A new report confirms what progressives have saying for several legislative sessions now: Rhode Island needs tax equity.

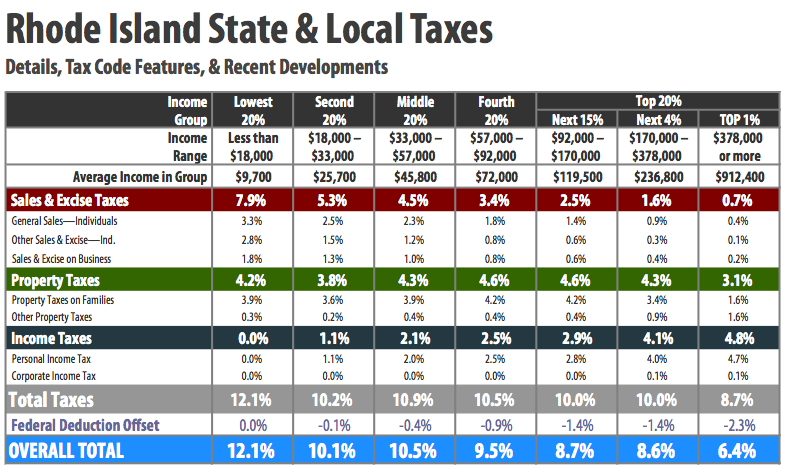

According to the nonpartisan Institute on Taxation and Economic Policy report the poorest Rhode Islanders will pay more than twice as much in percentage of income than will the richest residents of the Ocean State. Rhode Island has the eighth highest taxes on the poor in the nation, according to the report.

Executive Director of ITEP and an author of the study Michael Gardiner said:

We know that governors nationwide are promising to cut or eliminate taxes, but the question is who’s going to pay for it. There’s a good chance it’s the so-called takers who spend so much on necessities that they pay an effective tax rate of 10 or more percent, due largely to sales and property taxes. In too many states, these are the people being asked to make up the revenues lost to income tax cuts that overwhelmingly benefit the wealthiest taxpayers. Cutting the income tax and relying on sales taxes to make up the lost revenues is the surest way to make an already upside down tax system even more so.

The report also lists as one of the most regressive features that the state “Fails to require combined reporting to calculate the corporate income tax.” Gov. Chafee’s proposed budget last year suggested implementing combined reporting but the legislature decided to study the issue instead.

Read the entire report here. Or read the Kathy Gregg’s front page ProJo here and Ted Nesi’s blog post here. Nesi and Gregg are Rhode Island’s two most influential journalists, and influential progressives often complain that both have editorial biases against liberal economic policies.

This report forces both writers to acknowledge Rhode Island’s very regressive tax structure, which is something progressives feel is often ignored by the local media even though it is very popular in both the General Assembly – where almost half of the legislature co-signed a tax equity bill last session – and among Rhode Islanders in general – a Fleming poll last year showed almost 70 percent favored a less regressive income tax structure.

This alone will be regarded as a small victory for progressive Rhode Islanders who feel that the mainstream media turns a blind eye to Keynsian economics.

But the Providence Journal’s story goes one step farther, implying in the very first sentence that the report could affect the politics of tax equity at the State House. “As the tax debate begins anew on Smith Hill, a new study has identified Rhode Island as one of 10 states with the highest taxes on the poor,” writes Gregg, who is widely regarded as the most astute handicapper of local politics.

The ProJo story quoted Kate Brewster of the Economic Progress Institute to illustrate how the new report could tip the scales toward tax equity this legislative session.

Kate Brewster, executive director of The Economic Progress Institute in Rhode Island, viewed the report as ammunition for the campaign by organized labor and others to persuade state lawmakers to ask the wealthy to “pay a little more” by creating a new tax bracket. Advocates are drafting a bill that would raise the top rate from 5.99 percent to 7.9 percent on those whose household income tops $250,000.

“This report provides clear evidence that our tax structure is very regressive and policies are needed to improve fairness for the state’s low- and modest-income taxpayers,” Brewster said of the study titled “Who Pays?”

Brewster acknowledged that the sales tax hits the poor more heavily than any of the other taxes do, but she voiced hope lawmakers would look at the “combined impact of all state and local taxes.”

“If you look at the overall impact, it appears there is more room to ask upper-income households to pay more, through the personal income tax,” and to help the poor by increasing the size of the refund available through the state’s earned-income tax credit, she said Tuesday.