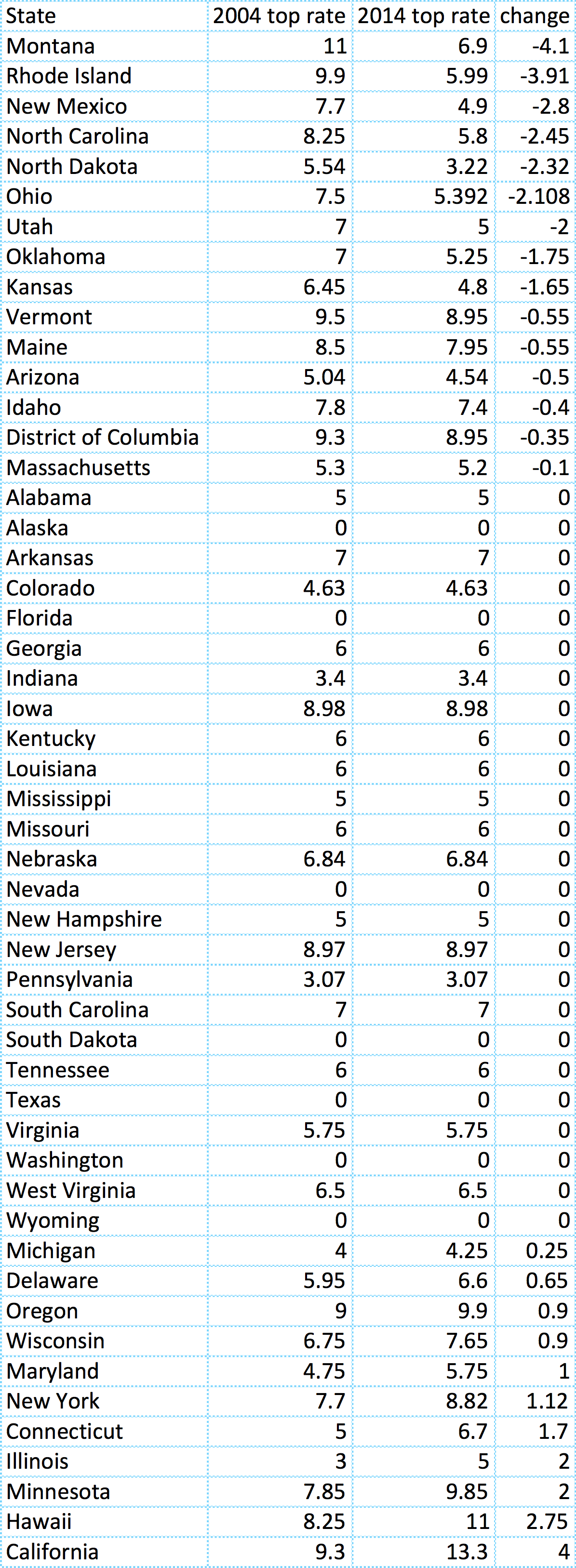

Since this debacle, there’s been a wave of think pieces about how income tax cuts for the rich as big as Kansas’s are just way too extreme, even for Republicans. But here’s the thing—Rhode Island’s tax cuts for the rich were even bigger. From 2006 to 2010, Rhode Island slashed the top marginal income tax rate for the rich by 3.91 points. That’s compared to 2.55 points in Kansas.

This all got me thinking about a question I’ve been wondering about for a while: In the past decade, has any state cut income taxes for the rich by as much as Rhode Island?

To answer this question, I compiled a list of the top marginal individual income tax rates for each state in both 2004 and 2014, using a database put together by the Tax Foundation, a right-wing think tank.

The only state with bigger cuts than Rhode Island was Montana. At 4.1 points instead of 3.91 points, they weren’t much bigger. And when you start digging into the details, it’s clear they weren’t as extreme as Rhode Island’s.

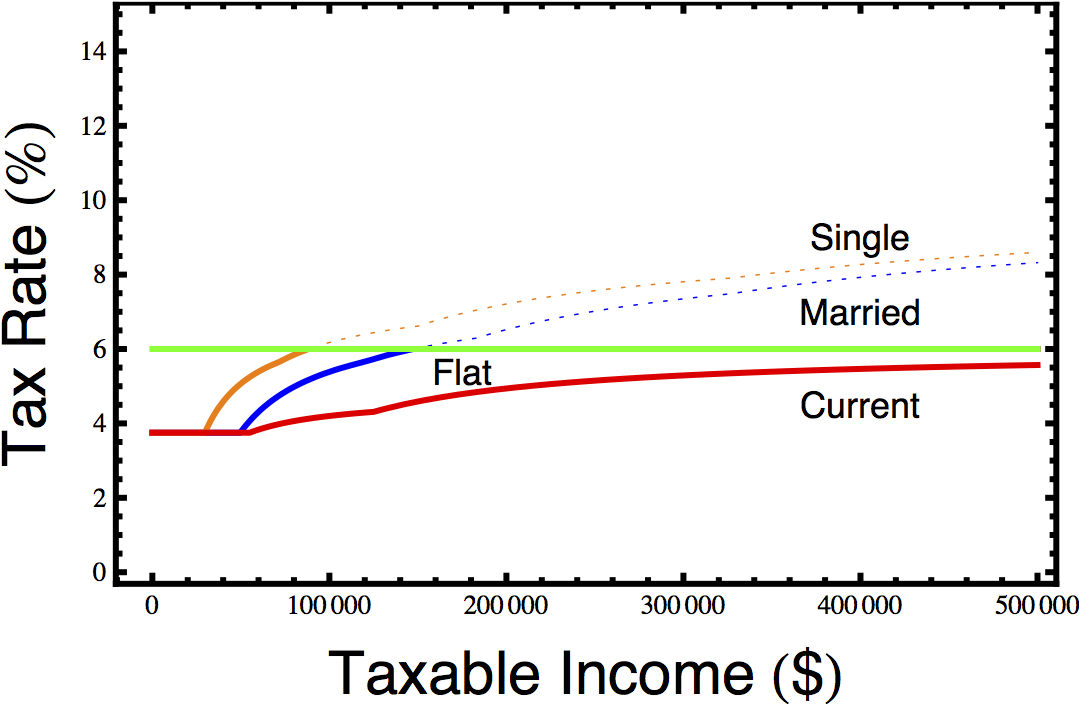

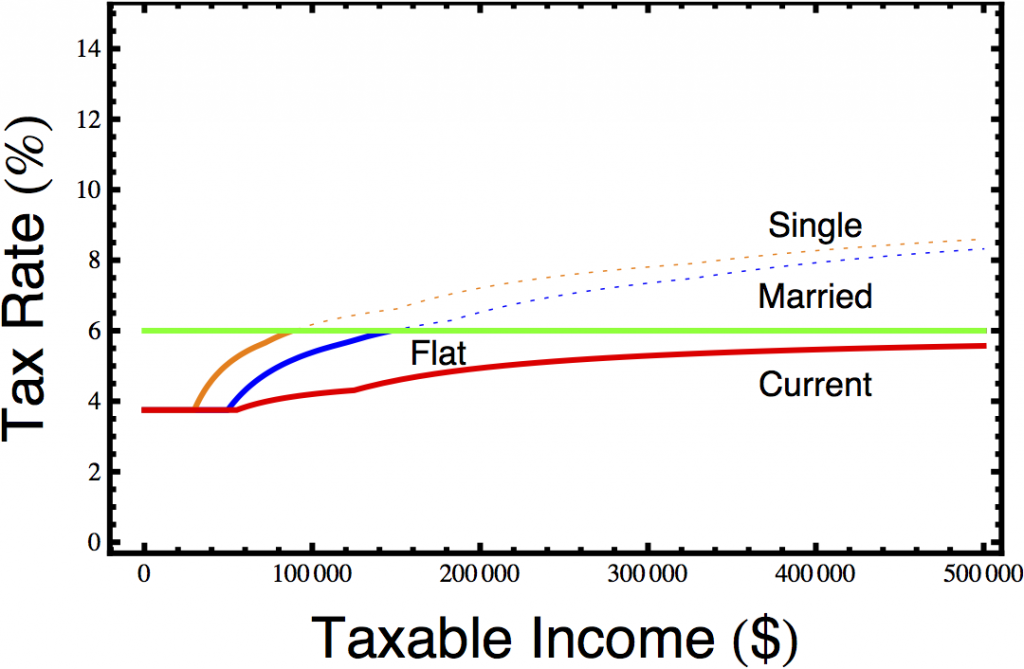

When Montana’s tax cuts were passed, they were barely projected to cut the wealthy’s tax burden at all. That’s because Montana also capped the deduction for federal income tax at $5,000 (or $10,000 for married couples). Before the law, a wealthy Montanan could deduct the 35% of their taxable income in the top federal tax bracket they paid in federal taxes. Because it’s a big giveaway to the rich, most states don’t do this. The idea was that this system effectively gave a top rate of 7.15 points, so capping the deduction and switching to a top rate of 6.9 points would barely represent a cut for the rich at all. This was key to selling the package.

Now, it turns out that the budget projections Montana Republicans put together were completely wrong. A lot of complications, including the AMT, kept them from raising as much money from capping the deduction as they said they could. The original budget projections showed a mere $6 million decrease in income tax revenue from households making $500,000 or more. The actual reduction was $48 million. Still, capping the big deduction for federal taxes kept Montana’s tax cuts from giving as much to the wealthy as Rhode Island’s. And when they passed the bill, Montana Republicans claimed they were barely cutting taxes for the rich at all.

Montanans weren’t fooled. The next year, the Democrats ran on a message of economic populism. They captured the state House, the state Senate, and the Governor’s mansion—all while Bush was thumping Kerry by twenty points.

Montana and Kansas reveal a lot about why so few Tea Party state governments have gone the full Rhode Island. They’re afraid of a revolt from their own Republicans. When they try, that’s what usually happens.

In Louisiana, Governor Bobby Jindal proposed an even bigger tax cut for the rich than Rhode Island’s. He wanted to eliminate the income tax and pay for it by hiking taxes on the poor and middle class. But Republicans revolted. Even the state’s top big business group opposed the plan. So Jindal had to scrap it.

In North Carolina, a similar proposal died because conservative megadonor Art Pope opposed it. (Pope funds a network of conservative think tanks and politicians, and he got himself appointed state budget director.)

In Alaska, there are no income or sales taxes, since the state gets so much money from oil taxes. So when Republican Governor of Alaska Sean Parnell slashed taxes for the oil companies, even Sarah Palin thought he had gone too far. She was so mad about the tax cuts that she endorsed the Independent-Democrat fusion ticket, which successfully unseated Parnell in the middle of the 2014 red wave.

Sometimes, smart people portray Rhode Island’s experiment in right-wing tax policy as a sort of moderate conservatism, on parallel with today’s more restrained Republican state governments. To be honest, I used to see it this way.

After all, a lot of the policies of the conservative machine that has taken over the Rhode Island Democratic Party really do fall in the mainstream wing of the national Republican Party. Our abortion restrictions, for instance, while more severe than any other blue state’s (according to NARAL’s ranking) are more mild than the extreme TRAP laws some Tea Party governments have pushed through.

Like most Republican states, we do have voting restrictions, including an ID law, but they aren’t quite as strict as what the reddest states have pushed through. Our war on workers, while severe, isn’t quite as bad as what has gone on in states like Wisconsin. And in a few select areas, like marriage equality, our policies have actually aligned with the national Democratic Party.

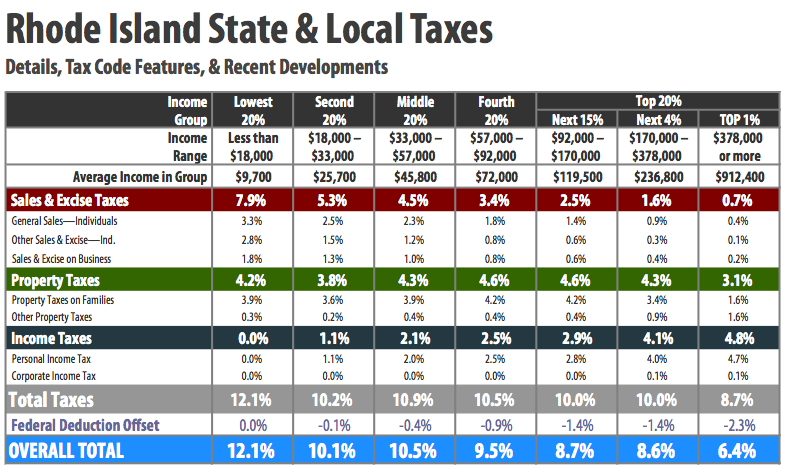

But when it comes to tax policy, the conservative Democratic machine that runs Rhode Island falls on the extreme right fringe of the national political spectrum. Even the most right-wing Republican state governments balk at tax cuts for the rich as large as what Rhode Island Democrats have done.