In the brouhaha about MetLife leaving, I did see and hear people try to blame this on the too-high RI taxes. Of course; it’s always about the taxes, isn’t it? I would like to make one point about that.

For 2012, MetLife reported $1.4 Bn of operating earnings. In comparison, the $80-90 Mn of tax relief that the will receive would just register as a rounding error in any single year. But those tax savings will be spread out over a number of years. As such, they don’t even constitute a rounding error.

Any company, of any size, that makes long-term decisions based on a few years worth of tax savings is not a company that will be around long enough to realize those savings. Only a company in dire straits would make so drastic a move for so little return. Because let’s face it, the up-front investment that is required will more than eat up those tax savings. In such cases, breaking even is a good result in the real world.

No: the savings will come from other areas: lower rent vs what is being paid in the Northeast, in greater Chicago, in the SF Bay area; it will come from lower wages paid to younger workers who do not incur the disability and medical expenses an older workforce will incur; it will come from pension benefits that do not continue to accrue to said older workers, and that will not be paid at all to younger ones. That’s where the money is.

No, RI’s problem is not the tax structure. It’s the size that matters.

The sad fact of the matter is that RI does not have its own economy. RI is a pale reflection of what is happening in Boston. Nor is this a recent development: it was already true in the early 1980s. Look back at the numbers; that was the period when Dukakis was creating (or taking credit for) the “Massachusetts Miracle.” The 128 Loop was America’s Technology Highway, where high tech lived before being superseded by Silicon Valley. Massachusetts recovered sooner than most of the country from the recession of the late 1970s; RI was a couple of years behind.

Then, in the mid-eighties came the phenomenon of Woonsocket turning into a bedroom community for Boston. Same with Nashua NH. Around then the ProJo carried a story of people taking classes to lose their RI accent because they felt that companies in Boston believed that people with an RI accent were less intelligent.

So, no, this is not a new phenomenon. What I have cited is anecdotal; but the numbers in the BLS and Census, etc. will support these contentions.

Also according to the US Census, in 2000, 79% of the population of the US lived in urban areas. In states like Nevada, it’s upwards of 90%. More, 45% of the population of the US now lives in the top 20 urban areas. In the meantime, the Census Bureau also says that one-third of all counties in the country are being drained of population. What does this mean?

It means that the urban concentration that began at the end of the 19th century is continuing. More and more people are living in and around cities while other areas languish. Telecommunication, and telecommuting were supposed to make cities obsolete; the opposite is happening. Telecommuting was all the fad in the late 90s and into the new millennium; now, companies are eliminating it.

It means that, in order to compete, size is a huge factor. Charlotte NC is now the #2 financial center in the country, after NYC. It has surpassed Chicago, with its Mercantile Exchange. It is the #2 center largely because the #1 bank, Bank of America, has its HQ there, and Wells Fargo has its East Coast operations HQ there. The Charlotte Combined Statistical Area has 2.4 million people. This is not rural America anymore.

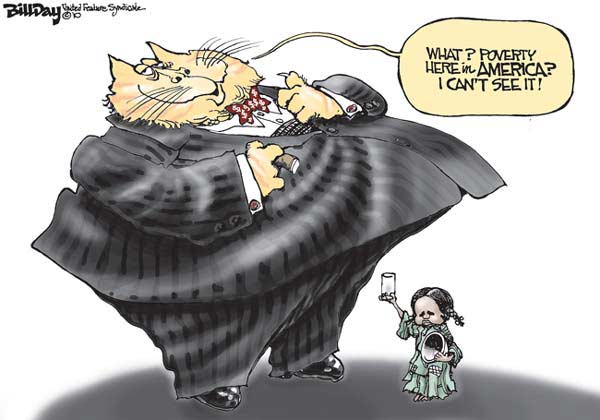

With a million people, Rhode Island cannot compete with such a center, any more that it can compete with Boston. The advantages of a large educated, concentrated workforce with good infrastructure and a compact geographical footprint are too great to overcome. This is why NYC not only continues to exist, but to thrive, in the face of all the reasons conservatives say it shouldn’t: high taxes, big government, and whatever else they complain about. Half of the wealthiest zip codes in the country are in NY and NJ, both of which are high-tax states.

RI is not losing jobs to lower tax states; RI is losing jobs because the vast majority of jobs are in these concentrated urban areas. If jobs aren’t there already, they’re relocating there. I heard a story on NPR that a growing company in Kansas could not find workers. That’s because no one is willing to relocate to a small town that depends on a single employer; what happens when that employer decides to off-shore the jobs? People are stuck in a small town without prospects. In a larger metro area, there are other jobs, or at least a greater possibility of other jobs.

Size matters. The country is not de-urbanizing. Exactly the opposite.

Addendum: The point is, MetLife made its decision to relocate to NC for its own reasons. Only then did it approach the NC government and see how much it could extort from the state’s taxpayers. In other words, MetLife got money from the state to do exactly what it would have done without the tax breaks. In fact, there have stories to this effect in the North Carolina media, complaints that the state of NC got played for chumps by a large company.

And, btw, NC in general, and Charlotte in particular, have unemployment rates that are only a couple of tenths of a percent lower than what RI and Providence has. It’s not exactly boom-town down there, either.

So, yes, NC is getting the jobs. But they would have gotten the jobs without the subsidies. So no, it’s not about the tax rates, no matter how often or how loudly conservatives will say it is.