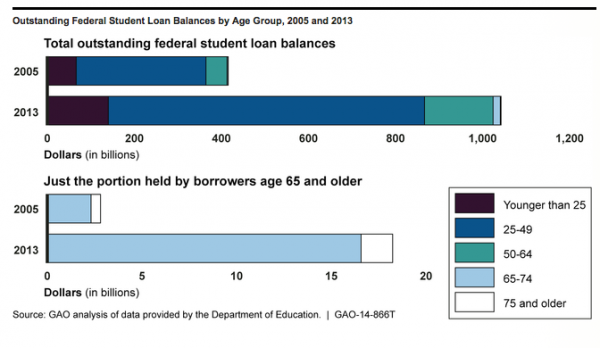

Following on the heels of a Government Accountability Office (GAO) report released last week, the U.S. Senate Special Committee on Aging held a hearing to put a Congressional spotlight on the alarming increase of older Americans becoming impoverished. The GAO policy analysts concluded that a growing number of the nation’s elderly, especially women and minorities, could fall into poverty due to lower incomes associated with declining marriage rates and the higher living expenses that individuals bear.

Following on the heels of a Government Accountability Office (GAO) report released last week, the U.S. Senate Special Committee on Aging held a hearing to put a Congressional spotlight on the alarming increase of older Americans becoming impoverished. The GAO policy analysts concluded that a growing number of the nation’s elderly, especially women and minorities, could fall into poverty due to lower incomes associated with declining marriage rates and the higher living expenses that individuals bear.

As many as 48 percent of older Americans live in or on the edge of poverty.

“While many gains have been made over the years to reduce poverty, too many seniors still can’t afford basic necessities such as food, shelter and medicines,” said Aging Committee Chairman Bill Nelson (D-FL).

Policy experts told Senate lawmakers on Wednesday that millions of seniors have been spared from abject poverty thanks to federal programs such as Social Security, Medicaid, Medicare, SSI, and food stamps. The testimony contrasted with the picture painted by House Budget Committee Chairman Paul Ryan (R-WI) earlier this week, who produced a report that labeled the federal government’s five-decade long war on poverty a failure.

Appearing before the U.S. Senate Special Committee on Aging, Patricia Neuman, a senior vice president at the Henry J. Kaiser Family Foundation, stressed the importance of federal anti-poverty programs.

“Between 1966 and 2011, the share of seniors living in poverty fell from more than 28 percent to about 9 percent, with the steepest drop occurring in the decade immediately following the start of the Medicare program,” said Neuman. “The introduction of Medicare, coupled with Social Security, played a key role in lifting seniors out of poverty.”

Neuman’s remarks were echoed by Joan Entmacher of the National Women’s Law Center, who credited food stamps, unemployment insurance and Meals on Wheels, along with Social Security, for dramatically reducing poverty among seniors.

The report was highly critical of many programs designed to help the poor and elderly saying they contribute to the “poverty trap.” Ryan and other House lawmakers have long proposed capping federal spending and turning Medicaid, food stamps and a host of other programs for the poor into state block grants.

Older Women and Pension Benefits

GAO’s Barbara Bovbjerg also brought her views to the Senate Select Committee on Aging hearing. Managing Director of Education, Workforce, and Income Security Issues, she testified that the trends in marriage, work, and pension benefits have impacted the retirement incomes of older Americans.

Over the last five decades the composition of the American household has changed dramatically, stated Bovbjerg, noting that the proportion of unmarried individuals has increased steadily as couples have chosen to marry at ever-later ages and as divorce rates have risen.

“This is important because Social Security is not only available to workers but also to spouses and survivors. The decline in marriage and the concomitant rise in single parenthood have been more pronounced among low-income, less educated individuals and some minorities,” she says.

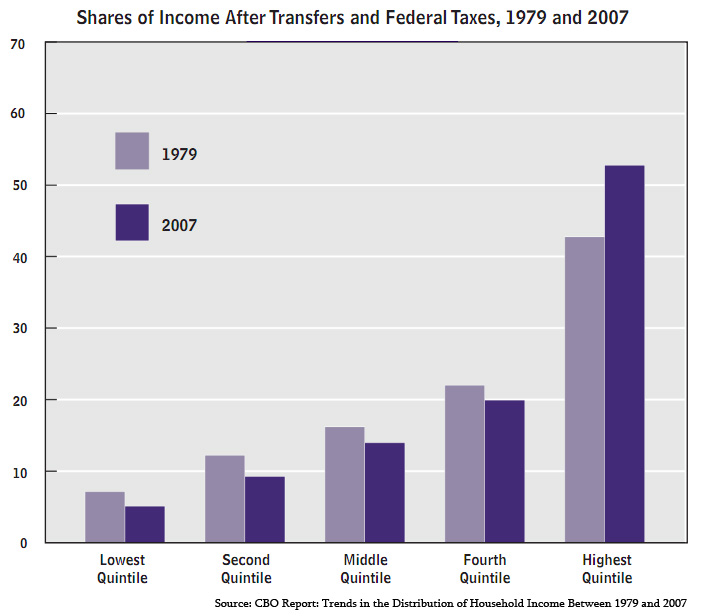

As marriage and workforce patterns changed, so has the nation’s retirement system, adds Bovbjerg. Since 1990, employers have increasingly turned away from traditional defined benefit pensions to defined contribution plans, such as 401(k)s, she says, this ultimately shifting risk to individual employees and making it more likely they will receive lump sum benefits rather than annuities.

These trends have affected retirement incomes, especially for women and minorities, says Bovbjerg, that is fewer women today receive Social Security spousal and survivor benefits than in the past; most qualify for benefits on their own work history. While this shift may be positive, especially for those women with higher incomes, unmarried elderly women with low levels of lifetime earnings are expected to get less from Social Security than any other demographic group.

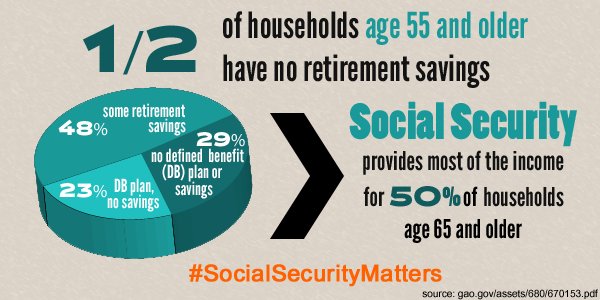

According to Bovbjerg, these trends have also affected household savings Married households are more likely to have retirement savings, but the majority of single-headed households have none. Obviously, single parents in particular tend to have fewer resources available to save for retirement during their working years. With Defined Contribution pension plans becoming the norm for most, and with significant numbers not having these benefits, older Americans may well have to rely increasingly on Social Security as their primary or perhaps only source of retirement income.

Inside the Ocean State

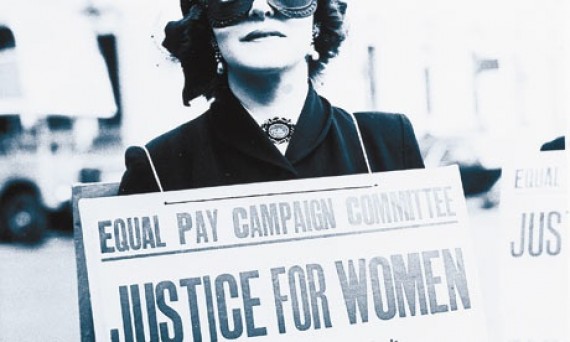

Although the GAO report findings acknowledge a gender-based wage gap that pushes older woman into poverty, Maureen Maigret, policy consultant for the Senior Agenda Coalition of Rhode Island and Coordinator of the Rhode Island Older Woman’s Policy Group, observes that this inequity has been around since the 1970s when she chaired a legislative commission studying pay equity. “Progress in closing the gender wage gap has stagnated since 2000 with the wage ratio hovering around 76.5 percent,” she said.

GAO’s recent findings on gender based differences in poverty rates are consistent with what Maigret found researching the issue for the Women’s Fund of Rhode Island in 2010. She found that some of the differences in the Ocean State can be attributed to the fact that older women are far less likely to be married than older men. Almost three times as many older women are widowed when compared to men.

Maigret says that her research revealed that older women in Rhode Island are also less likely to live in family households and almost twice as likely as older men to live alone. Of those older women living alone or with non family members an estimated one out of five was living in poverty. For Rhode Island older women in non-family households living alone, estimated median income in 2009 was 85% that of male non-family householders living alone ($18,375 vs. $21,540).

Finally, Maigret’s report findings indicate that aound 11.3 percent of older Rhode Island women were living below the federal poverty level as compared to 7.3 percent of older men in the state. Older women’s average Social Security benefit was almost 30 percent less than that of older men and their earnings were only 58 percent that of older men’s earnings.

There is no getting around peoples’ fears about outliving their savings becoming a reality if they live long enough,” said AARP Rhode Island State Director Kathleen Connell. “One thing that the latest statistics reveals [including the GAO report] is the critical role Social Security plays when it comes to the ability of many seniors to meet monthly expenses. Social Security keeps about 38 percent of Rhode Islanders age 65 and older out of poverty, according to a new study from the AARP Public Policy Institute.”

“Nationally, figures jump off the page,” Connell added. “Without Social Security benefits, 44.4 percent of elderly Americans would have incomes below the official poverty line; all else being equal; with Social Security benefits, only 9.1 percent do, she says, noting that these benefits lift 15.3 million elderly Americans — including 9.0 million women — above the poverty line.”

“Just over 50 percent of Rhode Islanders age 65 and older rely on Social Security for at least half of their family income—and nearly 24 percent rely on Social Security for 90 percent of their family income” states Connell.

“Seniors trying to meet the increasing cost of utilities, prescription drugs and groceries would be desperate without monthly Social Security benefits they worked hard for and planned on. As buying power decreases, protecting Social Security becomes more important than ever. Older people know this; younger people should be aware of it and become more active in saving for retirement. Members of Congress need to remain aware of this as well,” adds Connell.

Kate Brewster, Executive Director of Rhode Island’s The Economic Progress Institute, agrees with Maigret that older women in Rhode Island are already at greater risk of poverty and economic security than older men.

“This [GAO] report highlights several trends that make it increasingly important to improve women’s earnings today so that they are economically secure in retirement. Among the ‘policy to-do list’ is shrinking the wage gap, eliminating occupational segregation, and raising the minimum wage. State and federal proposals to increase the minimum wage to $10.10 would benefit more women than men, demonstrating the importance of this debate to women’s economic security today and tomorrow.”

House Speaker Gordon Fox is proud that the General Assembly in the last two legislation sessions voted to raise minimum wage to its current level of $8 per hour. That puts Rhode Island at the same level as neighboring Massachusetts, and we far surpass the federal minimum wage of $7.25, he said. He says he will carefully consider legislation that has been introduced to once again boost the minimum wage.

“Bridging this gap is not only the right thing to do to ensure that women are on the same financial footing as men, but it also makes economic sense”, says Rep. David N. Cicilline.

At the federal level, the Democratic Congressman has supported the ‘When Women Succeed, America Succeeds’ economic agenda that would address issues like the minimum wage, paycheck fairness, and access to quality and affordable child care. “Tackling these issues is a step toward helping women save and earn a secure retirement, but we also have to ensure individuals have a safety net so they can live with dignity in their retirement years,” says Cicilline.

With Republican Congressman Ryan in a GOP-controlled House, captured by the Tea Party, leading the charge to dismantle the federal government’s 50 year war on poverty, the casualties of this ideological skirmish if he succeeds will be America’s seniors. Cutting the safety net that these programs created will make economic insecurity in your older years a very common occurrence.

Herb Weiss, LRI ’12, is a Pawtucket writer who covers aging, health care and medical issues. He can be contacted at hweissri@aol.com.

On August 14, 1935 President Franklin Roosevelt signed the Social Security Act into law, perhaps one of the greatest and most important strands of the fraying American social safety net.

On August 14, 1935 President Franklin Roosevelt signed the Social Security Act into law, perhaps one of the greatest and most important strands of the fraying American social safety net.