On my last post I was called out for having previously said somewhere at some time that the General Assembly, and the House in particular, has too many white, male lawyers. Here I’m going to lay out some of the facts I found about the over-representation of that specific type of person.

On my last post I was called out for having previously said somewhere at some time that the General Assembly, and the House in particular, has too many white, male lawyers. Here I’m going to lay out some of the facts I found about the over-representation of that specific type of person.

95% of our State Representatives are white. 77% of Rhode Islanders are white.

75% of our State Representatives are male. 48% of Rhode Islanders are male.

28% of our State Representatives are lawyers. 0.4% of Rhode Islanders are lawyers.

27% of our State Representatives are white, male lawyers.

I’m all for having some white, male lawyers in the State House. It’s also okay to have more lawyers than the general population. As some people have pointed out, the job of a legislator is to make laws, so a law degree does not hurt in that regard. However, more important than the technical drafting of the language (after all, there are State House staff with this responsibility) is representing the interests of all Rhode Islanders. Passing a budget that works for all Rhode Islanders. Strengthening public education, investing in infrastructure, creating job opportunities and maintaining safety nets is what I want my legislators to be busy doing. You can’t fix problems you don’t see, and so I want my General Assembly to have eyes in as many places as possible, and I do believe that requires diversity in all factors, from gender, race and age, to class, employment history, and experiences with poverty.

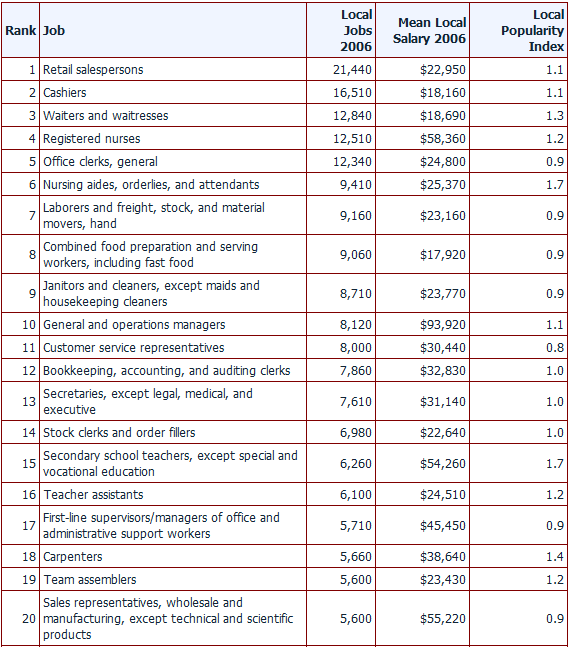

So, if you’re a cashier, or a waitress or a salesperson, it’s time you gave some thought to running for office. Your community needs you. The stakes are too high to sit on the sidelines.

My sources:

http://www.rilin.state.ri.us/ – each state rep’s bio page for gender, race, occupation info

http://www.statehealthfacts.org/profileind.jsp?ind=5&cat=1&rgn=41 – for gender and race info on RI

http://lawschooltuitionbubble.wordpress.com/original-research-updated/lawyers-per-capita-by-state/ – for lawyer info on RI

http://www.seniorjobbank.org/database/Rhode_Island/Rhode_Island.html – for employment info for RI

There’s no other way to say this: The old ways aren’t working, our state is moving in the wrong direction, and I need your help to fix it.

There’s no other way to say this: The old ways aren’t working, our state is moving in the wrong direction, and I need your help to fix it.

Today, John Lombardi announces his candidacy for State Representative of District 8. Mr. Lombardi has served on the City Council for almost three decades, and I thank him for his years of service to the City of Providence. But it is time to look forward.

It’s time for new ideas and new leadership – that’s why I’m running. Our neighborhoods deserve better, and with your help, I know we can turn it around

The fact is that there’s really no difference between John Lombardi, and our current state rep, Michael Tarro – they’re both political insiders, with a stake in the old way of doing things, in City Hall and on Smith Hill.

For years, all of us in Federal Hill, Olneyville and Valley have been let down by poor leadership. And for too long, elected officials have been making short-sighted decisions in order to reward friends and get re-elected. Today we’re all living with the results. Since April, I’ve knocked on hundreds of doors and the response has been overwhelmingly positive. People are ready for a new direction, they’re tired of politics as usual, and I’m in this to fight for all of us who know that Providence can do better. I’m in this to win.

I need your help. Please donate $100 or $10 today, or sign up to volunteer.

Though the number of people seeking to represent District 8 changes today, our campaign does not.

I look forward to working with you to build a stronger Rhode Island. Please feel free to email me and let me know your concerns, to learn more about my campaign, and how you can get involved.

]]>Hope to see you Tuesday, in the State House rotunda, 3:30 pm.

]]> Last night’s ‘ReBoot approved’ event started with a rally at the Harry Kizirian Elementary School with three or four speakers, marched over to Chad Brown, and then directed attendees to Kobi Dennis’ regular Tuesday night community meeting. Turnout was awesome, probably about 250 folks there: lots of kids, lots of teenagers, lots of parents. This was my camera phone pic of the night.

Last night’s ‘ReBoot approved’ event started with a rally at the Harry Kizirian Elementary School with three or four speakers, marched over to Chad Brown, and then directed attendees to Kobi Dennis’ regular Tuesday night community meeting. Turnout was awesome, probably about 250 folks there: lots of kids, lots of teenagers, lots of parents. This was my camera phone pic of the night.

Click HERE for a list of other local events calling attention to this tragedy.

]]>

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 2448

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

“there was a march in memory of treyvon martin of about 40+ people on

friday which started on thayer street and made its way down to as220.

it was pretty darn good for something that got thrown together in 2 hours.

some chants for future marches were:

no justice no peace, treyvon rest in peace!

and

you killed treyvon, and now it’s on!”

Sunday night at 6 pm. Community Forum on Trayvon Martin Murder. Great, thoughtful and heartfelt discussion, about 50 people for two hours. Photo from my camera phone attached.

Sunday night at 7 pm. March from Central High School to Burnside Park. I got this report in:

“There were about 13 people. I did not have pictures of the march because I was in front of the line, holding the sign. But there was someone there with a camera. I can get a picture for you. “

Tuesday (Tonight) at 8 pm. Providence “Justice for Trayvon” Community Rally & March

“Meet Tuesday March 27th @ 8PM at Father Lennon Park in Providence (60 Camden Avenue in Providence next to Madeline Rogers Rec) to show your commitment to justice in the Trayvon Martin case.

We will meet at the park, and then march through OUR community and end at Kobi Dennis’ ongoing Tuesday night Community Rally to discuss what we as a community need to do to protect OUR youth. It’s On Us… remember that.

Bring signs to express how you feel about the situation. Where a Hoodie if you want to show your solidarity with all the Trayvon’s in our communities that may or may not have made the news headlines. Greeks are encouraged to wear para.

This is a PEACEFUL event. Come with the right attitude, or please don’t come at all.

For more information contact ReBoot401@yahoo.com or (401) 338-7606”

Friday, March 30, 12 pm. Rally on the State House lawn.

“Im gathering people to rally infront of the state house in downtown providence,ri @ 12 noon time till ? Bring signs and if u like wear a hooded sweatshirt.. Its Non violent event”

Friday, March 30th 7:00 p.m. Central High School 70 Fricker St.

“Outraged over the murder of Trayvon Martin? You are not alone! Join us Friday evening at 7:00 for a march in honor of Trayvon Martin. We’ll gather in front of Central High School (Where Westminster, Cranston, and Fricker Sts. meet). After the march, we’ll head over to Libertalia, 280 Broadway, for a film screening and discussion. Wear a hoodie and/or dress in black.”

Wednesday, April 4, 4:00 pm Martin Luther King JR Unity Day at City Hall. Here is a link to the video promotion. http://www.youtube.com/watch?v=MnZTtYLmFrQ&feature=share Contact Bill Bateman, liberator401@cox.net for more information.

Please add information on events I missed in the comments.

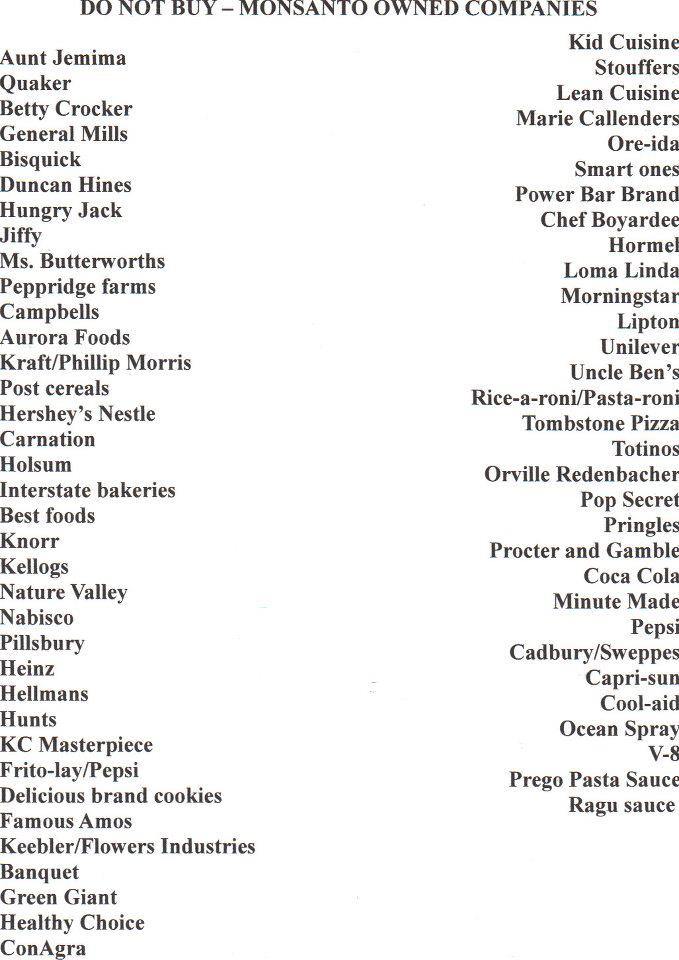

]]>This extensive list was included in a blast-email today from Marina Peterson of the East Bay Patriots. In the same breath where she urges consumers to organize against Monsanto to “put them out of business or at least try,” she announces the upcoming meeting on “Agenda 21.”

Some background on Agenda 21 from this article on Tennessee tea party groups:

Chattanooga has a direct connection with Agenda 21. Dave Crockett, director of the city’s Office of Sustainability, said Friday he attended the 1992 U.N. meeting in Rio De Janeiro as a local businessman. He said the idea of Agenda 21 was simply a way for governments to look at how they could do things better and think of how things could be “greener” in the process.

Examples include putting energy-efficient light bulbs in street lamps, trying to promote consuming food grown within 100 miles and also community issues such as crime or poverty, Crockett said.

Agenda 21’s goal is to get measurable goals to make human life better.

Go figure.

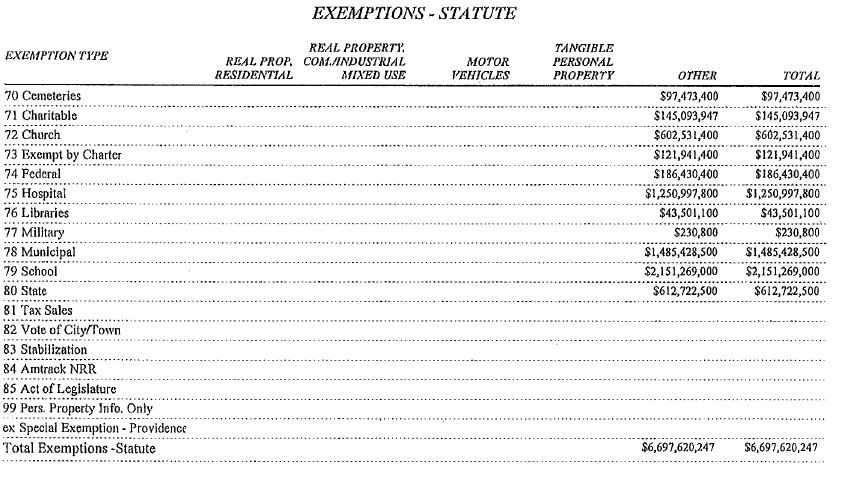

]]>We’re all pretty familiar by now with the gist of this table, even if the numbers are dizzying:

Between the variations of public property, the “meds and eds,” and other tax-exempt properties, Providence is not collecting property taxes on $6.7 billion of assessed value [cue any criticisms you may have about the assessment process]. All this is determined by statute.

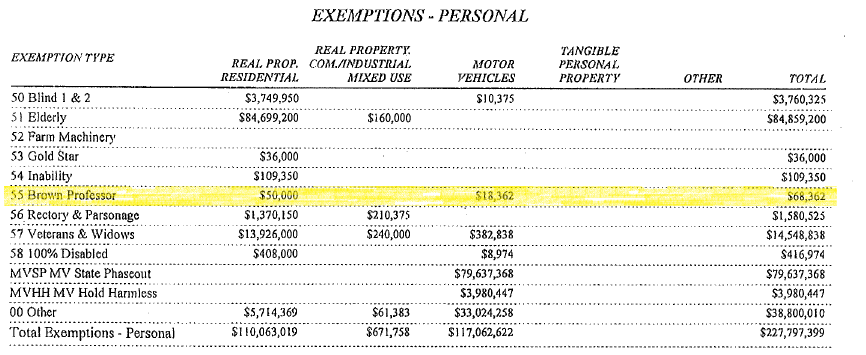

But just up the page are the tax exemptions determined by personal qualities, such as being a veteran, a widow, blind, or “Brown Professor.” I can only assume the latter refers to individuals who are employed at Brown University as professors and are then eligible for exemptions on the taxes on both their real property and their motor vehicles.

The total assessed value that comes out of this is only $68,362, which means its impact on the city budget is no more than $3,000. But still, what is going on with this exemption? Does anyone know the back story?

Before leadership of RI’s legislative and executive branches jumped on board, there were the hardworking activists of Democracy Matters and Common Cause of Rhode Island working all fall to put together this legislation, designed to pull best practices from other states who have introduced similar reforms. Congratulations on putting everything in place for an exciting announcement tomorrow!

Before leadership of RI’s legislative and executive branches jumped on board, there were the hardworking activists of Democracy Matters and Common Cause of Rhode Island working all fall to put together this legislation, designed to pull best practices from other states who have introduced similar reforms. Congratulations on putting everything in place for an exciting announcement tomorrow!

(The photo is the old guard of Democracy Matters, a group of us at the State House in early 2006 introducing that year’s Clean Elections bill)

IRS Commissioner Doug Shulman advises, “Scam artists will tempt people in-person, on-line and by e-mail with misleading promises about lost refunds and free money. Don’t be fooled.”

The following is the Dirty Dozen tax scams for 2012:

1. Identity Theft

2. Phishing

3. Return Preparer Fraud

4. Hiding Income Offshore

5. “Free Money” from the IRS & Tax Scams Involving Social Security

6. False, or Inflated Income or Expenses

7. False Form 1099 Refund Claims

8. Frivolous Arguments

9. Falsely Claiming Zero Wages

10. Abuse of Charitable Organizations and Deductions

11. Disguised Corporate Ownership

12. Misuse of Trusts

1. Identity Theft

Topping this year’s list Dirty Dozen list is identity theft. In response to growing identity theft concerns, the IRS has embarked on a comprehensive strategy that is focused on preventing, detecting and resolving identity theft cases as soon as possible. In addition to the law-enforcement crackdown, the IRS has stepped up its internal reviews to spot false tax returns before tax refunds are issued as well as working to help victims of the identity theft refund schemes.

Identity theft cases are among the most complex ones the IRS handles, but the agency is committed to working with taxpayers who have become victims of identity theft.

The IRS is increasingly seeing identity thieves looking for ways to use a legitimate taxpayer’s identity and personal information to file a tax return and claim a fraudulent refund.

An IRS notice informing a taxpayer that more than one return was filed in the taxpayer’s name or that the taxpayer received wages from an unknown employer may be the first tip off the individual receives that he or she has been victimized.

The IRS has a robust screening process with measures in place to stop fraudulent returns. While the IRS is continuing to address tax-related identity theft aggressively, the agency is also seeing an increase in identity crimes, including more complex schemes. In 2011, the IRS protected more than $1.4 billion of taxpayer funds from getting into the wrong hands due to identity theft.

In January, the IRS announced the results of a massive, national sweep cracking down on suspected identity theft perpetrators as part of a stepped-up effort against refund fraud and identity theft. Working with the Justice Department’s Tax Division and local U.S. Attorneys’ offices, the nationwide effort targeted 105 people in 23 states.

Anyone who believes his or her personal information has been stolen and used for tax purposes should immediately contact the IRS Identity Protection Specialized Unit. For more information, visit the special identity theft page at www.IRS.gov/identitytheft.

2. Phishing

Phishing is a scam typically carried out with the help of unsolicited email or a fake website that poses as a legitimate site to lure in potential victims and prompt them to provide valuable personal and financial information. Armed with this information, a criminal can commit identity theft or financial theft.

If you receive an unsolicited email that appears to be from either the IRS or an organization closely linked to the IRS, such as the Electronic Federal Tax Payment System (EFTPS), report it by sending it to phishing@irs.gov.

It is important to keep in mind the IRS does not initiate contact with taxpayers by email to request personal or financial information. This includes any type of electronic communication, such as text messages and social media channels. The IRS has information that can help you protect yourself from email scams.

3. Return Preparer Fraud

About 60 percent of taxpayers will use tax professionals this year to prepare and file their tax returns. Most return preparers provide honest service to their clients. But as in any other business, there are also some who prey on unsuspecting taxpayers.

Questionable return preparers have been known to skim off their clients’ refunds, charge inflated fees for return preparation services and attract new clients by promising guaranteed or inflated refunds. Taxpayers should choose carefully when hiring a tax preparer. Federal courts have issued hundreds of injunctions ordering individuals to cease preparing returns, and the Department of Justice has pending complaints against many others.

In 2012, every paid preparer needs to have a Preparer Tax Identification Number (PTIN) and enter it on the returns he or she prepares.

Signals to watch for when you are dealing with an unscrupulous return preparer would include that they:

- Do not sign the return or place a Preparer Tax identification Number on it.

- Do not give you a copy of your tax return.

- Promise larger than normal tax refunds.

- Charge a percentage of the refund amount as preparation fee.

- Require you to split the refund to pay the preparation fee.

- Add forms to the return you have never filed before.

- Encourage you to place false information on your return, such as false income, expenses and/or credits.

For advice on how to find a competent tax professional, see Tips for Choosing a Tax Preparer.

4. Hiding Income Offshore

Over the years, numerous individuals have been identified as evading U.S. taxes by hiding income in offshore banks, brokerage accounts or nominee entities, using debit cards, credit cards or wire transfers to access the funds. Others have employed foreign trusts, employee-leasing schemes, private annuities or insurance plans for the same purpose.

The IRS uses information gained from its investigations to pursue taxpayers with undeclared accounts, as well as the banks and bankers suspected of helping clients hide their assets overseas. The IRS works closely with the Department of Justice to prosecute tax evasion cases.

While there are legitimate reasons for maintaining financial accounts abroad, there are reporting requirements that need to be fulfilled. U.S. taxpayers who maintain such accounts and who do not comply with reporting and disclosure requirements are breaking the law and risk significant penalties and fines, as well as the possibility of criminal prosecution.

Since 2009, 30,000 individuals have come forward voluntarily to disclose their foreign financial accounts, taking advantage of special opportunities to bring their money back into the U.S. tax system and resolve their tax obligations. And, with new foreign account reporting requirements being phased in over the next few years, hiding income offshore will become increasingly more difficult.

At the beginning of this year, the IRS reopened the Offshore Voluntary Disclosure Program (OVDP) following continued strong interest from taxpayers and tax practitioners after the closure of the 2011 and 2009 programs. The IRS continues working on a wide range of international tax issues and follows ongoing efforts with the Justice Department to pursue criminal prosecution of international tax evasion. This program will be open for an indefinite period until otherwise announced.

The IRS has collected $3.4 billion so far from people who participated in the 2009 offshore program, reflecting closures of about 95 percent of the cases from the 2009 program. On top of that, the IRS has collected an additional $1 billion from up front payments required under the 2011 program. That number will grow as the IRS processes the 2011 cases.

“Free Money” from the IRS & Tax Scams Involving Social Security

Flyers and advertisements for free money from the IRS, suggesting that the taxpayer can file a tax return with little or no documentation, have been appearing in community churches around the country. These schemes are also often spread by word of mouth as unsuspecting and well-intentioned people tell their friends and relatives.

Scammers prey on low income individuals and the elderly. They build false hopes and charge people good money for bad advice. In the end, the victims discover their claims are rejected. Meanwhile, the promoters are long gone. The IRS warns all taxpayers to remain vigilant.

There are a number of tax scams involving Social Security. For example, scammers have been known to lure the unsuspecting with promises of non-existent Social Security refunds or rebates. In another situation, a taxpayer may really be due a credit or refund but uses inflated information to complete the return.

Beware. Intentional mistakes of this kind can result in a $5,000 penalty.

6. False/Inflated Income and Expenses

Including income that was never earned, either as wages or as self-employment income in order to maximize refundable credits, is another popular scam. Claiming income you did not earn or expenses you did not pay in order to secure larger refundable credits such as the Earned Income Tax Credit could have serious repercussions. This could result in repaying the erroneous refunds, including interest and penalties, and in some cases, even prosecution.

Additionally, some taxpayers are filing excessive claims for the fuel tax credit. Farmers and other taxpayers who use fuel for off-highway business purposes may be eligible for the fuel tax credit. But other individuals have claimed the tax credit when their occupations or income levels make the claims unreasonable. Fraud involving the fuel tax credit is considered a frivolous tax claim and can result in a penalty of $5,000.

7. False Form 1099 Refund Claims

In this ongoing scam, the perpetrator files a fake information return, such as a Form 1099 Original Issue Discount (OID), to justify a false refund claim on a corresponding tax return. In some cases, individuals have made refund claims based on the bogus theory that the federal government maintains secret accounts for U.S. citizens and that taxpayers can gain access to the accounts by issuing 1099-OID forms to the IRS.

Don’t fall prey to people who encourage you to claim deductions or credits to which you are not entitled or willingly allow others to use your information to file false returns. If you are a party to such schemes, you could be liable for financial penalties or even face criminal prosecution.

8. Frivolous Arguments

Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims to avoid paying the taxes they owe. The IRS has a list of frivolous tax arguments that taxpayers should avoid. These arguments are false and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to disobey the law.

9. Falsely Claiming Zero Wages

Filing a phony information return is an illegal way to lower the amount of taxes an individual owes. Typically, a Form 4852 (Substitute Form W-2) or a “corrected” Form 1099 is used as a way to improperly reduce taxable income to zero. The taxpayer may also submit a statement rebutting wages and taxes reported by a payer to the IRS.

Sometimes, fraudsters even include an explanation on their Form 4852 that cites statutory language on the definition of wages or may include some reference to a paying company that refuses to issue a corrected Form W-2 for fear of IRS retaliation. Taxpayers should resist any temptation to participate in any variations of this scheme. Filing this type of return may result in a $5,000 penalty.

10. Abuse of Charitable Organizations and Deductions

IRS examiners continue to uncover the intentional abuse of 501(c)(3) organizations, including arrangements that improperly shield income or assets from taxation and attempts by donors to maintain control over donated assets or the income from donated property. The IRS is investigating schemes that involve the donation of non-cash assets –– including situations in which several organizations claim the full value of the same non-cash contribution. Often these donations are highly overvalued or the organization receiving the donation promises that the donor can repurchase the items later at a price set by the donor. The Pension Protection Act of 2006 imposed increased penalties for inaccurate appraisals and set new standards for qualified appraisals.

11. Disguised Corporate Ownership

Third parties are improperly used to request employer identification numbers and form corporations that obscure the true ownership of the business.

These entities can be used to underreport income, claim fictitious deductions, avoid filing tax returns, participate in listed transactions and facilitate money laundering, and financial crimes. The IRS is working with state authorities to identify these entities and bring the owners into compliance with the law.

12. Misuse of Trusts

For years, unscrupulous promoters have urged taxpayers to transfer assets into trusts. While there are legitimate uses of trusts in tax and estate planning, some highly questionable transactions promise reduction of income subject to tax, deductions for personal expenses and reduced estate or gift taxes. Such trusts rarely deliver the tax benefits promised and are used primarily as a means of avoiding income tax liability and hiding assets from creditors, including the IRS.

IRS personnel have seen an increase in the improper use of private annuity trusts and foreign trusts to shift income and deduct personal expenses. As with other arrangements, taxpayers should seek the advice of a trusted professional before entering a trust arrangement.

]]>

At the February 2nd meeting of the Providence City Council, Council President Michael Solomon (Ward Five) announced the creation of a new Women and Healthy Communities subcommittee of the Committee on Ordinances. Councilmembers Sabina Matos (Ward Fifteen), Carmen Castillo (Ward 9), David Salvatore (Ward 14), Seth Yurdin (Ward 1), and Samuel Zurier (Ward 2) were named as members of the subcommittee.

“The subcommittee on Women and Healthy Communities will take on issues affecting youth, families, seniors, and new residents, with a special focus on women and girls,” said Councilwoman Matos. “This is a fantastic opportunity to focus our attention on concerns that, all too often, are over-looked.”

The Council President explained that Providence was following the successful model of the Boston City Council, which established a similar committee in 2009. “I’m very proud that the Council has decided to create this subcommittee, which will serve as a new venue for discussions of how to best combat poverty, prevent violence, and stabilize our families and communities,” said Solomon.

The subcommittee will hold its organizational meeting in the coming weeks to elect a chairperson and vice-chairperson, and discuss upcoming agenda items.

GoLocalProv had this scoop!

]]>