As has been amply reported by other writers here and in other places, the state budget has emerged from the mists of the Finance Committee, and will likely be voted on and passed this week. It contains no broad-based tax changes, though there are small increases in cigarette taxes, and small expansions of the sales tax, and tolls, to cover restoring 40% of the money cut from care to the developmentally disabled, and to fund the state’s education funding formula — the one that the legislature’s own study shows is inadequate. Due to more encouraging revenue projections than were the case last fall, some money has been restored to important places, but it’s just a bit here and there.

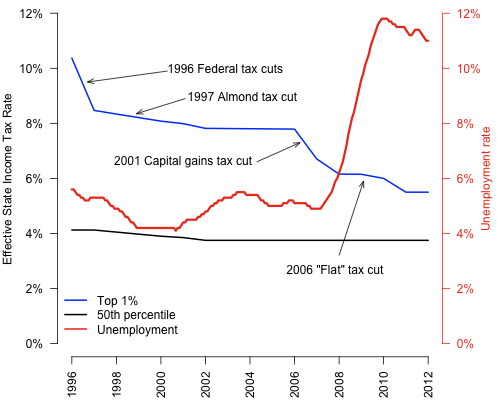

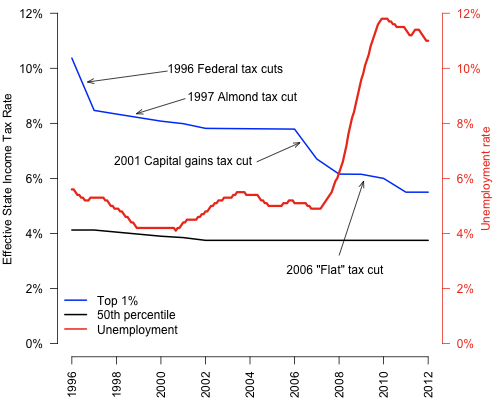

This graph is still the policy of the state:

That lower line is the effective tax rate on the median taxpayer. The blue line is the rate on the top 1%, and the red line is just thrown in there to show there is no relationship between taxes and unemployment.

The message overall from the legislature is that the cities and towns be damned. There seems no willingness to acknowledge that the fiscal crisis in the cities is largely the result of state policies. Tremendous cuts in state aid in 2008-2010 to both the municipal and education sides of city and town budgets brought fiscal havoc everywhere, and last week we had the spectacle of Lisa Baldelli-Hunt, a representative from Woonsocket, begging her colleagues in the legislature not to allow Woonsocket to fix the problems caused by her colleagues. Oddly enough, they complied, and now we have two more cities half a step from joining Central Falls in bankruptcy.

The sad fact is that by and large the people in charge of our cities and towns have actually been more fiscally responsible than legislators in the General Assembly, but they have less power, and so the Assembly leadership can pretend otherwise.

That’s quite a claim, isn’t it? How to back it up? How about this: as of 1990, Rhode Island cities and towns collected about $1.3 billion, between state aid, property taxes and various municipal fees. In 2008 — before the worst of the state aid cuts — they took in a bit less than $3 billion. This does not count the car tax payments from the state, which only offset taxes that towns would have collected from their residents. If you’re keeping score, that’s growth of about 1.9% per year — after correcting for inflation. This is troubling, but it’s not necessarily evidence of mismanagement. Inflation measures the price of goods and a few services, while towns spend their money on services and a few goods.

So how best to measure this if not against the inflation rate? If you want a yardstick with which to measure a service-oriented enterprise like a town, how about a private-sector service like Federal Express? Fedex is fiercely competitive, I hear, and non-union, to boot. How did they do? In 1990, it cost $11 to send an overnight letter across the country, and today it’s about $25.50 for the same service. After correcting for inflation, that’s up about 2% a year.

What about the state? After accounting for inflation in the same way, the state’s general revenue has gone up 2.4% per year since 1990, and overall expenses are up even more. (That’s the structural deficit and the rise in state debt you’re smelling.)

So who is being more responsible with tax dollars? The General Assembly, with members like Baldelli-Hunt who give lectures to municipalities, or the towns, who have controlled costs not only better than the state, but better than Fedex. But it’s the towns who get cut while the state basks in the adulation of business leaders who praise legislators for their tax cuts.

The main message of this budget bill is continuity. This is a budget motivated by policy choices virtually identical to the ones of the previous year, the year before that, the year before that, and so on. The idea is to squeak through another year with minimal pain to everyone, especially the wealthy. But it was to a large extent that very set of policies that brought us to the status quo: high unemployment, bankrupt cities, ever-rising tuitions at the state colleges, and lower taxes on rich people.

Do you like the way things are going around here? Hope you do, because the legislature is voting this week to give you more of the same.