Candidate for Treasurer Seth Magaziner says that he has a history of standing up to big Wall Street firms, highlighting his work as the author of a shareholder proposal to break up Citigroup. He has worked at Trillium Asset Management, a socially responsible investment firm, for the last four years.

Candidate for Treasurer Seth Magaziner says that he has a history of standing up to big Wall Street firms, highlighting his work as the author of a shareholder proposal to break up Citigroup. He has worked at Trillium Asset Management, a socially responsible investment firm, for the last four years.

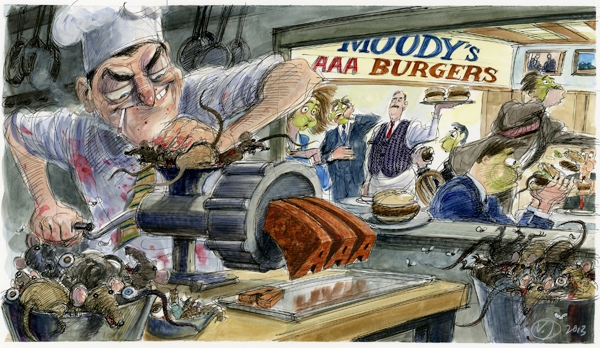

Magaziner said in an email to me: “I believe that one of the biggest disappointments with the Dodd-Frank Financial reform was its failure to adequately deal with the ratings agencies, which absolutely shared a great deal of responsibility for the 2008 financial crisis. It is ludicrous that bond issuances are rated by for-profit companies which are paid by the issuers. The conflicts of interest are mind-boggling.”

He continued, “38 Studios was a terrible deal for taxpayers. I believe we should explore any legal avenue that might limit the cost to taxpayers, including the role played by the ratings agencies. As Treasurer I will also work to bring all parties to the 38 Studios deal to the negotiating table, to see if we can reach a settlement that will minimize cost to taxpayers while avoiding the potentially severe consequences of an outright default.”

Magaziner has criticized Frank Caprio’s initial support of the 38 Studios deal, but as I pointed out in a previous post, Caprio did eventually come out strong against the deal and did his best to prevent it from happening.

Despite his criticism of Caprio, the two candidates seem to agree more than they disagree. But it seems that Magaziner’s approach is too muted. I’d like to see him be more vocal about standing up to Wall Street and fighting for the people of Rhode Island.

]]> Former Treasurer (and current candidate for Treasurer) Frank Caprio reached out to me concerning my stories about the deceptive ratings practices of the ratings agencies.

Former Treasurer (and current candidate for Treasurer) Frank Caprio reached out to me concerning my stories about the deceptive ratings practices of the ratings agencies.

According to Caprio, the ratings agencies hands weren’t clean in the 38 Studios deal because they did in fact overrate the bonds. Furthermore, Caprio asserts that if he is re-elected as Treasurer, that he will dig into the ratings agencies.

As Ian Donnis reported in August 2010, Caprio visibly fought to prevent the 38 Studios deal from happening by going directly to the ratings agencies and investors. Unfortunately, his efforts were circumvented by the EDC, who had the discretionary power to issue the bonds. Some people have criticized Caprio for his initial support for 38 Studios and then changing his stance in opposition of the deal. In my opinion, it was courageous for Caprio to change his mind and he demonstrated leadership qualities by standing up for the taxpayers of Rhode Island.

To take action, Caprio said he would follow similar steps that he took in 2009 regarding the mismanagement scandal at the Central Landfill. Although he didn’t have an official oversight role as Treasurer, he pressured the State to take action. The result was that the right outside experts and attorneys were hired and without even having to file a lawsuit, his work led to a recovery against the Central Landfill board’s directors liability insurance of its policy limit of $5 million dollars.

Concerning the misdeeds by the ratings agencies, Caprio believes RI can look to the actions taken by the Obama administration and states such as CT and CA in seeing which law firms could be possible partners to work with RI against the ratings agencies.

Caprio also claims that the State can save substantial money by not voluntarily repaying the 38 Studios bonds. Instead, the State needs to call the bond insurer (Assured Guaranty) and the bond holders (large institutional investors) to the negotiating table to negotiate a settlement. He thinks that under the threat of non-payment by the State the insurer (who faces an $80 million dollar payout) and the bondholders would entertain the following:

- Since the bondholders have received over $20 million in payments already and the fact they can agree to a waiver of default per the bonds, the state should get the waiver (holders of 50 percent of aggregate principal of bonds have to agree – which is USAA and Transamerica) and start a deliberate negotiation. Caprio says, “I believe the bondholders will see it in their interest to take a haircut on future payments. The institutional holders of these bonds don’t want the national attention on this minimal investment they have in their multi-billion dollar portfolios.”

- The bond insurer should then be asked to be part of the solution with paying the new negotiated reduced amount to the bondholders and in return include them as leading the civil lawsuit currently being litigated against First Southwest, Wells Fargo, executives of EDC, etc. The bond insurer will then be in position to recover any payments it makes as part of this process.

All along this process the rating agencies will be briefed and updated by the State and it’s leaders. No default will happen since we will get time to negotiate per the waiver of default process allowed in the 38 Studio bonds (see page B-46: Waivers of Events of Default).

“I believe the State taxpayers will be relieved of having to make payments now for this failed deal. Remember that the RI taxpayers are not legally obligated to pay this bill per the bond nor by state law,” maintains Caprio.

Caprio has been outspoken on this issue for a while now. Last June, GoLocalProv reported:

Caprio says state, not Wall Street, has leverage

At a minimum, before making a decision on payment, Caprio said the state [needs to] convene a meeting of interested parties—including the bondholders and the insurer on the bonds—to attempt to negotiate a deal using the fact that it is not legally obligated to pay as leverage.

“I’m not going to lead the fight to defend multi-billion [dollar] insurance companies who are sophisticated investors to make sure they are made whole,” Caprio said, adding that the burden of paying back the bonds would fall on the average Rhode Island taxpayer. “If this money was coming out of every legislator’s personal pocket, would they be so quick to pay on debt which they have no legal obligation to pay?”

It seems to me that Caprio has a thorough understanding of the complexities of this issue and I commend him for that. I’ve been frustrated with a lot of other candidates and pundits who have simply been using Wall Street’s own talking points to bully Rhode Islander’s into thinking they have a bogus “moral obligation” to the 1%.

In my next feature, I’ll post candidate for Treasurer Seth Magaziner’s thoughts on how to deal with the ratings agencies.

]]>An appeals court just rejected the ratings agencies claims that the opinions they expressed in a case involving the CA pension system were protected by free speech.

Kudos to Frank Caprio, who said that he asked the ratings agencies not to rate the 38 Studios bonds in order to stop the deal in 2010, for being vocal on this issue.

The question still remains – when will Rhode Island stand up to the ratings agencies? When will AG Kilmartin join the federal government and other states in suing the ratings agencies?

Senate President Teresa Paiva-Weed and House Speaker Nick Mattiello just made a striking shift about the 38 Studios bailout, which is interesting since they both have a history of supporting the bailout.

Senate President Teresa Paiva-Weed and House Speaker Nick Mattiello just made a striking shift about the 38 Studios bailout, which is interesting since they both have a history of supporting the bailout.

Go back to what Paiva-Weed, and former Speaker Gordon Fox, said when the 38 Studios bonds were being issued. At that time, in 2010, Fox and Paiva-Weed told Wall Street’s credit-rating agencies that the state would bail out 38 Studios bondholders if 38 Studios was unable to pay, although the Rhode Island Constitution forbids the General Assembly to “pledge the faith of the state for the payment of the obligations of others” without voter consent. Still, even though our constitution is meant to give voters the right to have a say whenever the state is pledged to pay, Fox and Paiva-Weed did their best to get around our constitutional right and signaled that they would get the General Assembly to do a bailout if one was requested. The rating agencies decided to act as if there really was a promise by the state to pay, as if it really was state debt—though of course our state really didn’t have any kind of obligation, because the procedures that the constitution designed to protect taxpayers were never followed. Since the Speaker and the Senate President were in favor of making taxpayers pay for a bailout if need be, their perceived unofficial clout was enough to make some Wall Streeters think they could profit from participating in this dirty deal, even though 38 Studios didn’t seem to have a very viable business.

But the State House leaders are taking a different line in today’s Providence Journal. Paiva-Weed now says that what she said to the rating agencies in 2010 is not binding now, and Mattiello similarly says that he’s not bound by what Fox said then even though Mattiello had been Fox’s #2 at the time. Instead, Paiva-Weed and Mattiello now say that they’ll look at what’s best for Rhode Island right now (since we all know that our State House leaders are dedicated to figuring out what’s best for Rhode Island).

Paiva-Weed has been a longtime bailout supporter. Last June, when the House was debating the state budget, Mattiello was a big advocate on the House floor for bailing out 38 Studios bondholders. This year, Mattiello is often portrayed in the media as someone who hasn’t taken a position about a bailout. In today’s story, Paiva-Weed and Mattiello don’t say that they’re against the bailout. And I wouldn’t be surprised if they go back to saying that taxpayers should pay for this debt which we don’t owe, like they’ve said in the past. But they’re now saying that if they come out in favor of a bailout it will be because of what’s best for the state right now, not because of the personal pledge to the Wall Street rating agencies that was made in 2010.

It’s no secret that the 38 Studios bailout is very unpopular. The strongest advocates for a bailout have been those in high-ranking positions, like Fox and Paiva-Weed and (last year) Mattiello. After all, it’s generally those in high places who arrange all sorts of shady deals like 38 Studios, and it helps them if they can continue the tradition that those who seek to profit from these dirty deals will always be assured of being paid. If you go a little further down the power ladder to the representatives who were actually elected by voters, there was a serious rebellion last year against doing the bailout. And of course the bailout is even more unpopular among the voters themselves, who are the least powerful in this debate, which is why there was an effort to stick them with the bill in the first place.

From what I hear, a sizeable number of politicians who have to face the voters are planning to vote against the 38 Studios bailout this year, though there are also lots of politicians who are holding out against the voters’ will and supporting a bailout.

What I notice about the statement in today’s Projo by Mattiello and Paiva-Weed is that it’s exactly the kind of thing that would provoke the Wall Street rating agencies. Paiva-Weed is pretty clearly going back on what she said to the rating agencies 4 years ago. Mattiello is making a similar shift, even though he’s known to belong to the same clique as former speaker Gordon Fox and the preceding speaker William Murphy. Because Paiva-Weed and Mattiello said what they did in today’s Projo, we’re likely to see a downgrade by credit-rating agencies now that’s quicker or more severe than it would have been if Paiva-Weed and Mattiello had said nothing.

If Paiva-Weed and Mattiello have decided that they need a big downgrade to scare people into supporting the bailout, they’re doing exactly the right thing to anger the credit-rating agencies and provoke a big reaction, even though Paiva-Weed and Mattiello have always been careful not to suggest that they’re actually against a bailout. If all this works, we get a serious ratings downgrade, the politicians pass the bailout again, the crooks on Wall Street immediately put us back to a higher rating, and our unelected leaders get to preserve their reputation as people who can insure that those who want to be paid in these kinds of dirty deals will get a taxpayer bailout.

Let’s remember, by the way, that our credit rating is actually not the most important thing. Good investors look past the credit rating on a bond and do their own due diligence to see whether the bond is a good investment. They have to do that, since the credit-rating agencies got a reputation for doing shoddy work during the financial crisis, putting AAA ratings on investments that were worthless.

I assume that the rating agencies will lower our state’s credit rating, even on the legally binding voter-approved debt that’s obviously going to be paid no matter what happens. So yes, ratings agencies can certainly make these unjustified ratings as a way to pressure us into a bailout, but those rating agencies don’t speak for the whole market. Whether the rating agencies lower our voter-approved bond rating to BBB, or further to B, or even to D, doesn’t matter as much as what investors are willing to pay.

It’s traditional for rating agencies to retaliate, but it’s the business of smart investors to look instead at whether their investments will make a profit. Since we’re a small state that needs to sell only a small number of bonds, we only need a few smart investors, as I explained earlier. So let’s put aside the hype about credit ratings. Focusing on retaliatory credit ratings downgrades, rather than on what’s a good deal for investors in our voter-approved bonds, is exactly what people do when they want to present a slanted case for a bailout. For investors who want to buy legitimate, voter-approved bonds, we can actually offer a better deal when we don’t let the insiders waste our scarce taxpayer money on bailing out their dirty deals like 38 Studios.

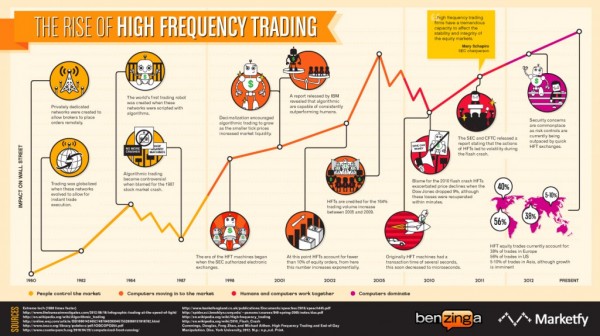

]]>“Providence is holding Wall Street accountable,” said Mayor Angel Taveras in a press release. “City employees who have served honorably should not have their retirement incomes compromised by high-tech schemes that enrich Wall St. insiders at the expense of hardworking Americans.”

High frequency trading is computerized stock trading that enables a large number of trades to happen in fractions of a seconds. The same technology that performs these trades can effectively glean other investor’s intentions and beat them to the buy.

High frequency trading is computerized stock trading that enables a large number of trades to happen in fractions of a seconds. The same technology that performs these trades can effectively glean other investor’s intentions and beat them to the buy.

Lead attorney Patrick J. Coughlin, best known for successfully suing Enron for $7 billion, said high frequency trading is simply using technology to do what’s called front running. “It’s always been illegal to front run,” he said.

The Providence pension fund invested some $611 million during the time the lawsuit covers (2009-present) and traded some 26 million shares, Coughlin said. But he didn’t want to speculate on how much the Providence pension fund lost out on as a result of high frequency trading. “It’s in the millions of dollars, I’ll say that.”

He did say he thinks his lawsuit will attract some of “the largest state funds in the nation.” That would mean Providence would no longer be the lead plaintiff as “the largest loser is the presumptive lead plaintiff,” he said.

His firm, Robbins Geller Rudman & Dowd LLP, has worked with Providence in the past, he said, and that the city knew about the his lawsuit prior to the 60 Minutes segment on high frequency trading.

The suit names as defendants the stock exchanges themselves and many of the biggest trading firms like Goldman Sachs, JP Morgan and Citigroup. It also names a number of lesser-known Wall Street trading firms such as Chopper Trading and Jump Trading.

It alleges they “employed devices, contrivances, manipulations and artifices to defraud in a manner that was designed to and did manipulate the U.S. securities markets and the trading of equities on those markets, diverting billions of dollars annually from buyers and sellers of securities to themselves.”

]]>

Another national journalist took another shot at Rhode Island’s most hotly-debated politician: Gina Raimondo.

Syndicated progressive columnist David Sirota connects dots between Raimondo’s Wall Street campaign supporters and Rhode Island’s inability to afford to make good on pension promises while almost simultaneously cutting taxes for the rich and increasing subsidies for corporations.

It’s an accurate picture of what the last decade or so of economic policy in the Ocean State can look like when not mired in the details the local media microscope provides Rhode Island. We’ve cut taxes for the winners and we’ve cut services for the losers. We broke financial commitments to workers and we made new ones to corporations.

“So who is the real Gina Raimondo?,” Sirota asks. “Is she the politician whose pension schemes aim to protect corporate welfare subsidies while converting retiree money into Wall Street fees? Or is she the defender of pensioners against the plutocrats?”

Many on the left – and in particular the pro-labor left – feel her campaign is co-opting the progressive label for a very different agenda. At the very least she’s using the term more broadly than it has been used in the past and pro-union progressives have good reason to both take umbrage and be skeptical of her political positioning as a lefty. Organized labor is the anchor of support for the entire progressive left in Rhode Island, so it’s something of an offense to trample all over the flagship then claim to be a member of the fleet.

I’d really like for her to address the issues and allegations raised in Sirota’s latest indictment of her. I think that’s how anyone campaigning as a progressive should handle such a damning indictment of progressive credentials from a well-respected progressive writer.

]]> Gina Raimondo “kicked off” her campaign for Governor yesterday, and wouldn’t you know it, but the centerpiece of her policy proposals will be a new invention of Goldman Sachs, the “social impact” bond.

Gina Raimondo “kicked off” her campaign for Governor yesterday, and wouldn’t you know it, but the centerpiece of her policy proposals will be a new invention of Goldman Sachs, the “social impact” bond.

What, you might ask, is a social impact bond? The idea is that some great source of capital like, oh, I don’t know, Goldman Sachs, lends some community millions of dollars to improve early-childhood education. Perhaps they build a new pre-K facility, or even use the money to pay some teacher salaries. A wealth of evidence shows that this kind of investment pays a return of sorts because the kids who enjoy this better education are less likely to become teen parents or teen lawbreakers. It stands to reason, therefore, that the community so enriched by this investment can repay the bond by sending to Goldman Sachs the money that would have been spent on the welfare or jail that those teens didn’t need. How’s that for a win-win?

From the perspective of the public budget, you’re really no further ahead, of course, since the money you were going to spend on jails is spent on paying Goldman instead, but at least you have this shiny new school, and fewer criminals, too.

Of course if your pre-K students grow up to be peaceable, responsible, taxpaying, and generally lovely adults — who happen to live somewhere else — well, you can’t make an omelette without cracking a piggy bank, right?

Snark aside, what do we really have here? Is it a good idea or not? Is this a way for communities to access funds for desperately needed investments, or is it a new way for the financiers who burned down our economy just a few years ago to rape the public funds — again? Bear in mind, please, that there is a substantial risk here. Research about the future costs of jail and welfare are estimates, made to illustrate various cost/benefit analyses. They are not carefully calibrated prices. The weight of evidence says there will be savings, and the side benefit is happy people and less crime. To me, that’s enough to argue for investment, but the happy people and less crime parts of the benefit aren’t going to help pay off a loan.

It might be worth asking at this point, why those communities can’t afford to invest in these improvements the evidence says will pay off. Oh, right, it’s all the tax breaks of the past decades. Did you know that business taxes used to be the third most important source of revenue to the state of Rhode Island? Now they are fifth, behind the lottery and all the fees collected by various departments. Did you know that the richest Rhode Islanders paid over three times the income tax of the average taxpayer in 1996, and in 2011, a bit more than twice? Over the past decades, our state and nation have cut taxes repeatedly in a vain and misguided attempt to stimulate the economy and things have only gotten worse for everyone except those whose taxes were cut.

So now that we can’t afford to make these investments in education and infrastructure (not to mention the human capital our business community claims they want access to but won’t pay for) here’s a new plan: take money from the rich, not as taxes, but as loans, and in return pay them the benefits that used to be thought of as belonging to everyone. And if the benefits don’t actually pan out, do you imagine that the financiers will be at risk?

It’s easy to imagine a community in dire straits, seeking to salvage the futures of some of its residents, with such a desperate and risky scheme. Business owners on Federal Hill used to find themselves wondering in the same way if they should ask the mob for help. But to imagine — no, to actually see and hear — a gubernatorial candidate suggest that this is a good idea on its own merits is appalling. The idea is a disgrace, a wholesale sellout of the very concept of the public good.

So what do we learn here? First, that the creativity of people paid millions of dollars to think of new ideas to make more money is nearly boundless. Over the past decades, we offered a bargain: tax cuts for rich people in exchange for a better economy. But they used the money to buy political power and used it to extract still more money from the rest of us. They are already on the way to owning the world. Here is yet one more way for the fabulously wealthy to solidify their control of our politics and our world.

The other thing we learn? That clearly Gina Raimondo is not at all worried by the idea that she might be perceived as too closely tied to the wolves of Wall Street. The question she should answer: does she want to promote the public good, or sell it?

]]> It’s all well and good to know who the characters in the 2014 campaign for governor are, but we still need to know the major themes before we can know what the plot might look like.

It’s all well and good to know who the characters in the 2014 campaign for governor are, but we still need to know the major themes before we can know what the plot might look like.

Here’s a list of some of the public policies I hope get a good vetting during the next 12 months.

- Wall Street vs. Main Street: Hedge funds, the real estate bubble, municipal bankruptcies and retirement investments … they all speak to what role high finance should play in economic development. Good, bad or indifferent – and I think it is a very good thing – because someone from Head Start and someone from venture capital are running against each other in a Democratic primary, RI will get to see this popular talking point play out in the form of a political campaign.

- Tests vs. teachers: High stakes tests will and should be a part of this conversation, but the bigger issue is the achievement gap between affluent suburbs and impoverished urban areas. If NECAP scores demonstrate anything, they show that rich kids are getting a decent public education and poor kids, by and large, are not.

- Cuts vs. expenditures: Conservatives will claim we need the lowest tax rates in the region to improve our economy while it remains to be seen if progressives will campaign on making the rich and powerful pay their fair share. Note that these goals aren’t necessarily mutually exclusive of each other. RI could, for example, the lower the small business tax rate and eliminate corporate tax expenditures (read: giveaways). And here’s hoping Clay Pell runs on a “tax me” platform!

- Legal vs. criminal: There are a host of issues before the General Assembly that will likely spill over into the governor’s campaign because of their national implications – think voter ID and pot prohibition. Payday loans will be a particularly interesting one, as both Angel Taveras and Gina Raimondo have worked together on this issue.

What am I forgetting? Let us know in the comments what issues matter most to you this campaign season…

]]> Divesting from dangerous weapons is a step in the right direction, and I applaud Gina Raimondo’s effort to make our pension fund more socially responsible. This blog doesn’t often have opportunity to agree with the hedge fund-loving general treasurer, but I certainly hope the State Investment Commission takes her advice and takes our money out of a company that distributes guns.

Divesting from dangerous weapons is a step in the right direction, and I applaud Gina Raimondo’s effort to make our pension fund more socially responsible. This blog doesn’t often have opportunity to agree with the hedge fund-loving general treasurer, but I certainly hope the State Investment Commission takes her advice and takes our money out of a company that distributes guns.

I’d also encourage Raimondo and the others who control Rhode Island’s $7 billion nest egg to look hard for other opportunities to be more socially responsible with our money. This would be a pension reform progressives would be proud to support, and would be better for our economy than cutting COLAs or enriching hedge fund managers.

Divestment, or socially responsible investing, is already a movement in Rhode Island. The Providence City Council recently voted to make its investment portfolio better match its values (what that will look like still remains to be seen) and Brown Divest Coal has long advocated for the Ivy League endowment to take its money out of companies that harm the environment.

Here’s hoping Seth Magaziner’s political ambitions will help shine a bright light on why socially responsible investing is a better bet for Main Street. High finance can be community-minded. And the more it is, the more profitable being community-minded will become.

]]> Both J. Michaels raise good points about how the public sector should manage its financial investments in Ed Fitzpatrick’s great column this morning for which he writes the perfect lede about Rhode Island’s game of pension football:

Both J. Michaels raise good points about how the public sector should manage its financial investments in Ed Fitzpatrick’s great column this morning for which he writes the perfect lede about Rhode Island’s game of pension football:

“It was the best of investment strategies. It was the worst of investment strategies.”

Thankfully, there may be a third way that could take the best of both while skimming away the parts nobody likes.

J. Michael Downey makes the point that General Treasurer Gina Raimondo’s big bet on hedge funds serves as a wealth transfer from local retirees to Wall Street investors. “Instead of promoting retirement security for all Rhode Islanders, the changes have apparently enriched wealthy hedge fund managers,” he told Fitzpatrick.

Meanwhile, J. Michael Costello, “one of the longest-serving members of the State Investment Commission and managing partner of Endurance Wealth Management,” according to the ProJo, defended hedge funds saying, “we have a very underfunded pension system that has to pay hundreds of millions of dollars in excess of what comes in every year. As a result, you need to be careful with the various market fluctuations, so the motivation is to use these types of funds that traditionally hedge against significant downside events.”

If only there were a way to protect against downside events without transferring wealth to otherwise disinterested economic actors … Oh wait, there is!

Rhode Island should consider divesting from both index and hedge funds and invest instead in local and/or sustainable funds. There is certainly a way to structure a fund that hedges against the S&P 500 while boosting the (not-yet-indexed?) Ocean State 250.

It’s also well worth noting on this blog that Raimondo has defended the investment and denounced the fees – and I hope to get to compliment her efforts one day at transferring the wealth back from Wall Street to Main Street.

]]>