One of the more reprehensible things that conservatives have come out with of late is the idea of the ‘lucky duckies.’

One of the more reprehensible things that conservatives have come out with of late is the idea of the ‘lucky duckies.’

This is what the Wall St Journal’s op-ed page called those of our society who are ‘fortunate’ enough to make such a low salary that they don’t have to pay fed income taxes.

This is truly verging (has crossed into?) Newspeak. You know, 1984–war is peace, freedom is slavery etc…)

In most people’s minds, getting stuck in a job that makes you $20k a year is the opposite of ‘fortunate’. And if those WSJ writers think these folks are so lucky, all they have to do is quit their cushy office job and stand on their feet 8 hours a day flipping burgers.

Lucky duckies, indeed.

[ Pre-emptive strike: the idea is that these people have no ‘skin in the game’, so they don’t care about tax rates because it’s so hard to make ends meet on $250k per year, yadda yadda. Utter nonsense. Give me the $250k, I’ll pay the 39% tax rate from the Clinton years, and still be waaaaaaayyyyy ahead of where I am now. And so would most of you reading this. ]

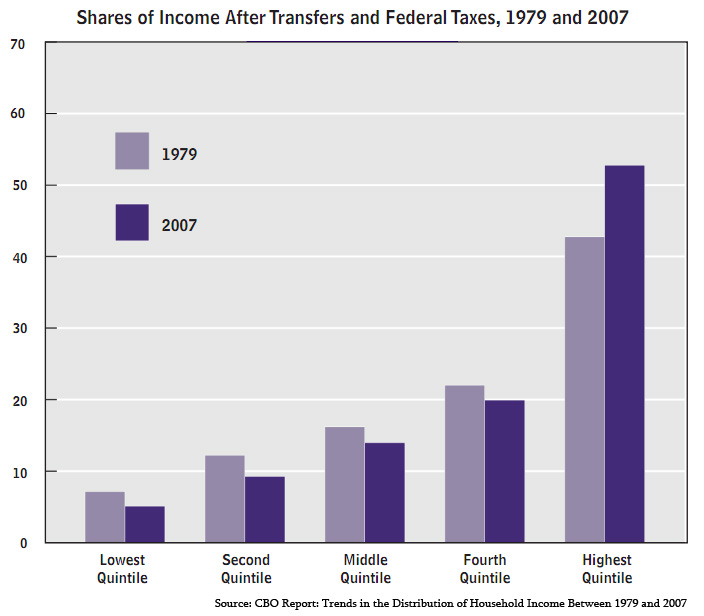

So far, this has been standard class warfare stuff as waged by the 1%. True, people in the bottom half don’t make enough to pay fed taxes. Think about that: almost half the country, by conservatives own reckoning, don’t make enough to pay fed taxes. Is the problem that their a) tax rate is too low; or, b) that their salary is too low?

If you’re a conservative, the answer cannot be (a), because tax rates are NEVER low enough.

And yet, that’s what they’re saying. That tax rates on the bottom half of the country have to go UP. While tax rates on the top 1% have to go DOWN. Talk about internally inconsistent.

Or, it would be if they actually cared about being logical. Or consistent. They don’t. They only care about waging class warfare against everyone who’s not part of the 1%.

What truly takes this distortion to another level, and makes it reprehensible is the way it looks at a tiny sliver of the situation, cherry-picks what suits their cause, then ignores the rest.

The fact is, this lower 47% that pays no fed income tax, pays plenty of other taxes. Payroll tax, which is hugely regressive since it’s capped at around $100k (may be higher; it moves with inflation), sales taxes (also hugely regressive) excise taxes, state taxes, local taxes, and so on.

What happens when we factor all of these in?

Here’s the result:

This is a chart done by the Corporation for Enterprise Development. It shows what the total, overall tax rate is for all income quintiles by state. It shows how much of their income the poorest 20% pays, vs how much of their income the top 1% pays in each state, then shows the ratio between the two.

The median state is Mississippi. The poorest 20% pay about 10.8% of their total income in taxes. The top 1%, OTOH, only pay 5.5% of their income.

In other words, the effective tax rate of the bottom 20% is about twice as high as the tax rate for the top%–despite paying no fed taxes.

And how does RI stack up? We’re worse.

Here, the bottom 20% pays about 11.9%, while the top 1% pays 5.5%.

In other words, the bottom 20% pays a rate that is more than twice the rate paid by the top 1%.

And Mass is two spots worse, CT is one spot better, so spare me the “Oh, I could just move to Mass and save all this money” lie. And founder of a certain ‘alternative’ party, I’m looking at you.

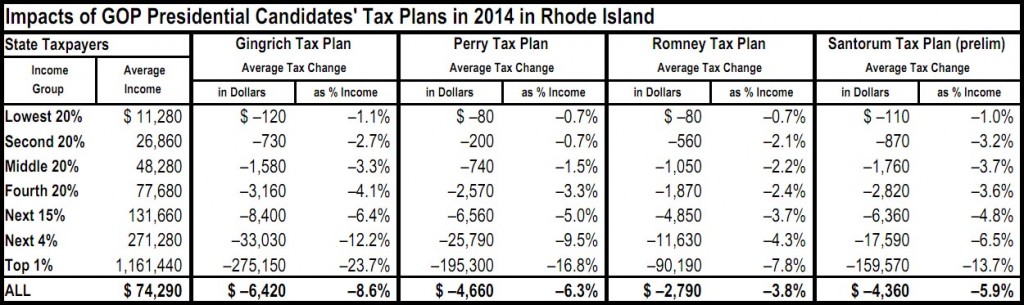

What does this mean? The top end earners are not overtaxed. They have a great gig going. And if we elect someone named either Willard or Newt, it will only get better for them, and much, much worse for the rest of us.

Lucky duckies, indeed.

The name changes, but the mission will stay the same. Over a year ago I (and many others) had conversations with a consultant who was working with the Poverty Institute to rebrand their image. And today, in coordination with the annual Budget Rhode Map, the Poverty Institute is officially changing its name to the Economic Progress Institute. And they have a flashy new website designed by the local web development firm Embolden.

The name changes, but the mission will stay the same. Over a year ago I (and many others) had conversations with a consultant who was working with the Poverty Institute to rebrand their image. And today, in coordination with the annual Budget Rhode Map, the Poverty Institute is officially changing its name to the Economic Progress Institute. And they have a flashy new website designed by the local web development firm Embolden.