Below this graphic are the prepared remarks of Gov. Chafee tonight. You can read his proposed FY 2014 Budget Summary here.

Mr. Speaker, Madam President, members of the General Assembly, Congressman Langevin, fellow General Officers, members of the Judiciary, distinguished guests, and my fellow Rhode Islanders,

Mr. Speaker, Madam President, members of the General Assembly, Congressman Langevin, fellow General Officers, members of the Judiciary, distinguished guests, and my fellow Rhode Islanders,

I am honored to join with you tonight in our beautiful State House. This building is both a symbol of Rhode Island’s proud and prosperous past and a beacon of hope reminding us that our brightest days are still ahead.

It is a pleasure and a privilege to work in this building and in this great state. Nothing could give me more satisfaction than helping to achieve progress on many fronts in Rhode Island.

Our state has gone through incredibly tough times recently. The national recession has taken its toll on our economy, our businesses, and, most dramatically, our people. Short-sighted decisions in better times left us struggling to provide the most basic services.

But Rhode Island is strong. And tonight we begin a new year with new opportunities to continue Rhode Island’s recovery.

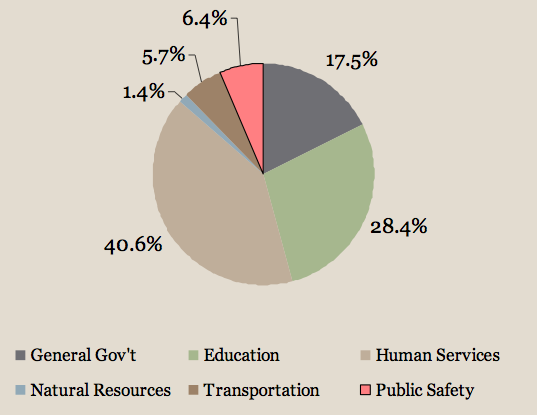

There is a popular saying that bears repeating tonight. It goes: “Don’t tell me what your priorities are. Show me your budget, and I’ll tell you what they are.”

Well, anyone wondering what my priorities are should read the budget I respectfully submit to you tonight. It continues the path that I believe will make Rhode Island a stronger state in both the near- and long-term future.

I submit this budget to the General Assembly on January 16th – on time and the earliest that a Governor has done so in over two decades.

Thanks to good management and good decisions, we have ended the past two fiscal years with surpluses. This was achieved by able and dedicated Cabinet directors. They have worked together with common purpose to provide quality services at a rate that is mindful of the taxpayers. Thank you to these dedicated public servants in all the departments of state government.

Our revenues are exceeding projections. This is another indication that the state is being run well – being managed responsibly – and that more and more each day people and businesses are investing and spending here. We are providing certainty, predictability, and stability. And that’s what businesses demand to have the confidence to create jobs in Rhode Island.

The budget I present to you tonight contains no increase in taxes, fees, or charges of any kind. Not only are there no tax or fee increases, I also propose lowering our corporate tax from 9.0 percent to 7.0 percent over the next three years. This will put Rhode Island’s rate below that of both our neighboring states.

We have avoided tax increases and are lowering the corporate rate through both good fiscal management and a strengthening economy. As we move forward, it is important to keep investing in the building blocks of this progress – that is, investing in education, infrastructure, and workforce development.

Throughout my career in public service, I have been committed to quality public education. There is simply no more important investment we can make than in our schools and the potential of our students. My commitment to education continues with this budget.

In 2010, the General Assembly worked with Commissioner Gist on behalf of our students to pass the state’s school aid formula. In this budget, I have once again provided the resources to fully fund the formula, including all categorical aid programs. This year, that amounts to $30.3 million in additional state education aid.

I have also allocated over $14 million to support repairs at the state’s vocational education facilities.

But the state’s responsibility to our students goes beyond K-12 schools. We must also do all we can to ensure that motivated and hardworking Rhode Islanders can attain a quality college education. And we must ensure that they can do so without taking on mounting levels of debt. The biggest barriers to these goals are ever-increasing tuition rates.

Therefore, in an effort to ensure that there is no tuition increase next year at the Community College of Rhode Island, Rhode Island College, or the University of Rhode Island, I propose an increase of $6 million for higher education.

However, the leadership of these institutions must meet me halfway. If they can achieve $6 million in total savings and efficiencies, coupled with my $6 million in additional funding, we can guarantee the students of these schools no tuition increase next year.

When you pass this budget, we will have invested $115 million in public K-12 and higher education in Rhode Island over the past three years.

It also is important to bear in mind that Rhode Islanders looking for work need to be ready not only for today’s economy, but for the economy of tomorrow. And Rhode Island employers looking to hire or expand need to have confidence that there will be qualified candidates to fill available positions. Therefore, I propose $3 million in new state support for workforce development initiatives.

I also want to applaud the good work of the Governor’s Workforce Board for all the volunteer time and effort they have given toward the betterment of our economy.

Many studies show that you can’t build a good economy without good infrastructure. Rhode Island is the second-most densely populated state and one of the most heavily traveled, all in a coastal salt air environment – and our infrastructure takes a beating. Maintenance of our roads and bridges is critical. Make no mistake: strengthening our infrastructure is an integral part of improving our economic competitiveness.

With this in mind, the budget I submit to you includes a number of strategic infrastructure investments. These have the dual benefit of strengthening our economic climate while putting Rhode Islanders back to work now. I have included a proposal to advance over $11 million in pay-as-you-go funding for already approved projects that can start immediately. This is a smart opportunity to get the trades back to work as soon as possible and improve the condition of our infrastructure.

Being more proactive about routine repairs and maintenance will also help us avoid costly replacement projects in the future. Unfortunately, we have seen a number of these in recent years, including the Sakonnet River Bridge. They have cost the taxpayers significantly and have forced hard decisions to be made. I do not want to have to rebuild another bridge because of lack of proper maintenance. This is not going to happen as long as I am Governor. We must invest in our infrastructure.

I am pleased to note that my Administration has also taken historic steps to reform how we finance our transportation system.

For the first time in memory, this past November voters did not have to approve a bond referendum to support transportation costs. We will no longer borrow to provide our state match for our federal highway dollars. This means that our valuable resources can be put toward important repair and improvement projects – not interest on the debt. Again, this is good fiscal management.

Although we didn’t bond for transportation funds, I am pleased that a number of important bond items were approved by an overwhelming majority of voters this past November. These initiatives will boost our economy by investing in some of Rhode Island’s premier assets, such as our environment, our institutions of higher education, and veterans’ services.

Thank you, Rhode Islanders, for your strong confidence in this Administration’s ability to wisely manage these projects worth over $200 million. Not only will we manage them well, we will get construction workers on the job as soon as possible.

I also want to accelerate the economic activity in Providence’s Knowledge District. To that end, I propose an additional $500,000 to enhance the operations of the 195 Redevelopment Commission. You have heard me talk before about the importance of the medical, research, and education fields – the ‘meds and eds.’ We must continue to focus on these assets to grow our economy and create jobs.

This past year saw another strong tourism season, highlighted by the return of America’s Cup racing to Newport and the Netroots Nation conference in Providence – among others.

To ensure that tourism and hospitality remain a strong sector of our economy and that we continue attracting visitors to Rhode Island, I recommend bolstering the state’s tourism marketing efforts with an additional $600,000.

As a former local official, I have worked in my time as Governor to make property tax relief a key priority of my Administration. I may sound like a broken record at this point, but in the years before I took office, cities and towns bore the brunt of the downturn in state revenues. Those most severely affected were the distressed communities that could least afford it.

I am generally skeptical of the myriad rankings and reports that place Rhode Island at the bottom of the barrel in terms of business climate. Many of them fail to take into account important factors, and many compare apples to oranges.

But here are some facts, from a report that compares apples to apples. The Department of Revenue studied the tax burden on Rhode Island businesses compared to other states.

Rhode Island ranks 26th in the burden of state taxes on businesses. We’re in the middle nationally with our sales and income taxes. In this same study, we rank 41st – near the bottom – in terms of local taxation borne by businesses. That is, the property tax.

While everyone likes to talk about onerous tax rates at the state level, the property tax is the real major barrier to economic growth – particularly on small businesses.

With that in mind, I will continue to work with the cities and towns for property tax relief.

How will we do it? On top of the $41 million in local aid contained in my previous two budgets, this year I recommend an additional $30 million for property tax relief. This is divided between $20 million in additional aid to our cities and towns – with particular attention to distressed communities – and $10 million in RICAP funds for local roads and streetscapes.

To further help our cities and towns, I also propose modifying the historic tax credit program by providing access to abandoned tax credits.

Failure to support these initiatives will only drive Rhode Island further down on the chart that matters most to our economic climate – the burden of local taxes borne by businesses. Our state as a whole cannot be successful without the financial health of our cities and towns. We’re going to continue encouraging local prosperity by supporting our municipalities.

You have heard me talk a lot tonight about Rhode Island’s economy. This is because, with a stronger economy and more Rhode Islanders working, all of our other challenges become more manageable.

But in order to do my job as Governor – for us to do our job as elected officials – we must care for the most vulnerable among us.

Each budget brings with it difficult decisions. That has been the case once again this year, as we worked to close the deficit. But it is my hope, as in years past, that if the May numbers upon which you, the General Assembly, will base your budget, come in stronger than the numbers on which I base mine, you will be able to undo some of these tough choices.

I also anticipate criticism about my decision to lower the corporate tax rate while there is a strain on social services. I would not make this recommendation if I did not truly believe that in the long run it will result in a stronger economy, more Rhode Islanders working, and fewer of our citizens in need of state support.

Our ultimate goal is always to get our people back to work and to give those who rely on social services a hand up, where possible, to financial independence. And again, hopefully May revenue numbers will provide better options.

Throughout my time in public service, whether as Mayor, United States Senator, or Governor, my whole agenda has been based on thinking not only about today, but about the long-term. I am always considering how the decisions we make today will influence Rhode Island years down the road.

We want to have a state where there are jobs and opportunities for our children and their children. They deserve to be able to stay in the state they love – a state with good roads and bridges, high-quality schools, clean water, protected open spaces, and a secure safety net.

Governing a state is not about quick gains that draw headlines. It’s about positioning Rhode Island for lasting success and prosperity.

Everyone likes accountability. And the best way to measure our progress is through tracking certain metrics.

The results indicate that we are moving steadily in the right direction.

Two years ago, when I was sworn in as Governor, Rhode Island was facing a $295 million deficit.

Our unemployment rate was 11.4%.

We had lost 40,000 jobs in the previous four years.

Many cities and towns were on the verge of collapse – most notably Central Falls.

We had sustained years of cuts to higher education and inadequate K-12 funding.

And our state workforce was demoralized.

A gloomy cloud of negativity gathered over our state.

It takes time for the sun to break through, but it is. Two years later, unemployment is heading in the right direction – still unacceptably high, but improving.

We are tackling our deficits.

Central Falls has been called a national model for emerging stronger from Chapter 9.

The Station District in Warwick is ready to realize its potential with the runway expansion and the arrival of JetBlue.

We are investing in our schools and in our students.

Things are getting better, and we must build on this momentum to continue our recovery.

I know that tomorrow the House of Representatives will be holding an economic summit. This follows an ongoing discussion that has occurred over the past year about how best to improve Rhode Island’s economy.

My hope is that you all will be skeptical and wary of deviating from the steady, methodical construction of a Rhode Island economy built for today and for the future. We tried the “get rich quick” approach by giving $75 million to a retired baseball player with zero business experience. We cannot make such panic-driven decisions again.

In addition to offering us an opportunity to look ahead, the State of the State reminds us to reflect and to learn from the year we have just completed.

Perhaps the darkest moment of the past year came just before its end. On December 14, just over one month ago, a troubled young man took the lives of 27 innocent victims – 20 elementary school students, 6 teachers and administrators, and his own mother. This tragedy happened in our neighboring state of Connecticut, in a community similar to so many in Rhode Island. It was the latest in a series of mass shootings that occurred this past year.

We should not need this reminder, but we have been given it. While respecting the rights of hunters and responsible gun owners, we could – and should – do more to prevent senseless acts of violence. That is why, in the current General Assembly session, I will join with the leaders of the House and Senate to craft, introduce, and pass legislation that makes Rhode Island a safer place both for us and our children.

Despite this horrific chapter, 2012 did have its positives. I am grateful that our state did not have the extensive damage and loss of life that Hurricane Sandy brought to other Northeastern states.

I want to thank all those who came together to get Rhode Island through the storm safely. This includes hardworking state and municipal employees, National Grid, the Red Cross and the United Way, and the many volunteers who pitched in to help their fellow Rhode Islanders.

I am also grateful to the Obama Administration for the millions of dollars in federal aid to help us recover, repair, and rebuild.

Looking ahead to our agenda for the year we have just begun, we in this room will have an opportunity to enact historic legislation. In this climate of intense economic competition, as we work to attract the best and brightest, we are currently at an economic disadvantage with our neighbors. For our economic development, for civil rights, and for basic fairness, we must extend the rights and benefits of marriage to all Rhode Islanders.

Let’s come together to pass marriage equality.

Rhode Island has a long legacy of tolerance and diversity. For centuries, new Americans have made this state strong. To uphold this legacy, in the coming weeks I will announce efforts to bring greater diversity to our state workforce.

We will also keep moving forward with the development of the Health Benefits Exchange, which will make healthcare more affordable for individuals and employers. This is an area where I am proud to say that Rhode Island continues to lead the way.

Finally, with so many Rhode Islanders returning home from foreign deployments, we will continue make it a priority to support military service members and their families – both during and after their service.

Mr. Speaker, Madam President, members of the General Assembly – my priorities are reflected in this budget. And your priorities will be demonstrated in the action you take in the coming months. The steps we have taken over the past several years, the changes we have made, are working. Rhode Island is working.

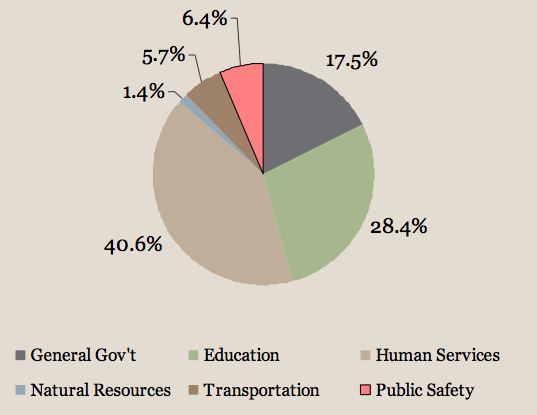

To summarize: in this budget, we are investing in education. We are investing in infrastructure. We are investing in workforce development. We are investing in our cities and towns and property tax relief.

And we’re doing it all without raising taxes or fees of any kind – and while lowering the corporate tax.

My fellow Rhode Islanders, the state of our state is steadily improving. I am eager to join with you to continue moving with purpose and vision toward our shared goal: a brighter future for our great state.

Thank you.