I see the Tax Foundation has some issues with disparaging comments I made about their data the other day. Scott Drenkard, one of their analysts, published a kind of defense, but managed to completely miss my point.

I see the Tax Foundation has some issues with disparaging comments I made about their data the other day. Scott Drenkard, one of their analysts, published a kind of defense, but managed to completely miss my point.

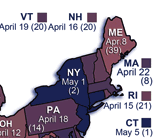

Here’s the story. The Tax Foundation, a DC “think tank”, put out a press release listing “Tax Freedom” dates for all the states. In their telling, you’ve been working for the government since January 1, and you only get to keep the money you earn after Tax Freedom day. In Rhode Island, that was April 15. In Massachusetts, it won’t be until April 22, and so on.

It’s an effective way to illustrate the point, which I suppose is why they do it, but there are some serious problems with their analysis. Topping the list, the state taxes included in their analysis count taxes you pay to other states. Rhode Islanders pay sales taxes in Massachusetts and Connecticut, and gas taxes that wind up in Alaska, and presumably income taxes to whatever states they happen to earn wages in if they work somewhere else. Fine. Maybe this is interesting to someone, but the point of information is to inform. If I want to know whether my state government is making good decisions, how will this help me? It won’t, because whatever decisions my state makes are mixed up with decisions other states have made.

And this isn’t even the end of it. Here’s more:

- The taxes we all pay are dominated by federal taxes. Because that federal tax is still somewhat progressive, the Tax Foundation analysis makes it appear that wealthy states have heavier tax rates than poorer states, just because they collect more money per person. Looking at their data, you might think that Massachusetts is more heavily taxed than Rhode Island, but in truth you can’t learn that from their data because there are multiple reasons why Massachusetts might be higher on the list. Their information has failed to inform about the very question you might consult the list to answer.

- The Tax Foundation data pretends to be for the current tax year, which is silly. The tax year 2012 isn’t even half over, and the most of the relevant data won’t be available until late 2013, at the earliest. Some components of those data will see multiple revisions before 2014. Municipal tax rates for half the year haven’t been set yet. The Tax Foundation is just guessing. Here’s the Center on Budget and Policy Priorities on how they’ve done in the past in this guessing game:

For example, the Tax Foundation’s 2002 report claimed that since 2000, tax burdens had risen in 38 states, fallen in five states, and not changed in seven states. When the Census Bureau released its data for 2002, it found that only four states’ tax burdens had risen, while tax burdens in 43 states had fallen (burdens were unchanged in three states).

In other words, the information is likely wrong, but we won’t know until late next year.

- The Tax Foundation analysis completely overlooks the distribution of taxes. “Taxes” are not one thing, they are many things. Poor people pay more sales and property taxes proportional to their incomes than rich people do. Rich people pay more income taxes proportional to their income than poor people do. Are these among the reasons states differ? The Tax Foundation data can’t say. The same tax rate pulls in far more money in rich towns than in poor ones. Which one is more heavily taxed? The Tax Foundation information can’t tell you.

- Tax Foundation property tax estimates don’t differentiate between areas with lots of vacation homes and those without. Block Island has a tiny tax rate because it has many multi-million dollar homes owned by people who don’t have kids in their schools, and most of whom don’t even live there. Much of the states of Maine (“Vacationland” says their license plates) and New Hampshire are in a similar situation. The tax assessor of Conway, NH told me once that almost half of their property tax bills are sent out of state. Are low taxes there a function of town policy or factors beyond their control? The Tax Foundation statistics can’t say.

An analysis that overlooks all these factors is a waste of pixels that could be better used to portray a kitten. These are numbers whose only legitimate use is to refute their own use. This is not scholarship. It is what Richard Hofstadter called, in his epic 1964 takedown of the intellectual style of the American right wing, the “apparatus of scholarship, even of pedantry.” It might look like scholarship, but the merest peek under the covers gives the game away and you discover vast tables of well-documented but unreliable numbers that don’t tell you what you think they might.

Sadly for our nation, the Tax Foundation has a reputable address and lots of money. They can afford a substantial staff who all wear nice ties in their pictures. (The women don’t, but there are only two of them, a law clerk and the senior fundraiser.) This is enough to garner respect in some quarters, and so their press releases are reproduced in our nation’s newspapers and state and federal legislators talk about their lists. And despite the many ways in which their lists are inadequate guides to policy action, that is precisely the way they are routinely used here in Rhode Island, to our detriment.

Because of the use their numbers get and the respect their address and funding earn, I’ve been checking out Tax Foundation data for almost two decades and have learned something about them. To their credit, they have voluminous footnotes — part of that “apparatus of scholarship” — where they amply document the strangeness of their analysis. What I’ve learned from those footnotes over the years is never to use their numbers. Like the example above, I can always trust their numbers to be right — about the wrong things.

Here’s the point: rankings are simple, but taxes are complicated. If all you know about taxes is where your state falls on a Tax Foundation list, you really don’t know much. Enjoy their lists — I certainly have had great entertainment from them over the years — but for heaven’s sake don’t use them.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387