A devastating fare hike for Rhode Island’s most vulnerable seniors and disabled people is the focus of a new budget fight. Although Rhode Island has long had a program where seniors and disabled people who have trouble affording bus trips ride free, the last year has seen efforts to end this program and charge more to those who can least afford it.

A devastating fare hike for Rhode Island’s most vulnerable seniors and disabled people is the focus of a new budget fight. Although Rhode Island has long had a program where seniors and disabled people who have trouble affording bus trips ride free, the last year has seen efforts to end this program and charge more to those who can least afford it.

Things are now coming to a head.

The recently revealed House budget includes money to put off the fare increase for six months, until January, but doesn’t quite put in enough funds to stop the fare increase altogether. RIPTA Riders Alliance is working to fight this, and there are several easy things people can do to help. When the budget comes up for a House vote Wednesday, there will be a proposed amendment to add a small amount of funds to RIPTA ($800,000) and stop the fare increase. Many disabled people and seniors have said publicly in the past year that they cannot afford to pay what RIPTA wants on their limited income, and RIPTA admits that they expect steep drops in how many bus trips disabled and senior Rhode Islanders will take. Fortunately, there are ways to make this better.

- One way people can help is by signing our online petition — it automatically sends messages to the State House when you sign. Please also share the petition link with others — we need people to respond quickly.

- Another thing you can do to help is to contact your state representative and state senator and ask them both to support budget amendments: $800,000 more for RIPTA to stop this attempt to squeeze more money from RI’s limited-income disabled and seniors who are already facing challenges. Go to vote.ri.gov to find your elected officials’ contact info — you can call them and/or email. RIPTA Riders Alliance has been distributing a flyer about this.

- Finally, RIPTA Riders Alliance will hold an event at 1:30 this Tuesday at the State House to talk about how important this is. We are sending the message that if Rhode Island’s senior and disabled people can’t afford to travel, they will be stuck at home, less able to shop, volunteer and visit loved ones — and isolation is deadly for seniors and the disabled. Protest makes a difference sometimes! Please come at 1:30 on Tuesday at the State House — and let people know about the Facebook event page.

Ironically, we’re facing this terrible fare hike on the most vulnerable because of a sneaky General Assembly move last year. When the House debated the budget last year, the House Finance Chair at the time, Raymond Gallison, put in a last-minute amendment to allow (that is, encourage) RIPTA to charge more to limited-income seniors and disabled people. Since then Gallison has had to resign. But it’s fitting that what began with one last-minute budget amendment is now leading to another, this time to save the most vulnerable who have been targeted as budget victims in the past. An amendment will be proposed in the House for Wednesday’s debate, and we are hoping to get an amendment in the Senate, too.

More useful information is available on RIPTA Riders Alliance’s Facebook page.

]]> Perhaps the most telling tale of the 2013 budget process is not about what we do or don’t invest in, but rather the uncommon affiliations one such spending decision has brought to light. Many on the left (progressives) and the right (Republicans) seem to disagree with the majority of moderate Democrats that Rhode Island should pay 38 Studios bondholders.

Perhaps the most telling tale of the 2013 budget process is not about what we do or don’t invest in, but rather the uncommon affiliations one such spending decision has brought to light. Many on the left (progressives) and the right (Republicans) seem to disagree with the majority of moderate Democrats that Rhode Island should pay 38 Studios bondholders.

This was first illustrated by Randall Rose and Occupy Providence’s great effort to put together a panel of diverse local experts, moderated by WJAR, to discuss the issue. Occupy Providence has long opposed paying on the bonds and it partnered with the Stephen Hopkins Center, a grassroots local libertarian group to call attention to the matter by having economists, college professors and bond buyers vet the pros and cons. Meanwhile, the legislature hosted a one-sided lecture on the merits of repayment.

House Republicans responded by vowing to vote against the budget bill today if the $2.5 million line item is included. Whether this is a principled stand against Wall Street-centric economic policy or simply political gamesmanship over the budget remains to be seen. Nobody, not even the ratings agencies, know which is the more fiscally-prudent path at this point and anyone claiming to support or oppose the $2.5 million line item based on such knowledge either doesn’t get it, or is lying (what some politics).

But now Sam Bell and Gus Uht, two influential members of the Rhode Island Progressive Democrats, have called upon liberal lawmakers to reject the budget proposal as well. Read their pieces here and here. They both mention the 38 Studios bonds, but also cite several other issues progressives have with the budget bill, such as cuts to RIte Care, pension payments and municipal aid.

The progressive caucus in the House has at least twice the membership as does the Republican Party. So if both these caucuses come together to oppose the budget, leadership would all of a sudden have a legitimate math problem on its hands. Which won’t happen, of course, because the progressive caucus is more closely-aligned with moderate Democrats in politics if not in economic theory.

What’s been really interesting to me is that pundits on both the left and right have used similar logic to call for default.

Here’s what Uht wrote in a previous post:

“Moral Obligation” bonds are a fabrication of Wall Street, created to satisfy its greed. The Economic Development Corporation, not the state, issued such bonds for 38 Studios … 38 Studios was not described as a sound investment to either the prospective investors or the insurer, yet they signed on anyway. They gambled and lost. This is not Rhode Island’s responsibility, but in the vague, smoky-back-room fashion of “moral obligation” bonds, it might hurt our reputation for being a good bond issuer if we don’t obligingly, voluntarily make it our responsibility.

Andrew Morse takes the debate one step further writing that the electorate should not even vote for politicians who support the payment (according to the headline).

This idea of government will be imposed upon Rhode Islanders by their state officials and Wall Street working together, unless Rhode Islanders are willing to reject politicians who use their offices to enforce the finance industry’s extra-legal understandings of how debt should work, and reward those who work to make sure that the finance industry lives under the same constitution and laws that everyone else does.

I agree with both Uht’s and Morse’s sentiments, but don’t think we should take such a severe stand for these values on either the budget bill or the next election. I do however think legislators have a moral obligation to oppose the budget bill based on the cuts to RIte Care, and if you read Tom Sgouros’ post from yesterday you probably do too.

But with respect to the 38 Studios bond payment, Imost Rhode Islanders probably agree with what progressive Rep. Art Handy told ABC6’s Mark Curtis:

I am of the opinion that we probably should pay it. I actually emotionally kind of think we shouldn’t. But intellectually I think I am at a place now where I feel like we probably should.

Me, I’m still standing behind what I wrote in a piece called “On moral obligations” back on April 18:

]]>…I’m really hoping it ends up being financially advantageous not to pay the bondholders – that way we can save money AND we’ll see who in Rhode Island is a real small government conservative and who is acting like a friend to the taxpayer when they are secretly just advocating for Wall Street and corporate America’s interest in our state government.

Rhode Islanders best not blink in June. If we do, we might just miss much new state policy being swiftly passed in the annual budget bill.

The tax and spending plan, and oftentimes some new policy tucked in for good (bad, or indifferent) measure, typically breezes through the General Assembly in the waning days of the legislative session. Any public debate happens during marathon late night meetings. Elected officials actually suspend open meeting laws to do so. Rhode Island’s budget process is truly democracy at its worst.

To that end, the best news about 2013 House Finance Committee’s budget – and the benefit is bipartisan – is that this year’s proposal didn’t sneak in any big picture policy changes; at least none that have been identified yet.

Last year’s budget bill retooled public education oversight but this year’s version does not yet include retooling economic development oversight as some expected. Tax and spending priorities belong in the budget bill, not public sector structure.

Similarly, regardless of whether one feels we should repay 38 Studios bondholders or not, the budget bill was not the ideal place for the state to make this decision. The proposal puts money aside to pay if that proves the most prudent path, and an additional $50,000 to study the ramifications.

The budget bill will also not decide if the new Sakonnett River Bridge be paid for by a use fee (capitalism) or by the people of Rhode Island (socialism). We should certainly have this conversation, and it should be done in the context of how to fund the nationally recognized need for better roads and bridges.

On spending

The budget bill doesn’t do much to help Rhode Island’s struggling cities, another great gift for bankruptcy lawyers. It ignores, for the second year in a row, Governor Chafee’s attempts to help urban areas hit hardest by the recession and state aid cuts. It did keep his $40 million new funding for public education, which is much better than a sharp stick in the eye but not nearly enough to neutralize the head start suburbs enjoy over cities in the race to the top.

Interestingly, creates a new state mandate that school districts to refinance construction debt. There are all sorts of repercussions to mandatory refinancing of debt, including giving schools a more vested interest in 38 Studios bonds. Update/clarification: the budget calls for a higher municipal share of refinance savings.

Social services were again cut, leaving some 6,500 poor people off of RIte Care, reports the Providence Journal.

The historic tax credit – technically a spending item – would be reinstated. It would allow the private sector to not pay up to $34 million in state taxes, but it’s capped at $5 million per project. Sorry Superman Building.

On taxes

Income taxes weren’t increased on the affluent nor were corporate tax rates cut. CVS keeps its lucrative loophole worth $15 million.

And the pharmacy giant isn’t the only drug dealer to make out in this year’s budget. Wine and spirit sellers will be given a sales tax holiday for two years. Beer, for some reason, wasn’t included (there’s something that feels regressive about lowering sales tax on wine and spirits but not beer).

The most interesting tax experiment, I think, is making locally-made art tax free. It seems to me that more people would cross state lines to buy art than have their dog groomed, but art is, by definition, subjective. Some may consider their poodle’s haircut art. It could also mean a giant tax break for a company like Alex and Ani if jewelry is considered art.

But despite opportunity for abuse, if the state is going to incentive growth through tax cuts, I’m glad it’s going to artists as this is the sector that has the best chance of building us a better economy.

]]> As reported here and here, the University of Rhode Island has spent close to $500,000 on repairs of its president’s tuition-funded home, which is among the fringe benefits that come with the president’s job, such as a car, an expense account, and club dues.

As reported here and here, the University of Rhode Island has spent close to $500,000 on repairs of its president’s tuition-funded home, which is among the fringe benefits that come with the president’s job, such as a car, an expense account, and club dues.

Excessive administrative spending is but one of many results of nationwide privatization of public education. Particularly distressing in this context is the root cause of this development, namely the decline of the fraction of the URI budget that comes from the Rhode Island general revenue, a percentage that has dropped from 60% in the 1950s to less than 10% currently.

Privatization has resulted in an explosive increase in tuition. As documented in Trends in College Pricing 2012, a College Board publication, inflation-adjusted tuition and fees have increased by more than 350% since the early 1980s. Excessive spending on presidential perks, in particular at URI, typifies a litany of deplorable policy decisions that coddle university and college administrators at the expense of public education. Recent examples are:

- URI’s previous president got a 14 percent raise in 2008-09.

- The previous president cashed in with a retirement incentive of 40 percent of the $183,000 “faculty” salary he earned after his resignation as president ot the university, a salary which happens to roughly 80 percent higher than full professor faculty salaries.

- URI’s current president started his tenure at a salary about 25 percent above what his predecessor ever made.

- A study performed for the American Association of University Professors found that between 2004 and 2010 spending on instruction and academic support at URI declined by 10 percent; while spending on administration increased by 25 percent.

In spite of all of these excesses and skewed priorities, the almost defunct Board of Governors of Higher Education routinely justifies the tuition hikes and administrative bloat it authorizes by claiming concern for quality education. Of course, the ultimate responsibility for the neglect of public education rests with the Rhode Island legislature. The legislature and its serial enablers of the Board of Governors for Higher Education, which is tasked with oversight of public higher education, are duty bound to uphold the Rhode Island Constitution and pertinent statutes. Their collective failure in this respect is monumental. As Sections I and IV of Article 12 of the Rhode Island Constitution state:

- […] it shall be the duty of the general assembly to promote public schools and public libraries, and to adopt all means which it may deem necessary and proper to secure to the people the advantages and opportunities of education and public library services.

- The general assembly shall make all necessary provisions by law for carrying this article into effect. It shall not divert said money or fund from the aforesaid uses, nor borrow, appropriate, or use the same, or any part thereof, for any other purpose, under any pretence whatsoever.

Title XVI [of the Rhode Island General Laws] adds:

- […] the purpose of continuing and maintaining the University of Rhode Island […] in order to promote the liberal and practical education of the industrial classes in the pursuit and the professions of life […]

Privatization is sold as if it provides better services at a lower cost to the taxpayer, but the real costs to Rhode Island and its citizens are hidden. In education, chief among those hidden costs are increased tuition and interest on student loans, which exclusively benefits moneylenders. The examples listed above are just a small sample of the many symptoms that characterize a society unable to keep in check the predatory impulses of a small minority.

]]>

Good for Politifact for calling foul on Rep. Patricia Morgan’s misuse of the old talking point that welfare programs account for more than 40 percent of the state budget.

First of all, her numbers were flat our wrong. As Politifact points out, her definition of welfare programs is quite broad. It includes “such spending as Federal Emergency Management Agency payments for storm cleanups as well as the legislative grants representatives and senators give out to such groups as Little League teams in their districts.”

The actual number, argues the ProJo, is 31 percent. Still, the paper of record decides to award her a half-true.

Fair enough, given that Linda Katz, executive director of the Economic Progress Institute, agrees with the number. But, watch this video to learn what programs are actually behind that number, who is actually fitting the bill and what some of the consequences would be of cuts to these programs.

]]>

Progressives had mixed reactions to the budget bill passed by the House Judiciary Committee late Thursday night, expressing disappointment with the lack of focus on the revenue side of the ledger. While there are few new cuts in this year’s spending proposal, and a few restorations, it didn’t include tax-the-rich revenue enhancers that organized labor and community activists lobbied for all session long.

“If this budget is passed as is, the wealthiest Rhode Islanders will skate by again while lower and middle-income Rhode Islanders get stuck with the bill,” said George Nee, president of the AFL-CIO who took an active role with Working RI, a group that led the charge for taxing the rich.

While legislative leadership and the local media widely predicted income tax equity reform wouldn’t pass this year, the fight isn’t over yet. Progressive lawmakers are expected to offer an income tax amendment to the budget bill when it hits the House floor next week. Rep. Maria Cimini, a progressive Democrat from the Elmhust area of Providence, led the charge in the House this year, could be the one to offer the amendment. She’s a rising star to the liberal left and an increasing thorn-in-the-side of the more moderate House leadership.

Her bill would have raised the income tax rate on those who make more than $250,000 from 5.99 percent to 9.99 percent, what the rate was before former Gov. Don Carcieri cut taxes to the rich. It also included a job creator incentive that would have lowered the proposed increase by 1 percent for every 1 percent the state’ unemployment rate dropped.

But Rep. Larry Valencia, a progressive Democrat from Richmond, also could offer the amendment. He sponsored a similar bill for the second consecutive year that doesn’t include the job creator incentive, which he said would make the budget more volatile.

“You can tell by the kinds of bills I’ve introduced that I would have preferred some changes to a more progressive tax code,” Valencia said, right after voting for the bill Thursday night. While he was hoping for income tax reform, he said he was happy it included some new sales taxes and glad it didn’t increase the meals and hotel tax – which would have hurt the the local tourism economy, one of the state’s strongest sectors.

Rep. Scott Guthrie, a populist Democrat from Coventry, has sponsored several income tax reform bills during the past two sessions also could offer an amendment.

House leadership has communicated to progressive legislators that it doesn’t want an amendment to come up on the floor. Income tax reform is expected to be used as a campaign issue this summer and fall, as voters seem to support it more than politicians. A Flemming Associates poll showed that 68 percent of Rhode Islanders support a more progressive income tax code, and many conservative legislators don’t want to be put on the record as supporting tax breaks for the wealthy.

]]> Should URI Faculty get a 3 percent raise? Let me tell you a story and you decide.

Should URI Faculty get a 3 percent raise? Let me tell you a story and you decide.

URI is the big kahuna among the three institutions run by the Board of Governors. It educates about 16,000 students, around 10,000 of whom are from Rhode Island. Researchers there pull in about $80 million each year in research funding, largely from federal sources, like the National Science Foundation and the National Institutes of Health, but also from corporate sources.

There are some important financial issues going on at URI, and none of them are about raises for faculty. One is that state dollars continue to decline in importance to URI’s budget. Twenty years ago, state general revenue funding of $57 million provided about a quarter of the overall budget of $214 million. Today, we provide $75 million for a budget of $705 million, or just a tiny bit more than 10% [B3-46], making URI essentially a private university with a small public subsidy. State contributions over that time grew at an average rate of 1.3 percent per year while the overall budget grew more than four times as fast.

The Governor is proposing to raise the state’s contribution by a little more than $3 million, which is $2 million more than level funding, so that will hike the percentage of the budget contributed by the state a smidge.

But wait, shouldn’t we be concerned about growth of more than 6 percent a year? Why yes, we should. This is a national problem; universities across the country are seeing this kind of cost inflation. Tuitions are pretty much the only thing around that rivals health care costs in the inflation department.

So what is URI spending its money on? Answer: Not professors. To teach more or less the same number of students, URI has almost a hundred fewer professors than it did in 1994. (I’ve used the 1994 personnel budget in this, because they changed the presentation that year and it matches the 2013 presentation better.) In 1994, the “Education and General” part of the budget had 623 professors of the three ranks (full, assistant, and associate), and in 2013, we expect to have 540. The collection of all full professors have seen their pay climb about 2.8% per year over that time.

Looking at the administration shows a different picture. The top couple dozen administrators—the deans, provosts, and vice presidents—have seen their pay go up an average of 4.5 percent per year. There aren’t more people at the top level of administration, but in 1994, there were 65 people with the title of “Director” of something (or assistant director), and in 2013, there are 89. Individually, their salaries didn’t grow quite as fast as all the deans’ and vice-presidents, but because there are so many more of them, they also saw approximately a 4.5 percent average growth rate.

That kind of growth is high, but doesn’t make it to 6%. How about capital projects? In 1994, URI spent $6.4 million on construction and debt service. This year we’re looking at $68 million, and next year it will come down to $59 million. This is a growth rate of 13 percent a year! If you walk around one of the URI campuses, you’ll see lots of new buildings. But few of them are very crowded.

The other huge growth is in the account that provides student aid to cover rising tuition costs. Tuition this year is expected to go up 9.5% as it has for a number of years in the past. Consequently, the aid bill also rises very fast.

So that’s the story: declining aid from the state, declining numbers of professors, increases in administrator pay and numbers, construction of fancy new buildings, and huge increases in tuition. The construction part makes it seem like investment, but all together, does that really sound like an investment in education to you?

There’s another dimension here. By 1995, URI had already lost a tremendous proportion of its state aid budget. In 1989, state dollars covered 58 percent of the budget, but by 1994 it was down to a quarter. This was a crisis. The University (under its new President Robert Carothers) responded by doing a revenue analysis of all the departments, to see which ones made money, and they abandoned most of the programs that didn’t. They stopped admitting students in 47 degree-granting programs, including 16 in science and engineering. From a financial perspective, this seemed to make sense, though it was virtually unprecedented in American university administration.

From an academic perspective, the benefit was hardly as clear. Consider philosophy. URI still teaches some introductory level philosophy courses, so they still need some faculty. So if you love philosophy enough to pursue a doctorate in it, what URI has to offer you is a career of teaching classes to students who don’t really care about it. This immediately makes URI a second choice for anyone in that field. Maybe you don’t care about philosophy, but there were 46 other programs that got the same treatment. Is that the best way to get good faculty? How about not giving them money?

Now I learn from a 2010 “Research and Economic Development” presentation to the URI Strategic Budget and Planning Council that over the ten years from 1996 to 2006, URI saw its research funding grow by 29 percent. Over that same time, UNH saw its research funding up by 271 percent, UVM’s went up 162 percent, and UConn saw its funding rise 136 percent. (All larger than the national average of 117 percent.) This was immediately following that downsizing. Do you think maybe this could have been related to a shrunken faculty? Downsized programs?

The presentation was clearly meant to show how worried the University should be about this poor showing. After all, after educating students, research is most of the point of an institution like URI. Research brings in grant funding, research builds prestige, and research is where the real economic benefit of universities comes from.

But not to worry. The folks who put together this presentation had a plan, which was, I gather, put into action. Their plan: Create a new Vice President.

]]> In volume II of the budget, you’ll find there the Executive Office of Health and Human Services (EOHHS), which contains the Departments of Children Youth and Families (DCYF), Health (DoH), Human Services (DHS), and Behavioral Healthcare, Developmental Disabilities, and Hospitals (BHDDH).

In volume II of the budget, you’ll find there the Executive Office of Health and Human Services (EOHHS), which contains the Departments of Children Youth and Families (DCYF), Health (DoH), Human Services (DHS), and Behavioral Healthcare, Developmental Disabilities, and Hospitals (BHDDH).

Collectively these departments spend over $3 billion, about 40% of the overall budget. In the Governor’s budget, only about 40% of that is actual tax dollars, and the rest is either federal money or restricted receipts, such as fees for service.

The big kahuna in the Human Services budget is, of course, Medicaid, so we may as well begin there. The expense for Medicaid has been moved from the DHS budget to the umbrella EOHHS. This, of course, means nothing to the budget’s bottom line, only that the accounting for that expense appears on page B2-118 for years before FY12 and before, and on B2-12 for FY13 and beyond.

So much for where to find it. How much is it? The Medicaid budget for next year is projected to be $1.66 billion, approximately the same as was originally budgeted for this year.

The same as this year? But what about the skyrocketing medical inflation? It’s there, but masked by offsetting cuts in service. The “Managed Care” portion of Medicaid that you see in the breakdown of the Medicaid costs is also known as RIte Care, and it has more than doubled in ten years, though it still amounts to only about a third of all the Medicaid. The annual cost increase for Managed Care has been about 7.5% each year. Eligibility rules tightened, but demand increased, so that includes a very minor decrease in enrollment over that time. What’s worse, federal reimbursement paid for 55 cents of every dollar in 2003, almost 64 cents in 2010 (part of the stimulus package) and only 51 cents in 2013.

In order to control these costs, the state has added or increased co-pays and restricted eligibility several times in recent years. Apart from that, there has been little more than some studies and planning from Lt. Governor Elizabeth Roberts in response to this ongoing disaster—remember, this affects everybody, not just the state budget—and this year is no different. The Governor’s 2013 budget will cut all dental care for adults to save $2.7 million. “Refinements to Medicaid managed care programs” will save another $2.5 million [ES-56]. Lots of these refinements involve cutting services, though some, like providing more care through “Patient-Centered Medical Homes” are potentially good ideas, depending on how they’re implemented.

One problem with the push for managed care is that in some cases it may well insert a new layer of bureaucracy where none is needed. A director of a residential care provider pointed out to me that his agency is already providing managed care for most of their residents. That is, with the advice of a consistent array of medical professionals, the agency selects care options for its residents. This is pretty much what the medical home concept suggests. If new requirements simply force them to add a layer of doctors to what they’re already doing, it won’t necessarily reduce any costs or improve any care. (It also calls into question the cost savings estimates for the managed care push.)

The other big component of cost saving in Medicaid is a proposal to save another $14 million by simply paying 4% less for the care.

Paying less? Who knew you could just solve the health care cost problem so easily. Why didn’t we think of this years ago? But yes, the Governor’s budget proposes paying 4.14% less for all Medicaid coverage that require a monthly per-person fee (“capitation”). This is mostly Neighborhood Health Plan, though United Health also has a share of that market. Neighborhood, though, has the misfortune of being in the business of serving the Medicaid population almost exclusively, so they will be much harder hit than the other two. Obviously any cost cutting reform has to start somewhere, but it’s hard to see how this will do the trick.

It’s worth an aside here to mention one of the factors in health care cost inflation that seems never to come up in serious discussions of the rising cost of health care. After all, what’s the fastest-growing component of a medical practice’s expenses? More likely than not, it’s health insurance for its employees. For all the fancy machinery of modern medicine, it’s still a labor-intensive business. A giant facility like Rhode Island Hospital puts more than half its budget towards salaries, and a small practice will see an even higher fraction, 70% or more.

A physician’s assistant earning $65,000 a year is probably receiving a health benefit worth around 20% of that if he or she has a family. What’s more, all those pharmaceutical firms, medical device manufacturers, and bandage makers also have to deal with rising health care costs. In other words, a significant part of what an increase in health care costs pays for is… an increase in health care costs.

This sounds like a dopey little irony, but engineers call this a feedback loop, and electronic systems with less feedback than this also spiral out of control. Obviously there are plenty of factors driving health care inflation—not least the vast number of people who see health care as a way to get rich—but at root, linking health care and employment creates an unstable system, prone to amplify increases. Could that not be worth some attention?

Next: Food inspection dereliction

Read more from this series

Trick question: Why is Rhode Island’s housing policy not made by the state government? How about economic policy? Why do we have two environmental agencies? Two elections agencies?

Trick question: Why is Rhode Island’s housing policy not made by the state government? How about economic policy? Why do we have two environmental agencies? Two elections agencies?

The questions sound unrelated, but they have very similar answers, and they’re all related to the state’s bevy of “quasi-public” agencies—whose budgets are in Volume I of the budget.

The Airport Corporation is here, who runs all the state’s airports, including Green. The Economic Development Corporation is also here, along with Rhode Island Housing, RIPTA, the Narragansett Bay Commission (sewers in Providence and Pawtucket), the Resource Recovery Corporation (runs the central landfill), and several others.

Truthfully, it’s more correct to say the outlines of their budgets are in Volume I [B1-331-366]. There isn’t much information there about some very important agencies, and in some cases this was part of the point of keeping them separate from the regular parts of the state government.

Some of the quasi-publics were formed when the state took over existing private corporations. RIPTA, for example, was formed to save the last private bus company. Others have a separate existence for legal reasons. The Turnpike and Bridge Authority, which maintains the Pell and Mt Hope Bridge, was formed to issue bonds against the toll revenue collected at those bridges. But many quasi-publics—along with some other agencies less quasi and more public—were formed out of power struggles between the legislature and the governor.

The Coastal Resources Management Council, for example, our extra environmental agency, was originally formed in the 1970s so that powerful members of the legislature could circumvent new DEM coastal regulations on behalf of their friends who owned waterfront property. Rhode Island Housing (technically the RI Housing and Mortgage Finance Corp.) may have originally formed to access some federal HUD funding, but it was also a creature of the legislature, witness the mortgage scandals of the 1980s. Later, under a stronger Governor, the Economic Development Corporation was created out of the Department of Economic Development to give the Governor Lincoln Almond more control over economic policy (and to pay its executives more like the corporate executives they lunch with).

EDC has another distinction. When it was spun out of the government into a quasi-public, it took over the shell of the RI Port Authority. Why? Because after Bruce Sundlun effectively put the Public Building Authority out of business (it was a campaign promise), the Port Authority was the only agency with unlimited authority to borrow money without voter approval. And boy have they used that authority. EDC now owes debt used for the Fidelity campus in Smithfield, the Shepard’s building in Providence, the Masonic Temple hotel across from the state house, the I-Way boondoggle, the Sakonnet River Bridge, and much more. Subsidiaries owe the debt used to build the airport and renovate Quonset.

Under Ed DiPrete, the PBA’s record of borrowing without voter approval was considered a minor scandal and contributed to his election loss in 1990. But none of these subsequent projects got voter approval. Don Carcieri managed to double the state’s debt, and almost all of it was unapproved borrowing, so it’s difficult to remember why it was such a problem for DiPrete.

There will be more to say about this borrowing when we look at the Capital Budget document. For now, let’s look at one of the quasi-publics that spends a lot of time in the news lately over its budget.

RIPTA

The state’s public transit authority was formed when the private bus company that ran transit in Providence and vicinity went under in the 1960s. It wouldn’t be correct to say it has had an untroubled existence until recently, but it did not always have the persistent deficit it has now.

What’s happened to the agency in recent years is a few things. First, like the rest of the state, it is a victim of our crazy health care system. Ten years ago, employee benefits were $10.5 million for a $28.7 million payroll. (For union employees, pension payments are a fraction of the health care costs, though their growth has tracked the health care costs fairly well.) In 2013, we’re looking at $24.8 million in benefits for a $45.8 million payroll [B1-355]. The cost of health care is going up almost two and a half times faster than payroll costs.

Second, transit for disabled people has taken a tremendous number of resources. Paratransit services between 2001 and 2011 more than quintupled, from a cost of $1.8 million to $9.1 million, and there are other categories of service that provide more or less the same function.

Finally, the gas tax has been a problem of its own. A portion of the gas tax is dedicated to RIPTA. The problem is that the gas tax is constituted as a number of pennies per gallon of gas. When gas prices rise, the gas tax actually falls, as people buy less gas. But when gas prices rise, RIPTA’s cost for fuel also rises. In other words, as gas prices rise, RIPTA’s ridership rises, and so do its costs, at exactly the same time that its gas tax revenue falls. Why does it seem that RIPTA is permanently in trouble? Because its funding system makes no sense, and provides falling revenue when expenses rise.

And for those who wonder what is the value of RIPTA to Rhode Island, take it from me that it’s actually pretty hard to get a seat on several of the lines I use frequently. High gas prices mean lots of riders, and also mean service cutbacks.

Unfortunately, pretty much none of the people who make funding decisions about RIPTA—its board, legislators, the Governor or his staff—actually use the system, so it turns out that RIPTA’s funding problems are thoroughly unaddressed in Governor Chafee’s budget. The documents cheerfully predict a $10 million operating deficit by June 2013 so we’ll be seeing lots of RIPTA headlines in the coming year.

]]>

One part of the Department of Administration that gets a lot of press is the Department of Motor Vehicles, which is actually a unit of the Department of Revenue. DMV, of course, gets press because people don’t like it, and the lines are long, and it’s in an inconvenient place, and so on and on.

Over last spring and summer, the agency saw a turnaround. Spurred on by stories of multiple-hour wait times, Governor Chafee appointed a new director, who made some management changes, shuffled people around, re-engineered the lines, put “greeters” out front to explain things, closed some satellite branches, and generally shook things up. Lo and behold, the wait times plummeted. An inspiring tale of how good management can make all the difference? A story of re-inventing government to do more with less in the 21st century? Well sort of, but not quite.

Watching the ticking clock in line at DMV has been a part of life for all of us in Rhode Island for a long time, but it’s not right to say that it’s been a neglected problem. Lincoln Almond suggested adding $300,000 per year to expand their hours, and Don Carcieri made a point of “fixing” it, too. He even listed new efficiencies and reduced wait times as one of his accomplishments in a 2004 interview.

But time went on and service decayed until it took hours just for routine business to happen. I waited there with my daughter for three excruciating hours one fine day in 2010, along with about three hundred good friends. By the time Lincoln Chafee took office, DMV was a joke, a travesty of government service. Chafee brought in a new interim director, Lisa Holley, to troubleshoot the agency, and — what do you know? — she got results. Wait times shrank dramatically and while it’s still hard to describe a visit to the DMV as a pleasure, the last time I was in one, last August, I was in and out in 25 minutes.

So what happened? What management magic did Holley bring to the agency? What lessons can we learn? Mostly just that it takes people to do the work.

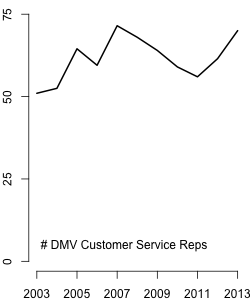

In the dark days of 2004, when Don Carcieri was taking credit for improving wait times, he was adding employees, and adding satellite locations. You can see the progress in the graph to the right, which counts customer service representatives in the department. Service got better with the new workers, and a little worse with the satellite offices. But then around 2006, Carcieri decided it was ok to let the service decay a little bit. He said the state had too many employees, and he started to enforce the statewide hiring freeze on DMV. And then the retirement fiasco of 2009 came, and a bunch of people left, and so in 2010 you had all the satellite locations, and 22% fewer people to stand behind all those desks.

In the dark days of 2004, when Don Carcieri was taking credit for improving wait times, he was adding employees, and adding satellite locations. You can see the progress in the graph to the right, which counts customer service representatives in the department. Service got better with the new workers, and a little worse with the satellite offices. But then around 2006, Carcieri decided it was ok to let the service decay a little bit. He said the state had too many employees, and he started to enforce the statewide hiring freeze on DMV. And then the retirement fiasco of 2009 came, and a bunch of people left, and so in 2010 you had all the satellite locations, and 22% fewer people to stand behind all those desks.

And that’s the crazy thing about management by attrition: you don’t get to plan for the loss of people. Carcieri simply said we’re not hiring any new people and we’re going to encourage people to retire, and that’s that. The only surprise was that people were surprised that service suffered — a lot.

So again, what management magic did Holley bring? She insisted on having more people, that’s what. Chafee asked the Assembly for 25 new workers. They balked, but they did cough up some, and so now there are almost as many people on the customer-facing staff as there were in 2006, at half as many locations. Of course there were some other improvements: line management systems, those greeters, a redivision of labor. But sometimes the big story is the simpler one: we got better service with more people.

There is another story I see lurking here. Governor Chafee saw a problem of poor service and acted to fix it, while Governor Carcieri saw the problem in terms of taxes, and acted to fix that instead, mostly by giving tax cuts to rich people. How did that work out for you?

There is one other feature to the DMV budget that should not go unremarked while we’re here. The RIMS computer system that was supposed to create a whole new class of efficiencies by getting all of DMV’s information about you in a single database is quite a bit behind schedule and over budget. This is pretty much SOP in the database development world, public and private. That is, it’s a shame and a waste of state dollars, but it’s not exactly unprecedented. I bring it up at least in part because you can’t exactly see it in the budget presentation, but you can see it in the Capital Budget, which we’ll get to soon.

NEXT: The Quasi-Publics

Read the previous posts in this series