“To cut or raise state taxes,” wrote Kathy Gregg in Friday’s Providence Journal, “which is better for Rhode Island’s struggling economy?”

It’s a fair question, given that Rhode Island’s political punditry is at odds over the answer. Those who advocate for the rich and powerful say raising taxes will hinder growth and the those who advocate for the working class saying the rich need to start paying their fare share for the state to recover.

A new research paper by two nonpartisan economists says the right is wrong on this one.

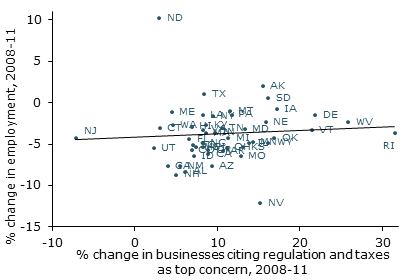

“While business concerns about government regulation and taxes also rose steadily from 2008 to 2011, there is no evidence that job losses were larger in states where businesses were more worried about these factors,” reads the report.

Here are the bios of the two economists who authored the study: “Atif Mian is a professor of economics and public policy at Princeton University and a visiting scholar at the Federal Reserve Bank of San Francisco. Amir Sufi is a professor of finance at the University of Chicago Booth School of Business.”

In Gregg’s story, House Speaker Gordon Fox is quoted as saying, “one thing we keep hearing from the business community is they want predictability in their tax policies … . If we are going to move [away] from that standard convince me and others reps why we should.”

Well here you go, Mr. Speaker and other legislators. The finale of these two nationally recognized nonpartisan economists research refutes this exact claim (emphasis mine):

The state-level evidence is less consistent about regulation and taxes as factors holding back employment. There are important caveats. For example, it’s possible that business uncertainty held back hiring nationally but did not show up differently across states. Or perhaps the NFIB’s specific question does not capture the type of policy uncertainty that researchers believe has been holding back hiring. In any case, the view that government-induced uncertainty held back employment must be consistent with the absence of any state-level correlation between employment growth and increases in business concerns about regulation and taxes.

This begs a question: If government-induced uncertainty is not holding back hiring, then what is? The basic pattern in Mian and Sufi (2012) continued to hold through 2012. U.S. counties with high household debt levels coming into the recession are the same counties with depressed levels of employment in the nontradable sector today. So why did the initial demand shock in these counties have a more permanent effect on employment? Important long-term trends should be considered here, in particular the continued decline in manufacturing and other mid-skill “routine” jobs (see, for example, Charles, Hurst, and Notowidigdo 2012 and Jaimovich and Siu 2012). Understanding why the United States has had such difficulty replacing lost jobs in the long run remains an open question.

It’s important to keep in mind that while activists on either side of the political spectrum may disagree on whether high taxes help or hinder economic growth, the public is not. A poll done last year by Fleming and Associates (the same pollster that WPRI uses) showed that almost 70 percent of respondents want to raise taxes on Rhode Island’s richest residents.

While this study doesn’t prove the public and progressives are right, it does show that the right is wrong. Or, it at least shows that the logic local conservatives have offered for why to resist raising revenue from the rich doesn’t hold economic water.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387