In a wide-ranging interview with NBC 10 Bill Rappleye, House Speaker Nick Mattiello said taxes were not reduced for Rhode Island’s richest residents.

In a wide-ranging interview with NBC 10 Bill Rappleye, House Speaker Nick Mattiello said taxes were not reduced for Rhode Island’s richest residents.

“There haven’t been tax cuts for the rich,” Mattiello said. “When folks refer to that I’m not sure what they are referring to. If you can point to the tax cuts to the rich I’ll be happy to consider that.”

At 8:00 minute mark:

News, Weather and Classifieds for Southern New England

In a follow-up interview with me, I guess that maybe Mattiello thinks the income tax rate cut to Rhode Island’s highest earners has been offset by the fewer exemptions they can claim. These were changed when the rate was lowered. I also point out that raising the estate tax exemption is a tax cut for the rich.News, Weather and Classifieds for Southern New England

I also point out that there are better ways to have a positive impact on jobs and economy than slashing taxes on retirement income – such as legalizing marijuana and increasing the earned income tax credit.

]]> Kansas’s tax cuts for the rich were one of the biggest state policy stories of 2014. Sam Brownback, an ambitious conservative Republican, swept into the Governor’s office in 2010 and pushed for massive tax cuts for the rich. And he got them. By 2014, the top marginal income tax rate had fallen by 1.65 points, and by 2018, if the law isn’t repealed, the rate will have fallen a full 2.55 points.

Kansas’s tax cuts for the rich were one of the biggest state policy stories of 2014. Sam Brownback, an ambitious conservative Republican, swept into the Governor’s office in 2010 and pushed for massive tax cuts for the rich. And he got them. By 2014, the top marginal income tax rate had fallen by 1.65 points, and by 2018, if the law isn’t repealed, the rate will have fallen a full 2.55 points.

The results, predictably, were disastrous. The revenue promised from miraculous economic growth never materialized, and Kansas’s credit rating got cut. Moderate Republicans were livid. And Democrats came within four points of unseating Brownback in the middle of the 2014 red wave.

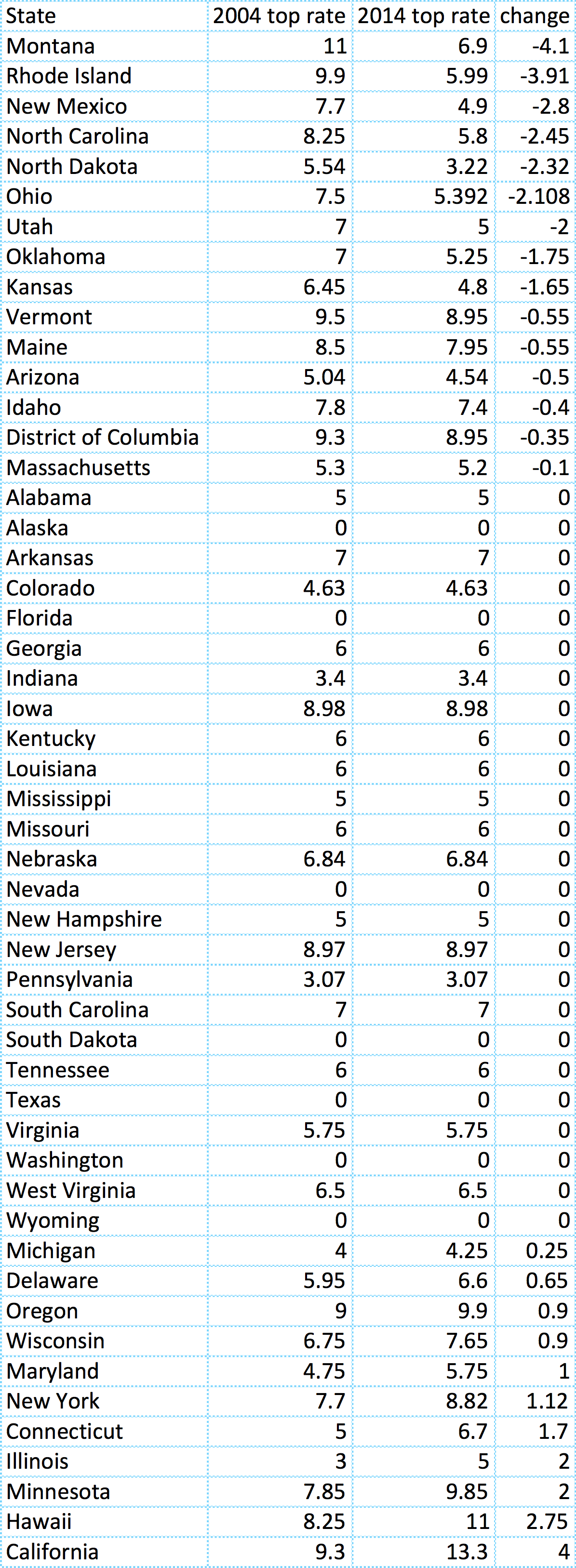

Since this debacle, there’s been a wave of think pieces about how income tax cuts for the rich as big as Kansas’s are just way too extreme, even for Republicans. But here’s the thing—Rhode Island’s tax cuts for the rich were even bigger. From 2006 to 2010, Rhode Island slashed the top marginal income tax rate for the rich by 3.91 points. That’s compared to 2.55 points in Kansas.

This all got me thinking about a question I’ve been wondering about for a while: In the past decade, has any state cut income taxes for the rich by as much as Rhode Island?

To answer this question, I compiled a list of the top marginal individual income tax rates for each state in both 2004 and 2014, using a database put together by the Tax Foundation, a right-wing think tank.

The only state with bigger cuts than Rhode Island was Montana. At 4.1 points instead of 3.91 points, they weren’t much bigger. And when you start digging into the details, it’s clear they weren’t as extreme as Rhode Island’s.

When Montana’s tax cuts were passed, they were barely projected to cut the wealthy’s tax burden at all. That’s because Montana also capped the deduction for federal income tax at $5,000 (or $10,000 for married couples). Before the law, a wealthy Montanan could deduct the 35% of their taxable income in the top federal tax bracket they paid in federal taxes. Because it’s a big giveaway to the rich, most states don’t do this. The idea was that this system effectively gave a top rate of 7.15 points, so capping the deduction and switching to a top rate of 6.9 points would barely represent a cut for the rich at all. This was key to selling the package.

Now, it turns out that the budget projections Montana Republicans put together were completely wrong. A lot of complications, including the AMT, kept them from raising as much money from capping the deduction as they said they could. The original budget projections showed a mere $6 million decrease in income tax revenue from households making $500,000 or more. The actual reduction was $48 million. Still, capping the big deduction for federal taxes kept Montana’s tax cuts from giving as much to the wealthy as Rhode Island’s. And when they passed the bill, Montana Republicans claimed they were barely cutting taxes for the rich at all.

Montanans weren’t fooled. The next year, the Democrats ran on a message of economic populism. They captured the state House, the state Senate, and the Governor’s mansion—all while Bush was thumping Kerry by twenty points.

Montana and Kansas reveal a lot about why so few Tea Party state governments have gone the full Rhode Island. They’re afraid of a revolt from their own Republicans. When they try, that’s what usually happens.

In Louisiana, Governor Bobby Jindal proposed an even bigger tax cut for the rich than Rhode Island’s. He wanted to eliminate the income tax and pay for it by hiking taxes on the poor and middle class. But Republicans revolted. Even the state’s top big business group opposed the plan. So Jindal had to scrap it.

In North Carolina, a similar proposal died because conservative megadonor Art Pope opposed it. (Pope funds a network of conservative think tanks and politicians, and he got himself appointed state budget director.)

In Alaska, there are no income or sales taxes, since the state gets so much money from oil taxes. So when Republican Governor of Alaska Sean Parnell slashed taxes for the oil companies, even Sarah Palin thought he had gone too far. She was so mad about the tax cuts that she endorsed the Independent-Democrat fusion ticket, which successfully unseated Parnell in the middle of the 2014 red wave.

Sometimes, smart people portray Rhode Island’s experiment in right-wing tax policy as a sort of moderate conservatism, on parallel with today’s more restrained Republican state governments. To be honest, I used to see it this way.

After all, a lot of the policies of the conservative machine that has taken over the Rhode Island Democratic Party really do fall in the mainstream wing of the national Republican Party. Our abortion restrictions, for instance, while more severe than any other blue state’s (according to NARAL’s ranking) are more mild than the extreme TRAP laws some Tea Party governments have pushed through.

Like most Republican states, we do have voting restrictions, including an ID law, but they aren’t quite as strict as what the reddest states have pushed through. Our war on workers, while severe, isn’t quite as bad as what has gone on in states like Wisconsin. And in a few select areas, like marriage equality, our policies have actually aligned with the national Democratic Party.

But when it comes to tax policy, the conservative Democratic machine that runs Rhode Island falls on the extreme right fringe of the national political spectrum. Even the most right-wing Republican state governments balk at tax cuts for the rich as large as what Rhode Island Democrats have done.

]]> While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

Demand.

Supply-side economists have this totally absurd notion that supply will create its own demand. That has to be one of the stupidest things I have ever heard. Why are there no Wal-Mart’s in the Yukon territory? Why did buggy-whip manufacturers go belly-up after the auto-mobile became popular? Why are there no stores that sell only items related to Reformation Theology?

Seems like a Wal-Mart should be enough of an attraction to create its own demand. Right?

Seems like a plentiful supply of quality buggy-whips should have enough appeal to create its own demand. Right?

And lots of books and pictures of Thomas Cramner, well, obviously, this is a supply that has to create its own demand. Right?

But then you have Prohibition. What happened there? Supply disappeared, at least in theory. So demand collapsed, because nothing is ever driven by demand. Right?

Except just the opposite happened. Demand created the supply. Just like illegal drugs. With sufficient demand, someone, and even lots of someones, will take great risks to produce a supply.

And yet, star-level economists, especially at the U Chicago insist that demand has no role in economic performance. Cut taxes, cut regulations, free the supply side and demand will follow. It HAS to! Our theory says it will! So it will be so!

Stop me if you’ve heard this one: my grandfather lived through the Depression. He had a line that held more wisdom than all of the collected works of the U Chicago school. My granddaddy had no illusions about “Good Old Days”, when it was all simpler. His line was “Sure, a loaf of bread only cost a nickel. But what the hell. You didn’t have a nickel.”

And there you have it. No matter how cheap a thing, people won’t buy it if a) they don’t want it (see Whips, Buggy above); or b) they don’t have any money.

Which leads to the current state of the economy. Five full years after the crash, a lot of people still don’t have jobs. Or, if they do, they are low-level service jobs that pay between minimum and maybe $10/per hour. $10 per hour grosses just shy of $21k per year. Can you rent for $400 per month? Can you keep a car on the road for $400 per month? Maybe that will cover gas, but you also MUST factor repairs and routine maintenance into that. Can you eat decently on $400 per month? And that means, you know, fresh fruits and veggies. Yes, you can get by on boxed mac-and-cheese, but that takes a horrible toll on your body. So we’re down to something like $500 per month discretionary. (Taking a month as 4.3 weeks). Not saying that’s not enough to get by on. It is. I know because I’ve done it (adjusting for inflation). But let me tell you, don’t plan on buying much.

And there, exactly, is the rub. I get so sick of people who say that employers have the right and the obligation to drive wages into the ground. And then say that workers should be thrilled to have any job,at any wage, no matter how pathetically low. Have to free up the job creators!

But what good does that do? Job creators are more free now than they have been in generations. They’re making huge profits. They’re sitting on piles and piles of money. So, they’re free*. Why don’t they create jobs? Or why don’t they create jobs that pay people a decent wage? Why is there a need to stockpile even more money?

Look, Henry Ford was a Nazi sympathizer. That is not a slur. It’s an historical fact. Go read anything about him and you will find out that he was so virulently anti-communist that he thought the Nazi government was a good thing, at least before the onset of WWII and the Final Solution. He figured out that it was a good idea to pay workers more than starvation wages. He realized that by paying his workers a good wage, he was creating customers.

In other words, he was creating demand for his products. In other words, paying workers more, and making a smaller profit, was in his best self-interest.

We are primed for a terrific natural economic experiment. Massachusetts is going to raise its minimum wage, gradually, to $11 per hour by 2017. The first increase is to $9/hour as of 1/1/15. Since Mass and RI currently have the same minimum wage, this means that millions of jobs will be fleeing from Mass, crossing the border into RI to take advantage of the lower wage. And it means that Mass will be plunged into economic darkness and decay because, everyone knows that a higher–and increasing—minimum wage will cost millions f jobs. By 2018, Mass will look like Detroit on a grand scale.

Everyone knows this. Just like everyone knows that millions of Rhode Islanders have fled to low-tax places like North Dakota and Wyoming. Because that’s what Econ 101 says.

Well, maybe those people should have stuck around for Econ 201, or 301. Maybe they’d have learned there’s more to the story.

And: assuming that my “predictions” don’t come true, and that the economy in Mass actually improves, I will expect a personal apology from every single person who says I’m wrong.

Because, fact of the matter, a higher minimum wage will stimulate demand. People will have money. They will buy more. That means companies will hire more people. And the virtuous cycle continues. If you want proof of this, cross the border into Canada, where the minimum wage is currently $11./hour. And then cross back. It’s like going from a First World country into a Third World country. When you cross back into the US, that is.

And if you don’t believe me, how about this guy?

]]>

Last evening the RI House Finance Committee heard testimony on two bills that would increase the marginal tax rate on people making more than $200,000 a year. Representative Maria Cimini proposed a 2% increase, from 5.99 to 7.99% on incomes over $250,000, while Representative Larry Valencia proposed a 4.01% increase on incomes over $200,000 for individuals and $250,00 for married couples.

Valencia asked the committee to explain the effectiveness of tax cuts for the rich (starting in 1996) given that these were supposed to bring more jobs to Rhode Island, not less, as evidenced by our high unemployment. Appeals to reason however, were not found persuasive by the committee.

At least ten people spoke in favor of the bills, some telling very moving stories about the way they struggle in a state that continues to cut services and cut assistance to our cities and towns, resulting in higher property taxes. In fact, it’s the property taxes that are hitting these Rhode Islanders the hardest, even as the myopic House Leadership continues to champion a policy of across the board tax cuts, curbs on spending and other austerity measures. The impassioned pleas of struggling Rhode Islanders fell on deaf ears, because appeals to compassion were not found to be persuasive.

Everyone knows that the bills proposed by Cimini and Valencia are going nowhere this year. Chairperson Raymond Gallison, recently appointed to his position by Speaker Mattiello, shaped the discourse by calling up all those in favor of the bills and listening politely, reserving the last word for John Simmons, executive director of a right wing think tank, the Rhode Island Public Expenditure Council (RIPEC). Gallison and Simmons are on a first name basis, and Simmons’ testimony was welcomed as a breath of fresh air.

Simmons simply restated the same things RIPEC says every year. Increasing taxes is wrong. The rich already face a higher tax burden than the poor. We shouldn’t be targeting the job creators. Philosophically, why should we be punishing those who are successful? The rich are rich because they are better than the poor, more deserving than the poor, and more important than the middle class. Here’s Simmons’ closing argument:

“Then there’s the philosophic issue, I guess I want to address that. It’s a little bit different. Is it because we can tax people who can make money and are successful that we should? Is that the philosophy we want for people to come to Rhode Island and grow a business here? If you make money we can take it from you? I don’t know that that’s the right message to send to people who want to come to Rhode Island. It’s the opposite. If you are successful we would like you to come to Rhode Island.”

Note that Simmons is not all that interested in those who already live in Rhode Island. He isn’t talking about improving the lives of Rhode Islanders, instead he’s talking about making Rhode Island a haven for the rich and successful. If Rhode Islanders are lucky, I suppose, we might find jobs shining the shoes and cleaning the yachts of our more deserving citizens.

This is what Gallison, representing House Leadership as Chairperson of House Finance, found persuasive: A naked appeal to everything he wants to believe is true, despite all evidence to the contrary. It’s called motivated reasoning, a process of having a conclusion and then searching for reasons to believe it. No contrary examples, no logic, no amount of suffering and no evidence contrary to the deeply held belief will be truly considered.

So what do you say to the man who eases your mind and continues to guide you down the primrose path of massive economic inequality? What do you say to the man who confirms all your biases and tells you that everything you sincerely wish were true is true and good, despite the nagging fear at the back of your mind that tells you it’s all a lie?

Gallison said, “Thank you very much John, I appreciate it.”

]]>As growing wealth inequality pressurizes the streets, squeezing the middle class into poverty and those in poverty into despair, people of moral consciousness will not allow budget cuts to eviscerate what remains of the social safety net so that politicians can pad the bank rolls of the elite who fund their campaigns and profit off of side deals.

Mr. Elmer Gardiner of the George Wiley Center Leadership Committee explains:

“They recently announced that NORAD, the 7th largest auto importer in the US located in Quonset, are going to ‘create’ almost 300 new jobs paying only $10/hour -which means still they would be still economic slaves. We can’t be subsidizing these large corporations profits by paying for food stamps (SNAP) which wouldn’t be necessary if paid a living wage of $15/hour. Then these workers to have pride and self esteem, not feel that their work isn’t even enough to sustain themselves.”

We have more people today living in poverty than at any time in the history of this country, including the highest rate of children in poverty of any industrialized nation. Here the top one percent owns 38% of all the wealth in America while the bottom 60% own 2.3% collectively. In fact one family, the Walton’s of WalMart, are worth 138 Billion Dollars, more than the bottom 40% own all together. At a freezing cold Black Friday protest, a student said had to quit his job at WalMart and work for a local business the pay wasn’t enough to live on. While protesters chanted “low pay is not OK,” Scott DuHammel of the Painters and Allied Trades Union said “I think this is a terrible situation. The workers obviously deserve more.”

We have more people today living in poverty than at any time in the history of this country, including the highest rate of children in poverty of any industrialized nation. Here the top one percent owns 38% of all the wealth in America while the bottom 60% own 2.3% collectively. In fact one family, the Walton’s of WalMart, are worth 138 Billion Dollars, more than the bottom 40% own all together. At a freezing cold Black Friday protest, a student said had to quit his job at WalMart and work for a local business the pay wasn’t enough to live on. While protesters chanted “low pay is not OK,” Scott DuHammel of the Painters and Allied Trades Union said “I think this is a terrible situation. The workers obviously deserve more.”

In fact one family, the Walton’s of WalMart, are worth 138 Billion Dollars, more than the bottom 40% own all together. At a freezing cold Black Friday protest, a student said had to quit his job at WalMart and work for a local business the pay wasn’t enough to live on. While protesters chanted “low pay is not OK,” Scott DuHammel of the Painters and Allied Trades Union said “I think this is a terrible situation. The workers obviously deserve more.”

UniteHere has been confronting the same poor pay and benefits at the Renaissance Hotel and the Weston, where the owners multi-millionaire owners lawyer threatened the city with “consequences” if they were not given tax credits for a development project.

And the story is the same all across the service industry. A mother of two children on strike at Wendy’s said “I am tired of getting paid $7.75/hour, and that’s sad…after working there for 4 years.” Women across the country have been earning 78 cents compared to every dollar that a man earns for doing the same job. Carolyn Mark, President of RI National Organization of Woman elaborated. “The number is higher now – 84.8 cents to the dollar, although it’s much lower for women of color. The common wisdom is that it’s not that RI women are doing so much better than women around the country, but that men in Rhode Island are doing that much worse.”

Poverty is the root community problem creating a cycle of crime leading to do to lack of opportunity – a downward spiral caused by a lack of jobs and unequal quality, materials for and access to education which is the key to social mobility. John Prince, founding member of Direct Action for Rights and equality points out that victory of the Ban the Box campaign, which a means amends employment laws to limit inquiries like “have you ever been convicted of a crime” helps to break a cycle of economic inopportunely. “I never heard a judge sentence anyone to a lifetime without employment. What we need now is for the City of Providence to finally enforce it’s First Source law to hire residents first so there are real jobs developed here.”

Today, the the House Finance Committee will be hearing Rep. Cimini’s bill H7471 would raise taxes by 2% for people making over $250,000 and Rep. Valencia’s Bill H7552 would raise taxes by 4% for people making over $200-250k. This is the way to raise revenues to develop the economy of the state, not by balancing the books on the backs of the poor and shrinking middle class. Austerity cuts are not an option. We need a law to raise the minimum wage to a living wage of $15/hour. Build Rhode Island “from the bottom up. Keep Martin Luther Kings Dream alive with action.

RIMAP is a coalition of organizations and individual from a wide array of backgrounds among anti-

Gina Raimondo’s recent policy proposal on infrastructure raises a lot of math questions, but here’s one of the most glaring: How is she going to pay for the $60 million she wants to spend each year on school construction? She really doesn’t say.

Gina Raimondo’s recent policy proposal on infrastructure raises a lot of math questions, but here’s one of the most glaring: How is she going to pay for the $60 million she wants to spend each year on school construction? She really doesn’t say.

She tells us she’ll simply find the money by “taking just half of a cent” out of the sales tax, but those dollars are already being spent on other things. So here’s a really basic question no one else is asking her: What is she going to cut out of the general fund to pay for the $60 million in sales tax dollars she’s redirecting? And what impact would those cuts have on job creation?

Progressives have lots of great ideas for closing budgetary gaps. In Rhode Island, our favorite idea is probably repealing the 2006 income tax cuts for the rich. It’s an easy solution, but conservatives don’t like it. So I’m very curious to see how Raimondo proposes to find $60 million.

Raimondo’s campaign did not respond to a request for comment.

]]> Progressive Providence Rep. Maria Cimini is probably best known for leading the charge for tax equity in the General Assembly. This year, she said, education will also be high on her priority list. In fact, she said she may earmark new revenue raised by her tax equity legislation to better fund education.

Progressive Providence Rep. Maria Cimini is probably best known for leading the charge for tax equity in the General Assembly. This year, she said, education will also be high on her priority list. In fact, she said she may earmark new revenue raised by her tax equity legislation to better fund education.

But when asked what she would focus on if she could only have one issue this session, she said education.

“I would want to focus on really widespread and broad education policy that would involve pre-K, solid care for children, looking at the GED changes that I think are going to be really difficult for low income individuals,” she said. “It’s beyond test taking and beyond even workforce training. It’s about preaparing people to work creatively and work in teams and respond to careers that we can’t even imaine exist at this moment and I’m concerned that the trajectory of public education is more focused on the jobs that exist right now and very finite skills and a world that changes.”

She also said she’ll be reintroducing her plastic bag ban bill. Please listen to our entire conversation here:

]]>

House Finance Committee Chairman Helio Melo said the oft-debated restructuring of Rhode Island’s income tax code under Governor Don Carcieri has resulted in more annual revenue, and that the wealthy are paying more than they did prior to the changes.

“I don’t think we cut income tax on the wealthy,” he told me last night, before sitting down for the first evening of the legislative session. “I think they actually pay more than they have in the past. We took away a lot of exemptions when we did that.”

He also said the changes top-down changes have resulted in more revenue, too.

“I think we are seeing more money coming in with personal income tax so if we just look at it that way I would say yes. Does it mean we are getting more jobs? I’m not too sure about that…”

You can listen to our conversation here, including voter ID (Melo: “I don’t have a problem with it.”) and later today I’ll be post my conversation with Rep. Maria Cimini about tax equity and her contrasting thoughts on it:

]]> Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Can you tell I’m getting tired of having to “prove” stuff that is so obviously factual? Well, in case you couldn’t, I am tired of it.

In fact, even the winners in this zero-sum game have tacitly begun to admit that wage inequality is growing. For the last couple of years, the main counter-argument put out by the lackies of the very wealthy has become that, yes, inequality is growing, but it doesn’t matter.

That’s a lie, too.

Growing wage inequality was one of the primary causes of the collapse of 2007/8. It remains a primary cause of the ongoing Great Recession. Since the vast majority of wage earners were finding their salaries stagnant, if not shrinking, these same people had to rely on credit to finance many of their purchases in the so-called “Bush Boom” of the naughts. I say “so called” because, for the first time since the end of WWII, the median salary at the end of the “boom” did not reach the median salary at the end of the previous boom. That is, median salary in 2007 was lower than it was in 2000/01, before the mild recession that occurred at the end of the 1990s. This is stark proof that wages, for the vast majority of people who actually work for a living (as opposed to living off dividend income, or carried-interest) was not growing despite what Republicans were touting as a “booming economy”.

And spare me the morality play about the evils of credit, about how it shows a lack of moral fibre, how it demonstrates that people are too lazy, or too insistent upon immediate gratification, that they can’t wait and save to make purchases, blah, blah, blah.

Here’s a secret: Had people done this in the naughts, there wouldn’t have been enough demand to create even the wimp “Bush Boom”. The US would have remained mired in the recession that started in 2000 throughout Bush’s first term. I can say this with complete confidence because the only thing that fueled the expansion of the economy—such as it was—was that people were buying stuff on credit. This created the demand that created the expansion.

And demand is the key component. Corporations are swimming in money. They have so much money they can’t figure out where or how to spend it. More, they can borrow billions and billions of dollars at de facto negative interest rates. And yet, corporations are not spending money. If “supply-side” economics had any validity, businesses would be spending money like drunken sailors right now, and they would have been doing so for the past five years, ever since we hit the point of negative interest rates. Why haven’t they spent money? No, the answer is not the uncertainty of possible tax or regulatory changes. That is an absolute crock. If you actually read the business press (as opposed to listening to FOX News) you will realize that businesses are reluctant to spend because they do not believe there is sufficient demand for more products.

Demand. There you have it. The engine that truly drives economic expansion. My grandfather had a succinct way of describing conditions during the Great Depression: “Sure, a loaf of bread only cost a nickel. But what the hell, you didn’t have a nickel.”

In case anyone doesn’t get the point: it doesn’t matter how cheap things are because of a large supply. If people still don’t have the cash to buy stuff, it doesn’t get bought. IOW, there is no demand.

Demand.

And that is what is holding up recovery as the Great Recession enters its fifth—or is it sixth?—year. Got that, people? Sixth year. Lehman Brothers collapsed in 2008, while G. W. Bush was still president. Before Obama had been elected, let alone before he had taken office. Got that? George Bush was president. Hank Paulson, former head of Goldman Sachs was Secretary of the Treasury. Not Obama, not Geithner (although he was President of the NY Fed at the time).

Inequality matters, people. It matters a lot. It keeps demand down. When demand is down, people lose jobs. When people lose jobs, demand drops further, and more people lose jobs. This is called a death spiral. It’s essentially the same phenomenon, but going in the opposite direction, of what caused the inflation of the 1970s. And no, cutting wages DOES NOT HELP. Cutting wages is the equivalent of throwing people out of work. Yes, perhaps fewer people will lose their jobs outright, but demand will still decrease. It may—or may not—take a little longer, but the same result is attained.

So the answer is that people need to make more money. But what is happening instead is that the wages of most people are being cut. It’s the time of the year when a lot of companies are doing compensation planning. For many big companies, this is now a very simple process. A few people, maybe ten percent of the corporation’s employees, will get nice raises, maybe 5%, probably more. The rest will get nothing.

That is, the rest of the employees will get a pay cut. Their pay will remain the same, but even 1-%-2% inflation will erode stagnant pay. The result is a de facto pay cut. The result is a further decrease in demand. Funny: Republicans scream about how tax increases will hurt the economy because they will take money out of people’s pockets. But a pay cut does exactly the same thing, and yet Republicans fall all over themselves to demand—DEMAND—pay cuts.

It’s enough to make you suspect that Republicans don’t care about the economy at all. All they care about is tax cuts. All they care about is making the wealthy even wealthier. Even if it means the rest of us slowly slip into poverty.

This is because their wealthy corporate masters want tax cuts. So Republicans bow and scrape and say “Yes, Master” and move heaven and earth to give their masters what they want.

The rest of us can pound sand.

]]>

The picture to the right is called “Christmas dinner in home of Earl Pauley near Smithfield, Iowa…” This is Christmas for a farm family in Iowa in 1936. This is the world that conservatives call the ‘good old days’.

This is the sort of country conservatives believe we should have. Again.*

This was the age before Social Security, before Medicare, before welfare, before government regulation. This is a farm family. They worked hard–so hard that you and I probably cannot begin to conceive of how hard they worked. I’ve done farmwork, but it was mechanized, and it was still damn hard. So this family worked hard. There was no unemployment insurance. These were not urban welfare queens. They had not made bad choices, unless trying to run a farm should be considered a bad choice. They were not coasting, using the safety net as a hammock, because there was no safety net.

I assume the family in the picture is living on its farm. A lot of families lost their homes in the period 1929-1936 because they couldn’t pay the mortgage. Farmers in particular lost their land because their crops died in the field–if they grew in the first place–because of a stretch of drought that lasted several years, and that led to the Dust Bowl. My grandmother lived through the Dust Bowl in Kansas. Her stories were horrific.

You need to look at this and remember that this is the world that conservative politicians want to bring back. They want to kill all the social programs that were created as a result of the Great Depression. Conservatives want people who lose their jobs, through no fault of their own, to be pushed down to the sort of life that you see in this picture. They want people without work to fall into the sort of poverty that you see here. They may not realize what would happen if we follow their policies and gut social programs and all assistance to anyone but the wealthy. They may not realize what the implications of their policies will be, but the picture gives you a graphic example of the world that conservatives want to re-create.

Oh no! they proclaim. Getting rid of all this government will release the job creators, and they will create jobs! For everyone!

Bull.

The job creators at the time of this photo were fully unleashed. They were barely regulated. They were lightly taxed. And yet the people in this picture were living the way you see. Dirt floor. Bare plank walls. Where was the magic of the market? It didn’t solve the problems then. It didn’t help the people you see here. Rather, the people you see got to the condition you see because of the lack of regulation, and the lack of government support, and the low tax burden on those at the top of the economic pyramid.

The unfettered might of the market did nothing to help the people you see here. In fact, those with money shrieked that these people had to be left on their own, to starve if necessary. Any attempt to interfere would destroy prosperity. In fact, any interference by the government was immoral. But even a casual glance at this picture will tell you that any prosperity this family had ever known had been destroyed some time ago, and all because of the magic of the market. The only thing immoral was the sanctimonious attitudes of the upper echelons who let families live like you see in the picture.

If you read Friedman’s Monetary History of the United States, you will see that he talks about a seemingly endless series of economic crises, starting in the 1870s and carrying through to the Great Depression. That’s a period of 50-60 years, and there were three acute recessions and at least one depression (depending on how you define the downturn that began in 1873), and the last depression was so bad we call it Great. This averages to almost one crisis every fourteen years; the ‘teens of the Twentieth Century were marked by the Great War, so it’s difficult to compare this to ordinary periods.

One crisis per generation.

This is what the magic of the market created. A downturn every 14 years on average. Just about every generation was hit by a very nasty downturn, all in a period when there was no one to help. Private charity? Private charity is only viable during a period of economic expansion; when unemployment is above 10%, there simply aren’t enough people with enough money to make private charity effective. That’s why you have a family going through an experience like the one in the picture. Because people of the time relied on private charity.

And these were crises without unemployment assistance, food stamps, housing subsidies, with no government assistance whatsoever. People caught without work for six months or a year or three years had nothing to rely on, but they still couldn’t get jobs. Talk to people who lived through the Depression, quickly, while they’re still alive. They will all tell you, there was no work to be had.

And, btw, Friedman’s thesis that the Great Depression could have been avoided has been shot full of holes by our current situation. Friedman claimed that the Fed could have solved the problem through looser monetary policy. Since 2008/9, the Fed has been doing just that, pumping huge amounts of money into the economy in any way possible. And the same conservatives who howled about FDR have been howling about Bernanke. Has the policy worked? Well, we didn’t have a depression, at least not one like our grandparents lived through, but ask a recent college grad how easy it is to find a job. Look at the unemployment rate. So Friedman was a quarter-right at best. Monetary policy alone cannot solve the economic problems we faced in the early 1930s, nor the problems that we are experiencing in the early 2010s

Nor can the magic of the market create prosperity for all, except for relatively short periods. If capitalism produced a crisis every 14 years, that means if you were fortunate enough to graduate into an economic expansion, you should expect a downturn by the time you hit 40. Then maybe you’ll benefit from the upturn by the time you hit 50. Of course, by then you will have lost five or ten of your prime wage-earning years. So how are you supposed to save for retirement?

So look really hard at this picture. Think of it the next time you hear someone claim that we need to unshackle the job creators. Think of it and remember that the Titans of Industry screwed it up in the 1920s, and the 1900s, and the 1890s, and the 1870s…that’s a lousy track record. The Titans of Industry created the world you see in the picture.

*This is an incredibly harsh statement. I do not ascribe malign motives to sincere conservatives. I am not saying conservatives are evil people who wish misery on others. However, ideas have consequences; we have a moral obligation to understand the ramifications of our policies and of what we advocate for society. In this, I believe, the conservatives fail. Perhaps this is because they do not understand history; but a point is reached where there must be willful ignorance of what they advocate. History is so very, very clear, if you realize that there was history before WWII, or even before 1970. I keep coming back to this, but it continues to be true: we tried it their way. It did not work. Most of human history has been a long, dreary experiment in laissez-faire markets. The outcomes were horrible; look at this picture.

And if free markets or government regulation or interference or high taxes didn’t cause the situation in this picture, what did? They have no real answer for that question.

So yes, I realize I am making a terribly provocative statement; but the point stands. If we follow their advice, this is where we will end up. Again.

]]>