Several weeks ago the Washington Post ran a story about the glories of Governor Gina Raimondo’s pension policy, a matter I wrote about for CounterPunch.

- UPDATE: FOLLOW THE MONEY ON THE RAIMONDO PENSION SCHEME: JOHN ARNOLD

- UPDATE: FOLLOW THE MONEY ON THE RAIMONDO PENSION SCHEME: MARVIN ROSEN

Since then, sources have shared with RI Future a 13-page letter dated December 8, 2015 sent by Edward “Ted” Seidle, President of Benchmark Financial Services to Elizabeth Rosato of the FBI’s White Collar and Complex Financial Crimes unit, LeeAnn Ghazil Gaunt of the SEC’s Municipal Securities and Public Pensions unit, and Stephen Dambruch of the U.S. Attorney’s Office – District of Rhode Island’s Criminal Division. The U.S. Attorney’s Office and the FBI said that they do not comment on potential or current investigations. The SEC has yet to get back.

[Editorial note: On the phone Seidle told RI Future editor Steve Ahlquist that he spoke to the agencies before sending the letter and that his concerns were met with a “good deal of interest.”]

Mr. Seidle has previously written about the Raimondo pension policy in Forbes:

There’s no prudent, disciplined investment program at work here—just a blatant Wall Street gorging, while simultaneously pruning state workers’ pension benefits. It’s no surprise that some of Wall Street’s wildest gamblers have backed her so-called pension reform efforts in the state legislature. Former Enron energy trader emerges as a leading advocate for prudent management of state worker pensions? That’s more than a little ironic.

Here’s the letter with all emphasis contained in the original and only minor formatting adjustments:

Re: Rhode Island Retired Teachers Association Request for Further Investigation and Prosecution of Potential Civil and Criminal Violations Related to the Employees’ Retirement System of Rhode Island

Dear Ladies and Gentleman,

Why have 40 percent of the assets of the tax-exempt Rhode Island state pension been invested offshore in high-cost, high-risk hedge and private equity funds that permit billionaire fund managers to avoid U.S. taxes and “mystery” investors to profit at the expense of the state pension—all in secrecy? Rhode Islanders want to know.

The Rhode Island Retired Teachers Association (RIRTA) has retained me to bring potential civil and criminal malfeasance related to the Employees’ Retirement System of Rhode Island (ERSRI) that I have investigated to your attention for both further investigation and prosecution and I am writing to you on RIRTA’s behalf. While RIRTA works to safeguard retirement benefits for Rhode Island educators, the potential violations of law discussed in this letter impact all stakeholders in ERSRI, including participants and taxpayers.

I am a former SEC attorney and the nation’s leading expert on pension forensics, having investigated over $1 trillion in retirement assets. Prior investigations include the pensions of the states of North Carolina, Kentucky and Alabama; the cities of Nashville, Jacksonville and Chattanooga; Shelby County, Tennessee and Town of Longboat Key, Florida; retirement plans of major corporations such as Wal-Mart, Caterpillar, Boeing, Edison, Lockheed, Northrop Grumman, Deere, Bechtel, ABB, Edison and US Airways; and asset managers handling retirement assets such as Fidelity, JP Morgan, Sanford Bernstein, and Banco Santander. [1] I train U.S. Department of Labor pension investigators around the country; have testified before the Senate Banking Committee regarding the mutual fund scandals and was a testifying expert in various Madoff litigations.

I write about my investigations for Forbes.com and was named as one of the 40 most influential people in the U.S. pension debate by Institutional Investor for both 2014 and 2015.

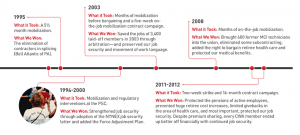

By way of background, I have completed two extensive investigations of the $7.4 billion ERSRI.

The first, entitled Rhode Island Pension Reform: Wall Street’s License to Steal [2] was commissioned by the American Federation of State, County and Municipal Employees, Council 94 (Rhode Island’s largest public employee union representing more than 10,000 state, city, town and school department employees) and completed October 17, 2013.

The second, entitled Double Trouble: Wall Street Secrecy Conceals Preventable Pension Losses in Rhode Island [3] was made possible through donations by 350 individual “crowdfunders”—with no contribution by organized labor and completed June 5, 2015. A petition to have the U.S. Securities and Exchange Commission investigate the potential violations of law related to ERSRI identified in the Double Trouble report posted on change.org by Concerned RI Taxpayers has been signed by 375 individuals to date. [4]

Each of these forensic investigations includes details regarding certain apparent civil and criminal violations of law by Wall Street investment managers and advisers managing or overseeing ERSRI’s assets—wrongdoing which I will discuss further below.

If I am correct in my analysis—and I am confident that I am—the potential violations of law by asset managers and advisers handling the assets of the already seriously underfunded state pension identified in these reports likely represent the greatest threat to the financial well-being of Rhode Islanders in the state’s history.

At the outset it is paramount to note the following alarming facts:

- In the past decade, state and local public pensions throughout the United States have significantly shifted assets toward a massive allocation into so-called “alternative” investments, including hedge and private equity funds. Today, roughly $660 billion of public pension assets are invested in hedge and private equity funds alone. Total public pension assets in all various alternative classes are estimated at $1 trillion.

Never before in the history of the nation’s state and local government pensions has so much money been steered so swiftly into newly-created, unproven investments. Approximately 40 percent of ERSRI’s assets have been invested in alternatives—in the past five years. - Alternatives are the highest cost, highest risk investments ever devised by Wall Street. The rich fees related to alternatives have enabled promoters to secretly reward influential politicians and pension intermediaries who recommend these investments— “marketing muscle” which largely explains the public pension surge into alternatives. These investments present inappropriate risks for American government workers retirement savings such as offshore (e.g. Cayman Island and other tax havens) regulation and foreign custody of assets; portfolios that are often exceptionally hard-to- value and prone to price manipulation by investment managers (whose pay is based upon inflated values); “friends and family” and other insiders who are permitted to invest on more favorable terms, as well as secretly profit at the expense of public pension investors; hidden, excessive and bogus fees and expenses; other unsavory business practices and complex (as well as questionable) investment strategies—all heretofore unknown to public pensions and which, if subjected to regulatory and law enforcement scrutiny, may be found to involve fraud or theft related to public sector retirement savings.

As I told a crowd of hundreds of stakeholders at a seminar sponsored by RIRTA in Providence in November, the pension has been “looted” and the looting continues through today. [5]

For example, as indicated in my initial investigation, [6] approximately $1 billion in ERSRI assets have been invested in 18 hedge funds. Investment luminaries such as Warren Buffett and John Bogle of Vanguard have both publicly warned that these hedge fund alternative investments are not suitable for public pensions. Rhode Island workers pensions invested offshore in the Cayman Islands? - As awareness of alternative investment business practices has grown, pervasive improprieties and illegalities have been identified. For example, the U. S. Securities and Exchange Commission announced in 2014 that more than half of the 400 private-equity firms its staff had examined charged bogus fees and expenses. [7]

Phony or inflated valuations of private equity portfolio holdings are common since these holdings are priced solely by the general partner managing the fund who is paid asset- based and performance fees on these values. [8] For example, in March 2015, the SEC charged Patriarch Partners and its CEO with improper asset valuations that caused investors to pay nearly $200 million more in higher fees. [9]

The private-equity model lends itself to potential abuse because it’s so opaque, according to Daniel Greenwood, a law professor at Hofstra University in New York and author of a 2008 paper entitled “Looting: The Puzzle of Private Equity.” [10]

While high net worth individuals may be unaware or even unconcerned about looting, when state and local government workers of modest means become aware their retirement savings have been stolen (as opposed to merely mismanaged), it is reasonable that they demand regulators and law enforcement intervene to protect their imperiled retirement savings. - Perhaps most insidious, the alternative investment industry—with the consent of public pension officials—has been permitted to operate in complete secrecy. Longstanding public records laws have been interpreted or changed almost overnight in all fifty states to permit hedge and private equity funds to manage approximately $1 trillion in public pension assets free of public scrutiny. In less than a decade, the nation’s public records laws have been eviscerated for the first time in history.

It should come as no surprise to regulators and law enforcement that secrecy fosters rampant wrongdoing by Wall Street in connection with handling state and local government workers’ retirement savings.

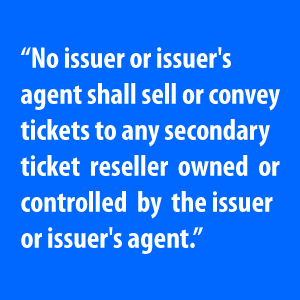

In Rhode Island, both current Treasurer Magaziner and former Treasurer Raimondo, now Governor, have claimed ERSRI is obliged—pursuant to contracts fund officials signed—to defer to the money managers it hired to manage pension assets on the release of supposedly “proprietary” information. Virtually all information regarding the risks, conflicts of interest, investment strategies and performance of the alternative managers has been withheld from the public as “proprietary.”

To be perfectly clear, offering documents and subscription agreements related to alternative investment funds that have been widely distributed to thousands of prospective investors and intermediaries globally—and that contain primarily publicly available information—have been deemed by ERSRI officials and the pension’s investment managers to be wholly “top secret.”

On August 8, 2013, four open-government groups – Common Cause Rhode Island, the state’s chapter of the American Civil Liberties Union, the Rhode Island Press Association and the League of Women Voters of Rhode Island sent a letter to the Treasurer voicing their concerns regarding the Treasurer’s strategy of withholding hedge fund records. These groups believe that since the financial reports were paid for with public funds and detailed how the state was investing the public’s money, they should have been made public in their entirety; further they found “troubling” the Treasurer’s decision to allow the hedge funds to decide what information to release.

In summary, at this pivotal moment when $1 trillion in public pension assets are at risk, it is crucial for taxpayers, public employees, regulators and law enforcement to pierce the veil of secrecy, examine the myriad forms of commonplace alternative industry wrongdoing, and craft an effective response to protect retirement funds set aside for government workers.

It is time to address whether alternative industry malfeasance may be criminally, as well as civilly actionable when public pensions, such as ERSRI, are harmed.

Bear in mind that ERSRI stakeholders are, at this time, five years into a ten year looting (since alternatives typically involve a ten-year commitment) and already an estimated $2 billion has been lost in Rhode Island.

Below are specific examples of potential violations of law which were identified in the two forensic investigations of ERSRI.

- A. Licenses to Steal: In my original forensic investigation of ERSRI, I identified language in the offering documents of a number of the hedge funds in which ERSRI had invested which indicated the fund managers were not required to provide the same type or level of disclosure regarding investments and strategies to all investors.

1. Informational advantages: That is, certain mystery investors would be permitted to invest in these funds on terms that provide access to information regarding fund investment portfolios that was not generally available to other investors and, as a result, would be able to act on such additional information (e.g., request withdrawal of their monies) that other investors (such as ERSRI) did not receive.

In the words of ERSRI hedge fund manager Brevan Howard, “The General Partner may in its absolute discretion agree to provide certain strategic investors in the Partnership with information about the Partnership and its investments which is not available to investors generally.” Says the Indus Asia Pacific Fund, “… the Fund, in its sole discretion, may permit such disclosure on a select basis to certain shareholders if the Fund determines that there are sufficient confidentiality agreements and procedures in place. Davidson Kempner states, “The Fund has entered and may enter into side letters and other agreements and arrangements with certain investors pursuant to which, among other things, an investor may receive reports and have access to information regarding the Fund’s portfolio that might not be generally available to other shareholders. Such investors may be able to base their investment decisions, including, without limitation, redeeming their shares from the Fund, on information that is not generally available to other shareholders.”

2. More favorable rights: The Ascend Partners Fund II adds further that, in addition to portfolio “informational” advantages, certain investors may be granted favorable “rights” not afforded other investors such as ERSRI. The fund states, “The Partnership and the General Partner may from time to time enter into agreements with one or more Limited Partners whereby in consideration for agreeing to invest certain amounts in the Partnership and other consideration deemed material by the General Partner, such Limited Partners may be granted favorable rights not afforded to other Limited Partners or investors, generally. Such rights may include one or more of the following: special rights to make future investments in the Partnership and/or the Other Accounts, as appropriate; special withdrawal rights, relating to frequency, notice and/or other terms; rights to receive reports from the Partnership on a more frequent basis or that include information not provided to other Limited Partners (including, without limitation, more detailed information regarding positions); rights to receive reduced rates of the Incentive Allocation and/or Management Fee; rights to receive a share of the Incentive Allocation, Management Fee or other amounts earned by the General Partner or its affiliates; and such other rights as may be negotiated between the Partnership and such Limited Partners. The Partnership and the General Partner may enter into such agreements without the consent of or notice to the other Limited Partners.”

In other words, ERSRI fiduciaries have gone along, for whatever reasons, with investment managers permitting certain mystery investors in the hedge funds to profit at its expense through “information” and “rights” advantages—effectively granting a license to steal from the state pension to these unknown investors. How do government workers benefit from exposing their retirement savings to these blatantly offensive practices?

3. Mystery investors: The identity of the privileged insiders permitted to profit from the state pension is not disclosed. The managers are not even required to notify ERSRI that other investors receiving greater information, paying lower fees, and enjoying special rights, do, in fact, exist. It is simply disclosed that mystery investors may exist without notice to, or the consent of, ERSRI.

As I concluded in my first report, “The identity of any mystery investors that may be permitted by managers to profit at ERSRI’s expense, as well as any relationships between these investors, the Treasurer or other public officials, should immediately be investigated fully by law enforcement and securities regulators—especially since leading hedge fund insiders have financially supported the pension “reform” that gave rise to these hedge fund investments and related mysterious arrangements.”

4. New forms of potential political corruption: State workers whose pensions are at risk deserve to know whether the “mystery” insiders secretly profiting at their expense may be linked to elected officials and pension fiduciaries. That is, have these officials been corrupt in selecting and relying heavily upon alternative investments for ERSRI which permit mystery investor profiting, or merely inept? Why would Raimondo and Magaziner initiate and commit for over a decade to a high-cost, high-risk alternative investment (losing) gamble which the best investors in the world—Buffett and Bogle— specifically warned against? Who stands to gain from this recklessness?

For example, according to most recent SEC filings Tudor Global Trading (related to hedge fund manager Paul Tudor Jones) is an owner of Point Judith Capital— a venture capital firm founded and owned in part by Governor Raimondo. Is any Jones-related entity directly or indirectly a special or strategic investor in a hedge fund permitted to profit potentially at the expense of ERSRI? Also, a philanthropic foundation established by another hedge fund insider, Houston billionaire and former Enron trader, John Arnold, reportedly donated $100,000 to a political action committee supporting Raimondo’s candidacy. [11] Arnold and his wife, Laura, previously made a $100,000 donation to the same super PAC a year earlier. [12] Is any Arnold-related entity directly or indirectly a special or strategic investor in a hedge fund permitted to profit potentially at the expense of ERSRI? Again, state workers deserve to know and regulators and law enforcement should investigate any such potential dealings, in my opinion.

5. Other violations of applicable regulations and law: The Brevan Howard fund goes on to state that it “may be constrained, or may find it unduly onerous, to disclose any or all such information or to prepare or disclose such information in a form or manner which satisfies certain regulatory, tax or other relevant authorities. Failure to disclose or make available information in the prescribed manner or format, or at all, may adversely affect the Partnership or the partners in the Partnership that reside in such jurisdictions.” In other words, investors in the fund are warned that its nondisclosure policies may violate certain applicable regulations and laws.

6. Cayman Island offshore regulation and custody: Some of the hedge funds in which ERSRI invests are incorporated and regulated under the laws of foreign countries, presenting additional, unique risks. Likewise, since ERSRI’s alternative investment assets are held at different custodian banks located around the world, as opposed to being held by ERSRI’s master custodian, the custodial risks are heightened.

Offshore regulation has clear advantages to the hedge fund billionaires managing ERSRI’s assets.

“Hedge fund titan George Soros reportedly amassed $13.3 billion in deferred hedge fund fees and investment gains on those fees by moving his assets to Ireland and then to the Cayman Islands. Hedge funds love to set up shop offshore. And it’s not because of the weather.” [13]

How does investing in offshore hedge funds (which involve additional substantial legal and regulatory risks) provide any benefit to government employees participating in ERSRI—a pension which is tax-exempt, the investments of which are required to be selected and managed for their exclusive benefit? - B.Private Equity Potential Fiduciary Breaches and Illegalities: In order to assess the risks, potential fiduciary breaches and violations of law related to the 72 private equity funds owned by ERSRI, I reviewed SEC filings and other public records related to 12 of these investments in my second investigative report. Millions in illegal fees, undisclosed payments to politically-influential intermediaries (placement agents); collusion by managers to suppress the share prices of companies; fraud on the U.S. government; tax evasion and the Governor potentially profiting at the expense of ERSRI are but a few of the matters investigated related to ERSRI alternative investments.

In addition to the substantial revelations of private equity wrongdoing mentioned below, I am aware there is a substantial body of confidentially-reported misdeeds. The overwhelming majority of abuses that have been reported to regulators (including malfeasance regulators are currently prosecuting) have not been made public by whistle-blowers, aggrieved investors and regulators. Thus, the abuses listed below are the mere “tip of the iceberg.”

1. Unauthorized or undisclosed fees: On November 3, 2015, the SEC announced that Fenway Partners LLC and four executives agreed to pay a total of more than $10.2 million to settle charges that they failed to tell investors about payments to employees by one of its private equity fund companies. The private equity firm and the executives were not “fully forthcoming” to a client and investors about the conflict of interest, which involved more than $20 million in payments, the SEC said. “The case is part of the SEC’s ongoing crackdown into what it sees as a widespread industry problem concerning how buyout firms allocate and disclose various kinds of fees. It follows a $39 million SEC sanction against Blackstone Group in October and a $30 million sanction against Kohlberg Kravis Roberts & Co. in June.” [14]

Earlier this year TPG disclosed millions in annual additional fees charged to investors (on top of asset management, performance, transaction and monitoring fees), as the SEC has pushed for greater disclosure. [15]

According to regulatory filings, Carlyle collected $245 million in extra fees between 2008 and the end of 2013, compared with $4.6 billion in carried interest. [16]

When private equity managers are “not fully forthcoming” or steal (i.e., take without permission) undisclosed monies from public pensions, criminal prosecution should be considered.

2. Secret agents: As noted in my first report, when asked by the SEC in 2009, ERSRI admitted that Fenway Partners Capital Fund III paid an influential intermediary, Marvin Rosen, of Diamond Edge Capital Partners $262,500 related to this investment and paid the firm a total of approximately $1 million related to four private equity investments. Mr. Rosen was a Democratic fundraiser linked to former President Bill Clinton whose firm earned millions in New York pension fund deals in 2005 and 2006 when Alan Hevesi was state controller. [17] Fenway and Mr. Rosen were also was involved in a pay-to-play controversy related to the New Mexico state pension. [18]

Carlyle, one of the largest and most politically connected private equity firms, in 2009 agreed to pay $20 million and make broad changes to its practices to end an inquiry by New York’s state attorney general into its pension business. Under the deal, Carlyle no longer would use intermediaries, known as placement agents, to gain investment business from public pension funds nationwide, and would curtail its campaign contributions to elected officials who oversee pension funds. [19]

3. Price Collusion: In August 2014, Carlyle settled a lawsuit contending that it and other large buyout firms had colluded to suppress the share prices of companies they were acquiring. The lawsuit targeted some other ERSRI private equity managers, i.e., Bain Capital, and TPG. Carlyle agreed to pay $115 million in a settlement but didn’t pay those costs. “Instead, investors in Carlyle Partners IV, a $7.8 billion buyout fund started in 2004, will bear the settlement costs that are not covered by insurance. Those investors include retired state and city employees in California, Illinois, Louisiana, Ohio, Texas and 10 other states. Five New York City and state pensions are among them.”

4. Fraud: It has been a bumpy few years for Providence Equity, said the New York Times in April 2015. In February, one of the firm’s biggest investments, the security screener Altegrity, filed for bankruptcy in the face of fraud accusations. Providence had its entire $800 million stake wiped out, the largest loss in the firm’s 26- year history. In 2011, a former USIS (Altegrity’s previous name) manager in Alabama filed a whistle-blower lawsuit that the government later joined asserting that 40 percent, or 665,000, of the investigations USIS turned in to the government between 2008 and 2012 were incomplete. [20] Altegrity’s reputation suffered another blow after revelations that it had performed the background checks on Edward J. Snowden, the former National Security Agency contractor who leaked documents to journalists, and Aaron Alexis, the Washington Navy Yard shooter who killed 12 people in 2013. The final straw was a hacking attack on USIS, which led the government to withdraw its contracts. With the loss of that business, and buckling under $1.8 billion in debt, Altegrity filed for bankruptcy protection in February.

Again, when public pensions suffer losses as a result of fraud perpetrated on the government, law enforcement should consider separate prosecution of the pension managers responsible.

5. Private equity secret profiting: As disclosed in Providence Equity’s most recent Form ADV filing with the SEC, certain of the principals and employees of the adviser or their family members may invest in the Providence funds and the management fees assessed on their investments are typically substantially reduced or waived entirely. In addition, all of the principals’ and employees’ capital subscription may be made through reductions in or waiver of the management fee payable to the adviser by such fund in lieu of capital contributions by such principals and employees.

Again, how does ERSRI gain from—why would ERSRI fiduciaries agree to—permitting employees of a richly-compensated asset manager to participate in the same funds in which the pension invests on more favorable terms? Based upon my experience, it is likely that virtually all of ERSRI’s private equity managers permit their principals, employees and “friends” to participate in their funds on a preferential basis—potentially profiting at the expense of ERSRI.

6. ERSRI’s Investment in Raimondo’s Point Judith II: ERSRI’s investment in Point Judith II venture fund, formerly managed by Governor Raimondo, raises numerous “red flags,” primarily discussed in my original report. As noted in my second report, since this investment will terminate in 2016, the truth about the performance of this investment may finally become known to the public in the near future.

Red flag: Not only was Raimondo successful in soliciting a $5 million investment from ERSRI in her small, unproven venture fund, for some reason ERSRI paid Point Judith Capital the highest of fees for this investment—fees even higher than the firm requested in its sales presentation to ERSRI. Why did ERSRI pay a higher fee to Raimondo’s Point Judith than the firm originally asked? As I stated in my first report, “It appears that the 2.5 percent asset-based and 20 percent performance fees paid to Point Judith by ERSRI are significantly higher than the then venture capital industry standard of 2 percent asset-based and 20 percent performance fees. Since Point Judith Capital was a small, unproven manager at the time of the investment by ERSRI, there is no reason to believe the firm should have commanded a higher fee.”

Red flag: Further, Raimondo and ERSRI made numerous public statements regarding the performance of the Point Judith II fund, as well as released summary performance figures which were strikingly divergent. Based upon incomplete information she has provided, the performance of the investment has ranged from her initial claim of 22 percent, to 12 percent, to 10.9 percent, to 6.2 percent, to 4 percent, to -16.7 percent. In conclusion, as a result of the Treasurer’s refusal to publicly disclose all of the material information regarding Point Judith Capital and the Point Judith II fund she formerly managed and sold to ERSRI, choosing instead to disclose limited unverified information which is wildly inconsistent, it is impossible for the general public, participants and taxpayers to assess her and the firm’s investment capabilities, as well as whether ERSRI should have ever invested, or should remain invested, in the Point Judith II fund. In order to prevent any possible confusion or misleading of investors, it is appropriate to refer this matter to the SEC for investigation, I stated.

Red flag: As a Point Judith insider, Raimondo, or other mystery investors, may have been granted special rights more favorable than those granted to the state, including special withdrawal rights; rights to receive reports from the partnership on a more frequent basis or that include information not provided to other limited partners; rights to receive reduced rates of the incentive allocation and management fee; rights to receive a share of the incentive allocation, management fee or other amounts earned by the general partner or its affiliates. If true, Raimondo who received her interests in the Point Judith fund for free and other mystery investors may be profiting at the expense of the state, which paid $5 million for its limited partnership interests.

In conclusion, the evidence of pervasive wrongdoing involving alternative investments held in the portfolios of pensions established for state and local government workers nationally, including ERSRI, is overwhelming. The malfeasance evident in ERSRI’s alternative investments is harmful to the already severely underfunded pension.

The so-called “reform” of ERSRI involving heavy use of alternative investment funds engaged in practices unsuitable or illegal for the pension is doomed to continue to fail. Five years into a ten-year looting, already an estimated $2 billion has been lost in Rhode Island. It is not too late to act to protect the retirement savings of state and local government workers of modest means.

At this pivotal moment when $1 trillion in public pension assets are at risk nationally, regulators and law enforcement must pierce the veil of secrecy, examine the myriad forms of commonplace alternative industry wrongdoing, and craft an effective response to protect government workers retirement security—before the ten-year looting cycle has been completed.

It is time to address whether alternative industry malfeasance may be criminally, as well as civilly actionable when public pensions, such as ERSRI, are harmed.

I am available to answer any questions you may have and provide any assistance. Please do not hesitate to call me.

Edward “Ted” Siedle

President

[1] Findings of certain of these forensic investigations have been made public and can be viewed at my company website, www.investigatemyretirementplan.com.

[2] http://www.scribd.com/doc/176896709/Rhode-Island-Public-Pension-Reform-Wall-Street-s-License-to-Steal

[3] http://files.golocalprov.com.s3.amazonaws.com/Double%20Trouble%20FINAL.pdf

[4] https://www.change.org/p/u-s-securities-and-exchange-commission-investigate-potential-violations-of-the-rhode-island-8-billion-state-pension-fund

[5] http://www.forbes.com/sites/edwardsiedle/2015/11/20/rhode-island-retired-teachers-association-turning-up- the-heat-on-pension-looting/

[6] Page 51.

[7] http://www.bloomberg.com/news/articles/2014-04-07/bogus-private-equity-fees-said-found-at-200-firms-by-sec

[8] How Fair are the Valuations of Private Equity Funds? http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2229547

[9] http://www.pionline.com/article/20150330/ONLINE/150339990/sec-charges-private-equity-firm-patriarch-ceo- with-improper-valuation

[10] https://people.hofstra.edu/Daniel_J_Greenwood/pdf/Looting.pdf

[11] http://www.providencejournal.com/article/20140224/NEWS/302249995

[12] http://wpri.com/2014/10/15/arnold-donates-another-100k-to-pro-raimondo-super-pac/

[13] http://www.forbes.com/sites/trangho/2015/05/09/why-hedge-funds-love-to-go-offshore/

[14] http://www.reuters.com/article/us-sec-fenway-idUSKCN0SS22620151103#GZTKQVh88ckmZo8f.97

[15] http://www.scmp.com/business/banking-finance/article/1673090/blackstone-tpg-capital-disclosefees-under-

pressure-us-sec

[16] http://www.wsj.com/articles/fees-get-leaner-on-private-equity-1419809350?cb=logged0.46937971841543913

[17] http://www.nydailynews.com/news/bill-clinton-pal-earned-huge-pension-fees-marvin-rosen-firm-millions- hevesi-reign-article-1.361953

[18] http://watchdog.org/15168/nm-gary-bland-trouble-for-the-sics-pay-to-play-lawsuit/

[19] http://www.nytimes.com/2009/05/15/nyregion/15carlyle.html

[20] http://www.nytimes.com/2014/10/19/business/retirement/behind-private-equityscurtain.html?_r=0

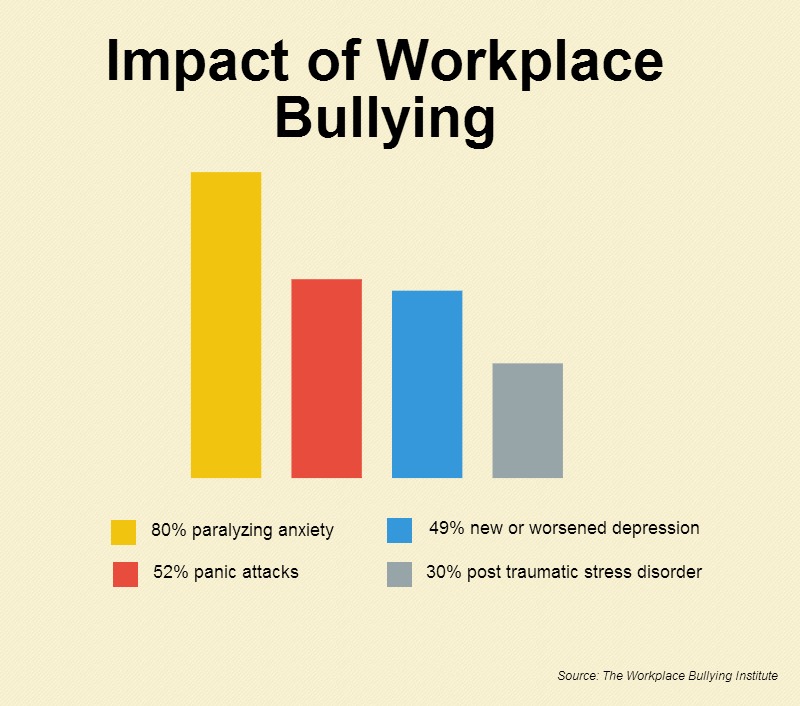

well-being or productivity. Imagine studying what work would be like if there were no yelling, screaming, pushing and shoving.

well-being or productivity. Imagine studying what work would be like if there were no yelling, screaming, pushing and shoving.