For the eighth year the Rhode Island Interfaith Coalition to Reduce Poverty held a vigil at the State House near the beginning of the legislative season to, in the words of House Speaker Nicholas Mattiello, “remind all of us in the General Assembly of how important it is to keep the issues related to poverty at the forefront of our agenda.”

The vigil was attended by representatives from a multitude of faiths. Governor Gina Raimondo, Speaker Mattiello and Senate President M Teresa Paiva-Weed all spoke briefly to the crowd. The keynote was delivered by Bishop Herson Gonzalez of the Calvary Worship Center in Woonsocket.

Maxine Richman, co-chair of the RI Interfaith Coalition to Reduce Poverty (Coalition) spoke first, outlining the 2016 Advocacy Platform for the group. She began with a sobering statistic. 14.3 percent of Rhode Islanders live in poverty. That rate climbs to 19.8 percent when we talk about children specifically.

“A 14.3 percent poverty rate is the story for this year,” said Richman, “but it need not be the story for next year.”

“A 14.3 percent poverty rate is the story for this year,” said Richman, “but it need not be the story for next year.”

The coalition believes that all Rhode Islanders are entitled to affordable housing, nutritious food, accessible healthcare, equitable education and work with decent wages.

Though the General Assembly raised the Earned Income Tax Credit (EITC) last session, something both Paiva-Weed and Mattiello touted as a great success in their opening remarks Tuesday, RI’s present 12.5 percent rate is a far cry from Connecticut’s EITC of 27.5 percent or Massachusetts’ 23 percent. The Coalition is asking the General Assembly raise the RI EITC to 20 percent.

Channeling yesterday’s loud rally, and on the day that Governor Raimondo has officially broken her campaign promise to issue an executive order allowing undocumented workers to obtain driver’s licenses, the Coalition asked state leaders to take this important step.

Right now low and no income Rhode Island families with children are eligible to receive cash assistance for a maximum of up to 24 months within a five year window. A mother with two children is eligible to receive $554 a month for up to 24 months. When the 24 months are done, the family is cut off, leaving children to live in crushing poverty. The coalition would like to end the 24 month limit.

Also, as they have asked nearly every year and to no avail, the Coalition would like the General Assembly to take action to reform PayDay loans. This is unlikely as long as Speaker Mattiello continues to pretend that “arguments against PayDay lending tend to be ideological in nature.”

Also, as they have asked nearly every year and to no avail, the Coalition would like the General Assembly to take action to reform PayDay loans. This is unlikely as long as Speaker Mattiello continues to pretend that “arguments against PayDay lending tend to be ideological in nature.”

The coalition would also like to see an expansion of Child Care Assistance and Early Childhood Education. as of Fall, 2014, for instance, only 34 percent of eligible children were enrolled in Head Start, “with many centers maintaining long waiting lists.”

The Coalition further wants to reduce out-of-school detentions which predominantly target students of color and feed the school-to-prison pipeline. They would also like to expand opportunities for workforce foundational skills and occupational training.

The RI Coalition for the Homeless (RICH) needs adequate funding to implement Opening Doors RI, and would like state leaders to seek a $100 million affordable housing bond.

The Coalition also backs efforts to prevent domestic abusers from accessing guns, a bill that died in committee last year to the consternation of supporters and the embarrassment of the General Assembly.

The Coalition would like to see adequate funding for Senior Centers and lastly, the Coalition wants the General Assembly to maintain the current RIPTA Senior/Disbabled Fare Program, recognizing that balancing the budget of public transit of the backs of the most vulnerable is simply cruel. Paiva-Weed was the only state leader to state that she would work to make this happen. Raimondo vowed to make RIPTA “affordable” which is apparently a number other than free.

“These all sound good, but where do we find the money?” asked Raimondo.

“I am very concerned about imposing a fee on elderly and disabled RIPTA passengers,” said Paiva-Weed, “and I am committed to looking at alternative funding.”

Attempting to explain his statement at last years Interfaith Poverty Vigil where he said that he wants to eliminate the social safety net, Speaker Mattiello spun a vision of a Utopian future world. “When we get the economy to a point where everybody’s thriving,” said the Speaker, “every single family has a wage earner that is successfully feeding the family, and everybody is doing well and is well fed… families are happy… that will be the day we don’t need a safety net. And at that time our safety net will justifiably be smaller.”

Here’s Bishop Herson Gonzalez’s keynote address.

Note: I was fortunate today to get permission from Rachel Simon to run her pictures of the event. So all these pictures are under her 2016 copyright.

And here’s the full vigil.

]]> As of January 1, the Rhode Island minimum wage will be raised to $9.60. Although a good step towards financial equality, it cannot compensate for the nation’s polarizing wealth divide. We need banks to do that.

As of January 1, the Rhode Island minimum wage will be raised to $9.60. Although a good step towards financial equality, it cannot compensate for the nation’s polarizing wealth divide. We need banks to do that.

In 2013, 63 million Americans spent a combined $455 billion nationwide on alternative financial services, as reported by the Federal Deposit Insurance Company. This includes scams such as payday loans, pawnshops, and check-cashing services. Pay day loans offer immediate loans with steep interest and short payback, pawn shops take expensive collateral with hefty fees for small cash loans, and check-cashing services charge significant flat-rates, often around $40 per paycheck. United For A Fair Economy believes alternative financial services outnumber McDonald’s and Starbucks franchises combined in America today. Alternative financial services set up in areas they believe densely impoverished to prey on the financially disadvantaged. Institutionally, they operate to widen the wealth gap.

In his 2014 campaign, Rhode Island General Treasurer Seth Magaziner highlighted that one in four Rhode Islanders are underbanked. In Magaziner’s words, underbanked citizens “don’t have a bank account at all, or they have a bank account and they’re still relying on high-cost financial services like payday loans, pawn shop check cashing and so on.” Of the 63 million consumers that are underbanked in America, 24 million of them have no bank account at all. The families with limited bank account usage spend an average of $3,000 a year working while the average underbanked family spends $43,000 in their careers on check-cashing services. For these 63 million underbanked Americans, the vision of banks is a dark one. Among the most common reasons for using alternative financial services instead of banks, the top responses were “lack of money”, “I don’t like dealing with or trust banks”, “inconvenient hours or location.” These responses show a fundamental misunderstanding of the comparably greater convenience, affordability, and security of banks.

Communicating this is one of the smaller barriers banks have traditionally held, like extensive documentation, high minimums and maintenance fees, and new account screenings. Others responded “account fees are too high or unpredictable.” Many of these individuals live paycheck to paycheck and do not earn enough to meet minimum balance or direct deposit requirements for free checking. What should they do?

Put money in the bank. Bank accounts provide the financial security needed to build wealth. While accumulating interest, your money is protected from fires, burglary, misplacement, or other damage. With a bank account you build a credit history, critical for loans for cars, for home mortgage, and for higher education. And bank accounts are cheaper and more convenient than alternative financial services, from free bill pay, to free check cashing, to free ATM withdrawal.

As of 2015, nine banks or credit unions in Rhode Island have little to no minimum balance requirement nor require direct deposit for free checking. Many have no minimum balance and free checking. Almost all have free online statements, credit building opportunities, mobile banking, and free ATM access. Looking to the future, financial literacy is on the rise in Rhode Island’s schools, and a new state backed program College Bound incentivizes saving for the higher education of Rhode Island’s next generation.

Banks still need lower entry barriers for Rhode Islander’s looking to open checking accounts. New account screenings must offer forgiveness for previous debts. With financial guidance banks could aid in paying off the prior institution to which their new customer is indebted. It is equally as crucial that banks and credit unions offer an entry-level checking account with no minimal fees and balances.

Some banks would object to the operating cost they incur for maintaining an account with little immediate return. These banks need to look forward. The short term loss in revenue will be returned manifold as Rhode Island’s poor accumulate the wealth they then reinvest in said bank. Banks understand the delayed but greater return of a bond. Banks need to bond with Rhode Island’s consumer, for delayed but greater returns for both.

America today resembles a plutocracy. The assets of the top 1 percent is now approaching 45 percent of the nation’s wealth, having steadily risen toward levels unseen since the Great Depression. The wealth of the bottom 90 percent continues to hover between 10-20 percent of the nation’s wealth for the last century. The stagnant trend makes clear that growth in national income has not yielded a more equitable distribution of wealth.

Expert on urban and racial inequality and poverty, Melvin Oliver says, “Income feeds your stomach, but assets feed your head.” Many Rhode Island stomachs will be fuller by sixty cents an hour come January 1st. But will their heads will still be hungry? Wealth breaks the cycle of living day to day. Alternative financial services drain wealth while banks can nurture it. Rhode Island and Rhode Island’s banks: stop living day to day on pennies, and bond.

]]>

If you want to know why all the pro-payday loan industry advocacy has been done in backrooms of the State House by high-priced speaker-turned-lobbyist Bill Murphy and out-of-state special interests, look no further than today’s Providence Journal editorial on the subject.

It’s evidence that a credible argument can’t be made for this predatory practice. There’s at least one error, manipulation of fact, insulting derogation or full-on lie in every paragraph but the last two!

Let’s go through them all, shall we…

With many Rhode Islanders struggling, and traditional banks unwilling to tide them over, it is clear there is a consumer need for what is known as payday loans.

It’s true there are many Rhode Islanders struggling, and it’s also (sort of) true that traditional banks don’t offer a similar product (Navigant Credit Union does, but many do not). But that in no way, shape or form means there is any kind of consumer need for a payday loan! This, of course, is just basic logical fallacy 101 stuff, but it’s important to note because there’s usually something fishy if someone needs to toss aside the laws of logic in order to sell their point.

Here’s what it looks like as an equation: A (people struggling) + B (banks not helping) =/= C (We need big corporations to loan fast cash to struggling poor people at astronomically high interest rates). Said another way, the existence of something does not mean there is a need for that thing. Or, I guess there is a need for teachers’ unions and master levers?

Neither government nor charities have stepped in at the level required to meet that need, and are not expected to do so.

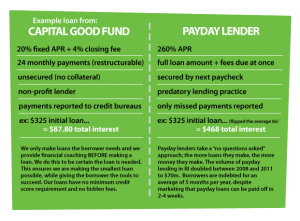

It’s insulting to suggest there are no other ideas or alternatives out there. The Capital Good Fund has received tons of attention for their alternative product to payday loans, as has Navigant Credit Union and the West Elmwood Housing Association. And as far as what the writer expects to happen … both Gina Raimondo, often hailed for her ability to get things done, and Seth Magaziner, have put forward ideas to rid Rhode Island of payday lenders. Magaziner was just this week given a true rating by Politifact in another part of the Providence Journal on one of his ideas for addressing payday loans. Here are more suggestions from the Pew Center.

Other forms of obtaining money to meet obligations — including turning to loan sharks — may be much worse for borrowers than payday loans.

That payday lenders are somehow protecting poor people from the “loan sharks” is one of the worst lies the payday lenders and their lobbyists spread. Here’s a good place to start for some scholarly research on the payday loans or else loan shark canard: LOAN SHARKS INTEREST-RATE CAPS AND DEREGULATION. And the Pew Center says 81 percent of people would just cut back on expenses.

Hence, it makes sense to have a regulated payday loan industry operating in Rhode Island.

Well, no. See logical fallacy 101.

In part because Rhode Island politicians have created one of the worst business climates in America, many people in the state are struggling, living on the edge. An occasional advance on a paycheck — while not cheap — can help them avoid even more costly financial losses, such as paying large penalties to restore electricity or heat.

Oh, come on! I’m half surprised the author didn’t blame the calamari bill for the payday lending! This is, of course, ridiculous pandering to hate radio-style talking points. How about we just make it against the law to cut of someone heat in the dead of winter?

Such are the decisions that people freely make, after weighing the consequences.

This isn’t so much untrue as it is just completely devoid of any understanding of poverty, and it really has no place in Rhode Island’s paper of record.

Much as we might wish our neighbors did not face such hard choices in life, our pretending their problems do not exist does not make them go away.

It’s true, ignoring a problem doesn’t make it go away. Neither does a payday loan though. Pew research shows 69 percent use payday loans for recurring expenses, and one in seven can’t afford the loan. If people can’t afford their bills at 0 percent interest, how does charging them 260 percent interest help?

Unfortunately, some activists would like to take away these choices by shutting the door on payday loans.

In addition to “some activists” there’s also 3/4 of all Rhode Islanders, according to a 2012 Public Policy Polling survey, all Democrats running for governor and most members of the General Assembly. Eliminating payday lending is the one thing Angel Taveras and Gina Raimondo have ever agreed on, and the Providence Journal editorial page pretends as if it’s just “some activists.” That’s wrong.

One proposal, to arbitrarily cap annual interest rates for short-term loans at 36 percent, would have that effect.

Actually, 36 percent is not an arbitrary number. It’s the state law for maximum usury rate for every other kind of loan in Rhode Island except payday loans. Payday loans, as a matter of fact, were given an arbitrary carve out of the state’ usury laws in 2001.

Lenders say they would have to pull out of Rhode Island, as they could not turn a profit at that rate, given their costs of doing business with high-risk borrowers.

Who knows if this is true or not (let’s hope it is, though!) but what we do know is the Providence Journal editorial board and other corporate apologists will claim anyone and everyone is leaving Rhode Island if it means hey can advocate for more conservative policy.

Most people using the service take out a loan for only a short period and pay it back, with 10 percent interest.

Most people who take out a payday loan end up taking a subsequent payday loan to pay for the prior one. So, yes, they are paid most often paid back, but they are most often paid back with a new payday loan.

Spread over a year, the interest rate looks like a staggering 260 percent, but that is not how people actually use payday loans.

Yes it is, here’s the data. Most payday loan customers take out 8 loans a year and 63 percent use them 12 times a year.

The General Assembly has done the right thing in refraining from legislating such loans out of existence. Such a political attempt to dictate the marketplace, while pleasing to activists, would only hurt people in need. Rather, the state should permit this industry, which does create jobs and tax revenues, to function under a regulated structure.

Again, the General Assembly actually legislated them into existence, thus creating a market for them.

Regulations should be based around some key goals: protecting access to short-term loans by those who may occasionally desperately need them; shielding consumers from unscrupulous or unregistered operators; fostering a competitive marketplace to give borrowers greater choices, something that would tend to lower rates.

If the goal is to limit the need for payday loans, rather than merely their availability, the best thing the General Assembly could do is create a climate much less hostile to business, with better-paying jobs and greater opportunity.

These are the only factually correct and/or intellectually honest statements in the entire piece. At least, I guess, it went out on a high note…

]]>Thursday Dec 5, 2013

North Kingstown, RI – Good morning, Ocean State. This is Bob Plain, editor and publisher of the RI Future blog podcasting to you from The Hideaway on the banks of the Mattatuxet River behind the Shady Lea Mill in North Kingstown, Rhode Island.

It’s Wednesday, December 5th … and all across the country today fast food employees will be walking off the job. Here in Rhode Island, Warwick Wendy’s employees who protested outside their workplace in November plan to walk out of work at noon, organizers tell me. RI Future will be there capturing video of the action….

It’s Wednesday, December 5th … and all across the country today fast food employees will be walking off the job. Here in Rhode Island, Warwick Wendy’s employees who protested outside their workplace in November plan to walk out of work at noon, organizers tell me. RI Future will be there capturing video of the action….

The emerging nation-wide movement of fast food workers is seeking $15 an hour … an average 67 percent in pay, according to the New York Times.

The Providence Journal is for sale! And according to publisher Howard Sutton that news “…opens a new chapter in the history of our news organization.” Indeed, all of Rhode Island.

In a post on this blog last night, Sam Howard suggested the people of Rhode Island should buy the ProJo. This is actually really really doable. The paper is expected the fetch somewhere between 10 and 50 million … or, 25 million less than we gave a baseball player to make a video game. I’m not suggesting the state buy the paper, but rather that numbers aren’t an unheard of investment in these parts. I bet both Linc Chafee and Ken Block gave serious consideration to making a play for our paper of record last night …. much more on this idea to come…

More positive economic development news: the Newport Jazz Festival is adding a third day to feature less-well-known musicians. The Rhode Island Foundation is helping to fund the Friday performances and Executive Director Neil Steinberg, said, “we’re leveraging a treasure.” ….Same could be said of big old grant from the Foundation to buy the ProJo…

In a victory over NIMBYism, Rhode Island approved a transmission line from the Block Island wind farm to meet the mainland near Scarborough Beach. Some neighbors and tea party-types were fighting against the transmission line….

And according to a new poll, 46 percent of respondents said the plastic bag ban in Barrington encouraged them to use reusable bags, 56 percent said they support the new rule and half of respondents said they support a state-wide ban … meanwhile 28 percent said they shop less in Barrington because of the lack of plastic bags …. I would love to interview the Barrington resident who is driving to Warren or Portsmouth for groceries because they need their plastic bags!

A Westerly zoning board member resigned over the COPAR quarry fiasco yesterday saying lawyers for both sides have caused unnecessary delays. According to the Westerly Sun, he said, “Neither I, nor the other members of the Zoning Board, are the reason that this appeal has repeatedly been continued and not heard. It has apparently been determined by attorneys on both sides of the appeal that there has been a mutual benefit to the continuances.”

A pod of pilot whales has become stuck in the shallow flats of the Everglades in south Florida … several have died, and so-far the surviving some-odd 40 whales are still swimming, but they won’t leave the shallow water and scientists don’t understand why not…

NPR had a story on payday loans this morning and Morning Edition host David Greene called the interest rates “ridiculously high” …Ridiculously, that was adverb NPR, not RI Future, used, a news organization that is often ridiculously unbiased.

And the New York Times reports that the five major oil companies are prepared to build a carbon tax into their cost of doing business … this is noteworthy because Republicans have long claimed that industry would refuse to do so … so in this case, and maybe others, free enterprise is more amenable to paying for its consequences than the political party who defends them would have America believe … go figure…

]]>

It’s all well and good to know who the characters in the 2014 campaign for governor are, but we still need to know the major themes before we can know what the plot might look like.

It’s all well and good to know who the characters in the 2014 campaign for governor are, but we still need to know the major themes before we can know what the plot might look like.

Here’s a list of some of the public policies I hope get a good vetting during the next 12 months.

- Wall Street vs. Main Street: Hedge funds, the real estate bubble, municipal bankruptcies and retirement investments … they all speak to what role high finance should play in economic development. Good, bad or indifferent – and I think it is a very good thing – because someone from Head Start and someone from venture capital are running against each other in a Democratic primary, RI will get to see this popular talking point play out in the form of a political campaign.

- Tests vs. teachers: High stakes tests will and should be a part of this conversation, but the bigger issue is the achievement gap between affluent suburbs and impoverished urban areas. If NECAP scores demonstrate anything, they show that rich kids are getting a decent public education and poor kids, by and large, are not.

- Cuts vs. expenditures: Conservatives will claim we need the lowest tax rates in the region to improve our economy while it remains to be seen if progressives will campaign on making the rich and powerful pay their fair share. Note that these goals aren’t necessarily mutually exclusive of each other. RI could, for example, the lower the small business tax rate and eliminate corporate tax expenditures (read: giveaways). And here’s hoping Clay Pell runs on a “tax me” platform!

- Legal vs. criminal: There are a host of issues before the General Assembly that will likely spill over into the governor’s campaign because of their national implications – think voter ID and pot prohibition. Payday loans will be a particularly interesting one, as both Angel Taveras and Gina Raimondo have worked together on this issue.

What am I forgetting? Let us know in the comments what issues matter most to you this campaign season…

]]>

Payday Lending reform wound up in the laps of the Senate Committee on Commerce this week, and the hearing was pretty packed with what seemed like an even split of advocates for capping payday loan interest rates at 36 percent, and employees of Advance America, one of two payday lenders operating in Rhode Island.

You can watch the full committee meeting here.

Proponents of capping rates included representatives of the NAACP, AARP, The Capital Good Fund, the RI AFL-CIO, and the RI Council of Churches.

The parade of Advance America employees that testified against the reform relayed stories of their customers calling payday loans “freedom” and their employees “heroes.”

Leo Sullivan, an Advance America employee, testified in opposition to the reform. Citing unintended consequences of payday lending reform, he said, “If you choose to limit customers ability to use our services, there may be consequences for those customers beyond what is readily apparent,” but he did not specify what these consequences might be.

Jamie Fulmer of Advance America said new restrictions aren’t needed and, taking a page from the CVS playbook, may force his company to withdraw from Rhode Island.

Testimony from the lenders themselves indicated that there are no other options for those who need small loans or those who have bad credit ratings, but in Rhode Island, the Capital Good Fund offers small loans, free tax preparation, and financial coaching for their customers, none of which are offered by payday lenders; other local financial institutions like Navigant Credit Union are getting in on the small, short-term loan business.

Research by the Pew Foundation has shown that payday loans don’t perform as advertised.

Andy Posner, founder and director of the Capital Good Fund, said “Every day I see people who have gone through payday loans and regret it, or those who think they need them, who go through our financial coaching, and realize that they don’t.”

A big difference between payday lenders and loans from other financial institutions is this: payday lenders do not report to credit agencies, and therefore, do not help their customers build credit history, which would help to create a more stable financial future.

Margaux Morrisseau, co-director of the Rhode Island Coalition for Payday Lending Reform and Community Director for NeighborWorks- Blackstone Valley, said, “We started to see many of the residents of our affordable housing programs who took advantage of these payday loans fall behind on their approved budgets. People have come to our offices, in tears, after falling into the cycle of debt created by these loans.”

“Representatives from Advance America have testified that the average customer takes out eight loans a year,” said Shawn Selleck, a Providence resident that has previously worked in the microfinance sector, “that should be indication enough that these customers need financial coaching, and this is not a service provided by Advance America or Check ‘n’ Go.” He added that it was also telling that not one direct beneficiary of payday loans had testified before the senate committee.

Mike Mancino, of the RI AFL-CIO, testified by saying, “I will avoid using poll data, charts, and graphs in my testimony and simply ask this: What do your conscience and heart tell you?”

]]>

Rev. Don Anderson, president of the Rhode Island Council of Churches, says there are religious reasons for supporting payday loan reform.

“In every religious tradition, the concept of usury is addressed,” Anderson said, at an State House event last week to call attention to payday loan reform.

[vsw id=”vFkKA30fHYM” source=”youtube” width=”525″ height=”344″ autoplay=”no”]

Anderson, who is also an important advocate for tax equity legislation, added, “Concern for the poor transcends all faiths.”

The Bible has many – or unethically high interest rates. But one not need to read scripture to understand why payday loan shops like Advance America are preying on the poor.

Annual interest rates can be as high as 260 percent, and customers are sometimes cajoled into thinking it will be easier to pay back than is realistic. Rhode Island is the only state in New England to allow predatory payday loans.

A recent Pew report concluded that payday loans “fail to work as advertised” and most people who use them have other options that they often use to get themselves out of the payday loan debt spiral.

]]>

Activists, citizens, legislators, the General Treasurer and three Republican mayors gathered at the State House to voice their opposition to the usurious payday loan schemes practiced by companies like Advance America, and Check ‘n’ Go. These businesses overwhelmingly serve the poorest Rhode Islanders, and have a tendency to put those who partake of their services in a spiral of debt through annual interest rates of 260 percent.

Activists, citizens, legislators, the General Treasurer and three Republican mayors gathered at the State House to voice their opposition to the usurious payday loan schemes practiced by companies like Advance America, and Check ‘n’ Go. These businesses overwhelmingly serve the poorest Rhode Islanders, and have a tendency to put those who partake of their services in a spiral of debt through annual interest rates of 260 percent.

The RI Payday Lending Reform Coalition includes groups that span age, color, creed, and socioeconomic brackets like AARP, The RI State Council of Churches, the RI Latino PAC, the NAACP and CommunityWorks RI.

The reform legislation would cap APR at 36 percent. Some activists think this is the year it will pass, but not until a compromise APR rate is reached somewhere between 260 percent and 36 percent.

Rhode Island is the only New England state that allows payday lenders, and Congress passed a law recently making it illegal to locate them near military bases. A recent Pew report said most of people who take out payday loans had another, more reasonable, avenue to obtain short-term financing.

“Payday loans are marketed as an appealing short-term option, but that does not reflect reality. Paying them off in just two weeks is unaffordable for most borrowers, who become indebted long-term,” said Nick Bourke, Pew’s expert on small-dollar loans. “The loans initially provide relief, but they become a hardship. By a three-to-one margin, borrowers want more regulation of these products.”

The press conference featured bill sponsors Rep. Frank Ferri and Sen. Juan Pichardo, along with Mayors Avedesian, Fung, Diossa, and Fontaine of Warwick, Cranston, Central Falls, and Woonsocket, respectively.

[vsw id=”CMZJNR5lvHE” source=”youtube” width=”525″ height=”344″ autoplay=”no”]

“In poverty, there is money to be made,” said Sen. Pichardo, “These most vulnerable communities have historically been targeted for products, financial and otherwise, that are not in the community’s best interest.”

Pichardo said his mission is to protect low-income and minority populations by providing them with the right information to ensure their long-term financial health.

When asked if there was any data suggesting that folks who are receiving federal and state aid are also relying on payday lending to make ends meet, Margaux Morrisseau, Co-director of Rhode Islanders for Payday Lending Reform said, “It’s difficult to determine exactly who is taking out these loans. The Department of Business Regulation captures a very narrow band of data on these lenders. There is very little sharing of information between departments. What we do know is that many of the people who have fallen into the Payday Lending debt trap are frequenting food pantries to feed their families.”

[vsw id=”_FNpAf6LRPY” source=”youtube” width=”525″ height=”344″ autoplay=”no”]

]]>

“Payday loans fail to work as advertised,” concludes a new report from the Pew Charitable Trust.

“Payday loans fail to work as advertised,” concludes a new report from the Pew Charitable Trust.

The predatory practice of payday lending has been a highly charged issue for several legislative sessions. Standing in the way of reform is House Speaker Gordon Fox’s loyalty to former speaker Bill Murphy, who has been hired as an industry lobbyist to make the exact kinds of claims that the Pew report rejects.

Reform is important to progressives because the loans take advantage of impoverished, desperate people who mistakenly think a payday loan can help their situation. The new report shows they don’t.

“Many of these borrowers ultimately turn to the same options they could have used instead of payday loans to finally pay off the loans, including getting help from friends or family, selling or pawning personal possessions, or taking out another type of loan,” according to an overview of the new report. “Seventy-eight percent of borrowers rely on lenders for accurate information, but the stated price tag for an average $375, two-week loan bears little resemblance to the actual cost of more than $500 over the five months of debt that the average user experiences.”

Fox has said he is skeptical of reform because there are no other alternatives to payday loans. In fact, there are three “short term, small dollar” loans available in Rhode Island that have vastly lower interest rates than payday loans.

The Providence Journal had an excellent story on payday loan reform in which Fox was quoted as being open to compromise. My question would be: if his reasons for supporting the practice aren’t legitimate (as evidenced by the previous paragraph) why is a compromise the appropriate fix?

]]>

It’s simply not true that payday loans are the only option to low wage borrowers as House Speaker Gordon Fox suggested to RIPR this morning.

“I don’t like predatory lending practices,” Fox told RIPR, “but I also understand for folks that have nowhere else to go, it might be a valid tool for them to go to and not be driven to more onerous kinds of lending, including Internet lending, at higher interest rates, if you could imagine such a thing, or backroom lending, which is even worse.”

In fact, there are three alternatives in the local lending market: the Capital Good Fund and the West Elmwood Housing Development Corporation, both in Providence, as well as Navigant Credit Union, which has 13 locations in the state including branches in Central Falls, Pawtucket and Woonsocket.

Additionally, according to a Pew Center report on payday loans from July, “In states that enact strong legal protections … borrowers are not driven to seek payday loans online or from other sources.”

Reform advocates testified about alternatives last session at the State House and RI Future reported on them then. Additionally, Margaux Morisseau, of the Coalition for Payday Lending Reform, said her group has presented the data to Fox.

“We’ve given him the information,” she said. “We need him to read the information.”

Gina Raimondo, a proponent of payday lending reform, mentioned these alternatives in a Providence Journal op/ed in May.

Fred Reinhardt, chief lending officer at Navigant Credit Union, said they offer a “short term, small dollar” loan that allows credit union members to borrow between $200 and $600 for up to 90 days at 18 APR. Payday loans can carry interest as high as 260 percent annually.

“We designed this product primarily specifically so people can refinance existing payday loans,” Reinhardt said.

He said they just started offering the loan in April and since then “most of them have been repaid on time,” he said.

Borrowers must be credit union members for 30 days before taking advantage of the loan, he said, but he noted that branch managers have told him that several people have opened accounts in order to apply for the loan.

The Capital Good Fund loan does not require a waiting period and loans up to $2,000 and 20 APR, according to Andy Posner of CGF. The average interest in a $325 loan from CGF is $87.80 compared with $468 from a payday lender.

The West Elmwood Housing Development Corporation loans up to $1,500 at 18 to 25 APR, Morisseau said.

According to the Pew report, “Most borrowers use payday loans to cover ordinary living expenses over the course of months, not unexpected emergencies over the course of weeks.”

Rhode Island is the only New England state that still allows predatory payday lending. Currently they are exempt from usury laws and charge interest up to 260 percent a year. Reform legislation last session introduced by Rep. Frank Ferri and Sen. Juan Picahrdo would cap them at 36 percent.

]]>