Each year on Labor Day we honor the hardworking women and men that drive our state’s economy forward. This has been an encouraging time of growth and momentum for workers, with Rhode Island gaining 5,000 jobs this year and a new national report showing we rank higher than every other New England state for advanced industry job growth.

Each year on Labor Day we honor the hardworking women and men that drive our state’s economy forward. This has been an encouraging time of growth and momentum for workers, with Rhode Island gaining 5,000 jobs this year and a new national report showing we rank higher than every other New England state for advanced industry job growth.

Rhode Islanders are returning to work rebuilding our roads and bridges through RhodeWorks, modernizing our schools with the School Building Authority, and completing green energy retrofit projects through the Infrastructure Bank. We’re attracting new high-wage jobs from out of state, like GE Digital, and some of our biggest employers are doubling down on the state, including Citizens Bank. We have a long way to go, but it’s clear we are moving in the right direction.

Labor Day is an important time to recommit to supporting and protecting our workers. It’s why we raised our minimum wage last year and we’re working to do it again. We’re cracking down on misclassification and going after companies that break the rules to ensure that every worker gets a fair day’s pay for a fair day’s work.

Our resilient and tireless workers do everything they can to grow our economy and strengthen our middle class. And in turn, I’ll be relentless in doing everything I can to ensure everyone has the opportunity to make it in Rhode Island.

I wish all Rhode Islanders a safe and happy Labor Day.

]]>

“This business, [with] 17, 18 employees, this is the lifeblood of Rhode Island’s economy. Most Rhode Islanders work for companies just like this, [with] 10, 20, 30, 40, 50 employees,” Raimondo said. “So, as governor, I am very focused on making it easier to do business, less expensive to do business.”

Some of the initiatives that Raimondo spoke about were big parts of the state budget, like the elimination of the sales tax on energy for businesses, as well as decreasing the corporate minimum tax from $500 to $450. Raimondo also took the time to highlight other parts of her jobs plan, such as the streetscape improvement fund, a small business assistance program run by the Commerce Corporation, and a program for “innovation vouchers.”

“Think of it as a coupon,” Raimondo said. “You can come to the Commerce Corporation, get a coupon, and then redeem your coupon at one of our local universities to get access to R&D. If you have a new technology you want to investigate, if you’re a healthcare company, if one of your clients is a healthcare company, a lot of the times they want access to a research team at URI or Brown or RISD or Johnson & Wales. Get the coupon from the Commerce Corporation, check it in with the university, and have special access. We’re trying to promote more innovation.”

Silva, who has owned and operated Graphic Ink since 1997, said that he was very excited for the governor to come visit his shop, and expressed support for her jobs plan.

“I think her plan that she’s launching is right on point with where small businesses need to be, and small businesses are the backbone of the state in my opinion,” Silva said. “It’s very exciting to hear that she is really encouraging to support small businesses.”

Silva said initiatives like the energy sales tax elimination and the roadside improvements continue to make it easier for his business, and businesses like his, to keep employing people, and therefore invest in the local community. He even said that he believes that, because the state is on an economic upturn, that Rhode Islanders are more likely to invest in small businesses.

“I believe she has recharged the state in a way that, there are many people, companies, organizations, colleges, that have a lot of activity going on. We are an event-based business. We produce things for events. There are lots of things going on, which in turn makes us a busy shop,” he said.

According to Silva, this increase in activity, and reinvestment in small businesses, has opened up a lot of jobs in the community, which is looking for skilled workers. In his opinion, now that the economy is beginning to heal, the next logical step is to work on getting vocational education programs out there for students to become trained laborers right out of high school, or in college. Silva said that he is always willing to train an employee on site, but some positions do require skilled labor, such as graphics or design.

With all of these changes, Silva envisions a bright future for small businesses in Rhode Island.

“I see small business, in my case, [becoming] stronger and stronger, as the owners and employees are willing to put some effort into it. As long as we put some effort into it and work hard, hard work pays off.”

]]>

A new study says a carbon tax in the state would create between 2,000 and 4,000 jobs, as well as create up to $900 million in state revenue by 2040. Scott Nystrom, a senior economic associate and project manager for Regional Economic Models, Inc. presented the study’s findings at Brown University.

Sponsored by the Energize Rhode Island Coalition, REMI’s study examined the possible benefits and consequences of instituting such a tax in the state.

Introduced this year, the Carbon Pricing Act has been tabled for the session but will be resubmitted next year. The bill, if passed, would be the first of its kind in the United States, setting an environmental standard for the rest of the country. More information can be found here.

Energize Rhode Island is currently promoting the Clean Energy Investment and Carbon Pricing Act, which would impose a carbon price (or tax) on all fossil fuels at the first point of sale within the state. The price would be $15 per ton of carbon dioxide for the first year the act is in effect, and raise at a rate of $5 per year.

The Carbon Pricing Act has two main goals – to provide a disincentive for using fossil fuel revenue to compensate for the cost of moving toward green energy. The price would be returned to Rhode Island’s economy in four different ways: a dividend check to households, a dividend to employers based on their share of state employment, a fund for energy efficiency costs, and administrative overhead.

According to REMI’s analysis, Rhode Island would receive positive benefits from implementing a carbon price.

“You actually have more jobs in Rhode Island that you would have otherwise with this policy,” Nystrom said during his presentation. Although the impact is relatively small, only around 1 percent of the jobs in the state, that’s still 2,000 to 4,000 jobs that were not there before. The Coalition says 1,000 of these jobs would be created within the first two years of the price’s introduction.

Total gross state product would rise as well, with the construction industry gaining roughly $86 million. The only industry that takes a serious hit due to the price is chemical manufacturing, which would lose $16 million. Real personal income would also increase between $80 and $100 million dollars during that time.

Nystrom also explained that instituting a carbon price could result in a population increase.

“Because the labor market is stronger, it draws more people to the state to an extent,” he said. “They move into the state as a consequence of the labor market, they buy a house, they settle down, and they increase the state’s population.”

With all of the new jobs and people living in Rhode Island, state revenues would be on the rise as well, earning between $200 and $900 million through the 2030s.

For all these benefits, cost of living would only increase minimally.

“Even though this does increase the cost of energy for states, It’s about a half a percent,” Nystrom said. “This means you have three months of extra inflection between now and 2040 than you would have otherwise.”

Carbon emissions were not the main focus of the study, but Nystrom did add that they would decrease over the course of a few years, and then stabilize.

“Emissions are purely a byproduct,” he said. “This is a result of the model.”

]]>

“Over 40 percent of the youth of color between the ages of 10 and 24 are unemployed,” Jim Vincent, executive director of the Providence branch of the NAACP. “That’s a recipe for disaster.”

Because of this, the lack of good public schools in the urban core and the general feeling that the streets there have become less safe has inspired he and others who fight for social justice to hold a press event today at 4:30 in front of the Garrahy Judicial Complex in Providence today.

Vincent told me some 12 community organizations are coming together to advocate for a safer city, better education and a firmer commitment that Rhode Island’s urban core will not be left behind.

Listen to our conversation here:

]]> I am of the mind that the biggest issue facing the state right now is the sluggish economy. I know many share this belief. With that in mind, I will be focusing my (unfortunately limited) time writing specifically on creative strategies to improve Providence’s and the state’s economy, and thinking about it from the perspective of the upcoming gubernatorial and Providence Mayoral campaigns (i.e., what do the candidates have to say about what I write?). Before I delve into specific suggestions, I believe there are a few items relevant to economic growth that need to be clarified at the outset.

I am of the mind that the biggest issue facing the state right now is the sluggish economy. I know many share this belief. With that in mind, I will be focusing my (unfortunately limited) time writing specifically on creative strategies to improve Providence’s and the state’s economy, and thinking about it from the perspective of the upcoming gubernatorial and Providence Mayoral campaigns (i.e., what do the candidates have to say about what I write?). Before I delve into specific suggestions, I believe there are a few items relevant to economic growth that need to be clarified at the outset.

First, there isn’t much the government can do to improve the economy directly, particularly in this climate of economic distress and innovation paralysis. When the economy is running smoothly, most folks want the government to “stay out of the way.” But when the economy tanks, policymakers are the first to be blamed (this is a disingenuous and undeserved complaint), and everyone wants them to “fix it.” First, you can’t have it both ways people. Second, there is no magic solution to “fixing” the economy.

Second, economic growth takes time, commitment, alignment on a vision, and the autonomy to make things happen. It is unlikely to see radically positive results in a few months or even a couple years. Economic development is a decades-long strategy, that often requires partnerships and long-term planning that are challenging for public officials, policymakers, and civil service staff. While the pain of recessions, joblessness, and foreclosures is real, there are often few options for state and local officials to ease that pain.

Third, everything matters to economic development: education, transportation, infrastructure, workforce, land-use, zoning, existing markets, history, taxes, regulations, natural assets, etc. But each of these matter to varying degrees depending on the industrial sector and individual businesses. To assume that “lowering taxes” or “reducing regulations” is the most important of considerations is foolish, ill-advised, offensive, and immeasurably distracting from the various other issues that are generally much more important for long-term economic success. While everything is important, some things are more important than others.

Fourth, every strategy comes with trade-offs and there are always winners and losers with any policy change. Typically, those with wealth and power can influence policy to their benefit. And while this may benefit them personally, or as a group, there are long-term consequences for the economy that are generally ignored. The incremental policy decisions that have been made in the past have led to our little state to lack the sufficient resiliency to bounce back from the recent and ongoing depression/recession. The economic conditions in which Rhode Island finds itself will take many, many years to rectify.

Fourth, every strategy comes with trade-offs and there are always winners and losers with any policy change. Typically, those with wealth and power can influence policy to their benefit. And while this may benefit them personally, or as a group, there are long-term consequences for the economy that are generally ignored. The incremental policy decisions that have been made in the past have led to our little state to lack the sufficient resiliency to bounce back from the recent and ongoing depression/recession. The economic conditions in which Rhode Island finds itself will take many, many years to rectify.

Fifth, demand for goods and services drives the supply of goods and services. If no one wants to buy stuff, stuff doesn’t get made, and people lose their jobs. Most tools that are deployed by cities and towns and the state try to stimulate the economy do not address economic demand, and as such they are largely inefficient and/or ineffective.

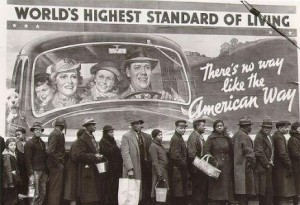

Sixth, underlying everything is an often ignored but crucial criterion: the importance of inclusive and dispersed economic growth. The benefits of economic growth need to be broadly shared because the more people who earn money, and the more money that they earn, the higher the level of economic growth. When economic growth benefits a small (and shrinking) number of people, aggregate demand declines and the economy suffers. When a rising tide actually lifts all boats, something that the post-WWII economy was notable for, everyone benefits. When a growing number of boats are chained to the bottom of the ocean, as has been the experience from the mid-1970s onward (with a notable exception during the 1990s), the economy flounders, people fall deeper in debt to maintain their standard of living, and the economy slows.

Seventh, the ONLY way the state (or any state, region, city, etc.) can be successful in the long-run is by improving its competitiveness in particular economic areas. This can be done by increasing the productivity of existing businesses through innovation or better trained employees or achieving higher workforce participation rates, while ALSO supporting the high and rising wages and living standards of Rhode Islanders. Period. This is hard to do, but not impossible. The role the city and state can play is to lay the groundwork for an iterative process of successive improvements to support business productivity gains and assist with the dispersion of economic benefits.

Eighth, when we discuss economic development, it’s important to differentiate between locally-traded clusters, sectors, and industries and those that are subject to larger markets, regional, national, or global in scope. The first group includes restaurants, local health services, residential housing construction, etc. while the second group includes software development, manufacturing, higher education, etc. The success of the first group is largely dependent upon the success of the latter. To put it another way, an economy can only grow by exporting lots of high-value goods and services and bringing in money to the state from other parts of the country / world. The degree to which the economy is exposed to and successfully competes in global markets is the single largest factor that explains how successful its local economy is. This isn’t to say that the local economy isn’t important, just that everyone selling hamburgers to each other does not grow the economy.

Finally, businesses grow at various points over their lifecycle. The only businesses that are guaranteed to have net positive job growth are new businesses, for the obvious reason that they will employ at minimum the owner of the business and they have no current employees to let go. Many businesses grow to a certain size and stay there for their entire existence. Many businesses have dramatic fluctuations in their employment based on seasonal or market demand. Some businesses have limited but sustained growth. And only a few businesses experience pronounced growth, and that growth is generally limited to a short period of time. All of this is important when it comes to growing jobs because there are only limited opportunities to identify and support existing businesses during their growth phases. But the opportunities are innumerable to support new business growth, and it is new business startups that have been responsible for net new job growth in the past decade.

There are additional factors that contribute or impede economic growth, but in my mind, the 9 above are of paramount importance. Feel free to bookmark this post as I will update it as I begin listing specific strategies to Rebuild Rhode Island!

]]>

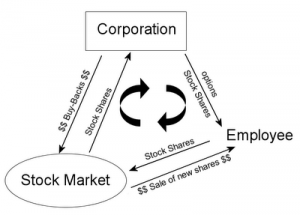

One of my last posts touched on how corporations are spending their money, what they are doing and not doing with the piles of record profits they’ve been making in the past few years while median wages have stagnated or fallen.

Here’s some additional information. First, the cites:

http://online.wsj.com/article/SB10000872396390444657804578052472320753336.html

http://www.thereformedbroker.com/2012/10/12/the-buyback-epidemic/

If you piece the two of them together, you will glean that dividend payments to shareholders are near an all-time low. Something like 34% of earnings are being paid out in dividends today. OTOH, stock buybacks by the S&P 500 hit $112 billion just for the second quarter of 2012. You will also learn that, in contrast, companies paid out about 60% of their earnings in dividends in 1960. This is despite a top tax rate of 91%. No, that’s not a typo. 91%.

Why the preference for stock buybacks over dividend payments? Again, apply the principle of ‘cui bono’: to whose benefit?

Dividends generally benefit the average holder, the smaller holders. In fact, as I’ve said before, prior to about 1990, one bought stocks in order to collect the dividend paid, not with the idea of the price of the stock going up. In fact, stocks like utilities were considered ‘widows and orphans’ stocks because of the generous dividends they generally paid.

Buybacks, OTOH, generally benefit the corporate executives because the bulk of their compensation is in company stock. One component in the price per share of stocks is the number of shares outstanding. In fact, it’s the denominator in the equation. Since corporate compensation comes from huge issues of common stock, the denominator grows, which drops the average price, which means that the shares executives increase in value. Shares that are bought back are retired, decreasing the number of shares outstanding, which has the impact of pushing the price up, other things being equal.

Yes, the average holder gains from this too, but the benefit is much more limited. Let’s say I own 1,000 shares, which is a big holding for most middle-class folks. If the price goes up a dollar, I’ve made $1,000. Not bad. But if I own 100,000, or 500,000 shares, the gain is much higher. And grants of hundreds of thousands of shares are not unusual. An executive holding a million share is not unusual.

Plus, this gain is completely tax-free, until the stock is sold. This benefits the executive who can then borrow against the shares and perform feats of legerdemain with the money. The small holder, OTOH, will generally never see the benefit f the capital appreciation because s/he is less likely to sell shares.

Yes, they may, and then turn around and buy others. However, this sort of trading mentality is very dangerous for the small investor. 80% of professional investors do not ‘beat the market’ through frequent trading. If these professionals can’t, then what chance does the small investor have? A small one, and then usually only for a short time before regression to the mean sets in. The safest strategy for the small investor is to buy stocks that pay a decent dividend and hold them for the income. Now, that few companies do this any longer is certainly a problem. Once again, the market is tilted in favor of the larger investor who can make a lot of money on fairly small increases in price, or who can hedge, or who has access to resources and information that the small investor does not have.

Cui bono? The corporate executive.

In the WSJ (yes, Wall St Journal), note the following quote:

- …More than seven decades ago, in his classic book “Security Analysis”, the great investor Benjamin Graham made a call so radical that it still sounds shocking today. Complaining of the “despotic powers wielded over dividend policy by corporate executives and directors, Graham argued that companies should no longer be allowed to direct surplus cash away from paying dividends–even for reinvesting in the business–without first obtaining formal “consideration and appraisal” from their investors, most likely through a vote at the annual meeting.

- Capitalist to his core, Graham was dead serious with this Bolshevik-sounding suggestion. He wanted shareholders–who, after all, own the company–to force management to provide at least a general justification for using cash for any purpose other than paying a dividend.

- With the percentage of profits paid out as dividends today near all-time lows, at 34%, Graham’s drastic proposal is just what we need to cattle-prod companies out of being such skinflints.

One “argument” that tax-cutters like to use is that it’s our money, not Washington’s. Fair enough. But those corporate profits belong to the shareholders, not to the CEO. So why should the CEO decide?

(Yes, he is a shareholder, but he & his board almost never control a majority of shares. Plus, Graham’s point was to make them explain why they were not issuing larger dividends. You know, make them accountable? Radical notion, I realize. Only people on the bottom are accountable for anything. Those on top can do whatever they damn well please.)

(Point 2: the fact that dividends are ‘double taxed’ is completely irrelevant to the argument. But let’s put it this way: they are double taxed. So what? What difference does that make?)

Here’s how the other article describes the buyback/dividend issue:

…One other thing — executives use buybacks to offset compensation, they issue themselves shares or options, and then get the board to approve a stock buyback to counter the effect of dilution. If you’re asking yourself “wait, so buybacks can be used as a tool to transfer shareholder money to executives?” then you’ve got it figured out, that’s exactly what they can be used for. And they often are.

As I said, cui bono? The corporate executive. He does not own the company. He–in theory, anyway–works for the shareholders, and yet he’s following policies that enrich himself (and it’s pretty much always a ‘he’) at the expense of those he works for. Somehow, I suspect that if he found an underling at the company doing something similar, the underling would be fired, if not prosecuted.

As an aside, the comments section of the WSJ article is hilarious. Note the utter horror–The horror! The horror!–with which they regard a tax rate of 39% on dividends. Somehow, the returns to capital should be privileged above actual work. And note how they throw out retirees who will be hurt by paying an hypothetical 39% in taxes on their dividend income, after the confiscatory Obama plan of letting the Bush tax cuts expire. But, 39% is the top tax rate. Only people making the highest incomes would pay at that rate. For the rest of us, we would pay at the rate we pay on the rest of our income. The only retirees who would be hit by the top tax rate are those who are earning in the top level of income.

One final word. A while back I wrote a post about how the purpose of allowing capital to accumulate was so that business could expand and benefit more people through hiring. IOW, there’s an implicit deal: we allow capital formation so you can increase the number of people you hire, which benefits everyone. However, the capital side of deal has not kept up its end of the bargain. For pointing this out, I was excoriated as a…whatever. You can fill in the blank. But this is exactly what is happening: the profits are not being reinvested in the US, those receiving the benefits of the profits are not paying taxes to support our society, even though they benefit disproportionately from the peace and security provided by the US government. They’ve breached the contract.

Finally finally, here’s something about the effects of income polarization.

- “If a man is not an oligarch, something is not right with him.”

http://blogs.reuters.com/great-debate/2012/10/15/the-billionaires-next-door/

OK, feel free to excoriate mindlessly by calling me all sorts of names, and saying I’m wrong without ever quite showing how I’m wrong.

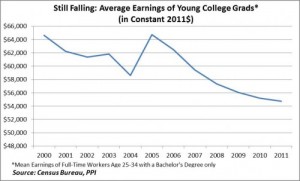

]]> Evidence shows that real wages for college grads fell in 2011. More: real wages for college grads are down from 2000, and real wages for college grads are down from 2004, the trough of the Bush recession. These wages did go up–sharply–in 2005, and then began a long, not-so-slow slide from which they have not begun to recover.

Evidence shows that real wages for college grads fell in 2011. More: real wages for college grads are down from 2000, and real wages for college grads are down from 2004, the trough of the Bush recession. These wages did go up–sharply–in 2005, and then began a long, not-so-slow slide from which they have not begun to recover.And yes, the link is to the Progressive Policy Institute, but the data is drawn from the Census Bureau’s annual Income, Poverty, and Health Care report for 2012 that was published recently. So this is standard gov’t data. As the article makes clear, this is very significant information. It seriously cripples the argument that people can lift themselves up by getting a college degree. Or that income inequality is simply the premium paid for education.

So the graduate enters the real world to find that a) jobs are very hard to find; b) that those lucky enough to get a job are making less than they expected; and c) they have a mountain of debt to pay off. This latter was exacerbated by policy changes in the Bush era, which have been, thankfully, addressed by Obama.

But, no problem. This is all part of the Grand Plan to make sure that a) levels of income inequality continue to rise; and b) that these differences become stratified into place, resulting into a permanent caste system. Yes, this is the goal. Let the rich get richer, and let everyone else go to hell in a handbasket. That is what the corporate overlords want. Is this bordering on tinfoil-hat paranoia? Perhaps, at first glance, but let’s look at the evidence.

Income inequality shrank significantly between 1948 & 1973. Why? Because of deliberate government actions that fostered the downward redistribution of wealth. Unions were institutionalized, providing labor with a powerful voice to protect workers’ rights. The steady, significant, upward trend of real middle-class wages was the result of deliberate policy.

Another deliberate policy that fostered income redistribution was very high tax rates. Even after Reagan’s 1981 tax cuts, the top tax rate ‘fell’ to 50%. Prior, it was in the 70s, and it only ‘fell’ to 77% after being cut in 1964. I say we do what the GOP wants and emulate Reagan. Let’s put that 50% tax rate back in place. If it was good enough to St Ronnie, then it’s good enough for me, right?

And let’s make one thing clear: today’s “corporate titans” are not the steely-eyed heroes of a bad Ayn Rand novel. These are not entrepreneurs. They are bureaucrats. The guys sitting in the chairs at Citibank or GM or 3M or Exxon did not build their company from scratch. Yes, you have (or had) your occasional Steve Jobs and Bill Gates, companies like FedEx that grew into market behemoths, but they are, far and away, the exception and not the rule. The family-owned, family run corporate giants like Standard Oil or Dagny Talbert’s (Atlas Shrugged; yes, I read it) railroad barely exists today.

The point is, when a public corporation makes money, it can choose what to do with it. The corporation can return it to the owners–the shareholders–in the form of dividends. This was the traditional thing to do. Until sometime in the 1990s, buying stock in the expectation of the price going up so you could sell it was the definition of ‘speculation.’ Rather, one bought stock to hold it, so you could collect the 5% annual dividend. In some ways, IMO, the worst thing about the dot-com boom was the idea that dividends were ‘quaint’, and something only old-fogey companies did. Now, dividends of 2% are considered generous, and perhaps foolish. Apple, with all its money, has never paid a dividend.

Or, if a corporation chooses not to give the money to the real owners, another choice is to re-invest the money in the company by building another plant, or buying new, improved machinery. This is not happening. Business investment in this country is at its lowest level in decades. Yes, some companies are spending the money in other countries by outsourcing, but that doesn’t do a college grad in this country much good, does it?

So the corp is not returning the money to its real owners, the shareholders; nor is it re-investing the money in the company. How about higher wages?

Despite enormous productivity gains, wages–which is where we came in–are stagnant at best, falling at worst. In the period 1948-1973, there was a rough equivalency between productivity increases and wage increases. If an improved process makes the product cheaper, the profit margin increases. In the time to 1973, this extra profit was shared more or less equally by everyone in the company, workers and management alike. But, starting somewhere around 1980, this trend stopped. Oh, productivity has increased, dramatically at times, but wages have remained stagnant.

IOW, it’s gotten cheaper to do things, but that money is not being distributed to those who actually do the work. It’s being kept by management.

We are living in a time when corporate profits are at record high levels, and the percent of profits going to labor is at record lows for the post-Depression period. Coincidence? No.

Why is this happening? Here’s where my tinfoil-hat conspiracy theory comes in: because this is the plan. Those fortunate enough to climb into the executive level of a corporation they did not build, have decided that they’re going to keep the extra money themselves. So, the wages for college grads falls, because it can. Why has the GOP fought so relentlessly to stymie every pro-jobs proposal brought before it? To maintain the 8-10% unemployment rate. Why do they want to maintain this high rate? Because high unemployment puts downward pressure on wages. When someone asks for a raise, the corporate response is “you’re lucky to have a job.” Yes, it’s true, and that’s exactly my point.

I get a lot of flack claiming that I’m anti-business, or a pro-union shill, or an alarmist, or lots of other things. And yet, somehow, the actual evidence seems to be on my side. Oh, sure, you can nitpick a few of these points where I’ve overgeneralized and then shout “FAIL” (it’s happened), but I have yet to see a convincing, fact-based contrary argument.

Of course, one prime target is my conspiracy theory, that there is a plan to build in legal support for income inequality. Look, corporate management is a cohesive group. These guys–and it’s 90% men–sit on the boards of each others’ companies. They hang out together in the Hamptons on weekends. They ski in Aspen. The cabal is not nearly as incestuous as the power circle here in RI, but it’s on course for that. The first thing that happens when you get power is you try to make sure you keep power. It’s damn hard to get to the top of the pyramid, so, when you do, you bloody well try to stay there.

Now, if you’re Mitt Romney, and you can borrow untold amounts from your parents, and you’ve been sent to the best schools where you met the Next Generation of Leaders, getting there is a whole lot easier. He claims he got nothing, but that’s just flipping ridiculous. I saw a post showing a copy of a magazine article from like 1967 that listed him among the 25 most eligible bachelors in the nation. Yeah, he had to work really hard. He and GW Bush could call up daddy’s friends and ask for help, for investment money, etc. Real hard. And did you see how Mitt’s original contract at Bain Capital guaranteed him a place in the parent company should the venture fail? A real risk-taker.

Even Adam Smith recognized the collusion of management: “We rarely hear, it has been said, of the combinations of masters, though frequently of those of workmen. But whoever imagines, upon this account, that masters rarely combine, is as ignorant of the world as of the subject.” Wealth of Nations, Part I, Ch VIII

So, yes, the people in power have a vested interest in maintaining their power. And they have the ability to shape circumstances–to some degree–to help them maintain their power. So, conspiracy? That might be a stretch. A plan, perhaps not fully articulated as such? Absolutely.

]]> In a world where self-described “leaders” show their “leadership” largely by describing it in press releases, and politicians routinely praise their own bold choices, it is refreshing to see one who actually lives up to his own billing.

In a world where self-described “leaders” show their “leadership” largely by describing it in press releases, and politicians routinely praise their own bold choices, it is refreshing to see one who actually lives up to his own billing.

Anthony Gemma, on the other hand, has a jobs plan that is indeed as “innovative, strategic, and transparent” as he says. Unfortunately it’s also silly, misguided, and occasionally bizarre. (And hard to find. Go look on his home page and wait until you see “Enough is enough” and click on that.)

The centerpiece of his plan is to nurture the growth of the “wellness” industry in Rhode Island. This includes businesses who produce dietary supplements and organic foods, as well as “wellness jobs that include personal trainers, aerobics and pilates instructors, managers, researchers, Web site designers, wellness and fitness writers, and dietitians.”

Well all right, then. Maybe it sounds goofy, but could it work?

Sadly, probably not. Here’s a little economics lesson for you. What Rhode Island sorely needs is not goods and services to sell to other Rhode Islanders, but things to sell to the rest of the nation or the rest of the world. Do we currently suffer from a shortage of Pilates instructors? Are there aerobics classes that can’t run because no instructor can be hired? If we had more personal trainers could we sell them to people in Kentucky or India? These are services that are not in short supply, and are really no good for export, either.

Ok, how about the nutritional supplement part of the mix? This would presumably trade on our lack of strength in this sector. So far as I can tell, as far as nutrition companies go, Rhode Island is home only to Edesia Global Nutrition Solutions, an international effort aimed at distributing nutritional supplements to starving kids. Edesia is a very cool organization, and sells teddy bears to support its mission. Though I can imagine it could be the seed for a thriving food industry here, it’s not exactly what Gemma was talking about. (Read about them here.)

So in other words, Gemma is proposing to grow an industry where what we have can’t be exported and what can be exported, we don’t have. Leveraging assets we don’t have seems an interesting approach to economic development. So you have to award points for originality, in exactly the same way you’d praise the architect who envisions a fountain in the desert before anyone has dug the first well. Exactly like that.

Bettering that, Gemma proposes that we encourage the Mayo Clinic or Tufts Medical to open wellness clinics here. This, of course, would be the opposite of exporting goods. Instead of bringing money into the state, we’d be sending it away, to Minnesota or Massachusetts to provide services that we can get in-state. This, again, is why success in business means little or nothing about success in making policy to benefit a whole state.

Too late, too little

There’s a section in this plan talking about how higher education should be demand-driven and responsive to the needs of businesses and students. That’s a great idea. So great, it was pretty much incorporated into the “CCRI 21st Century Workforce Commission” report from a couple of years ago. (Gemma also suggests asking the state’s 7 biggest employers for $250,000 apiece to shore up education at CCRI. Which is a funny thought: we can’t raise taxes on businesses, but we can demand contributions from them?)

Along the same lines, there’s a four item list on page 9, that describes what the state should do to encourage the growth of the wellness industry. What’s funny about the list is that the first three items on it — tax credits, loans, assistance finding federal money — are all things the state already does. So yes, these are good ideas. So good that someone already implemented them.

And then there’s this:

“It is incumbent upon us to eliminate the over-regulation of the small businesses which are the engines that drive the Rhode Island economy. I will create a workgroup to review all federal and state regulations that hinder wellness and health-oriented businesses…” [p.8]

This, presumably, would join the Secretary of State’s workgroup, and the legislative commissions and the Governor’s initiatives of years past. Courtesy of the Secretary of State’s office, this work is under way, and it’s hard to find anyone to disagree with the claim.

Honestly, you don’t have to find disagreement to understand why these things — streamlining, increased efficiencies, and so on — often don’t get done. People who crave simple answers will blame unions and fear of change, but it’s pretty easy to find deeper reasons.

In my experience, you can walk around any town hall or state building and find people who agree that there are efficiencies available, but don’t have the resources to re-tool their department’s operations. “Doing more with less” year after year leaves little room for designing new procedures or implenting new systems. When you walk into a tax assessor’s office and find the assessor trying to finish reports that her staff used to prepare, you’ve found someone who can’t afford to research or entertain new possibilities about the conduct of her department’s business. For better and worse, that’s how we run things these days. Studies and commissions are all well and good, but change requires resources, even when the change makes things more efficient. You’ve got to put something in to get more out.

So that’s what I learned by reading the Gemma Jobs plan: he suggests concentrating on a new industry that has approximately zero potential to bring new money into the state, and offers a bunch of other suggestions that are already in place. What’s more, almost all of his plan consists of state policy suggestions, while the last time I checked, he is running for federal office.

There’s plenty more, but I’ve piled on enough. Ok, sorry, one thing more. I have to share my favorite part. It’s a tax incentive on page 9, for people who get hired in the wellness industry. Seriously. Gemma would offer a tax credit to new employees. Really? Does he imagine that unemployed people need a tax incentive to help them find jobs? That would be the sound of the fountain designer who has finally been persuaded to help dig a well and shows up to work with a butterfly net.

So sure. Gemma is a smart energetic guy who has done good things in the past, and doubtless will again in the future. I just don’t want a congressman with judgment like this. His jobs plan is certainly “innovative, strategic, and transparent” as he says. But is there no place for “practical,” “sensible,” or “realistic?”

]]> Note: This was written by Paul Hubbard, Chris Murphy and Jared Paul. It reflects Occupy Providence’s position on the 38 Studios debacle. The die-in represents the destruction of jobs by trickle-down strategies not the workers who lost their jobs.

Note: This was written by Paul Hubbard, Chris Murphy and Jared Paul. It reflects Occupy Providence’s position on the 38 Studios debacle. The die-in represents the destruction of jobs by trickle-down strategies not the workers who lost their jobs.

CHANTING “MONEY for jobs and a decent wage, not for bailouts and 38,” 75 members and supporters of Occupy Providence (OPVD) rallied and marched through the streets of Providence on June 9.

OPVD organized the protest around three demands: No bailout of Wall Street/38 Studios bondholders, tax the rich, and solidarity not austerity, locally, nationally and internationally.

Assembling outside the Rhode Island Convention Center where the liberal blogger conference Netroots was in progress, the crowd heard personal testimony from working people who described how the economic crises and austerity agenda of the 1 percent have impacted their lives.

OPVD then marched several blocks to the former headquarters of 38 Studios, which spoken-word artist Jared Paul, an organizer with OPVD, described as a “crime scene.” Dozens of marchers then laid on the ground and were outlined in chalk as they participated in the great RI Jobs Dead On Arrival “die-in.” The action was designed to dramatize the destruction of good jobs caused by the “trickle-down” policies of the 1 percent and evidenced by the 38 Studios debacle.

38 Studios, a video game company owned by former Red Sox baseball star Curt Schilling, was financed in 2010 with a $75 million loan from the RI Economic Development Corporation (EDC). Gambling on Schilling’s risky start-up with taxpayer funds, the quasi-public agency floated up to $125 million in “moral obligation” bonds on Wall Street to guarantee the deal.

Chris Mastrangelo, an organizer with OPVD, made the analogy of a gambler who goes “on the street” to a loan shark for money to bet on a horse. Schilling, for many years a right-wing proponent of “small government,” was only too happy to accept the EDC loan.

– – – – – – – – – – – – – – – –

NOW THAT 38 Studios has collapsed, laid off its entire workforce in three states (700 people) and filed for bankruptcy, the bondholders (sharks) on Wall Street still expect to be paid. Gov. Lincoln Chafee and the Rhode Island Legislature have promised full payment. This will cost Rhode Island’s taxpayers $112 million over the next 10 to 20 years.

Speaking at the die-in, Paul Hubbard of the International Socialist Organization said:

The austerity agenda of Rhode Island’s 1 percent, recently imposed by the governor and the Rhode Island legislature, means massive cuts to education, the developmentally disabled, state worker pensions, public transportation and Rhode Island’s poor. These are the real crimes, crimes perpetrated against Rhode Island’s working families, against the 99 percent, against humanity…Our sisters and brothers in Greece, Egypt, Spain and Quebec have risen up against the austerity agenda of the global 1 percent. Occupy Providence is proud to stand in solidarity with the global 99 percent.

OPVD then marched through the city of Providence to the State House, where dozens of protesters assembled in front of the building’s main entrance. Chalk outlines of dead bodies, representing another crime scene, were drawn on the plaza outside.

Marching back to the convention center, the site of OPVD’s four-day “sidewalk occupation,” dozens of protesters stopped by another crime scene–the tax-exempt Providence Place Mall. Sixty protesters marched through the first floor, chanting, “Tax the rich! Solidarity not austerity!”

Security guards appeared and began assaulting peaceful protesters at the front of the march, physically pushing them toward the middle exit. A large group of protesters easily avoided the guards and continued to the exit at the far end of the mall as planned. There, a “mic check” ensued as OPVD again started chanting.

Security guards called in the Providence police, who detained and handcuffed about a dozen protesters as they attempted to leave. An hour later, all were released after signing agreements to stay off the mall premises for one year.

OPVD then re-assembled and finished the march, returning to cheers from those at the sidewalk occupation as well as bystanders outside the convention center. Speaking to the media, organizer Mariah Burns said, “The police used handcuffs on peaceful protesters simply exercising their rights to assembly and free speech. These tactics were clearly designed to intimidate and were completely unnecessary.”

As the scandal surrounding 38 Studios continues to unfold, OPVD has pledged to continue its struggle for justice and against Wall Street bailouts.

]]>

Greetings! My name is Spamthony Gemma. I’m running for Governor Congress because I have a scheme plan to create 10,000 jobs in Rhode Island. Rhode Island needs more businessmen like me, Mitt Romney, and Don Carcieri to get this state back on track.

Let me take a moment to present you with a business opportunity.

Low risk – High return – Work your own hours!

Now’s your chance to get into the recession proof spamming industry! I’ve been having great success in the spamming industry and I want you to get in on a piece of the action. Here’s how it works!

First, I will stop buying my 500,000+ facebook fans from 3rd party vendors and will begin hiring Rhode Islanders to create fake facebook profiles. You can then use your fake facebook profile(s) to spam your friends about useful things such as plumbing services (hint: toss in a few hundred inspirational quotes and photos). You can even take it to the next level and start spamming blogs like this one!

This is just the ground floor – there’s plenty of room to move on to bigger and better opportunitie$$$. Anyone can take advantage of these emerging trends of the 21st century! I hope you’ll join me so that we can get our state back on track – together.

P.S. Vote for me, Spamthony Gemma!

This is a satirical parody posted by a member of the RI Future community.

]]>