This presents a host of not just interest conflicts but potential illegal market manipulation committed in totality on the state level. If Raimondo manipulated the public in portraying the investments of the pension in a fashion to personally benefit her, that would constitute a serious malfeasance for investigation by the Attorney General. Furthermore, as this matter has involved court proceedings in a variety of cases, there could be potential perjury charges brought.

We will continue to explore these documents and bring highlights in further reporting.

§ 7-15-1 Definitions. – (a) “Enterprise” includes any sole proprietorship, partnership, corporation, association, or other legal entity, and any union or group of individuals associated for a particular purpose although not a legal entity.

(b) “Person” includes any individual or entity capable of holding a legal or beneficial interest in property.

(c) “Racketeering activity” means any act or threat involving murder, kidnapping, gambling, arson in the first, second, or third degree, robbery, bribery, extortion, larceny or prostitution, or any dealing in narcotic or dangerous drugs which is chargeable as a crime under state law and punishable by imprisonment for more than one year, or child exploitations for commercial or immoral purposes in violation of § 11-9-1(b) or (c) or § 11-9-1.1.

(d) “Unlawful debt” means a debt incurred or contracted in an illegal gambling activity or business or which is unenforceable under state law in whole or in part as to principal or interest because of the law relating to usury.

§ 7-15-2 Prohibited activities. – (a) It is unlawful for any person who has knowingly received any income derived directly or indirectly from a racketeering activity or through collection of an unlawful debt, to directly or indirectly use or invest any part of that income, or the proceeds of that income in the acquisition of an interest in, or the establishment or operation of any enterprise.

(b) It is unlawful for any person through a racketeering activity or through collection of an unlawful debt to directly or indirectly acquire or maintain any interest in or control of any enterprise.

(c) It is unlawful for any person employed by or associated with any enterprise to conduct or participate in the conduct of the affairs of the enterprise through racketeering activity or collection of an unlawful debt.

(d) Provided, that a purchase of securities on the open market for purposes of investment and without the intention of controlling or participating in the control of the issuer, or of assisting another to do so, is not unlawful under this section if the securities of the issuer held by the purchaser, the members of his immediate family, and his or her or their accomplices in a racketeering activity or the collection of an unlawful debt after the purchase do not amount in the aggregate to one percent (1%) of the outstanding securities of any one class, and do not, either in law or in fact, confer the power to elect one or more directors of the issuer.

…

§ 7-15-7 Investigative demands. – (a) Issuance. Whenever the attorney general has reasonable cause to believe that any person or enterprise has knowledge or is in possession, custody, or control of any documentary material pertinent to an investigation of a possible violation of this chapter, he or she may, prior to and/or following the institution of a civil or criminal proceeding on the violation, issue in writing and cause to be served upon the person or enterprise a civil investigatory demand by which he or she may:

(1) Compel the attendance of the person and require him or her to submit to examination and give testimony under oath; and/or

(2) Require the production of documentary material pertinent to the investigation for inspection and/or copying; and/or

(3) Require answers under oath to written interrogatories.

(b) Power to issue. The power to issue investigative demands does not abate or terminate by reason of the bringing of any action or proceeding under this chapter. The attorney general may issue successive investigatory demands to the same person in order to obtain additional information pertinent to an ongoing investigation.

(c) Confidentiality. In the event the attorney general initiates a civil investigatory demand prior to a criminal indictment for violation of this chapter, then the commencement, contents, and results of the civil investigatory demand is held in the strictest confidence by the attorney general and shall remain so until the time that a civil action is commenced, indictment for violation of this chapter returned, or removal of the confidentiality is ordered by a justice of the superior court.

(d) Contents of investigative demand. Each investigatory demand shall:

(1) State the nature of the conduct constituting the alleged racketeering violation of this chapter which is under investigation and the provisions of law applicable to the conduct;

(2) Prescribe a reasonable return date no less than twenty (20) days from the date of the investigative demand, provided that an earlier date may be prescribed under compelling circumstances;

(3) Specify the time and place at which the person is to appear and give testimony, produce documentary material, and furnish answers to interrogatories, or do any or a combination of the above;

(4) Identify the custodian to whom any documentary material is to be made available;

(5) Describe by class any documentary material to be produced with such definiteness and certainty as to permit the material to be fairly identified;

(6) Contain any interrogatories to which written answers under oath are required; and

(7) Advise in writing the person upon whom the demand is served that the material or statements may constitute a basis for prosecution against the person.

(e) Prohibition against unreasonable demand. No investigatory demand shall:

(1) Contain any requirement which would be unreasonable or improper if contained in a subpoena or a subpoena duces tecum issued by a court of this state; or

(2) Require the disclosure of any material which would be privileged from disclosure if demanded by a subpoena or a subpoena duces tecum issued by a court of this state.

(f) Service of investigative demand.

(1) An investigative demand may be served by:

(i) Delivering an executed copy to the person to be served, or if the person is not a natural person, to any partner, executive officer, managing agent, general agent, or to any agent of the person authorized by appointment or by law to receive service of process on behalf of the person;

(ii) Delivering an executed copy to the principal office or place of business of the person to be served; or

(iii) Mailing by certified mail, return receipt requested, an executed copy addressed to the person to be served, or if the person is not a natural person, addressed to its principal office or place of business in this state, or if it has none in this state, to its principal office or place of business.

(2) A verified return by the individual serving any demand or petition setting forth the manner of service is prima facie proof of service. In the case of service by certified mail, the return shall be accompanied by the return post office receipt of delivery of the demand.

(g) Authorization to examine. The examination of all persons pursuant to this section shall be conducted by the attorney general or a representative designated in writing by him or her, before an officer authorized to administer oaths in this state. The statements made shall be taken down stenographically or by a sound recording device and shall be transcribed.

(h) Rights of persons served with investigative demands. Any person required to attend and give testimony or to submit documentary material pursuant to this section is entitled to retain, or, on payment of lawfully prescribed cost, to procure, a copy of any document he or she produces and of his or her own statements as transcribed. Any person compelled to appear under a demand for oral testimony pursuant to this section may be accompanied, represented, and advised by counsel. Counsel may advise the person in confidence, either upon the request of the person or upon counsel’s own initiative, with respect to any question asked of the person. The person or counsel may object on the record to any question, in whole or in part, and shall briefly state for the record the reason for the objection. An objection may properly be made, received, and entered upon the record when it is claimed that the person is entitled to refuse to answer the question on grounds of any constitutional or other legal right or privilege, including the privilege against self incrimination. The person shall not otherwise object to or refuse to answer any question, and shall not by him or herself or through counsel interrupt the oral examination. If the person refuses to answer any question, the attorney general may petition the superior court for an order compelling the person to answer the question. The information and materials supplied to the attorney general pursuant to an investigative demand are not permitted to become public or be disclosed by the attorney general or his or her employees beyond the extent necessary for legitimate law enforcement purposes pursuant to this chapter.

(i) Witness expenses. All persons served with an investigative demand, other than those persons whose conduct or practices are being investigated or any officer, director, or person in the employment of the person under investigation, are paid the same fees and mileage as paid witnesses in the courts of this state. No person is excused from attending the inquiry pursuant to the mandate of an investigative demand or from giving testimony, or from producing documentary material or from being required to answer questions on the ground of failure to tender or pay a witness fee or mileage, unless demand for the witness fee or mileage is made at the time testimony is about to be taken and unless payment of the witness fee or mileage is not made.

(j) Custody of documents. (1) The attorney general shall designate, from within the department of attorney general, an investigator to serve as racketeer document custodian and any racketeering investigators that he or she determines are necessary to serve as deputies to that officer.

(2) Any person on whom any demand issued under this section has been served shall make the material available for inspection and copying or reproduction to the custodian designated in the demand at the principal place of business of the person, or at any other place that the custodian and the person subsequently agree and prescribe in writing or as the court may direct, pursuant to this section on the return date specified in the demand, or on any later date that the custodian may prescribe in writing. The person may, upon written agreement between the person and the custodian, substitute copies of all or any part of the material for originals of the materials.

(3) The custodian to whom any documentary material is delivered shall take physical possession of it, and is responsible for its use and for its return pursuant to this chapter. The custodian may cause the preparation of any copies of the documentary material that are required for official use under regulations which are promulgated by the attorney general. While in the possession of the custodian, no material produced shall be available for examination, without the consent of the person who produced the material, other than for legitimate law enforcement purposes pursuant to this chapter. Under any reasonable terms and conditions that the attorney general prescribes, documentary material while in the possession of the custodian shall be available for examination by the person who produced the material or any authorized representatives of the person.

(4) Whenever any attorney has been designated to appear on behalf of the state before any court or grand jury in any case or proceeding involving any alleged violation of this chapter, the custodian may deliver to the attorney any documentary material in the possession of the custodian that the attorney determines to be required for use in the presentation of the case or proceeding on behalf of the state. Upon the conclusion of any case or proceeding, the attorney shall return to the custodian any documentary material withdrawn which has not passed into the control of the court or grand jury through its introduction into the record of the case or proceeding.

(5) Upon the completion of the investigation for which any documentary material was produced under this chapter, and any case or proceeding arising from the investigation, the custodian shall return to the person who produced the material all the material, other than copies of it made by the custodian pursuant to this section, which has not passed into the control of any court or grand jury through its introduction into the record of the case or proceeding.

(6)(i) When any documentary material has been produced by any person under this chapter, and no case or proceeding arising from it has been instituted within a reasonable time after completion of the examination and analysis of all evidence assembled in the course of the investigation, the person is entitled, upon written demand made upon the custodian, to the return of all documentary material. Provided, that no documentary material shall be tendered, delivered, or made available to any other state, federal, or municipal agency.

(ii) Anyone who knowingly and willfully violates the provision of this subdivision shall, in addition to any civil liability, be punished by a fine of not more than five hundred dollars ($500) and/or imprisonment for no longer than one year.

(7) In the event of the death, disability, or separation from service of the custodian of any documentary material produced under any demand issued under this chapter or the official relief of the custodian from responsibility for the custody and control of the material, the attorney general shall promptly designate another racketeering investigator to serve as custodian of the documentary material, and transmit notice in writing to the person who produced the material as to the identity and address of the designated successor. Any designated successor has all duties and responsibilities as to the materials imposed by this chapter on his or her predecessor in office as to them, except that he or she is not responsible for any default or dereliction which occurred before his or her designation as custodian.

(k) Enforcement of investigative demands for production. Whenever any person fails to comply with any civil investigative demand served upon him or her under this chapter requiring the production of documentary material, or whenever satisfactory copying or reproduction of that material cannot be done, and the person refuses to surrender the material, the attorney general may file in the superior court and serve upon the person a petition for an order of the court for the enforcement of the demand.

(l) Refusal of persons served to testify or produce documents. Whenever any natural person neglects or refuses to attend and give testimony or to answer any lawful inquiry or to produce documentary material if in his or her power to do so in obedience to an investigative demand served upon him or her under this chapter, he or she may be adjudged in civil contempt by the superior court until any time that he or she purges him or herself of contempt by testifying, producing documentary material or presenting written answers as ordered. Any natural person who commits perjury or false swearing in response to an investigative demand pursuant to this section is punishable pursuant to the provisions of chapter 33 of title 11.

(m) Motion to quash. Within twenty (20) days after the service of an investigatory demand upon any person, or at any time before the return date specified in the demand, whichever period is shorter, the person served may file in the superior court and serve upon the custodian a petition for an order of the court modifying or setting aside the demand. The time allowed for compliance with the demand in whole or in part as deemed proper and ordered by the court shall not run during the pendency of the petition in the court. The petition shall specify each ground upon which the petitioner relies in seeking relief, and may be based on any failure of the demand to comply with the provisions of this chapter or on any constitutional or other legal right or privilege of the person.

(n) Right of persons producing documents. At any time during which any custodian is in custody or control of any documentary material delivered by any person in compliance with an investigatory demand, the person may file in the superior court and serve upon the custodian a petition for an order of the court requiring the performance by the custodian of any duty imposed upon him or her by this chapter.

(o) Duty to testify. (1) If, in any investigation brought by the attorney general pursuant to this section, any individual refuses to attend or to give testimony or to produce documentary material or to answer a written interrogatory in obedience to an investigative demand or under order of court on the ground that the testimony or material required of him or her may tend to incriminate him, that person may be ordered to attend and to give testimony or to produce documentary material or to answer the written interrogatory, or to do an applicable combination of these. The above order is an order of court given after a hearing in which the attorney general has established a need for the grant of immunity, as subsequently provided.

(2) The attorney general may petition the presiding justice of the superior court for an order as described in subdivision (1) of this subsection. The petition shall set forth the nature of the investigation and the need for the immunization of the witness.

(3) Compelled testimony shall not be used against the witness as evidence in any criminal proceedings against him or her in any court. However, the grant of immunity does not immunize the witness from civil liability arising from the transactions about which testimony is given, and he or she may nevertheless be prosecuted or subjected to penalty or forfeiture for any perjury, false swearing, or contempt committed in answering or in failing to answer or in producing evidence or failing to do so in accordance with the order. If a person refuses to testify after being granted immunity from prosecution and after being ordered to testify, he or she may be adjudged in civil contempt by the superior court until any time that he or she purges him or herself of contempt by testifying, producing documentary material or presenting written answers as ordered. The above does not prevent the attorney general from instituting other appropriate contempt proceedings against any person who violates any of the above provisions.

The House Commission on Drones has shown itself, over the course of its three meetings, to be very pro-drone. The concerns of those who seek to profit from drones have been given every consideration, the concerns of privacy advocates, not so much. As bad as this is, Rep Stephen Ucci used to be a lawyer working for Raytheon, one of the biggest drone manufacturers in the world, and he has declined to reveal what, if any, financial ties he still has to the company.

The House Commission on Drones has shown itself, over the course of its three meetings, to be very pro-drone. The concerns of those who seek to profit from drones have been given every consideration, the concerns of privacy advocates, not so much. As bad as this is, Rep Stephen Ucci used to be a lawyer working for Raytheon, one of the biggest drone manufacturers in the world, and he has declined to reveal what, if any, financial ties he still has to the company.

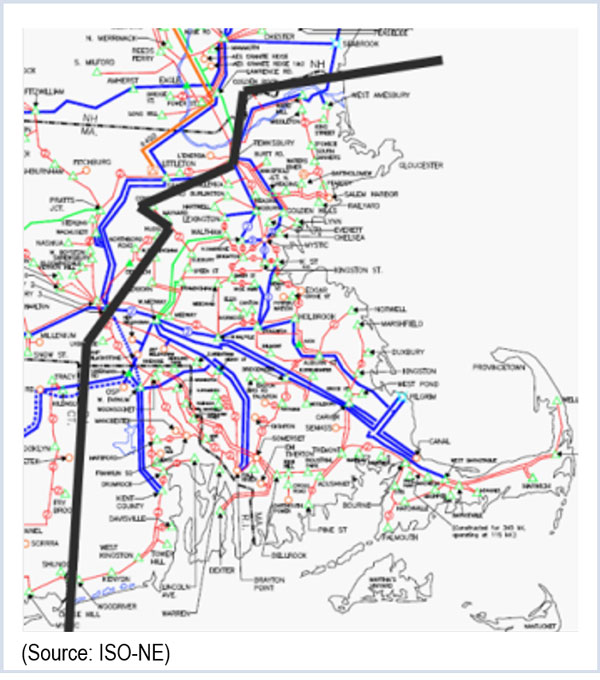

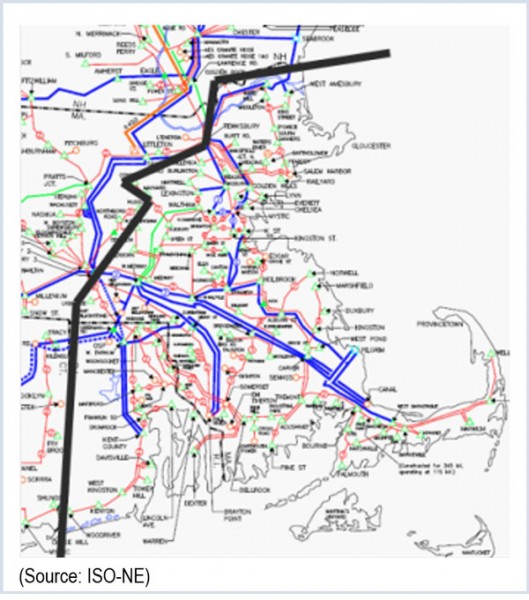

This is not what Invenergy expected when they presented their plans for the new plant. “If you look at Invenergy’s filing with the Energy Facility Siting Board (EFSB),” says Elmer, “they were talking about how desperately the plant is needed, it’s needed in RI to keep the lights on, and that the clearing price of capacity is going to be much higher in RI than in the rest of the ISO NE pool, what they call ‘rest of pool.’”

This is not what Invenergy expected when they presented their plans for the new plant. “If you look at Invenergy’s filing with the Energy Facility Siting Board (EFSB),” says Elmer, “they were talking about how desperately the plant is needed, it’s needed in RI to keep the lights on, and that the clearing price of capacity is going to be much higher in RI than in the rest of the ISO NE pool, what they call ‘rest of pool.’”

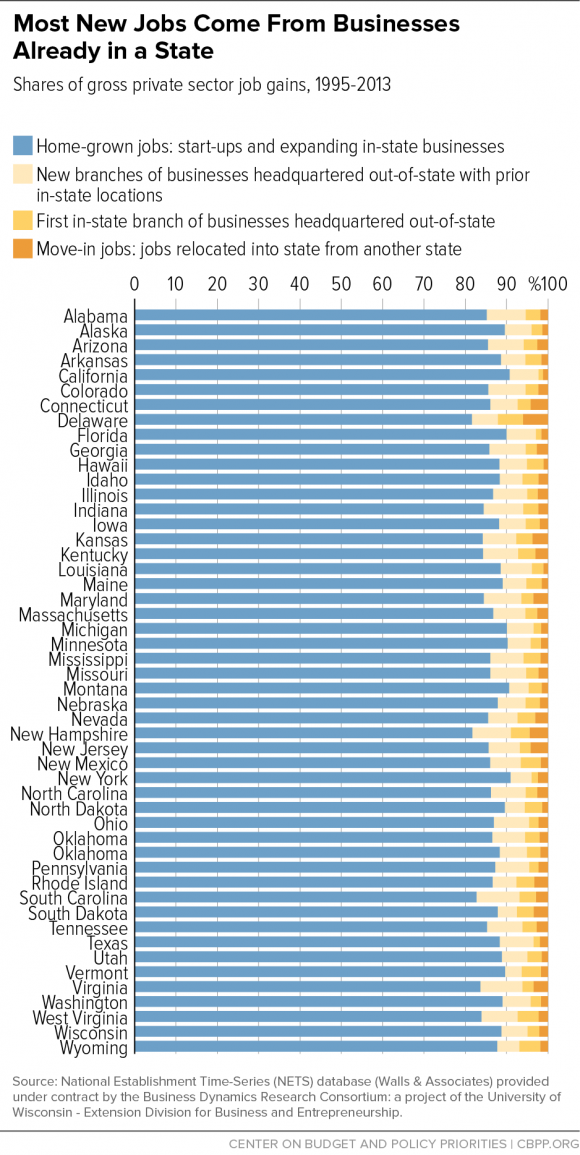

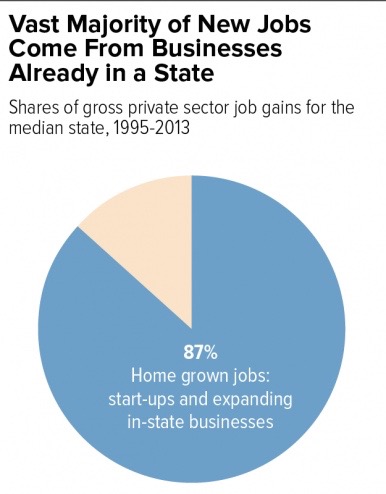

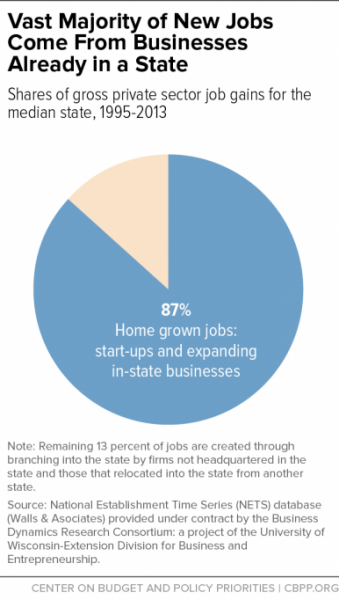

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”