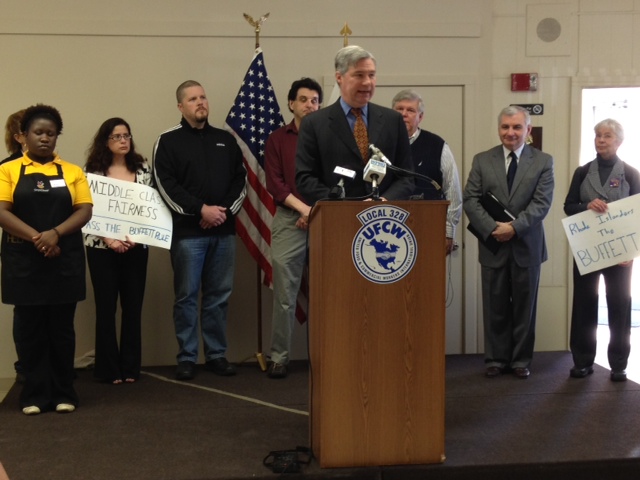

I was at the hearing at House Finance last night, talking about tax cuts for rich people. The remarkable thing about all the tax cuts we’ve given over the past 16 years is not that we’ve given them, but how we’ve paid for them.

I was at the hearing at House Finance last night, talking about tax cuts for rich people. The remarkable thing about all the tax cuts we’ve given over the past 16 years is not that we’ve given them, but how we’ve paid for them.

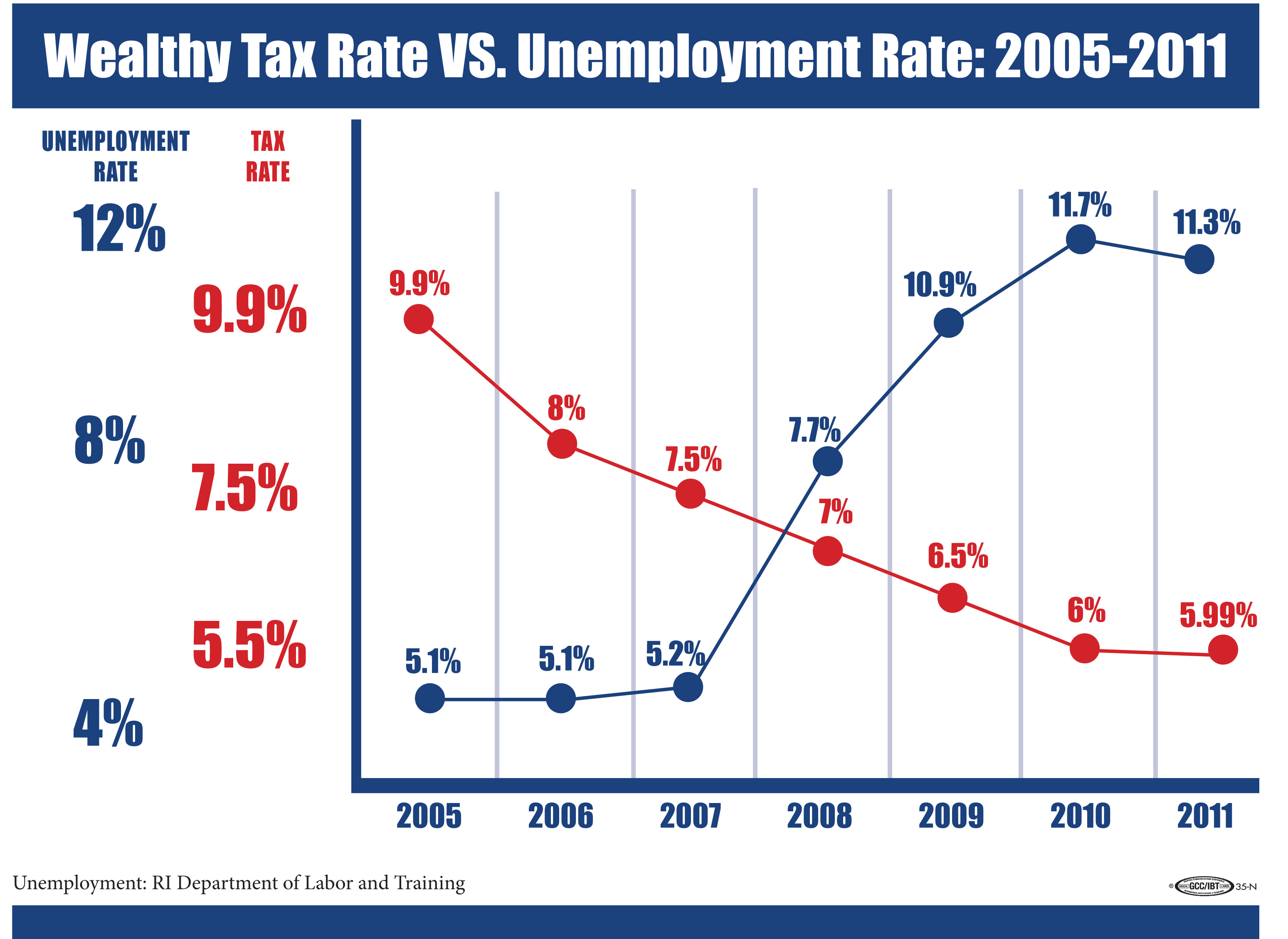

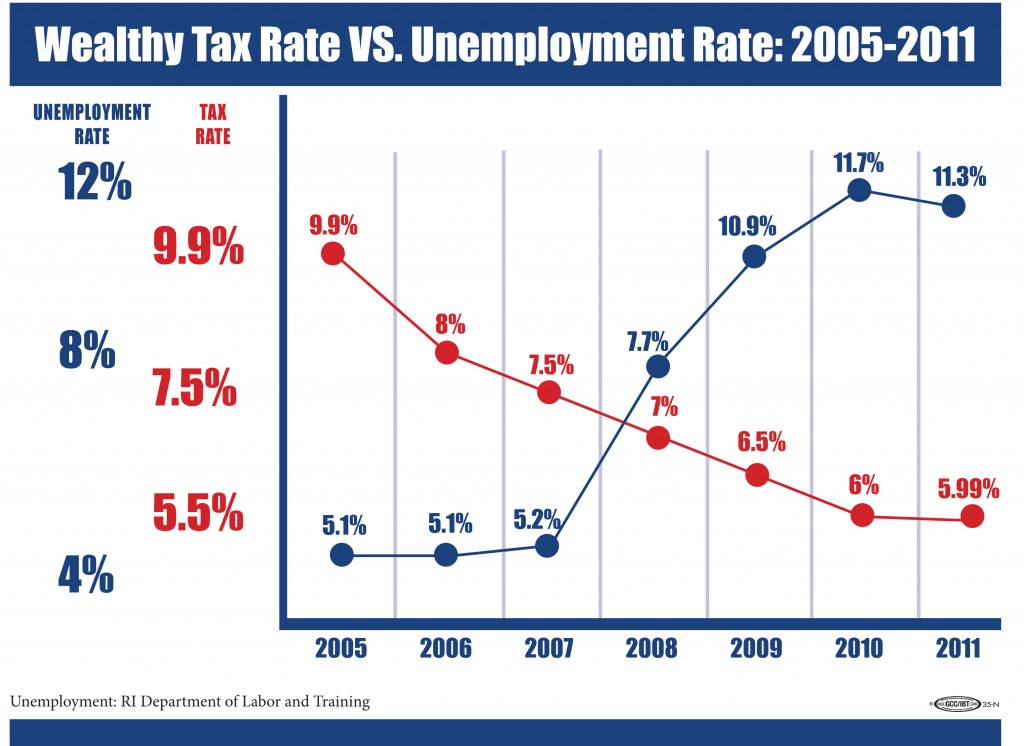

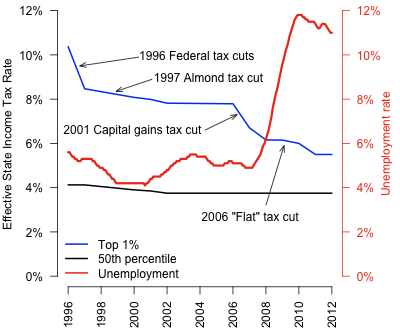

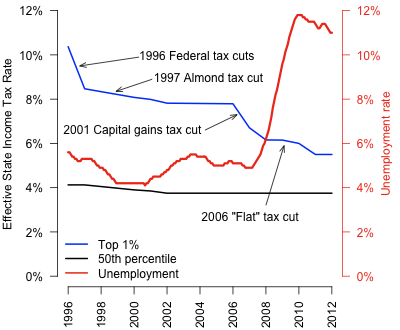

As we saw in the last installment, the story of the past 16 years has been relentless cuts in state income taxes on the top 1% of taxpayers. The cuts have come in several different forms, but the result has been the same: dramatically lower taxes on the top end, much smaller changes for everyone else.

That’s bad enough, but the real tragedy of the tax cutting of the past 16 years is that not a single one of the tax cuts passed by the General Assembly was paid for. The income tax cut of 1997, the car tax cut of the same year, the capital gains tax cut of 2001, and the flat tax cut of 2006 were all “phased in” to avoid having to make the tough decisions people are always talking about.

But the reduced state revenue had to be made up somehow. How did we do it? Over that time, we haven’t cut any major programs. So does this mean that government was too fat? Do we owe a debt of gratitude to the Almond and Carcieri administrations for finally starving the beast down to an affordable size? I’d like to share with you my observations of the five different ways to cut a budget, only the first of which has any claim to being a hard choice:

- Terminate a program or benefit.

- Supply a program or benefit in a more efficient fashion.

- Supply a program or benefit in a shoddier fashion.

- Borrow to hide the shortfall.

- Foist the cost onto somebody with another source of income.

In my review of state budget cuts over the past decade, I find very few examples of the first method, though there are some. Certainly the Medicaid program is somewhat less generous than it was a decade ago. We cut services for legal immigrant children and pregnant women, for example. But how many other examples are there? I don’t support Governor Chafee’s proposal to terminate funding of WSBE television, but I applaud him for having the temerity to actually propose ending a fairly popular program.

For the second method, there are a few good examples. The recent reorganization at DMV might qualify. Though it also required some new personnel, they are now providing better service with not too many more people. DOT’s proposal to get designs and buildings from the same contractor has promise in this regard, and the construction of the new train station in Wickford seems to have turned out well.

Unfortunately, too many of these border on examples of the third category: just doing a shoddier job. The General Assembly has, over the years, been not at all deferential to the judgment of department heads and experts about what is actually possible within the budget constraints presented, with disaster or shoddy service frequently resulting. The transfer of 17-year-olds from the Training School to the ACI a few years ago is an example, and last year’s cut to BHDDH funding is another. A couple of years ago, delays in food stamp processing were so great that the state lost a class-action suit on the issue.

The Department of Transportation’s shameful neglect of maintenance is still another example. Seventeen homes and four businesses in Tiverton are gone today because DOT didn’t maintain the Sakonnet Bridge adequately and they were in the way of the replacement bridge. Nor are they alone in their neglect of maintenance, as any visit to a state facility will attest. A few years ago, URI estimated the cost of deferred maintenance on their campus to be over $400 million, not so much less than a year’s budget.

Category four is excessive borrowing, and DOT has been a prime offender in the category, and so have the colleges, creating fancy new buildings while cutting back on the staff and projects that should be filling them. Governor Chafee has proposed cutting back the DOT borrowing.

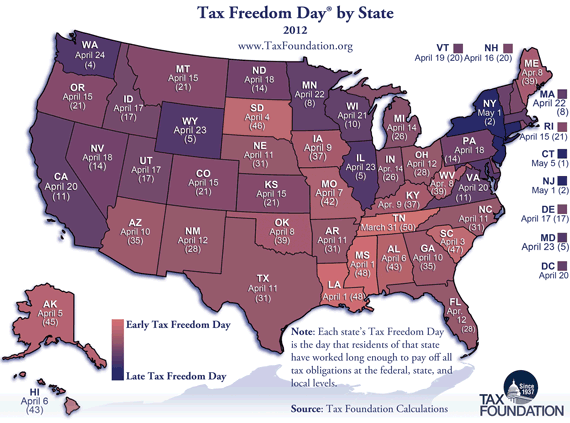

It’s probably the fifth category that has seen the most exercise. In the drive to cut taxes on rich people, the state has cut funding to: municipal governments and school departments who have to make it up with property taxes; to colleges who have to make it up with tuitions; to Medicaid recipients who have to make it up with co-pays; to everyone who fishes, drives, or runs a hospital who have to make it up with increased license fees, and to many more. We’ve even taken it from prisoners, for heaven’s sake, with parole fees, home confinement fees and medical co-pays. Property tax payers, students, poor people, and prisoners have paid for the tax cuts of the last 16 years.

One important point about these categories, is that numbers three and four are only the illusion of cutting costs, and generally make things more expensive in the long run. And number five doesn’t cut costs at all, either. If you want an explanation of why government in Rhode Island is expensive, look here.

Let’s be clear: courage is not foisting costs off onto others, nor is it insisting the state do its job badly. It is not borrowing to hide shortfalls or pushing costs into the next year. Calling for efficiency is laudable, but it is not courage, either. (Nor should it be confused with actually finding efficiencies.)

Courage means honesty. It means assessing with honesty our past policies, and not hiding behind some claim that we have to wait and see the effect of tax cuts we’ve been waiting for over a decade to see. It means honestly assessing claims that rose petals will fall from the sky if only we can avoid asking rich people to pay their fair share. It means honestly assessing what our state needs to do and finding a fair way to raise all the revenue with which to do it. Honesty is hard, the reason it’s equivalent to courage.

So listen skeptically when you hear someone — a member of the legislature, an anti-tax activist, or a friend — talking about making those tough choices. Are they talking about categories two through five? Those aren’t tough, so don’t let them hide there.

It’s hard to keep up with all the recent revelations in the struggle over pension reform in Providence but unions there would do well to recall Bob Flander’s now-famous advice of a haircut being better than a beheading. Let’s assume labor is right when it assumes a judge would invalidate the proposed (though possibly morphing) reform bill – even though the city need only to prove that breaking the contract constitutes a financial emergency, which seems a pretty easy burden for it to meet at this point – if that happens the city goes bankrupt, then employees and retirees would likely lose even more.

It’s hard to keep up with all the recent revelations in the struggle over pension reform in Providence but unions there would do well to recall Bob Flander’s now-famous advice of a haircut being better than a beheading. Let’s assume labor is right when it assumes a judge would invalidate the proposed (though possibly morphing) reform bill – even though the city need only to prove that breaking the contract constitutes a financial emergency, which seems a pretty easy burden for it to meet at this point – if that happens the city goes bankrupt, then employees and retirees would likely lose even more.

There is room at every election for new voices – including the ideas of former communists and those of

There is room at every election for new voices – including the ideas of former communists and those of