Perhaps the most honest statement to come out of the Senate Judiciary Committee regarding Paul Fogarty’s bill S3037A came in the hallway outside the hearing room after the vote, courtesy of Senator Leo Raptakis.

“What happened in there?” I asked.

“I don’t know,” replied Raptakis, “I don’t know why they brought it up for a vote at all.”

The confusion Raptakis felt was understandable. Normally, if you want to kill a bill in the General Assembly, you just never let it come to a vote. Eventually the session ends and the bill is dead.

So why bring the bill up for a vote? What was really going on?

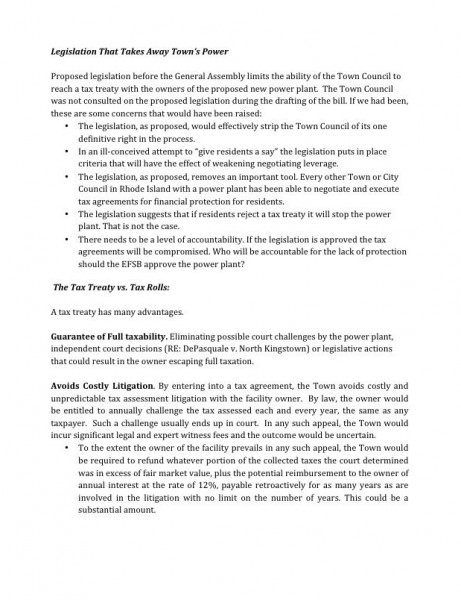

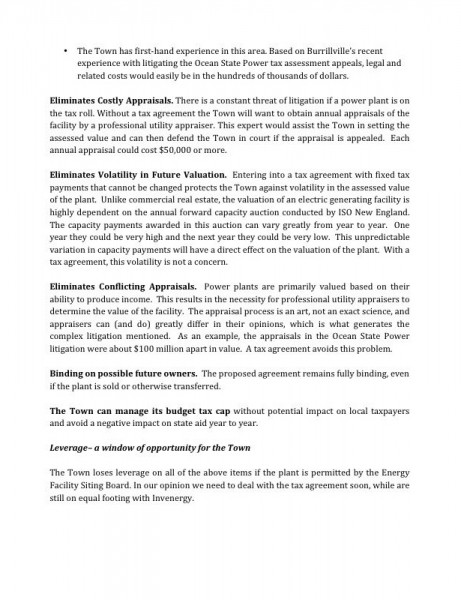

Senator Paul Fogarty’s bill would have allowed the voters of Burrillville the opportunity to vote on any tax agreements made by their town council with any power plant located in the town. The immediate effect of the bill would be to allow voters to decide on a tax treaty being negotiated with Invenergy, which wants to build a $700 million fracked gas and diesel oil burning power plant in the town. The Burrillville Town Council has been repeatedly dishonest with the residents of the town, and has been actively working to bring the power plant into the town against the wishes of most residents. Residents of Burrillville want a say in the process and they want to prevent the power plant from being built.

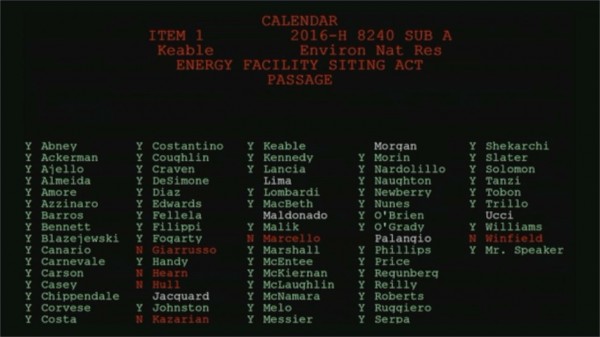

The House version of the bill, sponsored by Representative Cale Keable, passed out of the House Committee on Environment and Natural Resources on an 11-2 vote and passed the full House on June 8. The Senate version, after a long, contentious hearing that pitted Burrillville residents and environmentalists against labor and business, was tabled without a vote.

The forces in favor of the power plant did not want this bill to pass. It is believed by many that this bill will make it impossible for the power plant to be built, because it will interfere with Invenergy’s ability to secure financing for the project. A stable tax treaty is important to Invenergy because without it, the company faces the prospect of paying full taxes on the power plant. No tax treaty, no funding, some say.

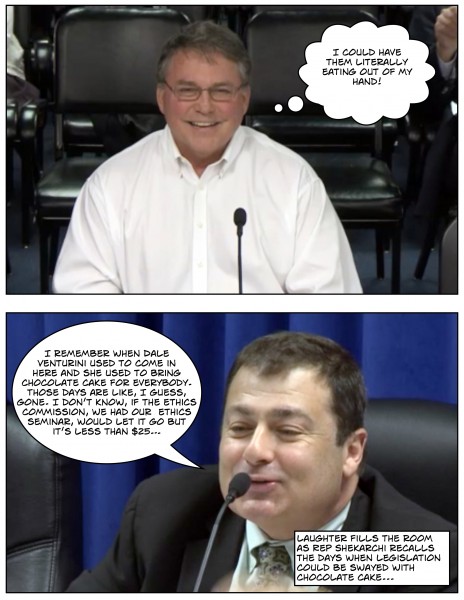

In an effort to kill the bill, Invenergy paid for a full page ad in the Providence Journal. An editorial and an op-ed were published in the paper as well. Pressure was brought to bear on the Senate from the Greater Providence Chamber of Commerce and the Northern Rhode Island Chamber of Commerce whose lobbyists testified against the bills. And labor, which wants the plant built because of the much needed jobs it will provide, lobbied the Senate hard.

Meanwhile, there was pressure being placed on Governor Gina Raimondo by environmentalists to not veto the bill, were it to be passed. Raimondo did not want to be put in the position of having to veto this bill. She wants the public appearance of being strong on environmental issues, even if she supports fracking and fossil fuels. For Raimondo’s purposes, the less known on the national scene about her true environmental positions, the better. Vetoing this bill would create the wrong kind of headlines, the kind of headlines that might hamper her national political ambitions.

Satisfying these powerful players is easy. All that needed to happen was for the bill to never get out of the Senate Judiciary Committee, and the bill would die, never to be voted on. There’s only one problem: If that were to happen, Senator Paul Fogarty would have failed the community he serves, and though Fogarty, for political reasons, is opposed to the power plant and in favor of his bill, he’s a strong union member and supporter. Under normal circumstances he would be a reliable pro-union vote and a valuable ally.

A way to both kill the bill and save Paul Fogarty’s political career was therefore devised.

Four Senators, Frank Lombardi, William Conley, Donna Nesselbush and Stephen Archambault, presented legal-sounding arguments against the bill, all the while telling Burrillville residents watching the proceedings live or at home how wonderful their Senator Paul Fogarty is. They laid it on pretty thick at times.

“Kudos to Senator Fogarty for the concerns that he showed his constituency in the town of Burrillville,” said Senator Lombardi, “and [for] having the intestinal fortitude to bring forth the bill on the behalf of his constituents.

“And I mean this, Senator,” continued Lombardi, looking at Fogarty who was seated in the center of the room, “I think that the people of the town of Burrillville are very fortunate to have you as their Senator and the work that you do for them. Quite frankly you listened to them and you put forth what you thought was a very favorable bill for your citizenry.”

Not to be out done, Senator Conley said, “Senator Fogarty’s advocacy on behalf of the people of Burrillville on this issue was extraordinary. I’m just about at the close of my fourth year in the General Assembly and I can say without reservation that I’ve never seen one of my colleagues advocate in such a meaningful and, I don’t want to say aggressive but certainly in a strong way, on behalf of legislation. His heart and soul is behind this bill and whether you agree with one of your colleagues or not, it’s always that kind of advocacy in this building that often goes unsung. So it’s important to note that.”

Senator Nesselbush was more circumspect in her praise, saying, “Senator Fogarty has been a passionate supporter of this bill that he even convinced me to be a co-sponsor of the bill.”

Senator Archambault, who might run for Attorney General in 2018, also chimed in with praise for Fogarty, “I want to echo the sentiments of my brothers and sister with respect to Senator Fogarty. He’s been here for you all along, he’s put in a tough piece of legislation, it certainly hasn’t made him any friends on one side but he did it because he cares. I think his actions speak for themselves.” After this performance, I don’t think any environmentalists will be voting for him.

With Senator Fogarty properly lionized and hopefully protected, all the Senators needed was an excuse, any excuse, to vote against the bill. As it is, they produced three excuses. They also needed someone to blame. They couldn’t blame the business community, they couldn’t blame the Governor and they couldn’t blame labor.

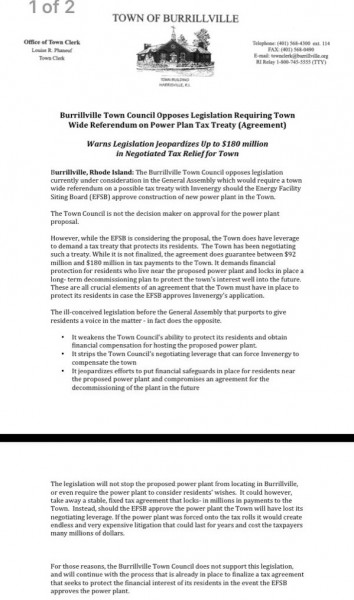

Enter the Republican Burrillville Town Council with their press release turned resolution. At the original Senate Judiciary Committee meeting to discuss the bill, Senator Lombardi foolishly tried to pass off a press release against the bill from the town council as a resolution, but in fact the Burrillville Town Council didn’t get around to issuing an actual resolution until the committee meeting was almost over. But now, with a “proper” resolution in hand, Lombardi was able to produce a villain: the Burrillville Town Council.

In his statement after the vote, Fogarty expressed his disappointment at the bills defeat, but did not blame the vote on his fellow senators. Instead, he referred to the resolution, writing that the “last-minute opposition of the Town Council… [was] the equivalent of getting two torpedoes to the bow.”

“It’s a shame that the Burrillville Town Council does not have enough faith and confidence in the local citizenry to make an informed decision on a matter that will impact the future of their community,” wrote Fogarty, forgetting that it was the Senate Judiciary Committee, not the Burrillville Town Council that killed the bill.

Lombardi’s second excuse was that he was concerned about the precedent that passing the bill would set. He said that when the residents of a city or town disagree with their elected officials, they shouldn’t be looking to the state to pass new laws. Lombardi feared that the General Assembly might be flooded with every local issue that is “controversial” if they passed this bill. Of course, it’s fairly easy to find dozens of examples where the state has stepped in to override local laws and ordinances. The very creation of the Energy Facilities Siting Board, the body that will ultimately decide whether or not the power plant will be built, is an example of the state overriding local concerns and laws, for instance.

Lastly, Lombardi noted that one of his colleagues “was gracious enough to provide us with a Rhode Island Supreme Court case entitled Warwick Mall Trust v State of Rhode Island.” Sources told me that the court case was provided to Lombardi and the other senators by Senate Majority Leader Dominick Ruggerio, a strong supporter of labor who sat in on the original Senate Judiciary Committee meeting that heard testimony on this bill.

Lombardi said that the decision in this case could be applied to Fogarty’s bill, and claimed that the bill, as written, would be unconstitutional.

In the end, of course, the Senate Judiciary Committee voted Fogarty’s bill down. It was such an unusual occurrence that Chairman Michael McCaffrey couldn’t quite get his head around how it was supposed to work. As the chairman struggled to find the right way to phrase a no vote, two Capitol Police Officers entered the room, to make sure the crowd did not react aggressively to the decision everyone seemed to know was coming. The vote was 7 -2 against. Only Nesselbush and Erin Lynch Prada voted in favor of the bill.

The disappointment of the Burrillville residents could be felt physically. There were tears. Nick Katkevich, of the FANG Collective, shouted “Shame!” as he was leaving the room. The Capitol Police responded by telling Katkevich to leave, but he was already gone. Out in the hallway, there were more hugs and tears among the Burrillville residents.

They say they will continue the fight.

Looking over every single Senate Judiciary Committee vote this session, you will find that every bill brought up for a vote passed. In fact, every bill before this committee, but two, passed with no votes against them. The two exceptions were S2333 on May 5 and S2505 on March 3, and both times it was Senator Harold Metts casting the lone vote against. Until this day, six of the senators present had not cast a no vote in committee this year.

The truth is that no one is ever really supposed to vote no. These committee votes are pro forma. It’s theater. Every vote serves a purpose and no bill is voted on in committee without a predetermined outcome known well in advance.

And the vote on Paul Fogarty’s bill was no different.

Ahead of yesterday’s finance committee votes in both houses of the General Assembly approving RhodeWorks, the truck toll plan, a press conference was held at the Greater Providence Chamber of Commerce (GPCC) featuring some of Rhode Island’s most powerful political, business and labor leaders. They were there to present a unified message in support of the tolls, despite vocal opposition.

Ahead of yesterday’s finance committee votes in both houses of the General Assembly approving RhodeWorks, the truck toll plan, a press conference was held at the Greater Providence Chamber of Commerce (GPCC) featuring some of Rhode Island’s most powerful political, business and labor leaders. They were there to present a unified message in support of the tolls, despite vocal opposition. As I said before,

As I said before,

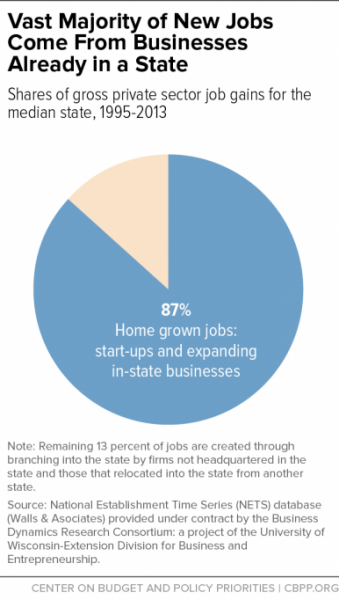

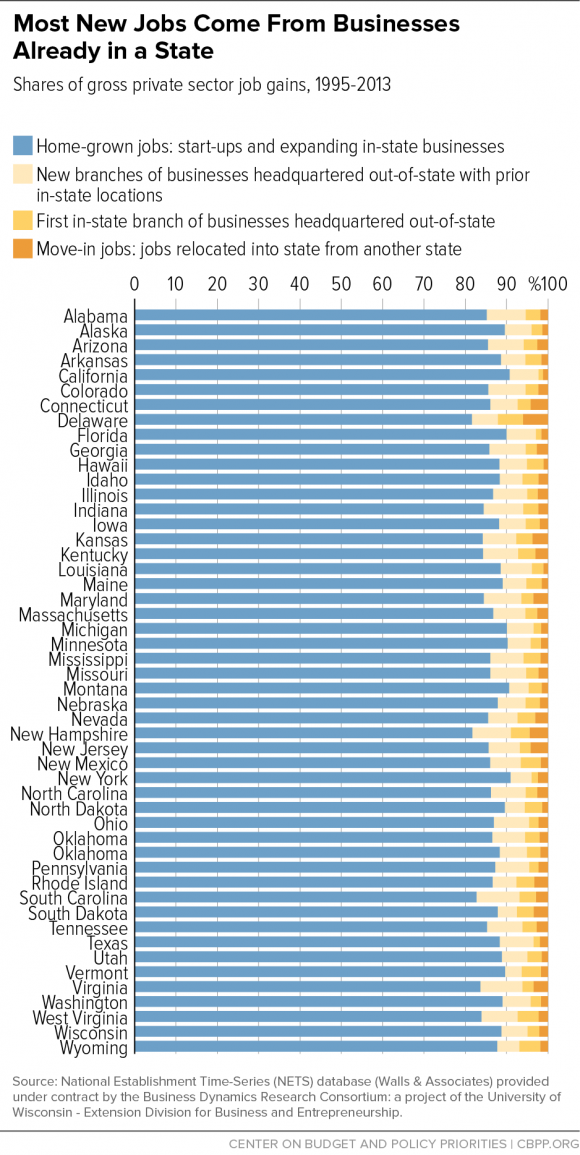

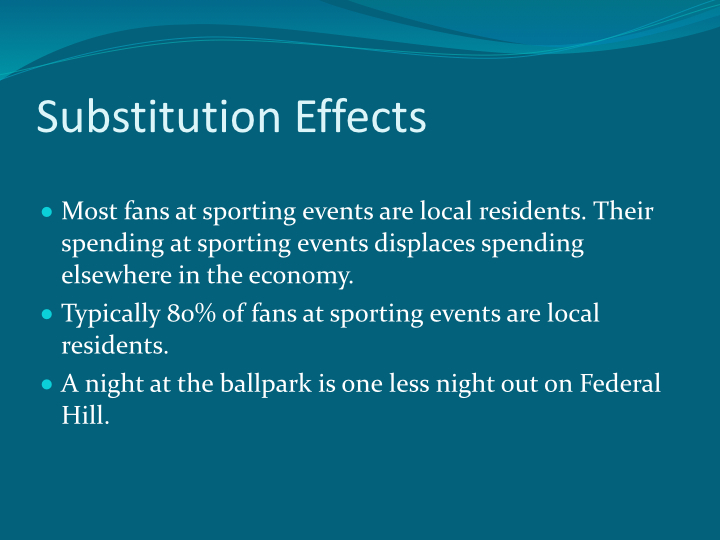

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

RhodeWorks is going to happen and nothing is going to stop it.

RhodeWorks is going to happen and nothing is going to stop it.

The

The