The New York Times published an expose this week on Texas’s regime of business incentives, but for anybody who pays passing attention to so-called municipal and state economic development schemes, there wasn’t much news: Our states and localities are cannibalizing one another as they concoct targeted tax breaks which they use to lure corporations from their neighbors. Meanwhile, a bevy of middlemen wet their beaks by helping corporations pit sucker states off of one another and brokering deals to sell the tax credits that comprise much of the ensuing largess. Here’s the rub:

The New York Times published an expose this week on Texas’s regime of business incentives, but for anybody who pays passing attention to so-called municipal and state economic development schemes, there wasn’t much news: Our states and localities are cannibalizing one another as they concoct targeted tax breaks which they use to lure corporations from their neighbors. Meanwhile, a bevy of middlemen wet their beaks by helping corporations pit sucker states off of one another and brokering deals to sell the tax credits that comprise much of the ensuing largess. Here’s the rub:

Granting corporate incentives has become standard operating procedure for state and local governments across the country. The Times investigation found that the governments collectively give incentives worth at least $80 billion a year.

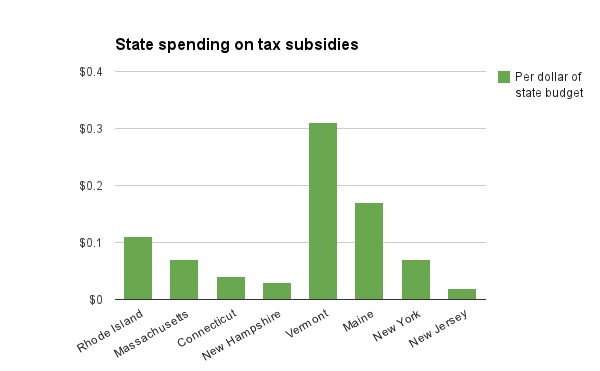

That’s an especially big deal for cash-strapped states, banned from deficit spending, no printing presses on hand. The $80 billion figure represents a full ten times the budget of my state of Rhode Island, and more than 15 times the amount spent from locally-generated funds.

It’s the most basic of game theory dilemmas, and in a less corrupt political dynamic, one that could be solved by the intervention of sensible federal government actors, or perhaps even through the initiation of an interstate compact that had states agree to stop poaching from one another. (It would still be open season on those states who failed to join said compact, incentivizing their joining the protected bloc.) Rhode Island is rare in that it, at least, has a provision in place that bans its cities from using subsidies to swipe existing businesses from one another — though it’s never enforced. I’d heard (and seem to remember having once found) that Puerto Rico has miraculous language on the books that requires its lawmakers ot consider the impacts of its subsidies on the jurisdictions from which they’re stealing businesses — but perhaps that’s apocryphal.

Good Jobs First has done yeoman’s work to expose the machinations of the “Site Location Consultancy” industry, spearheaded by the maniacal-sounding Fantus companies. (Fantus Factory Locating Service and Fantus Area Research.) Prior to seeing them on paper, I’d always envisioned the spelling as the more malevolent-looking “Phantus” which comports with the shadowy, yet profound, nature of their work.) Felix Fantus got to work in the 1950s, and as GJF describes it:

For the next four decades, Fantus dominated the site location consulting industry, playing a central role in the relocation of thousands of workplaces, most of them factories moving out of the Northeast and Midwest to the South. By its own count, it helped engineer more than 4,000 relocations by the time Yaseen retired in 1977, and 2,000 more in the next decade….

Fantus survives today as a Chicago-based consulting affiliate of the Big Four accounting firm Deloitte & Touche.

A couple of case studies:

Boeing is a master of this manipulative art, flipping the usual government-to-contractor relationship in 2003 as the company put out a 2003 RFP for states to respond to, to see who would offer up the most lucrative package of tax incentives for a manufacturing![]() plant for the 787. Washington State residents bested a couple dozen other states, offering to pay the hometown company $3 billion not to forsake them. (Well, it’s not quite fair to say that they were still deserving of the ‘hometown’ moniker at that point — corporate HQ had moved to Chicago a few years earlier, drawn by a mere $50 million in public funds.) Tragedy became farce in 2009, when South Carolina offered Boeing around $1 billion to open a Dreamliner plant there. Evidence of just how sad is this state of affairs: The WTO is the only body that’s threatened to provide any sort of meaningful check on this sordid dynamic, ruling that several billions of such subsidies to Boeing were problematic — but that European subsidies to Airbus were even more severely infringing.

plant for the 787. Washington State residents bested a couple dozen other states, offering to pay the hometown company $3 billion not to forsake them. (Well, it’s not quite fair to say that they were still deserving of the ‘hometown’ moniker at that point — corporate HQ had moved to Chicago a few years earlier, drawn by a mere $50 million in public funds.) Tragedy became farce in 2009, when South Carolina offered Boeing around $1 billion to open a Dreamliner plant there. Evidence of just how sad is this state of affairs: The WTO is the only body that’s threatened to provide any sort of meaningful check on this sordid dynamic, ruling that several billions of such subsidies to Boeing were problematic — but that European subsidies to Airbus were even more severely infringing.

Perhaps the most transparently absurd manifestation of war-between-the-states phenomenon is the case![]() of the film tax credit, driven by the movie industry’s exploitation of star-struck state legislators who seem to believe that the likes of Boise and Des Moines stand to become the next Hollywood. The film tax credits spurred the most precipitous race to the bottom I’ve witnessed in my time in politics. It came to a head in 2009, when Wisconsin had just spent $100,000 dollars to support Johnny Depp’s personal grooming expenses and Connecticut was fixing to subsidize episodes of Jerry Springer’s talk show — lots of broken chairs to pay for. The capstone of this farce was California’s institution of tax credits to entice productions back to Hollywood. As my friend and former Massachusetts state rep Steve Damico and I wrote at the time:

of the film tax credit, driven by the movie industry’s exploitation of star-struck state legislators who seem to believe that the likes of Boise and Des Moines stand to become the next Hollywood. The film tax credits spurred the most precipitous race to the bottom I’ve witnessed in my time in politics. It came to a head in 2009, when Wisconsin had just spent $100,000 dollars to support Johnny Depp’s personal grooming expenses and Connecticut was fixing to subsidize episodes of Jerry Springer’s talk show — lots of broken chairs to pay for. The capstone of this farce was California’s institution of tax credits to entice productions back to Hollywood. As my friend and former Massachusetts state rep Steve Damico and I wrote at the time:

This sprint to the bottom has just reached its predictable, pathetic conclusion: Burned particularly by the loss of the television show Ugly Betty, California’s recent budget includes a half-billion in tax credits of its own, under the guise of “stimulus,” as a bribe to keep Hollywood from off-shoring to Manhattan, Indianapolis, and Santa Fe, which are offering bribes of their own. The floor has been lowered across the land, achieving a new equilibrium where public subsidies accrue to industry moguls to make movies that would be made anyway. At least 42 states now provide incentives, with some exceeding 40% of production costs.

Even in the seemingly impossible universe in which a particular state seems to benefit from instituting such credits, it’s easy to see that once one abstracts to the regional or national level, all that we’re doing is paying people to move jobs to-and-fro, creating no new social value, and reducing net public benefit.

It’s worth deconstructing the particular form these subsidies tend to take. The terminology “tax credit” is construed to obfuscate the particulars of the mechanism at hand: Most people think it means that there’s a reduction in taxation on expenditures in service of the given project. Far from it, and far worse, here’s how it works: A movie films in State X, and spends $20 million therein. If State X offers a 50% transferable tax credit for film expenditures within its borders, it forks over $10 million thereof. In the case of a state like Rhode Island — or any state that isn’t the production company’s home base — the production company will have a accrued negligible state tax liability, so it will sell these credits to an entity that has a more substantial tax burden — usually a sizable corporation — at a rate of, perhaps, 80 cents on the dollar. A broker will take a cut of perhaps a nickel on the dollar. So the entity that the state was striving to subsidize gets only 75% of the funds the state is expending.

In the case study above the intended recipient of the benefit is an entity that’s achieving little social good (not hard to argue that much Hollywood schlock is, in fact, a social detriment) but even if it’s a worthy project that’s meant to achieve the benefit — say, renewable energy![]() installations — tax credits of this form are always a raw deal for the public, unless a substantial percentage of the credits go unclaimed: A full 25% or so of the subsidy is misfiring, going to middlemen and corporations with significant tax burdens. If you want to fund something efficiently, just fork over cash. (This, of course, could never be made to happen, since then the public would understand that all we’re really doing is forking over cash to millionaires.)

installations — tax credits of this form are always a raw deal for the public, unless a substantial percentage of the credits go unclaimed: A full 25% or so of the subsidy is misfiring, going to middlemen and corporations with significant tax burdens. If you want to fund something efficiently, just fork over cash. (This, of course, could never be made to happen, since then the public would understand that all we’re really doing is forking over cash to millionaires.)

It’s no surprise that tax credit brokers often make for generous campaign contributors. Such a figure is at the center of a still-unfolding scandal in Rhode Island which has been the subject of a fair amount of national reporting: Curt Schilling’s failed video game company 38 Studios, which received a $75 million loan guarantee and various tax credits in exchange for its locating in Rhode Island. The loan guarantee program was sold to us as that rare economic development proposal that seemed mostly sensible: A way to incubate and grow businesses indigenous to Rhode Island in the midst of the downturn, with credit very tight. Yet within a few months, state leaders had designated 60% of the fund for use by the (Republican, anti-tax, anti-welfare) former Red Sox pitcher. The company’s since gone bust, leaving the public on the hook for on the order of $115 million at last check.

It’s a mess, wrought by the usual mix of corrupt cash, a rotten philosophical paradigm, insane, inverted conceptions of capitalism (“States competing against one another is just the free market at work!”) and, especially in the case of the film credits, narcissism: Who doesn’t want a photo opp with Richard Gere?