Rhode Island’s cultural diversity is one of our great assets, but our communities often experience different opportunities to engage and enjoy. If we want our state to be more equitable, we require courageous leadership and intentional investments in racial and economic equity and access.

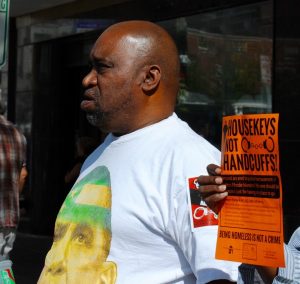

As organizations committed to racial justice, we feel the issue of race has been missing from the discussion about Kennedy Plaza. We all want to see vibrant community commons that support our economic and community development. But we recognize that strategies like increased policing will continue to disadvantage the poor, especially people of color, and siphon dollars away from social safety net programs that uplift those most marginalized.

New England communities were built with public “commons,” but despite their name these public spaces have always excluded the most disenfranchised: the indigenous people whose land was stolen, the enslaved Africans who quite literally built our communities, and those who did not fit society’s image of proper decorum. This continues today, with increase policing and criminalization of black and brown bodies, those exhibiting impact of addiction or mental illness, and the poor and homeless.

New England communities were built with public “commons,” but despite their name these public spaces have always excluded the most disenfranchised: the indigenous people whose land was stolen, the enslaved Africans who quite literally built our communities, and those who did not fit society’s image of proper decorum. This continues today, with increase policing and criminalization of black and brown bodies, those exhibiting impact of addiction or mental illness, and the poor and homeless.

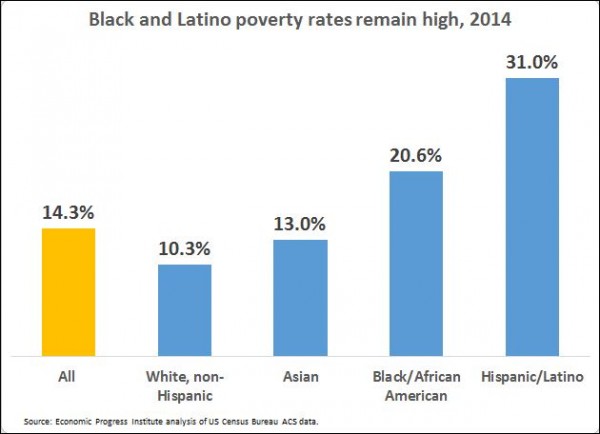

As our allies who are advocating for the homeless pointed out in their excellent “Reclaiming our Public Spaces” report, we cannot simply sweep away the poverty that many don’t want to see. Poverty and homelessness have disproportionate impact on communities of color, in large part because of public policies that exclude particular racial and ethnic groups from the supports that help build wealth and economic stability. Public policies fit together like bricks to shape our society, and our vision for racial justice requires some shifts in thinking. More people with criminal records, out of our workforce and warehoused at public cost, doesn’t help us build the society we envision.

Rather than seeking to invest our resources in short-sighted efforts to remove people we have deemed “undesirable,” let’s make real investments in the type of community supports and assets that eliminate the need for panhandling, support mental health and addiction recovery, and provide living wage jobs for everyone, including those with criminal records. Let’s engage our business community support in increased wages, publicly funded detox and recovery support, development of affordable housing, and compliance with First Source and Ban the Box laws. Let’s provide meaningful, well-paying work opportunities for adults with moderate education, and support public access to skilled training and higher education for our youth. Let’s recognize that amenities like public restrooms, drinking fountains, increased seating, and charging stations will support many types of users. And let’s bring love and compassion to the struggle of all those in our community, even those whose circumstances or behavior might make us uncomfortable.

Mike Araujo, Executive Director, Rhode Island Jobs with Justice

James Vincent, President, NAACP Providence Branch

Chanda Womack, President, Board of Directors, Cambodian Society of Rhode Island

On behalf of the Racial Justice Coalition.

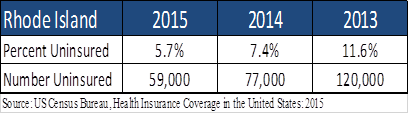

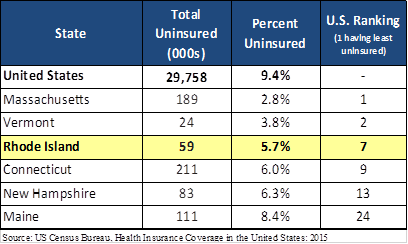

New Census data show that the percentage of uninsured Rhode Islanders was 5.7 percent in 2015, half the rate it was in 2013, the year before the Affordable Care Act (ACA) went into effect. In 2014, 7.4 percent were uninsured.

New Census data show that the percentage of uninsured Rhode Islanders was 5.7 percent in 2015, half the rate it was in 2013, the year before the Affordable Care Act (ACA) went into effect. In 2014, 7.4 percent were uninsured. “Rhode Islanders should be proud that we are 7th in the nation for the percent of residents who have health insurance coverage”, said Linda Katz, Policy Director at the Economic Progress Institute. “With health insurance, people are more likely to keep up with yearly preventive care visits and people with chronic conditions can get the treatment they need to promote their well-being. Besides the obvious benefits for families and individuals, having a healthy work force is a good selling point for our state. Medicaid and coverage through HealthSourceRI are vital to ensuring that thousands of our residents can afford comprehensive health insurance.”

“Rhode Islanders should be proud that we are 7th in the nation for the percent of residents who have health insurance coverage”, said Linda Katz, Policy Director at the Economic Progress Institute. “With health insurance, people are more likely to keep up with yearly preventive care visits and people with chronic conditions can get the treatment they need to promote their well-being. Besides the obvious benefits for families and individuals, having a healthy work force is a good selling point for our state. Medicaid and coverage through HealthSourceRI are vital to ensuring that thousands of our residents can afford comprehensive health insurance.”

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

On Friday

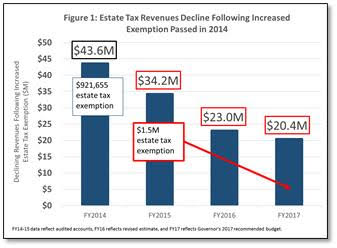

On Friday The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation (

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation ( As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

Though the big news was that Governor Gina Raimondo announced that she would be calling of an increase in the Earned Income Tax Credit (EITC) and the minimum wage when she presents her budget during the State of the State address Tuesday evening, the press conference where this was announced was to call attention to VITA, a program to help low and modest-income Rhode Islanders file their taxes and apply for tax credits like the EITC. Raimondo said that if the budget permits, she will push that rate higher.

Though the big news was that Governor Gina Raimondo announced that she would be calling of an increase in the Earned Income Tax Credit (EITC) and the minimum wage when she presents her budget during the State of the State address Tuesday evening, the press conference where this was announced was to call attention to VITA, a program to help low and modest-income Rhode Islanders file their taxes and apply for tax credits like the EITC. Raimondo said that if the budget permits, she will push that rate higher.

New carbon pricing legislation, backed by the

New carbon pricing legislation, backed by the

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.” So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As

According to EPI, “Rhode Island lawmakers increased the state’s Earned Income Tax Credit last year to 12.5 percent of the federal credit from 10 percent. This is expected to put an additional $6 million back in the pockets of over 80,000 working families who live in every city and town in the state. Neighboring states already do more to help low-wage workers through the EITC. Connecticut offers a 27.5 percent state credit and Massachusetts recently increased its state credit to 23 percent. A recent study, documented in the book

According to EPI, “Rhode Island lawmakers increased the state’s Earned Income Tax Credit last year to 12.5 percent of the federal credit from 10 percent. This is expected to put an additional $6 million back in the pockets of over 80,000 working families who live in every city and town in the state. Neighboring states already do more to help low-wage workers through the EITC. Connecticut offers a 27.5 percent state credit and Massachusetts recently increased its state credit to 23 percent. A recent study, documented in the book

Over the weekend the

Over the weekend the

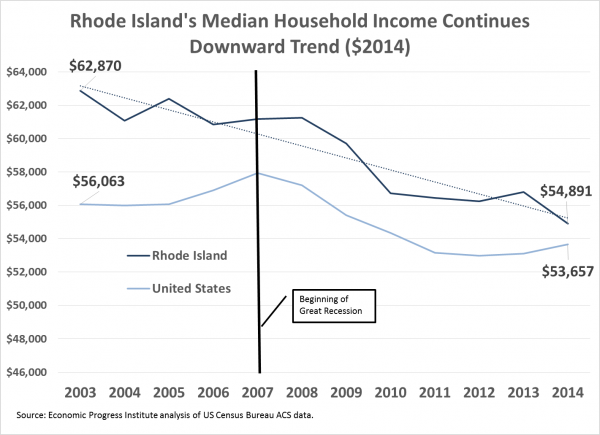

A “single-parent, with an infant (age 0-1) and a school-aged child (age 6-12) needs to earn $62,693 a year or $30.14/hour to cover the basic expenses required to raise a family in Rhode Island,” says the

A “single-parent, with an infant (age 0-1) and a school-aged child (age 6-12) needs to earn $62,693 a year or $30.14/hour to cover the basic expenses required to raise a family in Rhode Island,” says the