Last week, on June 6th, both a debate and a separate hearing were held whose sole focus was the 38 Studios’ bonds’ situation. (Related posts: first, second.)

Last week, on June 6th, both a debate and a separate hearing were held whose sole focus was the 38 Studios’ bonds’ situation. (Related posts: first, second.)

In a nutshell, my opinion is unchanged: Rhode Island should not repay the bonds. We should also outlaw such bonds. They have a shady origin (complete with a Watergate character!) and have gone downhill since then. We should use the 38 Studios debacle to clean up state finances.

Background:

There are two basic types of bonds. General Obligation bonds are fully backed by the state, including the use of its taxing authority to cover the bonds, hence the risk of non-repayment is low. In Rhode Island’s case the voters have to approve the bonds via a referendum.

The second type are Revenue bonds, issued by non-state authorities. These bonds are not guaranteed by the state. Voter approval is not needed. They are higher risk.

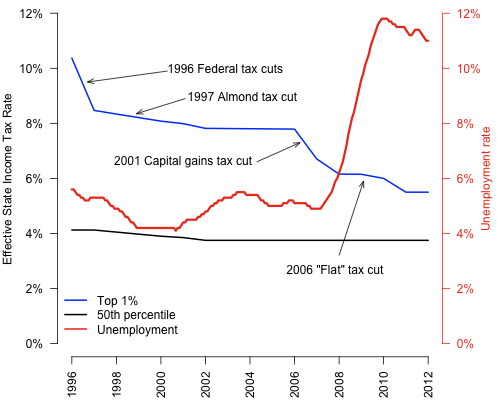

The 38 Studios bonds are a hybrid of General Obligation and Revenue bonds: so-called “Moral Obligation” bonds. This category of bond was devised by John Mitchell (of Watergate infamy) specifically to avoid the need for voter approval. These bonds are Revenue bonds with an ill-defined unwritten assurance by the state that it will repay the bonds in the case of the borrowers default. The state is not legally required to cover the bonds, but is expected to. Voter approval is not needed, so they are easy to issue. The risk is low, but at the same time the interest rates and hence profits for the bondholders are high. This is a win-win situation for the bondholders and the bond insurer but a burden on the issuer.

Review and comments….

The following are paraphrased versions of some of what was said at both the hearing and the debate, not necessarily in time-order. There were no common participants. Text within brackets ([ ]) are my own comments.

….on the hearing….

The House Finance committee heard testimony on the 38 Studios’ bonds repayment issue from (only) Matt Fabian and Lisa Washburn, both of Municipal Market Advisors. Only the committee and experts were allowed to participate. Overall the expert testimony was detailed but inconclusive. Rhode Island’s situation is unique. Fabian himself advised repayment, but concurred with a committee member that 20 experts would provide 20 different opinions. Actually Fabian had already talked to many experts; their opinions of the consequences of non-repayment went from: “little impact” to “catastrophic.”

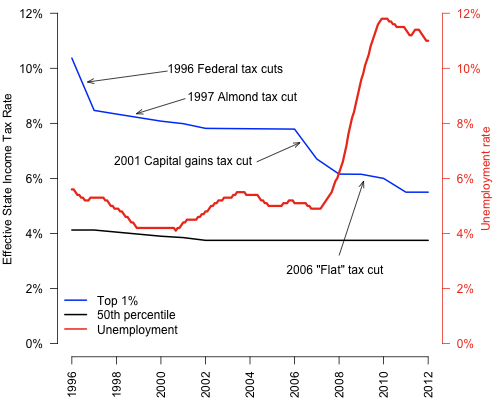

Rhode Island’s market reputation and ability to sell bonds at competitive interest rates are currently good and have been getting better. Fabian’s main concern was that non-repayment would reverse these characteristics and the cost of future credit to the state would be substantially higher; these effects might last for many years. Fabian emphasized that the market and ratings agencies would consider anything other than full repayment a default. Another possible outcome of non-repayment, though unlikely, is that the market would make an example of Rhode Island, punish it, and severely reduce its ability to borrow.

The effect of non-repayment on future Rhode Island borrowing varies on the type of the bond to be issued. The interest rates of new moral obligation bonds are likely to be extremely high, possibly even making them unsellable. [To me, the latter is a plus.] However, the effect on the state’s general obligation bonds would be much less, perhaps an increase of 0.5% to 1% in interest for many years. [It also might be possible to refinance the bonds at a lower interest rate after their issue, reducing the negative fiscal impact of non-repayment.]

Fabian recommended that Rhode Island make its repayment decision carefully and slowly. This would reduce any negative results if it decides against full repayment. Also, an in-depth market study might help Rhode Island make its decision to repay or not. However, just conducting a study might make the market nervous; thus, negative repercussions could occur even before a study is completed and a repayment decision made.

When the 38 Studios’ bonds were issued an insurance policy was purchased providing for full payment of both the principal and interest by the insurer to the bondholders in the case of default. Many Rhode Islanders say that the insurance pay-out will keep Rhode Island from having to repay anything and the bondholders will lose nothing. However, the insurer will likely use all available means to keep from paying, including legal, political and media attacks. It might be messy, last a long time and result in a significant decline in Rhode Island’s reputation in the bond market. One way to avoid this mess would be to make a compromise with the insurer and only make a partial repayment. The insurer would likely be willing to work with the state to do so, and Rhode Island would suffer less.

….and on the debate.

The debate was moderated. The panel included academics, bond market experts, an independent policy advisor, and a citizen advocate who might be directly affected by the outcome. The audience was allowed to participate. On the whole, predictions of what would happen upon a non-repayment were less dire than at the hearing.

The debate covered a lot of the same ground as the hearing, but not all. An expert at the debate said that it is a strong possibility that future Rhode Island general obligation bonds’ costs (higher interest rates) would be much less than feared [including much less than those suggested at the hearing]. One additional point made was that although a partial repayment would be viewed as a default by the bond market, it would be viewed more favorably by the market than a full non-repayment, so could be viewed as a reasonable option for Rhode Island.

There was a consensus by the panel that what needs to be done is an in-depth study, including a solid cost/benefit, pros/cons analysis of the alternatives in order to make an informed decision. It was suggested that as part of the study the major bond market players should be asked what they would do if the bonds are repaid by the state or not. [This may be difficult. Moody’s and Standard & Poor’s, the bond raters, have so far declined to do so.][Note that such a study may be inconclusive, too, since there are so many factors involved, even some not yet even contemplated.]

Analysis:

After the hearing I knew more but was less certain what the result of any particular course of action would be. The debate helped, but not much more.

There is no history to guide us. The bond market is irrational, volatile and unpredictable, though traditionally less so than the stock market. Even the experts don’t know the likely consequences. All crystal balls are out of order.

“Moral Obligation” bonds are a fabrication of Wall Street, created to satisfy its greed. The Economic Development Corporation, not the state, issued such bonds for 38 Studios. There was the usual kind-of-sort-of implication by EDC, the Assembly, and the governor (at that time), that the state would pay if 38 Studios defaulted, but with no actual obligation. The only clearly stated legal obligation of the state is that the Governor must put a request for repayment into the proposed budget each year. That’s it. The state legislature is under absolutely no obligation to actually include it in the final budget. Here is the key: 38 Studios was not described as a sound investment to either the prospective investors or the insurer, yet they signed on anyway. They gambled and lost. This is not Rhode Island’s responsibility, but in the vague, smoky-back-room fashion of “moral obligation” bonds, it might hurt our reputation for being a good bond issuer if we don’t obligingly, voluntarily make it our responsibility.

An issue that did not receive enough attention at either the hearing or the debate concerns the effects on low- or no- income Rhode Islanders of non-repayment. Both Rep. Ferri, a committee member at the hearing, and Ms. Heebner, citizen advocate at the debate, said that the General Assembly might not raise taxes to cover the shortfall, but instead would reduce human services. Those lowest on the economic ladder would suffer the consequences of the higher-ups’ bad decisions. While dumping on those least able to afford it is dishonorable, it is likely to happen, judging from the recent past.

Conclusions:

By all means, conduct an in-depth study, it might help. But don’t spend a lot on it.

No one can tell what the consequences of non-repayment would be. Even if we know the monetary consequences for certain, our decision could still go either way since it will (should) be based on more than what can be quantified by such a study. Let’s not base a decision solely on Wall Street or $$$, for a change. There is more to life. So let’s do the right things:

- Don’t repay the 38-Studio bonds. We aren’t obligated to and we have other, real, obligations like human services, education and infrastructure that need the funds. The “sky-is-falling” predictions are overblown.

- Make moral obligation bonds illegal. Only allow pure general obligation and revenue bonds having clear language and unambiguous responsibilities of the parties involved. This change in state debt funding would be a silver lining to the ugly situation of the 38 Studios debacle.

We might even start a positive national trend: Fabian said that nationally moral-obligation bonds would cease to be issued if Rhode Island doesn’t repay.

PostScript: I have heard that the political reality is that the first payment ($2.5 million) will absolutely stay in the FY2014 budget. However, from my perspective, nothing is final until the Assembly session is actually adjourned for the year. Further, a final decision on one or more of the much larger remaining payments ($12.5 million) might be postponed until the 2014 Assembly session; there isn’t enough time to either conduct a deeper study and/or make a reasoned decision before the end of this session. This would also leave enough time in the off-session for such a study.

The biggest debate of the budget process turned out not to be about a moral obligation to Wall Street but rather a moral obligation to Rhode Island retirees.

The biggest debate of the budget process turned out not to be about a moral obligation to Wall Street but rather a moral obligation to Rhode Island retirees.