Following the publication of a letter sent to the FBI, SEC, and US Attorney’s Office by Rhode Island’s Future, we chose to take a deeper look at the players and parties ripping off retired public employees. What we found was a massive mess of money, right-wing ideologues, and the attempted further bail-out of Wall Street at the expense of state and municipal workers that goes all the way to the top and which could end up shaking the foundations of the 2016 campaign in ways not imagined.

![]() The Raimondo pension scheme is just a test run of a larger agenda. If this is left to stand, it would clear the way for the privatization of Social Security and the total defenestration of the social safety net dating back to the New Deal years. Through a well-financed and insidious number of organizations including the Pew Charitable Trusts Foundation, the Bill and Melinda Gates Foundation, the Blackstone Group, and the Laura and John Arnold Foundation, as well as many others, a cunning and manipulative campaign has been created to deceive the general public into believing that retired teachers, firefighters, librarians, and civil servants are costing the taxpayers exorbitant amounts of money while your friendly Wall Street banker is in need of charity. And at the center of it all is Hillary Rodham Clinton, whose campaign is both financed by these crooks and soliciting the endorsements of unions from whose members the heist is being perpetrated against!

The Raimondo pension scheme is just a test run of a larger agenda. If this is left to stand, it would clear the way for the privatization of Social Security and the total defenestration of the social safety net dating back to the New Deal years. Through a well-financed and insidious number of organizations including the Pew Charitable Trusts Foundation, the Bill and Melinda Gates Foundation, the Blackstone Group, and the Laura and John Arnold Foundation, as well as many others, a cunning and manipulative campaign has been created to deceive the general public into believing that retired teachers, firefighters, librarians, and civil servants are costing the taxpayers exorbitant amounts of money while your friendly Wall Street banker is in need of charity. And at the center of it all is Hillary Rodham Clinton, whose campaign is both financed by these crooks and soliciting the endorsements of unions from whose members the heist is being perpetrated against!

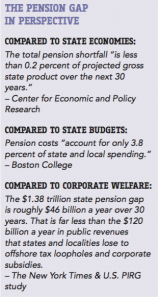

All this begs multiple questions. For example, where are the voices of Treasurer Seth Magaziner and Attorney General Peter Kilmartin in all of this? David Sirota argues in a report that “the “crisis” language around pensions is, unto itself, fraudulent“. What does this say about Gina Raimondo’s public statements and testimony made potentially under oath while the pension lawsuit was being litigated? Was she totally forthcoming when the SEC previously looked into these matters? Seidle writes in Rhode Island Public Pension Reform: Wall Street’s License to Steal:

All this begs multiple questions. For example, where are the voices of Treasurer Seth Magaziner and Attorney General Peter Kilmartin in all of this? David Sirota argues in a report that “the “crisis” language around pensions is, unto itself, fraudulent“. What does this say about Gina Raimondo’s public statements and testimony made potentially under oath while the pension lawsuit was being litigated? Was she totally forthcoming when the SEC previously looked into these matters? Seidle writes in Rhode Island Public Pension Reform: Wall Street’s License to Steal:

[T]he General Treasurer’s practice of withholding information and intentionally providing incomplete disclosures regarding ERSRI’s investments results in: (1) misleading the public as to fundamental investment matters, such as the true costs and risks related to investing in hedge, private equity, and venture capital funds; (2) understating the investment expenses and risks related to ERSRI; and (3) misrepresenting the financial condition of the state of Rhode Island to investors… [A]n investigation by state or federal securities regulators would reveal intentional withholding of material information and misrepresentations regarding state pension costs. [Emphasis added]

This is a scandal in development that makes Operation Plunder Dome look like shoplifting penny candy from the corner store. There never was a pension crisis, just a public swindle. This whole notion of a crisis is a gigantic fraud. And not only are public sector retirees and employees paying for it, every single taxpayer in Rhode Island is being duped into shoveling piles of cash into Wall Street’s trough.

The first person to scrutinize is John Arnold, the ex-Enron trader who was able to send a nice donation to both the Raimondo and Obama campaigns at key moments. Consider this line from a webpage cataloging his nationwide rampage:

Arnold donated hundreds of thousands of dollars to Engage RI, the PAC behind Raimondo’s campaign to cut benefits and move workers into a “hybrid” retirement system that includes a 401(k) component. The Arnold Foundation also helped finance a Brookings Institution report and an Urban Institute report trumpeting Raimondo’s pension cuts.

While Enron has gone down in history as having close ties with George W. Bush, complete with Ken Lay holding the classic Dubya appellation of “Kenny Boy”, this should not be surprising. For some years now, the Wall Street political donations have flowed into Democratic Party coffers whereas the Republicans depend on patronage from the fossil fuel industries. The reason Bush and Lay were buddies came down to the fact that Enron as a company operated in both worlds, trading in energy futures (which ended up being fraudulent in the long run), which combined the sale of commodities on an exchange floor like Wall Street with the generation of relationships to fuel corporations such as the ones the Bush family made their millions from.

David Sirota writes the following about Arnold:

According to CNN/Money, John Arnold is “the second-youngest self-made multibillionaire in the United States.” Only Mark Zuckerberg is younger and richer – but that’s not the only difference between the two. Whereas Zuckerberg made his fortune building a brand-new social media technology, Arnold made his the old fashioned way: through the kind of financial speculation that destroys economies, harms taxpayers and wrecks public pension funds… Underscoring the potential corruption surrounding the pension system, Siedle also reports that state pension officials became the target of “pay-to-play” allegations and a Securities and Exchange Commission inquiry. Meanwhile, the Economic Policy Institute reports that the Pew/Arnold-backed pension system “actually increases costs to state and local governments and taxpayers while making retirement incomes less secure.” Specifically, because of the comparative inefficiencies of the defined contribution part of the state’s new hybrid pension plan, state taxpayers will be forced to make “upwards of $15 million a year in additional contributions while providing a smaller benefit for the average full-career worker. [Emphasis added]

All this obviates a simple question, why?

The answer is relatively easy. The over-hyped Dodd-Frank Act and recession backlash has made the typical practice of bailing out the Too-Big-To-Fail banks untenable. After 2008, it is simply impossible to carry on with business as usual. There was the logical and sane option of breaking up the banks and reinstating the Glass-Steagall Act, the law dating back to the aftermath of the 1929 crash that segregated risky Wall Street investment from typical consumer depositor banking. But President Obama, who has always been up to his eyeballs in money from firms like Goldman Sachs and Blackstone, an outfit that makes Goldman seem like child’s play, could not do that. So instead, Wall Street had to find a new source of revenue.

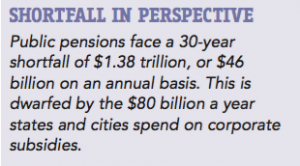

And what is perhaps the most trustworthy reservoir of cash to be found in America? The pension funds! Consider this line from Dan Pedrotty of the American Federation of Teachers: “Today, nearly $4 trillion is held in defined-benefit pension funds in our country on behalf of American workers for their retirement.” KA-CHING!

As with any fishing expedition, first you create the bait. Arnold has financed a “pension crisis” narrative through traditionally-dispassionate, objective venues that the public trusts immensely. For example, there was the shady report put out by the Brookings Institute that raised alarm bells. Or there was the nonsense news he financed for broadcast by the PBS division out of New York. There are all kinds of instances where Arnold’s plot is being rolled out. But you do not need me to tell you, just watch this delightful animated short created by the good union folks at AFSCME:

This of course helps to explain the motivation of why these folks are into education and push the charter school agenda. Besides the fact that it would break a major pillar of the union movement that could theoretically help union drives in the businesses of the Waltons (Wal-Mart and Sam’s Club) or the Gateses (Microsoft), it generates tons of revenue that goes into the pockets of the Wall Street investment firms! Consider also this point raised in The Plot Against America’s Pensions by David Sirota:

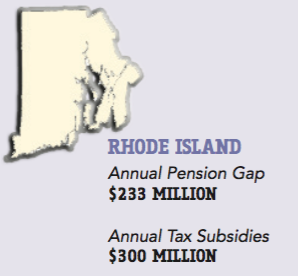

Like President George W. Bush’s proposal to radically alter Social Security, many of these plans would transform stable public pension funds into individualized accounts. They also most often reduce millions of Americans’ guaranteed retirement benefits. In many cases, they would also increase expenses for taxpayers and enrich Wall Street hedge fund managers…The goals of the plot against pensions are both straightforward and deceptive. On the surface, the primary objective is to convert traditional defined-benefit pension funds that guarantee retirement income into riskier, costlier schemes that reduce benefits and income guarantees, and subject taxpayers and millions of workers’ retirement funds to Enron’s casino-style economics…The bait-and-switch at work is simple: The plot forwards the illusion that state budget problems are driven by pension benefits rather than by the far more expensive and wasteful corporate subsidies that states have been doling out for years. That ends up 1) focusing state budget debates on benefit-slashing proposals and therefore 2) downplaying proposals that would raise revenue to shore up existing retirement systems. The result is that the Pew-Arnold initiative at once helps the right’s ideological crusade against traditional pensions and helps billionaires and the business lobby preserve corporations’ huge state tax subsidies. [Emphasis added]

It is worthwhile here to consider in closing some verbiage from Ted Siedle’s 2013 forensic audit:

Rhode Island’s state pension fund fell victim to a Wall Street coup. It happened when Gina Raimondo, a venture capital manager with an uncertain investment track record of only a few years—a principal in a firm that had been hired by the state to manage a paltry $5 million in pension assets—got herself elected as the General Treasurer of the State of Rhode Island with the financial backing of out-of-state hedge fund managers. Raimondo’s new role endowed her with responsibility for overseeing the state’s entire $7 billion in pension assets. In short, the foxes (money managers) had taken over management of the hen-house (the pension).

Indeed.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387