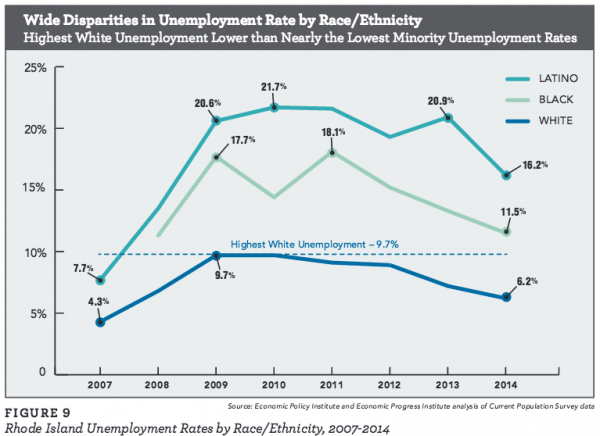

As bad as the unemployment crisis in Rhode Island was for white workers, it was nearly twice as severe for workers of color.

A new report from the Economic Progress Institute shows that black and Latino workers were unemployed at almost twice the rate of white workers from 2007 to 2014. “The takeaway here is that the worst unemployment situation White workers face is better than nearly the best unemployment situation that Black and Latino workers face,” reads the report.

“The significantly higher rates of unemployment for Latino and Black Rhode Islanders and lower wages for these communities and Southeast Asians – should set off alarm bells for business leaders and policy makers,” said EPI Executive Director Rachel Flum in a press release.

The white unemployment rate topped out at 9.7 percent in 2009, while the black unemployment rate was 17.7 percent that same year and maxed out at 18.1 percent in 2011. The Latino unemployment was even worse with a high of 21.7 percent in 2010 and hovering around a fifth of all working Latinos in Rhode Island from 2009 to 2013.

All three ethnicity’s unemployment rates dropped significantly in 2014, but at 16.2 percent the unemployment rate for Rhode Island Latinos was not only the highest in the nation but also “more than double the national Latino unemployment rate of 7.4%,” according to the EPI.

“This report underscores the need for Rhode Island to pivot towards the worker,” said Anna Cano-Morales, director of the Latino Policy Institute at Roger Williams University, in the press release. “When we do that, we not only maximize our economic potential but we also fully value all Rhode Islanders.”

]]> It’s always gratifying when one of the best and most deserving folk actually get a position in government where they can make a powerful difference. We recently learned that RI Future contributor Tom Sgouros has been appointed as senior policy adviser to Seth Magaziner, the new treasurer of Rhode Island.

It’s always gratifying when one of the best and most deserving folk actually get a position in government where they can make a powerful difference. We recently learned that RI Future contributor Tom Sgouros has been appointed as senior policy adviser to Seth Magaziner, the new treasurer of Rhode Island.

Tom was himself a candidate for the office of treasurer in 2010 but dropped out early in the race that Gina Raimondo would go on to win. He is known for his incisive, well-researched and often sarcastic insights into the economics and policies of Rhode Island.

In addition to writing for RI Future, Tom recently started — and will suspend — an excellent column in the Providence Journal. Which is a shame, but a fair tradeoff for honesty and transparency in government.

Tom’s most recent book, Checking the Banks is subtitled “The Nuts and Bolts of Banking for People Who Want to Fix It”, so it looks like they’ve picked the right person for the right job.

In the book, Tom goes into great detail about what’s wrong with the banking system, like the mortgage crisis, lack of loans to small businesses, and predatory practices. He also offers alternatives, solutions and possibilities for change.

We hope that Tom and Treasurer Magaziner will create bold initiatives to make banking more innovative. Maybe we can start our own state bank, and save taxpayers millions while priming the local economy’s pump…

At the beginning of the session everything is possible. Now the hard work begins.

(DISCLAIMER: As the editor and publisher of two of Tom’s best books, this article is 100% biased and slanted.)

]]> While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

Demand.

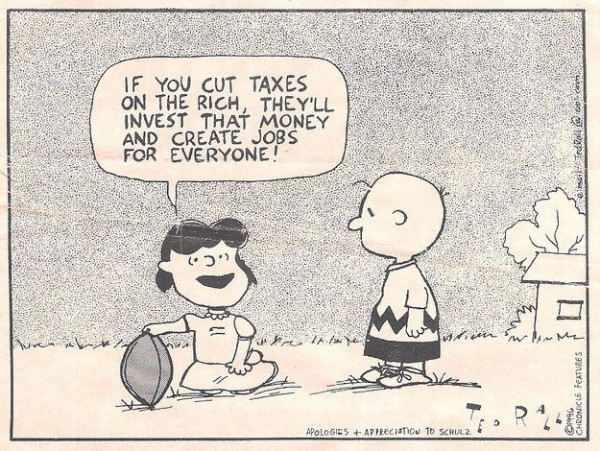

Supply-side economists have this totally absurd notion that supply will create its own demand. That has to be one of the stupidest things I have ever heard. Why are there no Wal-Mart’s in the Yukon territory? Why did buggy-whip manufacturers go belly-up after the auto-mobile became popular? Why are there no stores that sell only items related to Reformation Theology?

Seems like a Wal-Mart should be enough of an attraction to create its own demand. Right?

Seems like a plentiful supply of quality buggy-whips should have enough appeal to create its own demand. Right?

And lots of books and pictures of Thomas Cramner, well, obviously, this is a supply that has to create its own demand. Right?

But then you have Prohibition. What happened there? Supply disappeared, at least in theory. So demand collapsed, because nothing is ever driven by demand. Right?

Except just the opposite happened. Demand created the supply. Just like illegal drugs. With sufficient demand, someone, and even lots of someones, will take great risks to produce a supply.

And yet, star-level economists, especially at the U Chicago insist that demand has no role in economic performance. Cut taxes, cut regulations, free the supply side and demand will follow. It HAS to! Our theory says it will! So it will be so!

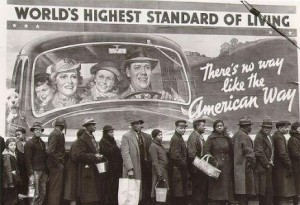

Stop me if you’ve heard this one: my grandfather lived through the Depression. He had a line that held more wisdom than all of the collected works of the U Chicago school. My granddaddy had no illusions about “Good Old Days”, when it was all simpler. His line was “Sure, a loaf of bread only cost a nickel. But what the hell. You didn’t have a nickel.”

And there you have it. No matter how cheap a thing, people won’t buy it if a) they don’t want it (see Whips, Buggy above); or b) they don’t have any money.

Which leads to the current state of the economy. Five full years after the crash, a lot of people still don’t have jobs. Or, if they do, they are low-level service jobs that pay between minimum and maybe $10/per hour. $10 per hour grosses just shy of $21k per year. Can you rent for $400 per month? Can you keep a car on the road for $400 per month? Maybe that will cover gas, but you also MUST factor repairs and routine maintenance into that. Can you eat decently on $400 per month? And that means, you know, fresh fruits and veggies. Yes, you can get by on boxed mac-and-cheese, but that takes a horrible toll on your body. So we’re down to something like $500 per month discretionary. (Taking a month as 4.3 weeks). Not saying that’s not enough to get by on. It is. I know because I’ve done it (adjusting for inflation). But let me tell you, don’t plan on buying much.

And there, exactly, is the rub. I get so sick of people who say that employers have the right and the obligation to drive wages into the ground. And then say that workers should be thrilled to have any job,at any wage, no matter how pathetically low. Have to free up the job creators!

But what good does that do? Job creators are more free now than they have been in generations. They’re making huge profits. They’re sitting on piles and piles of money. So, they’re free*. Why don’t they create jobs? Or why don’t they create jobs that pay people a decent wage? Why is there a need to stockpile even more money?

Look, Henry Ford was a Nazi sympathizer. That is not a slur. It’s an historical fact. Go read anything about him and you will find out that he was so virulently anti-communist that he thought the Nazi government was a good thing, at least before the onset of WWII and the Final Solution. He figured out that it was a good idea to pay workers more than starvation wages. He realized that by paying his workers a good wage, he was creating customers.

In other words, he was creating demand for his products. In other words, paying workers more, and making a smaller profit, was in his best self-interest.

We are primed for a terrific natural economic experiment. Massachusetts is going to raise its minimum wage, gradually, to $11 per hour by 2017. The first increase is to $9/hour as of 1/1/15. Since Mass and RI currently have the same minimum wage, this means that millions of jobs will be fleeing from Mass, crossing the border into RI to take advantage of the lower wage. And it means that Mass will be plunged into economic darkness and decay because, everyone knows that a higher–and increasing—minimum wage will cost millions f jobs. By 2018, Mass will look like Detroit on a grand scale.

Everyone knows this. Just like everyone knows that millions of Rhode Islanders have fled to low-tax places like North Dakota and Wyoming. Because that’s what Econ 101 says.

Well, maybe those people should have stuck around for Econ 201, or 301. Maybe they’d have learned there’s more to the story.

And: assuming that my “predictions” don’t come true, and that the economy in Mass actually improves, I will expect a personal apology from every single person who says I’m wrong.

Because, fact of the matter, a higher minimum wage will stimulate demand. People will have money. They will buy more. That means companies will hire more people. And the virtuous cycle continues. If you want proof of this, cross the border into Canada, where the minimum wage is currently $11./hour. And then cross back. It’s like going from a First World country into a Third World country. When you cross back into the US, that is.

And if you don’t believe me, how about this guy?

]]> It is outrageous to have millionaires collecting unemployment insurance payments, according to a Golocal article in which I am quoted. Maybe Golocal is on to something?

It is outrageous to have millionaires collecting unemployment insurance payments, according to a Golocal article in which I am quoted. Maybe Golocal is on to something?

Certainly their employer paid a premium to be insured against a layoff, but it’s also unlikely that they are actually in as dire a need for the assistance as someone who has been laid off from a lower-paid job. But the real problem with UI is the I. That is, unemployment is structured as an insurance program: your employer pays a premium and when unemployment happens, you can make a claim. Why is that a problem?

In structure, it’s just like property and casualty insurance. You pay a premium, and if your house burns down, you can make a claim to the insurance company. The difference is that only criminals incorporate burning down houses into their business strategy, while layoffs have become an accepted part of corporate management in the United States.

These days, my knees can only be counted on to remind me how old I am, but another way that I feel old sometimes is that I remember when layoffs were considered big news. In those days, permanent layoffs and factory closings were unusual events, not so unlike floods and lightning strikes, reasonable things to insure against. The problem is that when layoffs become common — when the health of the communities and workers who made a company successful ceased to be a part of managements’ concerns — the insurance structure of the unemployment program becomes less sustainable. (In fact, layoffs that are common now were actually illegal within my memory, but that’s a different, though equally maddening, part of the story.) Worse than unsustainable, it can become farcical when a company helping to cause the problem has the temerity to complain about it.

This came to my attention years ago, when Cranston Print Works complained to the General Assembly that it paid $500 per employee for UI in Rhode Island, but only $20 per employee in North Carolina. Quoting from a letter I wrote in 1996:

Dell [at the NC Labor Dept] speculated that the Cranston Print Works unemployment tax rate differential cited… was due not only to the difference in tax rates, but also to the fact that, over the past decade or so, as production has moved from here to there, Cranston has been laying people off here in RI and hiring them in NC. Since a company’s unemployment tax rate is largely dependent on how many people they’ve laid off, this would obviously make their rate much lower in NC than here. The whole thing becomes something of a self-fulfilling prophecy for businesses: they move to NC to lower costs, but by moving (hiring in NC, laying off in RI), they make the costs higher for their remaining divisions, and for those companies who stay. [emphasis added]

What has happened around here over the last few decades is that the companies who fled early have actually increased the costs borne by the companies who have not. This is true not only in unemployment insurance, but in a host of other ways. Fewer companies sharing the costs of infrastructure investment means higher electricity distribution costs for each individual company, parts distributors have fewer customers so the margins they charge have to go up, and the costs of other government expenses, like roads, water, and education, find fewer companies to share the costs, too. Costs go up for the companies who remain, who then complain that high costs force them to move, too. It’s not always as ironic as when the same company is doing both the moving and the complaining, but it’s the same dynamic.

What have we done to address this problem? Pretty much nothing, except where we’ve made it worse, by reallocating some of those burdens in disregard of a company’s ability to pay. Not only do we have a failure of policy to contend with, but we have a failure of policy development. You hear routine complaints about business costs in Rhode Island, but when has the analysis ever led to anything more substantive than just more tax cuts? The Assembly leaders who make economic development policy in our state seem to have only that single play in their playbook and they keep running it, hoping against hope for a different outcome each time. What I hear from the statehouse is that there is plenty of talk about further tax cuts this year, despite the anticipated budget shortfalls.

Rereading that old letter seems a little bit sad with 18 more years of perspective:

]]>There are dozens of creative and exciting economic development ideas that are proven to work by virtue of the fact they exist in other states, and are working there…The only special thing about the conditions here in Rhode Island is the lack of leadership and vision and commitment–from the Assembly, from the EDC, from the Governor–that are necessary to make them work. This means money, but not necessarily extravagance. Yes, the budget is tight, but as long as we simply complain that the pie is shrinking and there’s nothing we can do about these great ideas, there will continue to be less and less money with which to do anything. This is the great death spiral we’re in, and the tragedy is that no one seems to feel it important to resist.

Everyone knows that Rhode Island has the highest unemployment rate in the nation, right? After a few years of lagging Michigan and sometimes Nevada, we are now the nation’s leaders, despite the rate having ticked down slightly last month.

Everyone knows that Rhode Island has the highest unemployment rate in the nation, right? After a few years of lagging Michigan and sometimes Nevada, we are now the nation’s leaders, despite the rate having ticked down slightly last month.

But consider this: what do you learn by comparing a tiny state like ours to relatively gargantuan states like Michigan and Nevada? Is that comparison useful? Huge parts of Nevada are desert; huge parts of Michigan are farms; there are no huge parts of Rhode Island. Could that be relevant to the three states’ economies?

Comparing states to each other is a decent way to get a handle on differing state policies, but do we think that state policies are at the heart of our high unemployment rate? Are there no other differences you can think of between, say, Texas and Rhode Island? I believe our state’s policies certainly contribute to our economic condition, but sometimes another analysis can be revealing, too.

I looked last week at the unemployment rates for metropolitan areas (“Metropolitan Statistical Area” or MSA), as defined by the Census Bureau, and learned that the Providence MSA (which includes what you think of as greater Providence, as well as stretching out to include Fall River) has unemployment of 9.7%, higher than the statewide rate. We rank 339 out of 372, a pretty dismal showing. But that’s not dead last, so I also learned that there are 32 MSAs in 11 different states that rank lower than ours, including New Bedford, at 11.1%, and bottoming out at Yuma, Arizona, at over 22%. And Westerly and Hopkinton are part of an MSA centered in Connecticut, and their rate is 7.9%, or number 268 on the list. Nothing to be proud of, but better than 104 other places.

Half of the MSAs in California are doing worse than we are, as are three out of five in New Jersey, and four out of 25 in Texas. But those states also contain some high-performing MSAs, so the devastating performance of some areas are washed out in the statewide averages. There are several one-party states in that mix — from both parties — as well as several with divided control of their governments. It seems to me that anyone who wants to claim that Rhode Island’s high unemployment rate is entirely due to state policy has the burden of explaining why we should adopt the tax and regulatory policies that have brought Brownsville, Texas to a 9.8% unemployment rate or Yuma to 22%.

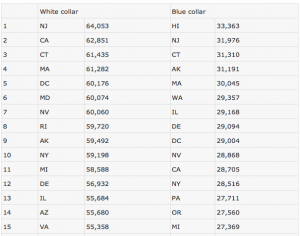

A few years ago I did an analysis that suggested the structure of the labor market might be relevant. Nestled between two richer states, Rhode Island’s white-collar jobs pay comparable wages to those neighbors. Jobs like these are good jobs, for which you might commute a long way, or even move your home. For jobs like being a psychologist, computer programmer, architect, or lawyer, this is pretty much a single job market. An employer in Warwick looking to hire a staff attorney competes for a pool of attorneys who might easily take a job in New London, Attleboro, Sharon, or Boston.

It’s not like that for hiring a cashier in a convenience store. You wouldn’t commute to Boston to work in a deli, and so it turns out that while white-collar wages here are at least comparable to wages for similar jobs in Massachusetts and Connecticut, blue-collar jobs vary much more, and in fact pay much worse here in Rhode Island.

I made a couple of rankings of states based on a selection of job categories, and I learned that some areas ranked high on my white-collar job list and low on my blue-collar list, while in some it was the other way around. (Read more about them in my book, “Ten Things You Don’t Know About Rhode Island.” The table is below, but you’ll have to check out the book to get all the details.)

In truth, I have no idea why these rankings differ, though it is entertaining to speculate. I noticed, for example, that places with a long history of union manufacturing (Ohio, Pennsylvania) pay good blue-collar wages, even for non-manufacturing jobs, and places that are very attractive to live (Hawaii, Oregon) tend to pay relatively poor white-collar wages. Agricultural areas tend to pay poor blue-collar wages, even for non-agricultural jobs. Rhode Island, with high white-collar wages and very low blue-collar wages, is an anomaly in the Northeast, and belongs with the states of the South, Southwest, and California.

Here’s what else I notice: the places that pay the worst blue-collar wages dominate the high end of the unemployment ranking.

This seems counter-intuitive — why would lower wages mean higher unemployment? — but it also seems to be true. On closer examination, maybe it’s not so crazy. People at the low end of the income spectrum tend to spend the money they have because they have to. More money in those people’s hands means more money being spent, so it makes sense that an area with better-off low-wage workers will enjoy higher levels of economic activity. This is just speculation, but it is broadly consistent with the basic Keynesian model of the economy that dominates our economic discourse.

But we can go one step farther, too. If we want to bring state policy into the equation, it seems that the metropolitan areas with the highest unemployment are not only places with low blue-collar wages, but are often in states where taxes on the low end of the wage scale are relatively high. According to the Institute for Taxation and Economic Policy (ITEP), Texas, Arizona, Illinois, and New Jersey are all places where total state and local taxes on the poorest people approach or top 12%, just like here. In other words, these are largely places where poor people are paid badly and taxed at high rates, too.

ITEP tells us that state and local taxes on poor people in Rhode Island average 12.1% of their income, while for people in the top 1%, the average rate is 6.4%. The tax cuts for the rich that we have given year after year have not resulted in lower taxes all around. Rather what has happened is that the state simply shirked its responsibilities to education and local aid. The cities and towns took up the slack by raising their property taxes, which fall most heavily on those with the least ability to pay. Taking money away from people who are most likely to spend it is what you might call the opposite of economic stimulus, so it is little surprise that the result is what you might call the opposite of prosperity.

What could we do about this? Pushing up the minimum wage would be a start. Cracking down on wage theft and the mis-classification of employees might help, too, as well as finally being honest about what we’ve been doing to our cities and towns.

Just something to think about when you read about the unemployment rate. As usual, it seems the things that everyone knows sometimes get in the way of understanding what’s going on.

| White collar | Blue collar | |||

| 1 | NJ | 64,053 | HI | 33,363 |

| 2 | CA | 62,851 | NJ | 31,976 |

| 3 | CT | 61,435 | CT | 31,310 |

| 4 | MA | 61,282 | AK | 31,191 |

| 5 | DC | 60,176 | MA | 30,045 |

| 6 | MD | 60,074 | WA | 29,357 |

| 7 | NV | 60,060 | IL | 29,168 |

| 8 | RI | 59,720 | DE | 29,094 |

| 9 | AK | 59,492 | DC | 29,004 |

| 10 | NY | 59,198 | NV | 28,868 |

| 11 | MI | 58,588 | CA | 28,705 |

| 12 | DE | 56,932 | NY | 28,516 |

| 13 | IL | 55,684 | PA | 27,711 |

| 14 | AZ | 55,680 | OR | 27,560 |

| 15 | VA | 55,358 | MI | 27,369 |

| 16 | GA | 55,323 | MN | 26,989 |

| 17 | HI | 55,231 | CO | 26,900 |

| 18 | CO | 55,141 | MD | 26,848 |

| 19 | NC | 54,849 | IN | 26,777 |

| 20 | TX | 54,734 | OH | 26,724 |

| 21 | OR | 54,552 | NH | 26,406 |

| 22 | PA | 54,415 | MO | 26,152 |

| 23 | TN | 54,110 | RI | 25,994 |

| 24 | WA | 54,105 | VA | 25,913 |

| 25 | MN | 54,096 | WI | 25,903 |

| 26 | WV | 53,906 | KS | 25,728 |

| 27 | OH | 53,878 | AZ | 25,445 |

| 28 | WI | 53,769 | TN | 25,396 |

| 29 | FL | 53,269 | IA | 25,294 |

| 30 | IN | 52,910 | GA | 25,153 |

| 31 | MO | 52,649 | WY | 24,968 |

| 32 | NH | 52,622 | VT | 24,708 |

| 33 | UT | 52,536 | NE | 24,635 |

| 34 | ID | 52,128 | ID | 24,611 |

| 35 | MS | 51,840 | SC | 24,333 |

| 36 | AL | 51,311 | UT | 24,299 |

| 37 | ME | 51,104 | MT | 24,161 |

| 38 | SD | 50,725 | ME | 24,075 |

| 39 | AR | 50,489 | LA | 24,004 |

| 40 | LA | 49,971 | NC | 23,983 |

| 41 | WY | 49,790 | KY | 23,967 |

| 42 | VT | 49,734 | SD | 23,850 |

| 43 | SC | 49,478 | ND | 23,841 |

| 44 | NM | 49,132 | OK | 23,753 |

| 45 | KY | 48,838 | TX | 23,502 |

| 46 | IA | 48,564 | FL | 23,466 |

| 47 | OK | 48,361 | WV | 23,353 |

| 48 | ND | 48,171 | NM | 22,634 |

| 49 | NE | 48,039 | AR | 22,562 |

| 50 | KS | 47,308 | AL | 22,428 |

| 51 | MT | 46,128 | MS | 22,097 |

(Source: SalaryExpert.com, 2005 data, methodology described here)

]]> If you are an unemployed Rhode Islander, David Cicilline wants to tell House Speaker John Boehner and the rest of Congress your story.

If you are an unemployed Rhode Islander, David Cicilline wants to tell House Speaker John Boehner and the rest of Congress your story.

Cicilline is collecting stories and photographs of unemployed Rhode Islanders as a way to put a human face on a bill to extend federal unemployment insurance that House Republicans are refusing to let come to a floor vote. The Senate bill, championed by Jack Reed and Republican Dean Heller of Nevada, passed with bipartisan support.

“It seems like in many ways unemployed individuals are just invisible to the Republican leadership,” Cicilline told me in a phone interview yesterday. His plan is to plaster the outside of his office with pictures of unemployed people.

“Every member of Congress will have to walk through the hallways and see the thousands of Americans who are suffering because of our failure to fix unemployment,” he told me. “We can’t continue to put our heads in the sand and pretend like this isn’t hurting real people.”

If you’ve got a story to tell, you can share it with Congressman Cicilline here. And please listen to our entire interview below, and check our our complete coverage of this bill (no real people though) here.

]]> In an effort to address Rhode Island’s unemployment rate, Senate leadership has announced a new workforce development plan, “Rhode to Work“, designed to address the skills gap. The skills gap is a labor market theory that posits that employers have job openings they can’t fill due to a lack of qualified applicants. This often goes hand-in-hand with rhetoric about building “tomorrow’s workforce” and our need to be competitive in the global economy.

In an effort to address Rhode Island’s unemployment rate, Senate leadership has announced a new workforce development plan, “Rhode to Work“, designed to address the skills gap. The skills gap is a labor market theory that posits that employers have job openings they can’t fill due to a lack of qualified applicants. This often goes hand-in-hand with rhetoric about building “tomorrow’s workforce” and our need to be competitive in the global economy.

There’s just one niggling little problem: there’s virtually no evidence that such a skills gap actually exists. Certainly not in Rhode Island, where six out of 10 of summer 2012’s job vacancies had either no education requirement or only a high school diploma or G.E.D.

I’ve talked about this before; specifically, UWM researcher Mark Price’s work debunking the skills gap in Milwaukee. Currently, for every 2 U.S. students who graduate with a science, technology, engineering, and mathematics (STEM) degree, only 1 gets a job; usually they cite that either they couldn’t find one or they could earn more in another industry. An article in the Institute of Electrical and Electronics Engineers’ Spectrum showed there were 11.4 million STEM-degree-holding workers employed in non-STEM fields in comparison to 277,000 STEM vacancies. Professor Peter Cappelli of the Wharton School’s Center for Human Resources concludes that there multiple issues at fault: refusal by employers to hire entry-level applicants, refusal by employers to provide on-the-job-training, overcomplicated job requirements, software that screens out potentially great matches for. For anecdotal evidence tied with data, there’s the manufacturing CEO who told New York Times writer Adam Davidson that he didn’t like workers with union experience and paid less than work in the fast food sector – not uncommon; Davidson says the Bureau of Labor Statistics’ data shows that skilled jobs have fallen off and their wages have fallen as well.

Perhaps you’ve noticed a trend there. Virtually all of the hiring issues are on the employer-side of the equation, not the applicant-side. That’s pretty much what a study from Illinois found. The researchers there suggest that there are four main reasons for advocating for the existence of a skills gap: it scapegoats job-seekers rather than business, it could be caused by employers parroting other employers in their sector from low-unemployment states, it increases the labor supply driving down wages, and it transfers the costs of training onto the state and off of the employer’s books.

“Rhode to Work” offers virtually no evidence of an existence a genuine skills gap. Instead, it cites this article from WPRI that used only two anecdotal pieces of evidence from employers, and never once offered data that concurred with their conclusions. Similarly, this article from The Providence Journal‘s John Kostrzewa made the rounds a few weeks ago, offering only employer-anecdotal evidence. Responding to that article, the far-right Current/Anchor’s Justin Katz reached pretty much the same conclusion as the above study (once you get past the moralizing); this is an attempt to socialize job training costs.

Let’s pause and say that job training isn’t bad. It’s perfectly fine for workers to be retrained or to learn new skills. It’s just that we need to make a couple things clear. First, job-training should be paid for by employers, who will benefit from it. And second, it is not a cure for Rhode Island’s unemployment issues. Once again, ostriches.

Rhetorically though, “Rhode to Work” (despite the tiresome wordplay) is a perfectly fine piece of politics. It’s hard to be against it unless you want to be seen advocating for keeping people ignorant (because that’s basically what the “skills gap” talk posits: Rhode Islanders are too stupid to do the work that’s available). And it’s an easy rallying point for supporters of dismantling the public education system; the exact same rhetoric is used, that creepy “building the workforce of tomorrow” language that’s supposed to inspire us to have our kids buckle down real hard for the tests that will decide their future. Also, it mainly focuses on a future workforce, rather than the one we’ve got (you know, the one in need of help). It’s good politics to focus economic policies on the future workforce, because it means during future boom times you can take credit for that success.

That refusal to deal with the problem at hand a real shame, because as we’ve previously pointed out, very few of Rhode Island’s policies are actually targeted at Rhode Islanders who actually need assistance. Maybe we can look to the House for better solutions. But I wouldn’t hold your breath.

]]>

As Nesi points out, RI proportionally has more long-term unemployed than any other state. If you drill down into the JEC Democratic staff’s numbers, what they show is that of our 9% unemployment rate (which is called the “U-3 unemployment rate” – that’ll be important later), 44% of those workers are long-term unemployed.

Why is that a problem? Well, there’s pretty clear evidence that employers don’t like to hire the long-term unemployed; at least according to a Boston Fed study released in October 2012. Not even a “can’t get an interview” situation, it’s a “won’t look at the application” situation. Unlike previous recessions, where when job vacancies rose both short-term and long-term unemployment fell the Great Recession has been different. An increase in job vacancies isn’t causing a decrease in long-term unemployment. So even when employers have openings, they aren’t filling them, despite the existence of candidates who are currently long-term unemployed.

Now, this might be the point where people start saying “well, there’s a skills gap, and we need more workforce development.” But March 2013 research from the University of Wisconsin Milwaukee demonstrates that, consistent with 40 years of jobs and training research, “workforce development” has little to no impact on workers and the “skills gap” is a mythological creature on par with Pegasus and the Questing Beast. The study quotes Anthony Carnevale of Georgetown University Center on Education and Workforce Development:

Training doesn’t create jobs. Jobs create training. And people get that backwards all the time. In the real world, down at the ground level, if there’s no demand for magic, there’s no demand for magicians.

As Matthew O’Brien of The Atlantic points out in the article linked above, the discrimination against the long-term unemployed is a vicious cycle which has the ability to permanently impoverish the country. Eventually, those 4.1% are going to burn their way through every family member, friend, and place of goodwill available. And they’ll end up homeless. Combine that with the structural deficit in the state budget, a likely loss in revenue from gambling once Massachusetts casinos start up, and a likely future economic crash due to failure on the part of the national government to reform our economy to prevent the abuses that caused the Great Recession… well, that means we’ll have a state even less capable of dealing with the crisis at hand.

Before I move on to our state’s “response” to this slow-motion crisis, I want to make a final point about the unemployment rate. If we really want to imagine what a healthy RI economy looks like, we have to look past the U-3 or “official” unemployment rate. According to the Bureau of Labor Statistics, Rhode Island’s U-6 unemployment rate for Q4 2012 through Q3 2013, which includes the total unemployed plus marginally attached worker (people who have given up looking for work in the past four weeks) plus people employed part time for economic reasons Rhode Island has a 15.8% unemployment/underemployment rate. While this means we are no longer the worst in the nation (5 states are equal to or above ours), it’s nowhere near the 8.3% we had just before the Great Recession hit.

So given that this is perhaps the greatest threat to our state’s economic well-being, what was the major economic package to come out of General Assembly and be signed by Governor Chafee? “Moving the Needle” which states the problem it intends to address in its first sentence: “In its annual ‘Top States for Business’ rankings, published on July 10, 2012, CNBC ranked Rhode Island 50th of 50 states on how appealing the state is to start or grow a business.”

Distractions. State leadership is more concerned with the subjective rankings given to it by a television station (which has as part of its goal, to entertain and make a profit) than the reality in front of it. That’s the reality where 4.1% of our labor force has been searching for work for six months or more. Where 9% of it is unemployed. Where 15.8% is either looking for work, discouraged or gave up looking for work, or taking a part time job until economic conditions improve. Let’s jump back to that Prof. Carnevale quote: “if there’s no demand for magic, there’s no demand for magicians.”

That’s the problem in a nutshell. There is a demand problem in the state. If you’re unemployed or on a really tight budget, you can’t buy what business is selling. So it doesn’t matter too much what businesses Rhode Island can’t attract, because even if it can attract them (“competitiveness” between states is usually nothing more generous cash giveaways), there’s a weak customer base that can’t support them. Moving the Needle is just about getting us more magicians… or illusionists, I think is the synonym.

It’s that mindset that produced 38 Studios, a pie-in-the-sky dream of beaucoup bucks while kick-starting a tech industrial boom and hiring a bunch of Rhode Islanders. It’s utterly backwards. We need a Rhode Islanders First jobs program, that puts our actually existing (and struggling) citizens ahead of all the fantasies of start-ups and imaginary migrating businesses. We know we can’t rely on the federal government to provide one, so we’ll have to do this ourselves. If that’s a Rhode Island-style WPA/CCC type effort, so be it. If it means we pay people to fix our infrastructure, assist our nonprofits and even work in support of our businesses, that’s fine with me.

You can say that’s government picking winners and losers. I will too. I say it’s definitely government picking a winner. Rhode Island.

]]> Since the economic crash in 2008, Congress has offered extended unemployment benefits after state benefits run out. Last year, during the fiscal cliff negotiations, Republicans successfully cut off these extended benefits effective last week. But Senator Jack Reed has teamed up with Senator Dean Heller, a Republican from Nevada, to extend the program for another three months.

Since the economic crash in 2008, Congress has offered extended unemployment benefits after state benefits run out. Last year, during the fiscal cliff negotiations, Republicans successfully cut off these extended benefits effective last week. But Senator Jack Reed has teamed up with Senator Dean Heller, a Republican from Nevada, to extend the program for another three months.

With a vote looming next week, Senator Jack Reed called into the RI Future newsroom today to speak to the politics behind the issue, as well as the economic and moral imperative to protecting the people out of work “through no fault of their own” from further financial harm.

You can listen to our full conversation here:

]]> Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Can you tell I’m getting tired of having to “prove” stuff that is so obviously factual? Well, in case you couldn’t, I am tired of it.

In fact, even the winners in this zero-sum game have tacitly begun to admit that wage inequality is growing. For the last couple of years, the main counter-argument put out by the lackies of the very wealthy has become that, yes, inequality is growing, but it doesn’t matter.

That’s a lie, too.

Growing wage inequality was one of the primary causes of the collapse of 2007/8. It remains a primary cause of the ongoing Great Recession. Since the vast majority of wage earners were finding their salaries stagnant, if not shrinking, these same people had to rely on credit to finance many of their purchases in the so-called “Bush Boom” of the naughts. I say “so called” because, for the first time since the end of WWII, the median salary at the end of the “boom” did not reach the median salary at the end of the previous boom. That is, median salary in 2007 was lower than it was in 2000/01, before the mild recession that occurred at the end of the 1990s. This is stark proof that wages, for the vast majority of people who actually work for a living (as opposed to living off dividend income, or carried-interest) was not growing despite what Republicans were touting as a “booming economy”.

And spare me the morality play about the evils of credit, about how it shows a lack of moral fibre, how it demonstrates that people are too lazy, or too insistent upon immediate gratification, that they can’t wait and save to make purchases, blah, blah, blah.

Here’s a secret: Had people done this in the naughts, there wouldn’t have been enough demand to create even the wimp “Bush Boom”. The US would have remained mired in the recession that started in 2000 throughout Bush’s first term. I can say this with complete confidence because the only thing that fueled the expansion of the economy—such as it was—was that people were buying stuff on credit. This created the demand that created the expansion.

And demand is the key component. Corporations are swimming in money. They have so much money they can’t figure out where or how to spend it. More, they can borrow billions and billions of dollars at de facto negative interest rates. And yet, corporations are not spending money. If “supply-side” economics had any validity, businesses would be spending money like drunken sailors right now, and they would have been doing so for the past five years, ever since we hit the point of negative interest rates. Why haven’t they spent money? No, the answer is not the uncertainty of possible tax or regulatory changes. That is an absolute crock. If you actually read the business press (as opposed to listening to FOX News) you will realize that businesses are reluctant to spend because they do not believe there is sufficient demand for more products.

Demand. There you have it. The engine that truly drives economic expansion. My grandfather had a succinct way of describing conditions during the Great Depression: “Sure, a loaf of bread only cost a nickel. But what the hell, you didn’t have a nickel.”

In case anyone doesn’t get the point: it doesn’t matter how cheap things are because of a large supply. If people still don’t have the cash to buy stuff, it doesn’t get bought. IOW, there is no demand.

Demand.

And that is what is holding up recovery as the Great Recession enters its fifth—or is it sixth?—year. Got that, people? Sixth year. Lehman Brothers collapsed in 2008, while G. W. Bush was still president. Before Obama had been elected, let alone before he had taken office. Got that? George Bush was president. Hank Paulson, former head of Goldman Sachs was Secretary of the Treasury. Not Obama, not Geithner (although he was President of the NY Fed at the time).

Inequality matters, people. It matters a lot. It keeps demand down. When demand is down, people lose jobs. When people lose jobs, demand drops further, and more people lose jobs. This is called a death spiral. It’s essentially the same phenomenon, but going in the opposite direction, of what caused the inflation of the 1970s. And no, cutting wages DOES NOT HELP. Cutting wages is the equivalent of throwing people out of work. Yes, perhaps fewer people will lose their jobs outright, but demand will still decrease. It may—or may not—take a little longer, but the same result is attained.

So the answer is that people need to make more money. But what is happening instead is that the wages of most people are being cut. It’s the time of the year when a lot of companies are doing compensation planning. For many big companies, this is now a very simple process. A few people, maybe ten percent of the corporation’s employees, will get nice raises, maybe 5%, probably more. The rest will get nothing.

That is, the rest of the employees will get a pay cut. Their pay will remain the same, but even 1-%-2% inflation will erode stagnant pay. The result is a de facto pay cut. The result is a further decrease in demand. Funny: Republicans scream about how tax increases will hurt the economy because they will take money out of people’s pockets. But a pay cut does exactly the same thing, and yet Republicans fall all over themselves to demand—DEMAND—pay cuts.

It’s enough to make you suspect that Republicans don’t care about the economy at all. All they care about is tax cuts. All they care about is making the wealthy even wealthier. Even if it means the rest of us slowly slip into poverty.

This is because their wealthy corporate masters want tax cuts. So Republicans bow and scrape and say “Yes, Master” and move heaven and earth to give their masters what they want.

The rest of us can pound sand.

]]>