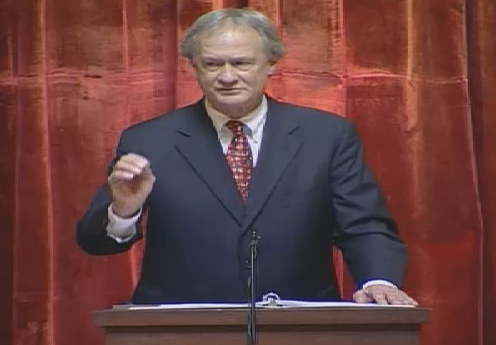

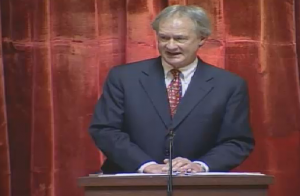

Governor Chafee gave, in my opinion, a great progressive State of the state speech last night. Here’s a the text of the speech and you can watch the video here. Here’s the Providence Journal, WPRI and the Associated Press‘ news coverage. And below is a random smattering of progressive opinions on Chafee’s speech and/or budget. Let us know what you thought of it in the comments section.

Governor Chafee gave, in my opinion, a great progressive State of the state speech last night. Here’s a the text of the speech and you can watch the video here. Here’s the Providence Journal, WPRI and the Associated Press‘ news coverage. And below is a random smattering of progressive opinions on Chafee’s speech and/or budget. Let us know what you thought of it in the comments section.

Senator Juan Pichardo:

I appreciated that the Governor opened his remarks by reflecting on some of the steps taken during his administration to benefit all Rhode Islanders, from his first action in office to rescind the e-verify executive order, to ensuring that all Rhode Island residents pay in-state tuition rates at our public colleges and university.

He also took time to recognize the 50th anniversary of the War on Poverty, and the alarming wealth disparity that exists, and acknowledged that education is the great equalizer. Governor Chafee has backed up is commitment to education with action, fully funding the education aid formula each year in office, including in the budget proposed today, and increasing support for higher education and the workforce training programs this Senate has strongly promoted.

While he has proposed many significant investments in the future of Rhode Island, I would have also liked to have seen more action to address the issue of housing in Rhode Island. The investments he proposed will help to provide stability for families and children, just as an investment in affordable housing would. That is why I will be proposing a $60 million bond for affordable housing this session.

.

Rep. Larry Valencia:

He gave a good speech, in that he looks more comfortable in his own skin.

He got to recount some of his successes, including marriage equality and the DMV fix.The budget aspects of Governor’s address was a partial relief and a partial disappointment.

First, the disappointment: As a lame duck governor, I thought there would a bold proposal or two. The proposed budget is relatively vanilla: no revenue increases, no large initiatives such as the creation of an infrastructure bank or a major overhaul of the tax code.He did mention $80 million for bridges (as a bond? I wasn’t clear on that) but our roads need help as well. He talked about $52 million for more historic tax credits, but not how he’s going to pay for that.

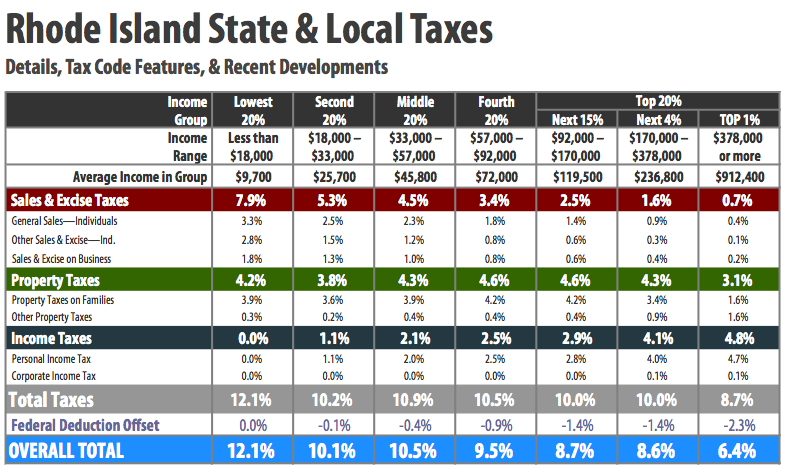

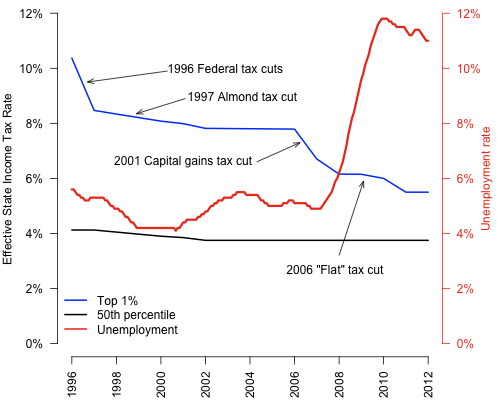

I would have liked to have seen at least one progressive revenue idea (perhaps combined reporting – Rep. Teresa Tanzi’s bill) incorporated, if not some version of the tax equity bills that Rep. Maria Cimini, Rep. Scott Guthrie and myself have submitted in the past to reduce income inequality. So with a structural deficit of $100 million to begin with, how does this come together? Will social services be cut to pay for these programs? [And] no codification of the state’s healthcare exchange.

The relief:

Continued funding of the education formula (an additional $38 million). Another $10 million for higher Ed to allow for tuition freezes at URI/RIC/CCRI. Additional $1.8M for workforce development.

.

Kristina Fox, Young Democrats of Rhode Island:

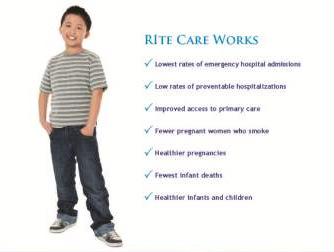

Lots of statements in Governor Chafee’s speech made me glad that we have a Democratic Governor: praising the repeal of E-Verify and the passage of marriage equality, stating clearly that climate change is happening and is caused by humans, proclaiming the need to invest in infrastructure and the arts, and touting our state healthcare exchange. I mean, you don’t hear Republican governors proclaiming that they’re “proud to be a state worker”! I’m especially happy to hear our Governor’s commitment to well funded public education both K-12 and higher ed. It goes without saying that being able to access a quality public education impacts young folks tremendously.

RI has a long road ahead before we’re back to good. As Governor Chafee said, we need more good jobs, we need more economic opportunity, and we need to work on these issues together. We can’t leave anyone behind. It’s now up to the General Assembly to take the inspiring words of tonight and turn them into solutions for tomorrow. I know that the Young Democrats will be helping out as much as we can. We also believe that our government plays a key role in helping all Rhode Islanders succeed!

.

Jim Ryczek, Rhode Island Coalition for the Homeless:

We are pleased that the Governor allocated $750,000 for rental vouchers for Rhode Islanders experiencing homelessness in his proposed FY 2015 budget. This will ensure that those who are currently being housed, due to last year’s funding by the General Assembly, will continue to maintain their housing. It is estimated that approximately 125 Rhode Islanders will move from homelessness to stable housing because of the leadership by the General Assembly in last year’s legislative session. It is encouraging that the Governor is proposing to continue that funding.

This is a positive step in the right direction to ensure full implementation of Opening Doors RI, the State’s Strategic Plan to Prevent and End Homelessness. We look forward to working with members of the General Assembly to move the state’s investment closer to the $3.4 million called for in the State’s plan.

Opening Doors RI outlines a plan that significantly transforms the provision of services to Rhode Islanders experiencing homelessness. Consistent with Opening Doors: Federal Strategic Plan to Prevent and End Homelessness, the Plan seeks to sharply decrease the numbers of people experiencing homelessness and the length of time people spend homeless.

There have been positive changes in the way we respond to homelessness in our state, as we indicated in the Opening Doors RI Report Card we released in October. Specifically, strides have been made in the areas that involve process, and the coordination of strategies to better serve Rhode Islanders experiencing homelessness.

Systems reform alone, however, cannot end homelessness. Through empirical research and evidence we know that full funding of the Plan will help the State improve its economy, realize long-term cost savings, and improve the lives of thousands of Rhode Islanders who are currently experiencing homelessness. Our state is positioned to make huge strides in addressing homelessness but at the end of the day financial investments are needed to achieve the goals in the Plan and we look forward to working with the General Assembly in the coming months on this effort.

.

Peter Hanney, Save The Bay:

Save The Bay thanks Governor Chafee for including this $75MM request in his 2014 budget. It is a big request designed to meet the state’s real need for investment in wastewater infrastructure, stormwater management, and flood prevention. Save The Bay is especially pleased to see $20MM in funding for the RI Clean Water Finance Agency to invest in wastewater and stormwater infrastructure, and $31.5MM linked to an array programs designed to restore natural buffers along our rivers coasts, expand floodplains, conserve valuable habitat and support public enjoyment of Rhode Island’s natural resources by investing in parks and recreational facilities like Rocky Point.

We thank the Governor and look forward to working with leaders and members of the General Assembly to secure passage. Save The Bay asks for the public’s support for the Bond early by letting legislators know that investing in clean water and healthy communities is important to Rhode Island.

.

Gus Uht, Rhode Island Progressive Democrats:

Gov. Chafee’s last budget proposal was an upbeat affair, containing many initiatives for improvements. While there are a number of good points about this budget (see disclaimer below), I am concerned that most additional support for the disadvantaged, if any, may come from ‘trickle-down’ mechanisms.

One good initiative is skills-training, to address RI’s “skills-gap”. FYI: there are a large number of job openings in RI, but few of the unemployed have the right qualifications (skills) to fill them, hence “skills-training.”

Exactly why companies can no longer provide on-the-job-training on their own dime is a mystery. Yes, it costs, but there’s a big payback. Maybe this is just today’s norm of short-term economic thinking. Also, if someone else will pay for it (the state), why not? Looks like a handout to industry, but it does have a large silver-lining.

What is not clear is where the budget cuts are coming from to fund the initiatives. According to Projo there are a multitude of them spread throughout the budget.

To be seen; it will take all of us a while to plow through the proposed budget, available here. (Warning: it is not exactly light-reading; the ‘Summary’ is 244 pages long.) As far as I could tell, the budget was only posted on the web during/right after the Governor’s speech.

Here’s to a good, a REALLY good, legislative session! (Hope springs eternal.)

[Disclaimer: the top bond issue proposed is to raze and rebuild most of the College of Engineering at URI. I’m on the faculty of the College. (Believe me, the College plant needs rebuilding.)]

In my

In my