Voting against the increase were Republicans Nick Kettle, of Coventry, Mark Gee, of East Greenwich, and Elaine Morgan, of Ashaway.

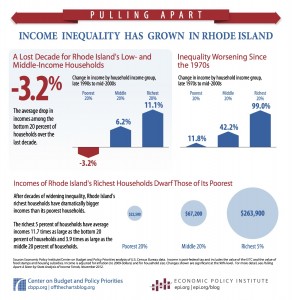

A study from 2012 conducted by the Center on Budget and Policy Priorities (CBPP) showed that from the 1970’s to the mid-2000s, the income gap has grown 70 percent. The poorest 20 percent of Rhode Islanders have only received a 11.8 percent raise in their household incomes, while the richest 20 percent have seen their income grow 99 percent.

In Connecticut and Massachusetts, the percentages are even more disconcerting. The poorest 20 percent of MA residents have seen no change in their income since the 1970s, but the richest 20 percent have had a 151.9 percent increase. Connecticut’s poorest residents have even seen a drop in their income by 4 percent since the 1970s, and a 9.8 percent drop in the past decade, more than both Rhode Island and Massachusetts.

How did this even happen? Kate Brewster, the executive director of the Economic Progress Institute, believes that trends have lead to the widening income gap.

“Our economy has shifted so dramatically,” she said. Brewster stated that over the years, Rhode Island has seen a move from the manufacturing to the service industry, as well as a decline in unionization among employees. These factors have lead to a decline in the minimum wage’s value.

Senator Erin Lynch (D-District 31), the sponsor of the legislation, said the move to $9.60 is a step in the right direction, even though she originally wanted $10.10.

“I would have loved for it to be $10.10,” she said. “I think any step forward is a good step forward.”

Lynch also added that even though raising the minimum wage is definitely a part of eliminating income inequality, it’s not the only piece of the puzzle.

“We want to continue moving in the direction we’re moving. There’s no one magic bullet. We’re working on all kinds of different things.”

Other pieces of the economic puzzle include workforce development, access to capital, and education. Lynch believes that those together can help to level out incomes in the state, especially because they will be able to help those who are providing for their families. Outside of the state house, Lynch works as a divorce lawyer, and sees the hardships that low wages can take on the family unit.

“I see a lot of parents. I see a lot of people getting second and third jobs. People are doing what they need to do to support their families,” she said.

Currently, Rhode Island has one of the highest minimum wages in the country, but will soon fall behind states like Massachusetts, California, and Washington, DC, as they move their wages upwards of $10 an hour going into 2016.

“An adult needs close to $12 to meet their basic needs,” Brewster said. “$10.10 would have been great, but $9.60 is better than $9.”

Lynch stated that she will continue working to move the state economy forward. Hopefully that means a brighter, more equal future for everyone in Rhode Island.

“This is home,” Lynch said. “We want to make it the best place it can be.”

]]> As President Obama lays out his tax plan for addressing income inequality in tonight’s State of the Union speech, in the first lady’s VIP box will sit a poster child for excessive CEO pay – Rhode Island resident and CVS CEO Larry Merlo.

As President Obama lays out his tax plan for addressing income inequality in tonight’s State of the Union speech, in the first lady’s VIP box will sit a poster child for excessive CEO pay – Rhode Island resident and CVS CEO Larry Merlo.

Merlo got the invite thanks to the fantastic corporate example the Rhode Island-based pharmacy chain set when it stopped selling tobacco products.

“Last year, CVS Caremark President and CEO Larry Merlo announced that CVS would be the first major retail pharmacy to eliminate tobacco sales in all of its stores,” according to a White House item about CVS and Merlo. “Soon after, the company changed its corporate name to CVS Health — a symbol of the organization’s broader commitment to public health.”

CVS certainly deserves tons of applause for this. But CVS has far from warranted corporate sainthood based on the way it pays employees.

Merlo makes $22 million a year, according to CNN Money. He’s the 8th highest paid CEO in America. And he’s number 1 when it comes to making more more than his or her underlings.

“CVS has the greatest disparity between CEO pay and the median wage of its employees among the 100 highest-grossing companies in the U.S.,” Fortune Magazine reports. “You would have to combine the wages of more than 400 CVS Caremark employees to match the salary of the company’s CEO, Larry Merlo.”

On the other end of the salary spectrum at CVS, some low wage employees say annual raises were denied this year to absorb the cost of an increase to the minimum wage. “Salary increases are based on market-based rates and the individual performance of employees, said CVS spokesman Mike DeAngelis when asked about the allegation. “The increase to Rhode Island’s minimum wage does not change this.”

The median CVS employee earns $28,000 a year, according to Fortune Magazine (DeAngelis did not immediately respond to an email yesterday seeking more exact numbers). According to the Economic Progress Institute, this is about $4,000 a year more than a single adult needs to survive in Rhode Island and $31,000 less than a single parent of two would need to pay their basic living expenses.

CVS can and should do better than this.

Like selling cigarettes, there is money to be made by paying employees a pittance. But there’s also very real, if sometimes latent, negative social costs in doing so. For example, we know many CVS employees will require social services to augment their low wages. And we also know low wages lead to poor health decisions.

Most fortunately, CVS has balked at profiteering on activity with a negative social impact. “This is the right thing to do,” said CVS when it stopped selling tobacco products. Just two years after severing its ties to ALEC, this is a hugely promising step for the Woonsocket-based corporation.

Paying a living wage to all employees is also the right thing to do. Let’s hope Michelle Obama impresses upon Merlo that economic security is also an important function of community health as well.

]]> The popularity of Thomas Piketty’s Capital in the 21st Century has conservatives and economic elites in a bit of lather. As they try to refute an economic reality that has become obvious to most everybody, they end up making some transparently deceptive arguments.

The popularity of Thomas Piketty’s Capital in the 21st Century has conservatives and economic elites in a bit of lather. As they try to refute an economic reality that has become obvious to most everybody, they end up making some transparently deceptive arguments.

Take Larry Summers, who headed up the US Treasury Department at the end of the Clinton Administration and has served as a top economic advisor to Barack Obama. This PBS News Hour piece in which Piketty refutes the criticisms quotes Summers, saying:

Even where capital accumulation is concerned, I am not sure that Piketty’s theory emphasizes the right aspects. Looking to the future, my guess is that the main story connecting capital accumulation and inequality will not be Piketty’s tale of amassing fortunes. It will be the devastating consequences of robots, 3-D printing, artificial intelligence, and the like for those who perform routine tasks. Already there are more American men on disability insurance than doing production work in manufacturing. And the trends are all in the wrong direction, particularly for the less skilled, as the capacity of capital embodying artificial intelligence to replace white-collar as well as blue-collar work will increase rapidly in the years ahead.

This argument is specious in the extreme. It says, in essence, “It’s not that elites like me are accumulating all this wealth; it’s that the ROBOTS are making us accumulate all this wealth.” Summers would have us think that robots are marching in from Robotland and taking over factories in some evil plot to destroy the middle class.

The reality is that economic elites have specifically developed these technologies to eliminate paid workers and increase profits for themselves. They know this, and now many other people know this. That second part kind of scares them because if enough people figure this out, they might actually do something about it.

Nota Bene: At no point does Summers actually say that wealth accumulation is not happening or that this factor is not what’s driving economic inequality or that economic inequality is not a big, big problem. He just says that it’s the robots that did it.

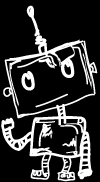

]]> Not since Roe v. Wade has a U.S. Supreme Court decision permeated the public consciousness quite like the Citizens United v. Federal Election Commission (FEC) case. In 2010, the nation’s highest court opened the campaign finance floodgates when – in a 5-4 decision – they sided with lawyers for the anti- Hillary Clinton political action committee (PAC) Citizens United who argued that PACs not be required to disclose their donors identities or the amounts of money they had contributed.

Not since Roe v. Wade has a U.S. Supreme Court decision permeated the public consciousness quite like the Citizens United v. Federal Election Commission (FEC) case. In 2010, the nation’s highest court opened the campaign finance floodgates when – in a 5-4 decision – they sided with lawyers for the anti- Hillary Clinton political action committee (PAC) Citizens United who argued that PACs not be required to disclose their donors identities or the amounts of money they had contributed.

Bold and continuing campaign finance reform in our nations capitol began in Washington, D.C., in 1971 and continued until 2002. The 1971 Federal Election Campaign Act required the disclosure of donors’ identities and the amounts they contributed to federal election campaigns.

A little known Supreme Court decision that, at its heart, concluded that the spending of money equals free speech was handed down in 1976. A Supreme Court majority held that a key provision of the Campaign Finance Act, which limited expenditure on election campaigns was “unconstitutional”, and contrary to the First Amendment.

The leading opinion viewed spending money as a form of political “speech” which could not be restricted due to the First Amendment. The only interest was in preventing “corruption or its appearance”, and only personal contributions should be targeted because of the danger of “quid pro quo” exchanges.

The 2002 Bipartisan Campaign Reform Act – better known as the McCain-Feingold Act after the bill’s primary sponsors, Republican John McCain and Democrat Russ Feingold – strengthened restrictions, but did nothing to challenge or reverse the Supreme Court’s previous rulings.

Essentially, the Citizens United case boiled down to this.

According to the U.S. Constitution, corporations are afforded the same rights as people, and therefore should be given the same protections as individuals when it comes to political donations. This decision, by correlation, asserted that the spending of money equates to the exercise of our First Amendment rights to free speech. While the Supreme Court’s decision may be true to the letter of U.S. law, it raised a widespread concern amongst Americans as to whether corporations should, in fact and practice, be afforded the same rights as people, and whether the spending of money constituted free speech.

[vsw id=”xQqzhjstb7E” source=”youtube” width=”550″ height=”400″ autoplay=”no”]

Just this week, the Supreme Court dealt another blow to campaign finance reform advocates in the McCutcheon v. FEC ruling. In essence, the decision did not affect federal campaign finance laws, save for one small factor. Prior to the decision, individuals and PACs were forced to abide by a hard-and-fast limit on aggregated donations to political candidates or PACs in support or opposition to particular legislation or candidates.

Let’s look at it this way.

Prior to the McCutcheon decision, there was a limit as to what I could donate to any and all political campaigns within an election cycle. That cap was $123,200. I could spend that total in any way I saw fit, as long as I abided by current FEC guidelines of $2,600 per federal candidate in each primary and general election or $32,400 per PAC in each cycle.

While the Supreme Court’s decision did not eliminate the $2,600 or $32,400 guidelines, it did declare the cap of $123,200 unconstitutional. This means I can donate $2,600 to any candidate in any state, and $32,400 to any PAC in any state, without restrictions, up to infinity dollars.

If I had the money to do this, I would, but therein lies the rub.

I don’t.

You don’t.

98 percent of the people in the U.S. don’t.

The McCutcheon decision has basically told big time donors that they can start buying candidates and PACs throughout the country, and in turn buy legislative influence.

Unfortunately, the U.S. Supreme Court has rightly ruled in both of these cases. As they stand, the only way to rescind these decisions is to amend the U.S. Constitution to say plainly that corporations are not people, and spending money is not free speech. This is where the nationwide movement to amend the U.S. Constitution comes into play.

Amending the U.S. Constitution is no small task. 38 of the 50 states must ratify an amendment. Our first step in Rhode Island is to amend our own constitution. As it stands, the Rhode Island chapter of the Move(ment) to Amend has bills before both the R.I. Senate and House. On their face, these bills do nothing, but when combined with bills in other states, we send a loud and clear message to the U.S. Supreme Court, and our legislators in Washington.

CORPORATIONS ARE NOT PEOPLE.

SPENDING MONEY DOES NOT CONSTITUTE FREE SPEECH.

Please, for the sake of our country, and our children and grandchildren, sign the petition to amend our Constitution today.

]]> ‘Inequality for All’ is coming to the University of Rhode Island tonight.

‘Inequality for All’ is coming to the University of Rhode Island tonight.

Well, just the blockbuster Robert Reich movie about the phenomenon on rampant income inequality in America. The phenomenon itself has been here for some time now, says Danielle Dirroco, the executive director of URI’s grad school labor union, host of the tonight’s event.

“Wealth inequality is the issue of our time, and we know this all too well here at URI,” she said. “As tuition creeps higher and higher, the opportunity for Rhode Islanders to gain access to a higher education is compromised and our capacity to creatively address our economic woes is undermined. To make any positive change, we have to begin by educating ourselves. Graduate Assistants United is thrilled to put the University of Rhode Island on the map for this nationwide campus event.”

The event starts at 6pm and there will be a special live webcast with Reich in which we can ask him a bunch of Rhode Island-specific questions. Here’s the Facebook event and below is the full press release from the URI Grad School Union:

]]>Graduate Assistants United, URI’s Graduate Employee Labor Union, will be providing its community with the opportunity to view and discuss this award-winning documentary about income inequality in our nation and the way it has shaped our economy and democracy. This event is held in conjunction with a national campus-based event that will include over 150 universities across the country. The University of Rhode Island will be the only university participating in this exciting event in state of Rhode Island.

Co-Sponsors include the URI Graduate Student Association, NewportFILM, the URI Department of Campus Equity and Diversity and SE Greenhouse. Refreshments generously provided by Starbucks Coffee Company.

The event will be held at the College of Biotechnology and Life Sciences Ryan Family Auditorium (CBLS 100). RSVP to Graduate Assistants United: uri.gau@gmail.com.

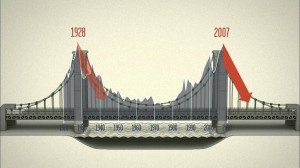

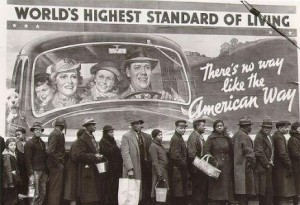

The American economy is in crisis. Enter Robert Reich: Secretary of Labor under Clinton, revered professor, charismatic pundit and author of thirteen books. “Bob” as he’s referred to in the film, is our hero and guide, shining a light on the urgency of this issue. Economic imbalances are now at near historically unprecedented levels. In fact, the two years of widest economic inequality of the last century were 1928 and 2007 – the two years just before the greatest economic crashes of modern times. What is the link between high inequality and economic crashes? What happened to the Middle Class?

As Americans, we’ve been taught that there is a basic bargain at the heart of our society: work hard, play by the rules and you can make a better life for yourself. But over the last 35 years, this bargain has been broken. Middle class incomes have stagnated or dropped over the same period during which the American economy has more than doubled. So where did all that money go? The facts are clear – it went to the top earners. In 1970 the top 1% of earners took home 9% of the nation’s income. Today they take in approximately 23%. The top 1% holds more than 35% of the nation’s overall wealth, while the bottom 50% controls a meager 2.5%. The last time wealth was this concentrated was in 1928, on the eve of the Great Depression.

What’s the big deal, you may ask? Didn’t the wealthy earn it? INEQUALITY FOR ALL is happy to acknowledge that. There is no vilifying of the rich here. The problem is that wide income divisions threaten the health of both our economy and our democracy.

When middle class consumers have to tighten their belts, the whole economy suffers. We saw this in the years before the Great Depression just as we see it today. The middle class represents 70% of spending and is the great stabilizer of our economy. No increase in spending by the rich can make up for it.

This is the moment in history in which we find ourselves: unprecedented income divisions, a wildly fluctuating and unstable economy, and average Americans increasingly frustrated and disillusioned. The debate about income inequality has become part of the national discussion, and this is a good thing. INEQUALITY FOR ALL connects the dots for viewers, showing why dealing with the widening gap between the rich and everyone else isn’t just about moral fairness.

The issues addressed in this film are arguably the most pressing issue of our times. The film alternates between intimate, approachable sequences and intellectually rigorous arguments helping people with no economic background or education better understand the issues at stake. INEQUALITY FOR ALL allows viewers to start with little or no understanding of what it means for the U.S. to be economically imbalanced, and walk away with a comprehensive and significantly deeper sense of the issue and what can be done about it.

For more information about INEQUALITY FOR ALL and to view the trailer, please visit InequalityForAll.com

This event is free to the public. Please RSVP via email to Graduate Assistants United at uri.gau@gmail.com

Rhode Island’s economy is recovering. But not for the 99 percent it isn’t.

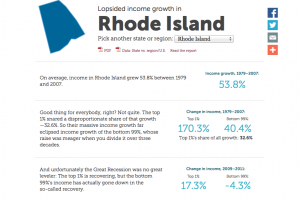

A new report by the Economic Analysis and Research Network shows that between 2009 and 2011, the 99 percent – those Rhode Island’s who make on average $41,958 a year – saw an average decline of 4.1 percent in their earnings.

On the other hand, the one percent in Rhode Island – those who make at least $287,311 a year – did quite well in the same two years. Their earnings increased by 17.3 percent from 2009 to 2011.

“Rhode Island has not escaped the disturbing trend of growing inequality over the past decades,” said Kate Brewster, executive director of The Economic Progress Institute. “Today, the average income of the top one percent is 20.3 times the average income of the bottom 99 percent. We call on leaders in Washington and here at home to put in place policies that increase income for the majority and help close the income gap.”

Only in four other states – North Dakota, Massachusetts, Texas and Colorado – did the one percent fare better from 2009 to 2011. And only the 99 percent in Nevada fared worse than the 99 percent in Rhode Island did from 2009 to 2011.

Conversely, there was less income disparity between the one percent and the 99 percent in Rhode Island from 1979 and 2007, and Rhode Island had less income disparity than the national average. The richest one percent of Rhode Islanders income grew by 170.3 percent from 1979 to 2007 compared to 40.4 percent for the poorest 99 percent of Rhode Islanders. Nationally during that same time frame, the richest one percent increased their earnings by 200.5 percent and the poorest 99 percent increased by only 18.9 percent.

The change in income distribution coincided with not only the economic collapse but also broad income tax cuts for the top tax bracket in Rhode Island proposed by former Governor Don Carcieri, a tea party Republican, and approved by the General Assembly, which took a hard turn to the right on economic policy during and after the Carcieri era.

From 2005 to 2011, the highest income tax rate in Rhode Island dropped from 9.9 percent to 5.99 percent. And during that same time frame that taxes were lowered on Rhode Island’s richest residents and they simultaneously started to earn a higher percentage of the state’s overall income, the unemployment rate creeped up to among the highest in the nation, further eroding the talking point from the far right and conservative Democrats that tax cuts help create new jobs.

The new report released today does not breaks down the data only into the one percent versus the 99 percent. You can read the full report here. Or check out the online version here. Here’s the Rhode Island-specific data.

In 2007, the one percent in Rhode Island accounted for 18.1 percent of all income. That was up from 1979, when the one percent only accounted for 10.3 percent. In 1928, the one percent in Rhode Island were responsible for 23.6 percent of all income.

]]> Senate President Teresa Paiva Weed said her chamber will focus on addressing poverty as a bottom-up strategy to fixing what ails Rhode Island’s economy this year.

Senate President Teresa Paiva Weed said her chamber will focus on addressing poverty as a bottom-up strategy to fixing what ails Rhode Island’s economy this year.

“The Senate’s focus this session on the economy will be inextricably intertwined with the causes of poverty,” she said at a State House vigil yesterday to call attention to poverty in Rhode Island. “We can’t move the economy forward without addressing the very issues that underline poverty.”

She said the vigil and a screening later in the day of Inequality For All “will set a tone for the year and the message will be carried with us as we work to meet the significant challenges ahead.”

Steve Ahlquist has the video:

]]> Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Can you tell I’m getting tired of having to “prove” stuff that is so obviously factual? Well, in case you couldn’t, I am tired of it.

In fact, even the winners in this zero-sum game have tacitly begun to admit that wage inequality is growing. For the last couple of years, the main counter-argument put out by the lackies of the very wealthy has become that, yes, inequality is growing, but it doesn’t matter.

That’s a lie, too.

Growing wage inequality was one of the primary causes of the collapse of 2007/8. It remains a primary cause of the ongoing Great Recession. Since the vast majority of wage earners were finding their salaries stagnant, if not shrinking, these same people had to rely on credit to finance many of their purchases in the so-called “Bush Boom” of the naughts. I say “so called” because, for the first time since the end of WWII, the median salary at the end of the “boom” did not reach the median salary at the end of the previous boom. That is, median salary in 2007 was lower than it was in 2000/01, before the mild recession that occurred at the end of the 1990s. This is stark proof that wages, for the vast majority of people who actually work for a living (as opposed to living off dividend income, or carried-interest) was not growing despite what Republicans were touting as a “booming economy”.

And spare me the morality play about the evils of credit, about how it shows a lack of moral fibre, how it demonstrates that people are too lazy, or too insistent upon immediate gratification, that they can’t wait and save to make purchases, blah, blah, blah.

Here’s a secret: Had people done this in the naughts, there wouldn’t have been enough demand to create even the wimp “Bush Boom”. The US would have remained mired in the recession that started in 2000 throughout Bush’s first term. I can say this with complete confidence because the only thing that fueled the expansion of the economy—such as it was—was that people were buying stuff on credit. This created the demand that created the expansion.

And demand is the key component. Corporations are swimming in money. They have so much money they can’t figure out where or how to spend it. More, they can borrow billions and billions of dollars at de facto negative interest rates. And yet, corporations are not spending money. If “supply-side” economics had any validity, businesses would be spending money like drunken sailors right now, and they would have been doing so for the past five years, ever since we hit the point of negative interest rates. Why haven’t they spent money? No, the answer is not the uncertainty of possible tax or regulatory changes. That is an absolute crock. If you actually read the business press (as opposed to listening to FOX News) you will realize that businesses are reluctant to spend because they do not believe there is sufficient demand for more products.

Demand. There you have it. The engine that truly drives economic expansion. My grandfather had a succinct way of describing conditions during the Great Depression: “Sure, a loaf of bread only cost a nickel. But what the hell, you didn’t have a nickel.”

In case anyone doesn’t get the point: it doesn’t matter how cheap things are because of a large supply. If people still don’t have the cash to buy stuff, it doesn’t get bought. IOW, there is no demand.

Demand.

And that is what is holding up recovery as the Great Recession enters its fifth—or is it sixth?—year. Got that, people? Sixth year. Lehman Brothers collapsed in 2008, while G. W. Bush was still president. Before Obama had been elected, let alone before he had taken office. Got that? George Bush was president. Hank Paulson, former head of Goldman Sachs was Secretary of the Treasury. Not Obama, not Geithner (although he was President of the NY Fed at the time).

Inequality matters, people. It matters a lot. It keeps demand down. When demand is down, people lose jobs. When people lose jobs, demand drops further, and more people lose jobs. This is called a death spiral. It’s essentially the same phenomenon, but going in the opposite direction, of what caused the inflation of the 1970s. And no, cutting wages DOES NOT HELP. Cutting wages is the equivalent of throwing people out of work. Yes, perhaps fewer people will lose their jobs outright, but demand will still decrease. It may—or may not—take a little longer, but the same result is attained.

So the answer is that people need to make more money. But what is happening instead is that the wages of most people are being cut. It’s the time of the year when a lot of companies are doing compensation planning. For many big companies, this is now a very simple process. A few people, maybe ten percent of the corporation’s employees, will get nice raises, maybe 5%, probably more. The rest will get nothing.

That is, the rest of the employees will get a pay cut. Their pay will remain the same, but even 1-%-2% inflation will erode stagnant pay. The result is a de facto pay cut. The result is a further decrease in demand. Funny: Republicans scream about how tax increases will hurt the economy because they will take money out of people’s pockets. But a pay cut does exactly the same thing, and yet Republicans fall all over themselves to demand—DEMAND—pay cuts.

It’s enough to make you suspect that Republicans don’t care about the economy at all. All they care about is tax cuts. All they care about is making the wealthy even wealthier. Even if it means the rest of us slowly slip into poverty.

This is because their wealthy corporate masters want tax cuts. So Republicans bow and scrape and say “Yes, Master” and move heaven and earth to give their masters what they want.

The rest of us can pound sand.

]]> I am of the mind that the biggest issue facing the state right now is the sluggish economy. I know many share this belief. With that in mind, I will be focusing my (unfortunately limited) time writing specifically on creative strategies to improve Providence’s and the state’s economy, and thinking about it from the perspective of the upcoming gubernatorial and Providence Mayoral campaigns (i.e., what do the candidates have to say about what I write?). Before I delve into specific suggestions, I believe there are a few items relevant to economic growth that need to be clarified at the outset.

I am of the mind that the biggest issue facing the state right now is the sluggish economy. I know many share this belief. With that in mind, I will be focusing my (unfortunately limited) time writing specifically on creative strategies to improve Providence’s and the state’s economy, and thinking about it from the perspective of the upcoming gubernatorial and Providence Mayoral campaigns (i.e., what do the candidates have to say about what I write?). Before I delve into specific suggestions, I believe there are a few items relevant to economic growth that need to be clarified at the outset.

First, there isn’t much the government can do to improve the economy directly, particularly in this climate of economic distress and innovation paralysis. When the economy is running smoothly, most folks want the government to “stay out of the way.” But when the economy tanks, policymakers are the first to be blamed (this is a disingenuous and undeserved complaint), and everyone wants them to “fix it.” First, you can’t have it both ways people. Second, there is no magic solution to “fixing” the economy.

Second, economic growth takes time, commitment, alignment on a vision, and the autonomy to make things happen. It is unlikely to see radically positive results in a few months or even a couple years. Economic development is a decades-long strategy, that often requires partnerships and long-term planning that are challenging for public officials, policymakers, and civil service staff. While the pain of recessions, joblessness, and foreclosures is real, there are often few options for state and local officials to ease that pain.

Third, everything matters to economic development: education, transportation, infrastructure, workforce, land-use, zoning, existing markets, history, taxes, regulations, natural assets, etc. But each of these matter to varying degrees depending on the industrial sector and individual businesses. To assume that “lowering taxes” or “reducing regulations” is the most important of considerations is foolish, ill-advised, offensive, and immeasurably distracting from the various other issues that are generally much more important for long-term economic success. While everything is important, some things are more important than others.

Fourth, every strategy comes with trade-offs and there are always winners and losers with any policy change. Typically, those with wealth and power can influence policy to their benefit. And while this may benefit them personally, or as a group, there are long-term consequences for the economy that are generally ignored. The incremental policy decisions that have been made in the past have led to our little state to lack the sufficient resiliency to bounce back from the recent and ongoing depression/recession. The economic conditions in which Rhode Island finds itself will take many, many years to rectify.

Fourth, every strategy comes with trade-offs and there are always winners and losers with any policy change. Typically, those with wealth and power can influence policy to their benefit. And while this may benefit them personally, or as a group, there are long-term consequences for the economy that are generally ignored. The incremental policy decisions that have been made in the past have led to our little state to lack the sufficient resiliency to bounce back from the recent and ongoing depression/recession. The economic conditions in which Rhode Island finds itself will take many, many years to rectify.

Fifth, demand for goods and services drives the supply of goods and services. If no one wants to buy stuff, stuff doesn’t get made, and people lose their jobs. Most tools that are deployed by cities and towns and the state try to stimulate the economy do not address economic demand, and as such they are largely inefficient and/or ineffective.

Sixth, underlying everything is an often ignored but crucial criterion: the importance of inclusive and dispersed economic growth. The benefits of economic growth need to be broadly shared because the more people who earn money, and the more money that they earn, the higher the level of economic growth. When economic growth benefits a small (and shrinking) number of people, aggregate demand declines and the economy suffers. When a rising tide actually lifts all boats, something that the post-WWII economy was notable for, everyone benefits. When a growing number of boats are chained to the bottom of the ocean, as has been the experience from the mid-1970s onward (with a notable exception during the 1990s), the economy flounders, people fall deeper in debt to maintain their standard of living, and the economy slows.

Seventh, the ONLY way the state (or any state, region, city, etc.) can be successful in the long-run is by improving its competitiveness in particular economic areas. This can be done by increasing the productivity of existing businesses through innovation or better trained employees or achieving higher workforce participation rates, while ALSO supporting the high and rising wages and living standards of Rhode Islanders. Period. This is hard to do, but not impossible. The role the city and state can play is to lay the groundwork for an iterative process of successive improvements to support business productivity gains and assist with the dispersion of economic benefits.

Eighth, when we discuss economic development, it’s important to differentiate between locally-traded clusters, sectors, and industries and those that are subject to larger markets, regional, national, or global in scope. The first group includes restaurants, local health services, residential housing construction, etc. while the second group includes software development, manufacturing, higher education, etc. The success of the first group is largely dependent upon the success of the latter. To put it another way, an economy can only grow by exporting lots of high-value goods and services and bringing in money to the state from other parts of the country / world. The degree to which the economy is exposed to and successfully competes in global markets is the single largest factor that explains how successful its local economy is. This isn’t to say that the local economy isn’t important, just that everyone selling hamburgers to each other does not grow the economy.

Finally, businesses grow at various points over their lifecycle. The only businesses that are guaranteed to have net positive job growth are new businesses, for the obvious reason that they will employ at minimum the owner of the business and they have no current employees to let go. Many businesses grow to a certain size and stay there for their entire existence. Many businesses have dramatic fluctuations in their employment based on seasonal or market demand. Some businesses have limited but sustained growth. And only a few businesses experience pronounced growth, and that growth is generally limited to a short period of time. All of this is important when it comes to growing jobs because there are only limited opportunities to identify and support existing businesses during their growth phases. But the opportunities are innumerable to support new business growth, and it is new business startups that have been responsible for net new job growth in the past decade.

There are additional factors that contribute or impede economic growth, but in my mind, the 9 above are of paramount importance. Feel free to bookmark this post as I will update it as I begin listing specific strategies to Rebuild Rhode Island!

]]> In my last post, I talked about Clarence Thomas and his truly remarkable rise to a position that his father could never, ever have achieved. Indeed, even a slightly older Mr. Thomas would probably not been able to attain such a truly lofty height.

In my last post, I talked about Clarence Thomas and his truly remarkable rise to a position that his father could never, ever have achieved. Indeed, even a slightly older Mr. Thomas would probably not been able to attain such a truly lofty height.

This all sort of gets to the idea of social mobility. If someone were born into conditions like those into which Mr. Thomas was born, how likely is it for that person to improve his level of economic security? Or, how likely is it for someone born into the upper echelons, such as Mr. Thomas’ children (does he have any?) to fall out of the exalted perch onto which she was born?

America has long perpetuated the ideal that everyone can improve their status. This is still true. It is still possible. But how likely is it? Or, how probable is it? And here, I use ‘probable’ in the technical sense of “Probability and Statistics”, the name of a book on my shelf. “Possible” and “Probable” are two very different words, with enormously different implications. The right wing continues to flog the notion of possibility. Sure, it’s possible. It’s possible that I can throw a ball through a solid wall, too. Or that all the air molecules in a room will suddenly rush into one corner and leave the rest of the room airless. But are these events likely to happen? No. According to the technical definition, that means, that they have an extremely low probability of occurring. Could a high school basketball team beat the Celtics? I suppose it’s possible. But the probability of this occurring is darn close to zero. It may not be exactly zero, but it’s probably (!) close enough to be considered zero in any real-world scenario.

Let’s set this up. Suppose you have been put into a situation in which you must choose one of two balls. One is yellow; the other is green. If you choose the correct ball, you will be given $100 million. If you choose the wrong one, you will have to spend the rest of your days working at a minimum wage job. Of course, you don’t know which ball gives the desired outcome, so you have to guess. And hope. And, as any fool knows, you have a 50/50 chance of getting it right. And an equal chance of getting it wrong. In other words, it’s a coin flip.

But let’s say we change the scenario, and introduce a blue ball. But even given the extra ball, there is still only one ‘correct’ choice. One ball will get you the $100M; either of the other two will get you consigned to the minimum wage. What has happened to your chance of success? It has been diminished. It has gone from 1 in 2, to 1 in 3. That is, rather than a 50% likelihood of success, you have a 33% chance.

For the next iteration, we’re back to two colors, red and green. The red ball gets you the $100M; the green results in the minimum wage job. But you have to pick either of the two balls out of a basket in absolute darkness, so you can’t see which ball is which. We’re back to 50/50. But let’s start adding green balls. If we add two more green balls, for a total of three green, one red, your chance of success has been cut in half. It’s now 1 in 4, or a 25% chance of success. Starting to look grim, isn’t it? Now let’s bring the total of green balls up to ten. This is a 1 in 11 chance, and suddenly your chances of success drop below 10%.

This is what tax cuts, cutbacks in social spending, cuts in education have been doing: they have been adding green balls into the system. At least, they’ve been adding green balls into the basket from which those on the lower end of the scale have to choose. At the same time, these policy choices—tax cuts, cuts in social spending, cuts to education—have been adding red balls into the basket from which those born into the upper echelon get to choose. In other words, we’ve been increasing the odds against success for those in the bottom half, while increasing them for those at the top. Put another way, we’ve been rigging the game in favor of those at the top. How would you feel about entering the game with the odds of success sitting at 11 to 1 against you? Would you want to take a chance on winning the $100M if there were a 9o% chance of being consigned to the ranks of minimum wage workers? Kinda stinks, doesn’t it?

This is what I meant in my previous post about my good fortune. I got to pick from a basket that was probably 75% red (good) balls. Yes, I could have failed, made a lot of bad choices, and ended up dropping. But the game was rigged in my favor from the start. Yes, I had to work for what I got, but that does not change the fact that I had an enormous head start over a lot of people.

And that, I think, is the clearest difference between a liberal and a conservative. A liberal recognizes—or never forgets—where she or he started. A liberal is aware that there were, there are always extenuating circumstances. Had Clarence Thomas worked twice as hard, but lived in the wrong place or time, all his effort may have been in vain. A conservative, from what I see, becomes convinced that they made it solely on their own merits. They fail to contextualize their success. They remember the work they put in to getting where they are, and nothing else. Yes, this is not the whole story of the differences between the two, but I think that it may be the single key difference. Clarence Thomas, or Rush Limbaugh, or—the golden example—George W Bush are all convinced that they did it on their own. No one helped them. They don’t think that the stable family environment, or the genes or temperament that put the grit into their belly to succeed was an advantage that, perhaps, other people don’t have. They don’t see that being in a semi-decent school with semi-decent parents who instill values gives them a big leg up on a lot of other people. They forget that they happened to be born at a good time, or a good place.

So conservatives don’t see why other people might need help. Perhaps growing up they did not have the advantage of government assistance (but they did; they just fail to recognize this, or to acknowledge this), so why should other people get this help? So we continue with the aforementioned policy choices—tax cuts, cuts in social spending, cuts to education— and what we’re doing is increasing the number of people who have to choose from the basket of mostly green (bad) balls. Each cut to Head Start, or SNAP, or job training, or education, we’re both adding to the number of green balls and increasing the number of people choosing from this basket. In other words, we’re stacking the deck against them. Such behavior would get you shot in a lot of gambling establishments. Ask Wild Bill Hickok.

If you don’t believe me, here’s some evidence.

Take a look at the chart on page 10 of the report at the link. For someone born into the bottom income quintile, there is more than a 33% chance that they will end up there. For someone born into the top quintile, the odds are over 37% in favor of them remaining. But it’s worse than that. There is a cumulative probability of 60 percent that someone born in the bottom quintile will stay in one of the bottom two quintiles. That is, they will never be above what the lowest 40% of the country makes. That is, they only have a 40% chance of making it to middle class.

BUT: for each percentage point you move up in the scale, your chances of remaining in the top levels goes up. That is, someone born in the 95th percentile, their chances of staying there are about 75%.

As for where the most people make it, or remain stuck where they are, check out the second link.

http://www.equality-of-opportunity.org/

What you find is that the places with single-digit movement from the bottom to the top are largely in the South. You know, the area of the country where low taxes, low union density and small-but-business-friendly government is attracting lots of Good Jobs. Just gobs and oodles of them! Charlotte, North Carolina is a great example of how this works. Remember, MetLife was planning to move several hundred jobs from RI, and a thousand (or more) from the Northeast to Charlotte, that land of opportunity. See! Charlotte attracts Good Jobs! But, per the second link, of the top 50 metropolitan areas in the US, Charlotte is #49 in inter-generational upward mobility. There, only 4% of those born in the bottom quintile can be reasonably expected to reach the top quintile. And note, that means the 81st percentile. Admission to this is a salary of about $78k per year. We’re not talking about top-flight surgeons, or anything such. We’re talking a solid job, something around what a teacher with ten years experience makes here. So the chance of someone being born into the bottom quintile of ending up with a job with a teacher’s salary is less than 5%, or 1 chance in 20. How would you like to pick from that basket?

As for the idea of talent, well, it ain’t what it used to be. An average student born into a family in the top quintile is several times more likely to graduate college than a bright student born into the bottom three quintiles. What this means is that the uninspired student from wealth is picking from a basket with lots of red (good) balls in it. And even if someone from the bottom 40% does beat the odds and finish college, that’s not the guarantee of success it once was. Average wages for college grads have been falling over the past 10 years, so I don’t want any nonsense about how all people have to do is pull themselves up by their bootstraps and work their way through college, blah, blah, blah.

Is this the kind of country we want? Where most people are pretty much destined to fail?

]]>