While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

While zipping through Netflix the other night, I came across a movie about bootleggers–that I wouldn‘t really recommend. As I watched, however, something became very clear.

Demand.

Supply-side economists have this totally absurd notion that supply will create its own demand. That has to be one of the stupidest things I have ever heard. Why are there no Wal-Mart’s in the Yukon territory? Why did buggy-whip manufacturers go belly-up after the auto-mobile became popular? Why are there no stores that sell only items related to Reformation Theology?

Seems like a Wal-Mart should be enough of an attraction to create its own demand. Right?

Seems like a plentiful supply of quality buggy-whips should have enough appeal to create its own demand. Right?

And lots of books and pictures of Thomas Cramner, well, obviously, this is a supply that has to create its own demand. Right?

But then you have Prohibition. What happened there? Supply disappeared, at least in theory. So demand collapsed, because nothing is ever driven by demand. Right?

Except just the opposite happened. Demand created the supply. Just like illegal drugs. With sufficient demand, someone, and even lots of someones, will take great risks to produce a supply.

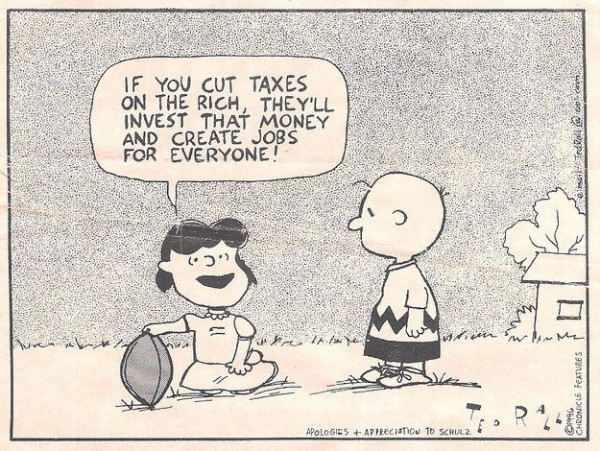

And yet, star-level economists, especially at the U Chicago insist that demand has no role in economic performance. Cut taxes, cut regulations, free the supply side and demand will follow. It HAS to! Our theory says it will! So it will be so!

Stop me if you’ve heard this one: my grandfather lived through the Depression. He had a line that held more wisdom than all of the collected works of the U Chicago school. My granddaddy had no illusions about “Good Old Days”, when it was all simpler. His line was “Sure, a loaf of bread only cost a nickel. But what the hell. You didn’t have a nickel.”

And there you have it. No matter how cheap a thing, people won’t buy it if a) they don’t want it (see Whips, Buggy above); or b) they don’t have any money.

Which leads to the current state of the economy. Five full years after the crash, a lot of people still don’t have jobs. Or, if they do, they are low-level service jobs that pay between minimum and maybe $10/per hour. $10 per hour grosses just shy of $21k per year. Can you rent for $400 per month? Can you keep a car on the road for $400 per month? Maybe that will cover gas, but you also MUST factor repairs and routine maintenance into that. Can you eat decently on $400 per month? And that means, you know, fresh fruits and veggies. Yes, you can get by on boxed mac-and-cheese, but that takes a horrible toll on your body. So we’re down to something like $500 per month discretionary. (Taking a month as 4.3 weeks). Not saying that’s not enough to get by on. It is. I know because I’ve done it (adjusting for inflation). But let me tell you, don’t plan on buying much.

And there, exactly, is the rub. I get so sick of people who say that employers have the right and the obligation to drive wages into the ground. And then say that workers should be thrilled to have any job,at any wage, no matter how pathetically low. Have to free up the job creators!

But what good does that do? Job creators are more free now than they have been in generations. They’re making huge profits. They’re sitting on piles and piles of money. So, they’re free*. Why don’t they create jobs? Or why don’t they create jobs that pay people a decent wage? Why is there a need to stockpile even more money?

Look, Henry Ford was a Nazi sympathizer. That is not a slur. It’s an historical fact. Go read anything about him and you will find out that he was so virulently anti-communist that he thought the Nazi government was a good thing, at least before the onset of WWII and the Final Solution. He figured out that it was a good idea to pay workers more than starvation wages. He realized that by paying his workers a good wage, he was creating customers.

In other words, he was creating demand for his products. In other words, paying workers more, and making a smaller profit, was in his best self-interest.

We are primed for a terrific natural economic experiment. Massachusetts is going to raise its minimum wage, gradually, to $11 per hour by 2017. The first increase is to $9/hour as of 1/1/15. Since Mass and RI currently have the same minimum wage, this means that millions of jobs will be fleeing from Mass, crossing the border into RI to take advantage of the lower wage. And it means that Mass will be plunged into economic darkness and decay because, everyone knows that a higher–and increasing—minimum wage will cost millions f jobs. By 2018, Mass will look like Detroit on a grand scale.

Everyone knows this. Just like everyone knows that millions of Rhode Islanders have fled to low-tax places like North Dakota and Wyoming. Because that’s what Econ 101 says.

Well, maybe those people should have stuck around for Econ 201, or 301. Maybe they’d have learned there’s more to the story.

And: assuming that my “predictions” don’t come true, and that the economy in Mass actually improves, I will expect a personal apology from every single person who says I’m wrong.

Because, fact of the matter, a higher minimum wage will stimulate demand. People will have money. They will buy more. That means companies will hire more people. And the virtuous cycle continues. If you want proof of this, cross the border into Canada, where the minimum wage is currently $11./hour. And then cross back. It’s like going from a First World country into a Third World country. When you cross back into the US, that is.

And if you don’t believe me, how about this guy?

]]> So I understand that a number of people are upset about the plan to move some of the probation and parole offices to downtown. This really came to my attention when on Facebook, Angus Davis posted the following:

So I understand that a number of people are upset about the plan to move some of the probation and parole offices to downtown. This really came to my attention when on Facebook, Angus Davis posted the following:

Governor Lincoln Chafee plans to relocate a parole office serving over 1,500 convicted criminals to the heart of Providence, which my company and others are trying to revitalize. This is an inside deal, a no-bid crony contract that would triple costs to taxpayers and was rushed through the state property commission with no debate just before Christmas. My letter: http://ang.us/KhkkK8 Please share + call Governor, (401) 222-2080 to oppose turning Kennedy Plaza into a Criminal Convention Center. Many of us are working to move Providence forward – this sets us back.

While I appreciate the concern, I also want to raise a few questions to help people fully reflect on this matter.

- Where, ideally, should parole and probation offices be located? It would seem to me they should be located near the central bus line, where people can most easily access them if they rely on public transportation. While the offices in the Dix Building of the Pastore complex are fine and will continue to serve many ex-offenders, they are not very centrally located and are not as easily accessed by bus as the Providence downtown area is.

- Do Angus Davis and others who have businesses downtown realize that ex-offenders are already downtown? Do they realize that many of them take the bus from Cranston and other outlying shelters to Providence and spend time there anyway? Do they also realize that current offenders do landscaping and garbage collection, among other jobs, and are also frequently downtown?

- What would it be like if, instead of categorically rejecting ex-offenders in the community, employers like Angus Davis considered setting up employment opportunities for ex-offenders in their businesses? They might find that some ex-offenders are quite employable and have a valuable contribution to make to society.

I welcome your feedback on this important matter.

]]> Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Wage inequality has been growing astronomically over the past 30 years. This is a fact. Anyone claiming otherwise is either ignorant or lying or both.

Can you tell I’m getting tired of having to “prove” stuff that is so obviously factual? Well, in case you couldn’t, I am tired of it.

In fact, even the winners in this zero-sum game have tacitly begun to admit that wage inequality is growing. For the last couple of years, the main counter-argument put out by the lackies of the very wealthy has become that, yes, inequality is growing, but it doesn’t matter.

That’s a lie, too.

Growing wage inequality was one of the primary causes of the collapse of 2007/8. It remains a primary cause of the ongoing Great Recession. Since the vast majority of wage earners were finding their salaries stagnant, if not shrinking, these same people had to rely on credit to finance many of their purchases in the so-called “Bush Boom” of the naughts. I say “so called” because, for the first time since the end of WWII, the median salary at the end of the “boom” did not reach the median salary at the end of the previous boom. That is, median salary in 2007 was lower than it was in 2000/01, before the mild recession that occurred at the end of the 1990s. This is stark proof that wages, for the vast majority of people who actually work for a living (as opposed to living off dividend income, or carried-interest) was not growing despite what Republicans were touting as a “booming economy”.

And spare me the morality play about the evils of credit, about how it shows a lack of moral fibre, how it demonstrates that people are too lazy, or too insistent upon immediate gratification, that they can’t wait and save to make purchases, blah, blah, blah.

Here’s a secret: Had people done this in the naughts, there wouldn’t have been enough demand to create even the wimp “Bush Boom”. The US would have remained mired in the recession that started in 2000 throughout Bush’s first term. I can say this with complete confidence because the only thing that fueled the expansion of the economy—such as it was—was that people were buying stuff on credit. This created the demand that created the expansion.

And demand is the key component. Corporations are swimming in money. They have so much money they can’t figure out where or how to spend it. More, they can borrow billions and billions of dollars at de facto negative interest rates. And yet, corporations are not spending money. If “supply-side” economics had any validity, businesses would be spending money like drunken sailors right now, and they would have been doing so for the past five years, ever since we hit the point of negative interest rates. Why haven’t they spent money? No, the answer is not the uncertainty of possible tax or regulatory changes. That is an absolute crock. If you actually read the business press (as opposed to listening to FOX News) you will realize that businesses are reluctant to spend because they do not believe there is sufficient demand for more products.

Demand. There you have it. The engine that truly drives economic expansion. My grandfather had a succinct way of describing conditions during the Great Depression: “Sure, a loaf of bread only cost a nickel. But what the hell, you didn’t have a nickel.”

In case anyone doesn’t get the point: it doesn’t matter how cheap things are because of a large supply. If people still don’t have the cash to buy stuff, it doesn’t get bought. IOW, there is no demand.

Demand.

And that is what is holding up recovery as the Great Recession enters its fifth—or is it sixth?—year. Got that, people? Sixth year. Lehman Brothers collapsed in 2008, while G. W. Bush was still president. Before Obama had been elected, let alone before he had taken office. Got that? George Bush was president. Hank Paulson, former head of Goldman Sachs was Secretary of the Treasury. Not Obama, not Geithner (although he was President of the NY Fed at the time).

Inequality matters, people. It matters a lot. It keeps demand down. When demand is down, people lose jobs. When people lose jobs, demand drops further, and more people lose jobs. This is called a death spiral. It’s essentially the same phenomenon, but going in the opposite direction, of what caused the inflation of the 1970s. And no, cutting wages DOES NOT HELP. Cutting wages is the equivalent of throwing people out of work. Yes, perhaps fewer people will lose their jobs outright, but demand will still decrease. It may—or may not—take a little longer, but the same result is attained.

So the answer is that people need to make more money. But what is happening instead is that the wages of most people are being cut. It’s the time of the year when a lot of companies are doing compensation planning. For many big companies, this is now a very simple process. A few people, maybe ten percent of the corporation’s employees, will get nice raises, maybe 5%, probably more. The rest will get nothing.

That is, the rest of the employees will get a pay cut. Their pay will remain the same, but even 1-%-2% inflation will erode stagnant pay. The result is a de facto pay cut. The result is a further decrease in demand. Funny: Republicans scream about how tax increases will hurt the economy because they will take money out of people’s pockets. But a pay cut does exactly the same thing, and yet Republicans fall all over themselves to demand—DEMAND—pay cuts.

It’s enough to make you suspect that Republicans don’t care about the economy at all. All they care about is tax cuts. All they care about is making the wealthy even wealthier. Even if it means the rest of us slowly slip into poverty.

This is because their wealthy corporate masters want tax cuts. So Republicans bow and scrape and say “Yes, Master” and move heaven and earth to give their masters what they want.

The rest of us can pound sand.

]]> In my last post, I talked about Clarence Thomas and his truly remarkable rise to a position that his father could never, ever have achieved. Indeed, even a slightly older Mr. Thomas would probably not been able to attain such a truly lofty height.

In my last post, I talked about Clarence Thomas and his truly remarkable rise to a position that his father could never, ever have achieved. Indeed, even a slightly older Mr. Thomas would probably not been able to attain such a truly lofty height.

This all sort of gets to the idea of social mobility. If someone were born into conditions like those into which Mr. Thomas was born, how likely is it for that person to improve his level of economic security? Or, how likely is it for someone born into the upper echelons, such as Mr. Thomas’ children (does he have any?) to fall out of the exalted perch onto which she was born?

America has long perpetuated the ideal that everyone can improve their status. This is still true. It is still possible. But how likely is it? Or, how probable is it? And here, I use ‘probable’ in the technical sense of “Probability and Statistics”, the name of a book on my shelf. “Possible” and “Probable” are two very different words, with enormously different implications. The right wing continues to flog the notion of possibility. Sure, it’s possible. It’s possible that I can throw a ball through a solid wall, too. Or that all the air molecules in a room will suddenly rush into one corner and leave the rest of the room airless. But are these events likely to happen? No. According to the technical definition, that means, that they have an extremely low probability of occurring. Could a high school basketball team beat the Celtics? I suppose it’s possible. But the probability of this occurring is darn close to zero. It may not be exactly zero, but it’s probably (!) close enough to be considered zero in any real-world scenario.

Let’s set this up. Suppose you have been put into a situation in which you must choose one of two balls. One is yellow; the other is green. If you choose the correct ball, you will be given $100 million. If you choose the wrong one, you will have to spend the rest of your days working at a minimum wage job. Of course, you don’t know which ball gives the desired outcome, so you have to guess. And hope. And, as any fool knows, you have a 50/50 chance of getting it right. And an equal chance of getting it wrong. In other words, it’s a coin flip.

But let’s say we change the scenario, and introduce a blue ball. But even given the extra ball, there is still only one ‘correct’ choice. One ball will get you the $100M; either of the other two will get you consigned to the minimum wage. What has happened to your chance of success? It has been diminished. It has gone from 1 in 2, to 1 in 3. That is, rather than a 50% likelihood of success, you have a 33% chance.

For the next iteration, we’re back to two colors, red and green. The red ball gets you the $100M; the green results in the minimum wage job. But you have to pick either of the two balls out of a basket in absolute darkness, so you can’t see which ball is which. We’re back to 50/50. But let’s start adding green balls. If we add two more green balls, for a total of three green, one red, your chance of success has been cut in half. It’s now 1 in 4, or a 25% chance of success. Starting to look grim, isn’t it? Now let’s bring the total of green balls up to ten. This is a 1 in 11 chance, and suddenly your chances of success drop below 10%.

This is what tax cuts, cutbacks in social spending, cuts in education have been doing: they have been adding green balls into the system. At least, they’ve been adding green balls into the basket from which those on the lower end of the scale have to choose. At the same time, these policy choices—tax cuts, cuts in social spending, cuts to education—have been adding red balls into the basket from which those born into the upper echelon get to choose. In other words, we’ve been increasing the odds against success for those in the bottom half, while increasing them for those at the top. Put another way, we’ve been rigging the game in favor of those at the top. How would you feel about entering the game with the odds of success sitting at 11 to 1 against you? Would you want to take a chance on winning the $100M if there were a 9o% chance of being consigned to the ranks of minimum wage workers? Kinda stinks, doesn’t it?

This is what I meant in my previous post about my good fortune. I got to pick from a basket that was probably 75% red (good) balls. Yes, I could have failed, made a lot of bad choices, and ended up dropping. But the game was rigged in my favor from the start. Yes, I had to work for what I got, but that does not change the fact that I had an enormous head start over a lot of people.

And that, I think, is the clearest difference between a liberal and a conservative. A liberal recognizes—or never forgets—where she or he started. A liberal is aware that there were, there are always extenuating circumstances. Had Clarence Thomas worked twice as hard, but lived in the wrong place or time, all his effort may have been in vain. A conservative, from what I see, becomes convinced that they made it solely on their own merits. They fail to contextualize their success. They remember the work they put in to getting where they are, and nothing else. Yes, this is not the whole story of the differences between the two, but I think that it may be the single key difference. Clarence Thomas, or Rush Limbaugh, or—the golden example—George W Bush are all convinced that they did it on their own. No one helped them. They don’t think that the stable family environment, or the genes or temperament that put the grit into their belly to succeed was an advantage that, perhaps, other people don’t have. They don’t see that being in a semi-decent school with semi-decent parents who instill values gives them a big leg up on a lot of other people. They forget that they happened to be born at a good time, or a good place.

So conservatives don’t see why other people might need help. Perhaps growing up they did not have the advantage of government assistance (but they did; they just fail to recognize this, or to acknowledge this), so why should other people get this help? So we continue with the aforementioned policy choices—tax cuts, cuts in social spending, cuts to education— and what we’re doing is increasing the number of people who have to choose from the basket of mostly green (bad) balls. Each cut to Head Start, or SNAP, or job training, or education, we’re both adding to the number of green balls and increasing the number of people choosing from this basket. In other words, we’re stacking the deck against them. Such behavior would get you shot in a lot of gambling establishments. Ask Wild Bill Hickok.

If you don’t believe me, here’s some evidence.

Take a look at the chart on page 10 of the report at the link. For someone born into the bottom income quintile, there is more than a 33% chance that they will end up there. For someone born into the top quintile, the odds are over 37% in favor of them remaining. But it’s worse than that. There is a cumulative probability of 60 percent that someone born in the bottom quintile will stay in one of the bottom two quintiles. That is, they will never be above what the lowest 40% of the country makes. That is, they only have a 40% chance of making it to middle class.

BUT: for each percentage point you move up in the scale, your chances of remaining in the top levels goes up. That is, someone born in the 95th percentile, their chances of staying there are about 75%.

As for where the most people make it, or remain stuck where they are, check out the second link.

http://www.equality-of-opportunity.org/

What you find is that the places with single-digit movement from the bottom to the top are largely in the South. You know, the area of the country where low taxes, low union density and small-but-business-friendly government is attracting lots of Good Jobs. Just gobs and oodles of them! Charlotte, North Carolina is a great example of how this works. Remember, MetLife was planning to move several hundred jobs from RI, and a thousand (or more) from the Northeast to Charlotte, that land of opportunity. See! Charlotte attracts Good Jobs! But, per the second link, of the top 50 metropolitan areas in the US, Charlotte is #49 in inter-generational upward mobility. There, only 4% of those born in the bottom quintile can be reasonably expected to reach the top quintile. And note, that means the 81st percentile. Admission to this is a salary of about $78k per year. We’re not talking about top-flight surgeons, or anything such. We’re talking a solid job, something around what a teacher with ten years experience makes here. So the chance of someone being born into the bottom quintile of ending up with a job with a teacher’s salary is less than 5%, or 1 chance in 20. How would you like to pick from that basket?

As for the idea of talent, well, it ain’t what it used to be. An average student born into a family in the top quintile is several times more likely to graduate college than a bright student born into the bottom three quintiles. What this means is that the uninspired student from wealth is picking from a basket with lots of red (good) balls in it. And even if someone from the bottom 40% does beat the odds and finish college, that’s not the guarantee of success it once was. Average wages for college grads have been falling over the past 10 years, so I don’t want any nonsense about how all people have to do is pull themselves up by their bootstraps and work their way through college, blah, blah, blah.

Is this the kind of country we want? Where most people are pretty much destined to fail?

]]>

A few weeks ago, my church had a Sunday sermon devoted to stewardship. Translated, that means how much are you going to pledge to donate to the church for the coming year? This year, the priest asked people in the congregation to stand up and explain why they gave. Now, I was a coward and did not speak in public. But I had thought of something that I thought clever, and that’s why I didn’t say it out loud: cleverness often comes across as something unpleasant.

A few weeks ago, my church had a Sunday sermon devoted to stewardship. Translated, that means how much are you going to pledge to donate to the church for the coming year? This year, the priest asked people in the congregation to stand up and explain why they gave. Now, I was a coward and did not speak in public. But I had thought of something that I thought clever, and that’s why I didn’t say it out loud: cleverness often comes across as something unpleasant.

My point was that I give to a church because I can. As a friend of mine describes it, I hit the cosmic lottery. Of all the places and times I could have been born into, I had the supreme good fortune to be born at a time, in a place, and to a family that gave me an enormous chance at being successful. In fact, the odds were stacked so far in my favor that I more or less succeeded despite my best efforts to screw it up. I have attained a level of physical comfort that 99% of the people who ever lived–royalty included–could only have dreamed about attaining.

That’s rather appropriate for a post-Thanksgiving thought. I am darn grateful for this opportunity. I’ve been on the underbelly of prosperity. I won’t say I was poor, because I wasn’t. But I was in a situation where money was in short supply, even if my basic needs were always met.

But the point. I was skimming a blog that has a strong right-wing bias. One of the entries was a review of a book about Clarence Thomas, the Supreme Court Justice who also has a decidedly right-wing bias. Apparently, Thomas spent a childhood of difficult poverty, and difficult family circumstances. Yet, he overcame these to become a member of SCOTUS. That is one huge accomplishment. It’s difficult enough for a child of privilege and opportunity to attain such a height, let alone someone from a background like the one Thomas had.

Now, of course, Thomas is convinced that he made this on his own efforts. Be if far from me to disparage or belittle what Thomas has achieved. And yet…time and circumstances matter. Had Thomas been born as few as ten years earlier than he was, and certainly had he been born twenty years sooner, no amount of Herculean effort would have gotten him to where he is. He could have worked twice as hard and been lucky to get half as far.

Thomas benefited, to an enormous degree, from the era in which he was born. He reached the peak of his career when the idea of an African-American Justice was not an alien, or a laughable, concept. He became a member of SCOTUS in 1991. In 1981, I think it would be highly doubtful that he would have been nominated. This was Reagan’s first year in office; would he have nominated Thomas? Would Reagan have made Thomas his first appointment? Probably not. And too, let’s face it, the country was not ready for someone as conservative as Thomas is. Now, this last statement is a matter of my opinion, but it took a long time for the right wing to gain the control it did. We were just coming out of the 70s; hedonism was still cool and it seemed like marijuana legalization was going to happen. And if he had been at the same point in his career in 1971, there is virtually no chance that he would have been considered for such a post. Thurgood Marshall was on the Court; another African-American would have been out of the question for any Republican president, let alone someone like Nixon.

And yet, he and the right wing would have us believe that the people at the top made it solely on their own efforts. Their own effort is certainly a necessary condition, but it’s nowhere near enough. Effort has to be matched with time and circumstance. The conditions that made it possible for Thomas to reach the pinnacle that he did are the same ones derided as giving Sonia Sotomayor an unfair advantage. Thomas made it on merits; Obama was a creation of affirmative action.

Do we see the hypocrisy?

Again, I do not mean to detract from Thomas’ accomplishment. I disagree with the man about 95% of the time, and I sincerely wish he was not on the Court, but that he has overcome obstacles he has is truly impressive. I only wish he would realize that he did not do it on his own, that the time and circumstances under which he came of age had an enormously beneficial effect on his efforts. More, I wish he would stand up for those who still languish under horrific impediments to accomplishment. I wish he would not continue to boast of his achievements while standing on the heads of those who would follow him.

More, I wish the entire right-wing apparatus would stop pretending that anyone and everyone who tries can “make it”. Yes, it’s possible for every child born in this country to become president, or a CEO, or whatever. It’s possible. A lot of things are possible. But difficult circumstances are holding a lot of people back. And not just from rising to become a member of SCOTUS. But from simply rising into–or staying in–the middle class. Thomas and his right-wing cronies are standing on people’s heads, or even their necks, holding them down, destroying the sorts of opportunities that Thomas and the rest of them enjoyed. They hold Thomas out as an example of what can be, even when they’re trying to ensure that there won’t be any more like him.

I applaud Thomas for doing what he has done. I strenuously object to the way he is trying to pull up the ladder behind him.

]]>

The picture to the right is called “Christmas dinner in home of Earl Pauley near Smithfield, Iowa…” This is Christmas for a farm family in Iowa in 1936. This is the world that conservatives call the ‘good old days’.

This is the sort of country conservatives believe we should have. Again.*

This was the age before Social Security, before Medicare, before welfare, before government regulation. This is a farm family. They worked hard–so hard that you and I probably cannot begin to conceive of how hard they worked. I’ve done farmwork, but it was mechanized, and it was still damn hard. So this family worked hard. There was no unemployment insurance. These were not urban welfare queens. They had not made bad choices, unless trying to run a farm should be considered a bad choice. They were not coasting, using the safety net as a hammock, because there was no safety net.

I assume the family in the picture is living on its farm. A lot of families lost their homes in the period 1929-1936 because they couldn’t pay the mortgage. Farmers in particular lost their land because their crops died in the field–if they grew in the first place–because of a stretch of drought that lasted several years, and that led to the Dust Bowl. My grandmother lived through the Dust Bowl in Kansas. Her stories were horrific.

You need to look at this and remember that this is the world that conservative politicians want to bring back. They want to kill all the social programs that were created as a result of the Great Depression. Conservatives want people who lose their jobs, through no fault of their own, to be pushed down to the sort of life that you see in this picture. They want people without work to fall into the sort of poverty that you see here. They may not realize what would happen if we follow their policies and gut social programs and all assistance to anyone but the wealthy. They may not realize what the implications of their policies will be, but the picture gives you a graphic example of the world that conservatives want to re-create.

Oh no! they proclaim. Getting rid of all this government will release the job creators, and they will create jobs! For everyone!

Bull.

The job creators at the time of this photo were fully unleashed. They were barely regulated. They were lightly taxed. And yet the people in this picture were living the way you see. Dirt floor. Bare plank walls. Where was the magic of the market? It didn’t solve the problems then. It didn’t help the people you see here. Rather, the people you see got to the condition you see because of the lack of regulation, and the lack of government support, and the low tax burden on those at the top of the economic pyramid.

The unfettered might of the market did nothing to help the people you see here. In fact, those with money shrieked that these people had to be left on their own, to starve if necessary. Any attempt to interfere would destroy prosperity. In fact, any interference by the government was immoral. But even a casual glance at this picture will tell you that any prosperity this family had ever known had been destroyed some time ago, and all because of the magic of the market. The only thing immoral was the sanctimonious attitudes of the upper echelons who let families live like you see in the picture.

If you read Friedman’s Monetary History of the United States, you will see that he talks about a seemingly endless series of economic crises, starting in the 1870s and carrying through to the Great Depression. That’s a period of 50-60 years, and there were three acute recessions and at least one depression (depending on how you define the downturn that began in 1873), and the last depression was so bad we call it Great. This averages to almost one crisis every fourteen years; the ‘teens of the Twentieth Century were marked by the Great War, so it’s difficult to compare this to ordinary periods.

One crisis per generation.

This is what the magic of the market created. A downturn every 14 years on average. Just about every generation was hit by a very nasty downturn, all in a period when there was no one to help. Private charity? Private charity is only viable during a period of economic expansion; when unemployment is above 10%, there simply aren’t enough people with enough money to make private charity effective. That’s why you have a family going through an experience like the one in the picture. Because people of the time relied on private charity.

And these were crises without unemployment assistance, food stamps, housing subsidies, with no government assistance whatsoever. People caught without work for six months or a year or three years had nothing to rely on, but they still couldn’t get jobs. Talk to people who lived through the Depression, quickly, while they’re still alive. They will all tell you, there was no work to be had.

And, btw, Friedman’s thesis that the Great Depression could have been avoided has been shot full of holes by our current situation. Friedman claimed that the Fed could have solved the problem through looser monetary policy. Since 2008/9, the Fed has been doing just that, pumping huge amounts of money into the economy in any way possible. And the same conservatives who howled about FDR have been howling about Bernanke. Has the policy worked? Well, we didn’t have a depression, at least not one like our grandparents lived through, but ask a recent college grad how easy it is to find a job. Look at the unemployment rate. So Friedman was a quarter-right at best. Monetary policy alone cannot solve the economic problems we faced in the early 1930s, nor the problems that we are experiencing in the early 2010s

Nor can the magic of the market create prosperity for all, except for relatively short periods. If capitalism produced a crisis every 14 years, that means if you were fortunate enough to graduate into an economic expansion, you should expect a downturn by the time you hit 40. Then maybe you’ll benefit from the upturn by the time you hit 50. Of course, by then you will have lost five or ten of your prime wage-earning years. So how are you supposed to save for retirement?

So look really hard at this picture. Think of it the next time you hear someone claim that we need to unshackle the job creators. Think of it and remember that the Titans of Industry screwed it up in the 1920s, and the 1900s, and the 1890s, and the 1870s…that’s a lousy track record. The Titans of Industry created the world you see in the picture.

*This is an incredibly harsh statement. I do not ascribe malign motives to sincere conservatives. I am not saying conservatives are evil people who wish misery on others. However, ideas have consequences; we have a moral obligation to understand the ramifications of our policies and of what we advocate for society. In this, I believe, the conservatives fail. Perhaps this is because they do not understand history; but a point is reached where there must be willful ignorance of what they advocate. History is so very, very clear, if you realize that there was history before WWII, or even before 1970. I keep coming back to this, but it continues to be true: we tried it their way. It did not work. Most of human history has been a long, dreary experiment in laissez-faire markets. The outcomes were horrible; look at this picture.

And if free markets or government regulation or interference or high taxes didn’t cause the situation in this picture, what did? They have no real answer for that question.

So yes, I realize I am making a terribly provocative statement; but the point stands. If we follow their advice, this is where we will end up. Again.

]]> It’s 7:00 in the evening. You, a Rhode Island resident, are at the mall in Attleboro. You’re out to dinner in Seekonk. You’re on vacation on the Cape. Suddenly, your teen-age child collapses, unconscious.

It’s 7:00 in the evening. You, a Rhode Island resident, are at the mall in Attleboro. You’re out to dinner in Seekonk. You’re on vacation on the Cape. Suddenly, your teen-age child collapses, unconscious.

What do you do?

Do you call an ambulance? The child is unresponsive. His eyes are rolled back in their sockets. He appears to be breathing shallowly. I repeat: what do you do?

Do you call 911? Or do you try to assess whether the situation is dangerous, whether you should try to take him to the hospital yourself, or whether you should just take him home and call a doctor in the morning? Which do you choose? And no, you’re not a doctor, and no, you don’t even play one on TV.

Some would suggest we should choose the latter route. Or, if we decide to go the ambulance route, we should call several providers, trying to see who has the best price, then see if we can haggle it downward a bit. Or maybe ask if they’ll take a chicken as a discount. In the meantime, your child is still unconscious. But being the hyper-rational homo economicus that you are, you pull out the copy of the local yellow pages you always carry in case of situations like this, or you use your smart phone to search the web for the local services, and then you coolly work the market and see what sort of price you can get.

OK, you’ve done that, only to find that the best deal you can get is $2,999.99. Now, you have insurance, but it will only cover 80% of the charge after the deductible is satisfied, and only if the situation is deemed an emergency. Well, your kid is unconscious; does that, in and of itself constitute an emergency? Are you a doctor? No. Do you have a clue whether it’s truly an emergency? No. And, 20% of that ambulance bill still comes to $599.98, assuming that everything goes as planned, that your deductible has been met, and the insurance will actually cover the 80%.

So what do you do? Does this change your behavior?

And remember: you get your insurance through your employer, so it’s not like you can negotiate your own deal with the insurance company. And that’s a good thing.

And what if your checkbook balance is somewhere south of $800 at the moment, and you still have to make the car payment? That $599 will take a pretty good bite out of that. If you’re making RI median, your next check will come in somewhere between $1200 & $1300 (depending on deductions, etc). And remember, this is just the ambulance. If you do go to the ER, there will be a plethora of other charges: for tests, x-rays, CAT scans/MRIs, physician services, and so on.

One thing that’s important to remember is that something like an ambulance, or an ER, has to be staffed and prepared at all times. An ER will probably use its facilities on a fairly constant basis, so there isn’t a lot of down time. That is not necessarily true for an ambulance. Maintaining and staffing that ambulance 24/7 costs money. Now, if you depend on paying for the ambulance by billing the people who use it, a significant part of the bill will be for maintaining that service when it’s not in use. So that means the price has to be a lot higher than just the cost of that particular run. A lot higher.

Now, we could subsidize the ambulance service as a common good; but that means taxes have to go up to pay for that. Since people who decide the level of taxes probably don’t have to worry about a couple of grand if they need an ambulance, they won’t see the point of having to pay taxes all the time to support an ambulance service that they may never need. Let the people who need it pay for it. Sounds ever-so-sensible. So the poor schnooks who do have to worry about having to pay a couple of grand for an ambulance will pay for all that down time out of their pocket.

But that’s fair, isn’t it? If you make the bad choice and get sick, well, hey, you made that choice. No one put a gun to your head and made your kid pass lose consciousness.

So you go that route. You kid goes to the ER, gets half-a-dozen tests, and, thank the Lord, appears to be fine. So you all go about your business for another month or so. And then the bills (note the plural: bills) start to come in. The first is for the ER, and that’s around $4,500. But your insurance works as planned, so your only responsible for $900 (which is 20% of the total). Then there are the bills for the MRI, the blood tests, physician services, yadda yadda yadda. These clock in at another $1,500, so you only have to pay $300. So we’re over a grand already.

Then the ambulance bill comes. Oh, that was out of network. So sorry! You’re not covered!

So now you’re faced with the whole $2,999.99.

And the whole episode cost something like $9000 (Well, technically, $8,999.99, using the figures I’ve presented).

Now, how would you have acted when your kid collapsed? Would you have rationally balanced a potential bill of about $4,300 against some unknown ailment with unknowable consequences? Would you have considered the hole this was going to blow in your budget and said, “well, I have no idea what’s wrong with my kid, but maybe it’s not a big deal?” Or do you go the ambulance/ER route with no clue what it’s going to cost?

Would you have done anything differently?

]]> In past posts, I have explained actions that businesses–usually large corporations–have taken that are decidedly contrary to the interests of the general public. For this, commentors have claimed that I’m anti-business, that I’m using scare tactics, I’m just a socialist, or some combination thereof.

In past posts, I have explained actions that businesses–usually large corporations–have taken that are decidedly contrary to the interests of the general public. For this, commentors have claimed that I’m anti-business, that I’m using scare tactics, I’m just a socialist, or some combination thereof.

However, in the news over the past month or so we have seen two excellent examples of Business Behaving Badly. The first, of course, was the decision of MetLife to summarily fire all of its Life Administration employees here in RI and other parts of the Northeast and across the country, in order to move those jobs to North Carolina. MetLife is firing these people in order to pad its already high profits: $1.4 Bn for 2012. That seems to be contrary to the interests of the general public.

And yes, these people are being fired. There is no other word that accurately describes what is happening. Fired. For no fault of their own. Without cause. With no justification other than it better suits Met’s interests. A lot of these people have worked loyally for Met for periods often measured in decades. The reward for loyal service is to be fired.

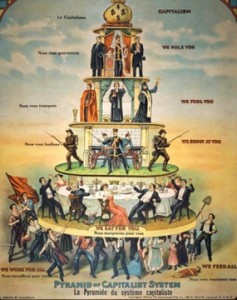

How does that fit with the propaganda that the free market will take care of employees better than any government? Answer, it doesn’t. What it does do is illustrate to perfection how a corporation will take care of its own needs, regardless of the number of lives that are damaged in the process. It’s all about increasing the benefits that flow in a torrent to those already at the apex of the financial pyramid.

The second example is the explosion of the fertilizer plant in West, Texas. Now, from what I can gather, this plant was not part of some multinational corporation. A company like Met could have bought and sold it out of the spare change in the couch cushions. But it was a business, run for profit. One way of increasing profit is to cut corners on safety issues. Despite the fact that ammonium nitrate was the explosive of choice used by Timothy McVeigh in the Oklahoma City bombing, those in charge of the fertilizer plant did not consider this a safety risk, Records indicate that the risk that concerned them most was the possibility of a leak of ammonia gas. This would be a bad thing, but not catastrophic.

So the company took no steps to mitigate the possible risk. Why not? Because they did not see the need, and taking steps would have cost money.

Now, it appears that no one in the town particularly blames the company, and the company was certainly not a rapacious corporation hell-bent on increasing profit. Still, the fact remains that no safety precautions were taken, and fifteen people are dead because of the lack of precautions.

The third example is the worst and most blatant of all: the collapse of the building in Bangladesh.

One thing we all hear about is the need for ‘common sense’. Doesn’t it seem that ‘common sense’ should include taking precautions to reduce the risk of a fire at a plant that stores large quantities of highly-explosive material? If you’re making dynamite, shouldn’t you build risk-mitigation into your plans? And ammonium nitrate, in the quantities on hand at the fertilizer plant is every bit as dangerous as dynamite. You can take Timothy McVeigh’s word on that. Doesn’t ‘common sense’ tell you to build a building so it won’t collapse?

It also appears that the fertilizer company may not have actually broken any laws. That also seems to be part of the problem. The plant is in Texas, and Texas prides itself on being a land of lax regulation. So fifteen people died so Texas could maintain its macho image of ‘hands-off’ conservatism. IOW, it’s more like Bangladesh, and less like the rest of the US that foolishly insists on standards. More, 68 people have died in mining accidents in the new millennium. The common thread of all these deaths is the lack of safety precautions. Why did the companies in question not take proper precautions? Because they cost money, and no one made them take the precautions.

In many ways, the impression is that the West Fertilizer Company was actually a fairly benign employer. In many ways, that only makes things worse. If this is how a well-intentioned company acts, how much worse are those actively looking for corners to cut?

This is how business will operate in an unregulated, or lightly-regulated market. Most businesses will be responsible, but there will always be a few who don’t. And when these businesses behave irresponsibly, and profit from this lack of concern, others will mimic that behavior and start cutting corners, too. And people will die. And it doesn’t have to be a business like mining, or fertilizer production with their built-in dangers; it could be the result of locked or nonexistent emergency exits, as happened in the Hamlet, NC chicken plant fire where 25 people died, or the even more horrific Triangle Shirtwaist fire, which killed over 140 people.

We are told that regulations in the US are too onerous. That they cost businesses money, and so jobs. We are told we need to lighten the regulatory burden on business, so that we can create jobs. IOW, we need to become more like Bangladesh, with its light (non-existent? Certainly not-enforced) regulations, no unions, and starvation wages for its employees.

You get what you pay for.

This is what happens when businesses are left to police themselves. Things are no different now than they were a century ago.

]]>

In the brouhaha about MetLife leaving, I did see and hear people try to blame this on the too-high RI taxes. Of course; it’s always about the taxes, isn’t it? I would like to make one point about that.

For 2012, MetLife reported $1.4 Bn of operating earnings. In comparison, the $80-90 Mn of tax relief that the will receive would just register as a rounding error in any single year. But those tax savings will be spread out over a number of years. As such, they don’t even constitute a rounding error.

Any company, of any size, that makes long-term decisions based on a few years worth of tax savings is not a company that will be around long enough to realize those savings. Only a company in dire straits would make so drastic a move for so little return. Because let’s face it, the up-front investment that is required will more than eat up those tax savings. In such cases, breaking even is a good result in the real world.

No: the savings will come from other areas: lower rent vs what is being paid in the Northeast, in greater Chicago, in the SF Bay area; it will come from lower wages paid to younger workers who do not incur the disability and medical expenses an older workforce will incur; it will come from pension benefits that do not continue to accrue to said older workers, and that will not be paid at all to younger ones. That’s where the money is.

No, RI’s problem is not the tax structure. It’s the size that matters.

The sad fact of the matter is that RI does not have its own economy. RI is a pale reflection of what is happening in Boston. Nor is this a recent development: it was already true in the early 1980s. Look back at the numbers; that was the period when Dukakis was creating (or taking credit for) the “Massachusetts Miracle.” The 128 Loop was America’s Technology Highway, where high tech lived before being superseded by Silicon Valley. Massachusetts recovered sooner than most of the country from the recession of the late 1970s; RI was a couple of years behind.

Then, in the mid-eighties came the phenomenon of Woonsocket turning into a bedroom community for Boston. Same with Nashua NH. Around then the ProJo carried a story of people taking classes to lose their RI accent because they felt that companies in Boston believed that people with an RI accent were less intelligent.

So, no, this is not a new phenomenon. What I have cited is anecdotal; but the numbers in the BLS and Census, etc. will support these contentions.

Also according to the US Census, in 2000, 79% of the population of the US lived in urban areas. In states like Nevada, it’s upwards of 90%. More, 45% of the population of the US now lives in the top 20 urban areas. In the meantime, the Census Bureau also says that one-third of all counties in the country are being drained of population. What does this mean?

It means that the urban concentration that began at the end of the 19th century is continuing. More and more people are living in and around cities while other areas languish. Telecommunication, and telecommuting were supposed to make cities obsolete; the opposite is happening. Telecommuting was all the fad in the late 90s and into the new millennium; now, companies are eliminating it.

It means that, in order to compete, size is a huge factor. Charlotte NC is now the #2 financial center in the country, after NYC. It has surpassed Chicago, with its Mercantile Exchange. It is the #2 center largely because the #1 bank, Bank of America, has its HQ there, and Wells Fargo has its East Coast operations HQ there. The Charlotte Combined Statistical Area has 2.4 million people. This is not rural America anymore.

With a million people, Rhode Island cannot compete with such a center, any more that it can compete with Boston. The advantages of a large educated, concentrated workforce with good infrastructure and a compact geographical footprint are too great to overcome. This is why NYC not only continues to exist, but to thrive, in the face of all the reasons conservatives say it shouldn’t: high taxes, big government, and whatever else they complain about. Half of the wealthiest zip codes in the country are in NY and NJ, both of which are high-tax states.

RI is not losing jobs to lower tax states; RI is losing jobs because the vast majority of jobs are in these concentrated urban areas. If jobs aren’t there already, they’re relocating there. I heard a story on NPR that a growing company in Kansas could not find workers. That’s because no one is willing to relocate to a small town that depends on a single employer; what happens when that employer decides to off-shore the jobs? People are stuck in a small town without prospects. In a larger metro area, there are other jobs, or at least a greater possibility of other jobs.

Size matters. The country is not de-urbanizing. Exactly the opposite.

Addendum: The point is, MetLife made its decision to relocate to NC for its own reasons. Only then did it approach the NC government and see how much it could extort from the state’s taxpayers. In other words, MetLife got money from the state to do exactly what it would have done without the tax breaks. In fact, there have stories to this effect in the North Carolina media, complaints that the state of NC got played for chumps by a large company.

And, btw, NC in general, and Charlotte in particular, have unemployment rates that are only a couple of tenths of a percent lower than what RI and Providence has. It’s not exactly boom-town down there, either.

So, yes, NC is getting the jobs. But they would have gotten the jobs without the subsidies. So no, it’s not about the tax rates, no matter how often or how loudly conservatives will say it is.

]]> Here’s a familiar story. A man and a woman get married when they’re young. Time passes, they age, they grow, and, before you know it, 25 years have passed. Then, one day, with no real warning, the man tells the wife that she’s too old. He’s dumping her for a younger woman who doesn’t have the wife’s expensive tastes. The wife protests, pleads, but to no avail. The husband has made up his mind. He’s leaving, selling the house, and moving out, more or less dumping the wife on the street. T0o bad.

Here’s a familiar story. A man and a woman get married when they’re young. Time passes, they age, they grow, and, before you know it, 25 years have passed. Then, one day, with no real warning, the man tells the wife that she’s too old. He’s dumping her for a younger woman who doesn’t have the wife’s expensive tastes. The wife protests, pleads, but to no avail. The husband has made up his mind. He’s leaving, selling the house, and moving out, more or less dumping the wife on the street. T0o bad.

This story is so cliche, so hackneyed, that selling it as a book or movie would be very difficult. However, it’s a story that I believe conservatives, libertarians, and–especially–capitalists love. It’s not just a story for them; it’s a paradigm, an ideal, an aspiration. They look for opportunities to do this, they lust over such opportunities to find a younger, less empowered, more pliable partner that can be browbeaten and coerced more easily than the stronger, more mature woman.

Of course, I’m not talking about marriage. It’s a parable, similar to the one told to King David after he’d arranged for the death of Bathsheba’s husband. The king became outraged, and then he was made to realize that he was the culprit.

The news just broke that yet another large, powerful corporation has decided to dump long-serving employees and replace them with younger, cheaper replacements in a warmer climate.

2o years, 3o years of service? Too bad. You’re out. We want younger, cheaper people somewhere that has a lower standard of living. Your loyalty? Who freaking cares?

When I have suggested that corporations behave in such a manner, I’ve been met with howls of protest from the corporate lackeys, who call me a hater, an anti-corporate socialist (somehow, the lowest form of life). When I provide examples, like the one above, I’m called a liar. And yet there are several hundred (the exact number is hard to pin down) families in RI and environs having grim dinner time conversations because the job that’s been there, to which they’ve given their youth and the best years of their life is being pulled out from under them. There was no warning. Just a hastily-assembled meeting or phone call.

And then there will be those howling that this is what companies have to do to take care of their shareholders. What a load of crap. Moves like this, generally, provide a quick bump in stock price, but have almost zero long-term positive effect on stock price. What they do impact are bonuses; the ones who made the “tough choices” are amply rewarded while those suffering the tough consequences are often left twisting in the wind.

And whatever happened to the employer’s loyalty to its employees? I believe that Econ 101 teaches that an employer will nurture its valuable employees because of the value they add. Funny, the people screaming that minimum wage increases will cost jobs because “that’s just Econ 101” must have been hungover and slept through class the day that employer loyalty was discussed. I keep going back to Henry Ford, but the dude was almost violently anti-communist, and this is why he decided to pay his good employees enough to keep them. He knew he was buying their loyalty, and paying them enough to be able to buy his product.

IOW, he took the long-term view, which today’s short-term managers almost never do. For most of today’s managers–and that’s all that CEOs are, for the most part: hired help, not the steely-eyed builders of a business as per the Ayn Rand fantasy world–are all well-schooled in the I’ll Be Gone school of management. This teaches: “loot the company, make your money, and leave before the chickens come home to roost.”

The other issue that conservatives claim is that people who lose their jobs are responsible. So tell me: how do several hundred people all screw up so badly as individually that they get fired collectively? How does that work? Outside of the Ayn Rand fantasy world? All of them? All at once?

No, their collective sin is that they’ve stayed too long. They’ve been loyal employees, through thick and thin, for better and for worse, in sickness (by coming to work instead of taking care of themselves) and in health, through good times and bad. So their collective reward is to be told that the company is moving south; of course, they’re welcome to apply for their old job, but they might end up with a pay cut.

This, so the company can pay people at the lower end of a lower scale, and, not coincidentally, get rid of older employees whose health has perhaps deteriorated–perhaps because they worked when they should have been home sick–and replace them with employees that are not only younger, but in better health. So they won’t cost so much in sick time or disability leave. And of course, the long-service employees will no longer be able to fund the pension that they were guaranteed when they signed on, limiting future pension liability. And of course, the new hires won’t get anything as archaic as pensions, even though the evidence against the efficacy of 401(k) programs is starting to mount. No, grind out your life working until the magic day you drop dead. And, btw, be so kind as to do that sooner rather than later. The corporate overlords thank you for your consideration.

So welcome to the working world, in this brave new millennium. Because this is exactly how things are, my friends. Welcome to the working world–just don’t expect to stay too long.

]]>