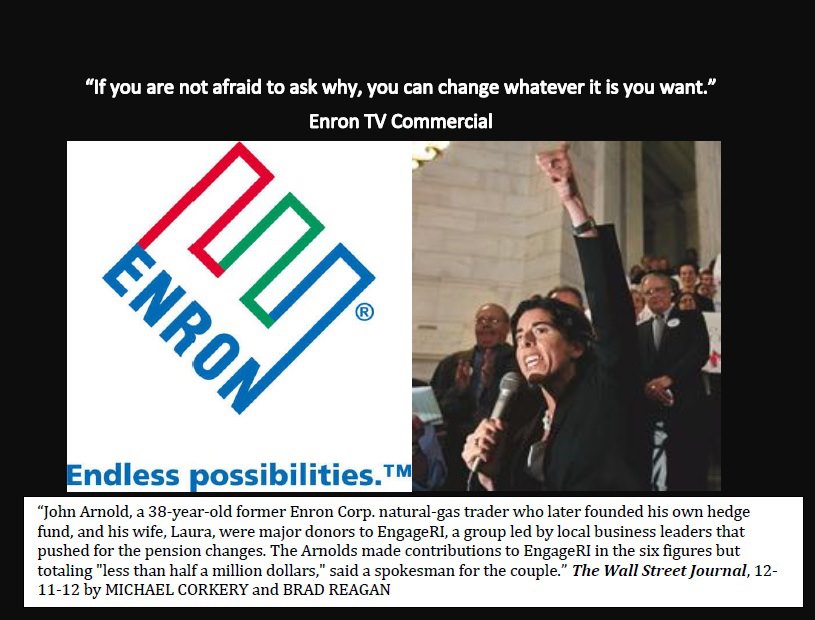

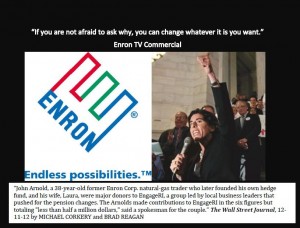

A new report singles out Rhode Island for favoring pension cuts over eliminating tax expenditures. It also suggests John Arnold, the former Enron investor who largely bankrolled Engage RI, and the Pew Charitable Trust, the supposedly non-partisan organization the General Assembly and Gina Raimondo had explain pension math and actuarial science to elected officials and members of the public and press, are working together to convince governments to transfer wealth from pensioners to Wall Street.

A new report singles out Rhode Island for favoring pension cuts over eliminating tax expenditures. It also suggests John Arnold, the former Enron investor who largely bankrolled Engage RI, and the Pew Charitable Trust, the supposedly non-partisan organization the General Assembly and Gina Raimondo had explain pension math and actuarial science to elected officials and members of the public and press, are working together to convince governments to transfer wealth from pensioners to Wall Street.

David Sirota wrote a report for the liberal think tank Institute for America’s Future called “The Plot Against Pensions: The Pew-Arnold campaign to undermine America’s retirement security – and leave taxpayers with the bill.” You can also read his synopsis published earlier this week here.

“Pew’s Public Sector Retirement Systems Project and the Laura and John Arnold Foundation are working in tandem on public pension policy to manufacture the perception of crisis and press for cuts to guaranteed retirement income,” the report says. It largely echoes the perspective exposed by Matt Taibbi and Ted Seidle – that pension cuts were driven by Wall Street interests – Governing magazine offers a somewhat favorable analysis of the report.

Sirota also adds to the debate the allegation that Arnold and the Pew Center are working together. This is significant to Rhode Island because both Arnold and the Pew Center were central players in Rhode Island’s pension legislation. Arnold funded the Engage RI, a 501c4 that refused to name its donors and spent millions lobbying for pension cuts. The Pew Center was brought in by the General Assembly and Gina Raimondo in a non-partisan capacity to educate law makers and the public.

According to Sirota:

…at the same time one branch of Pew was rightly sounding this moderate non-ideological alarm to shore up retirement security, and Pew’s Economic Development Tax Incentives Project was warning of states’ wasteful tax subsidies, a more political branch of the organization was working in tandem with controversial Enron billionaire John Arnold to begin championing an ideologically driven plan to make the retirement problem far worse.

This Pew-Arnold partnership began informally in 2011 and 2012 when both organizations marshaled resources to try to set the stage for retirement benefit cuts in California, Florida, Rhode Island and Kansas. With legislative success in three of those four states, Pew and Arnold created a formal partnership in late 2012 that targeted another three states, Arizona, Kentucky and Montana. This formal partnership continues today, with the organizations issuing joint reports and conducting joint legislative briefings advocating cuts to guaranteed retirement income.

Sirota also alleges that pension cuts served a political interest beyond just pension politics. He writes that pension cuts are being offered up to distract emphasis from tax expenditures, or tax breaks generally given to powerful companies and other corporate interests.

The goals of the plot against pensions are both straightforward and deceptive. On the surface, the primary objective is to convert traditional defined-benefit pension funds that guarantee retirement income into riskier, costlier schemes that reduce benefits and income guarantees, and subject taxpayers and millions of workers’ retirement funds to Enron’s casino-style economics.At the same time, waging a high-profile fight for such an objective also simultaneously helps achieve the conservative movement’s larger goal of protecting profligate corporate subsidies.Perhaps the most famous illustration of the pervasiveness of this deceptive argument comes from Detroit, Michigan. When the city recently declared bankruptcy, much of the media and political narrative around the fiasco simply assumed that public pension liabilities are the problem. Few noted that both Detroit and the state of Michigan have for years been spending hundreds of millions of dollars on wasteful corporate subsidies.

But as outrageous as the blame-the-pensioners mythology from Detroit is, it is the same misleading mythology that is now driving public policy in states across America. In Rhode Island, the state government slashed guaranteed pension benefits while handing $75 million to a retired professional baseball player for his failed video game scheme.

The report contains a special section on Rhode Island, and how it ignored tax expenditures while focusing on pension cuts.

Though Rhode Island faces a $7 billion pension shortfall over 30 years, that’s nothing compared to what it gives away to corporations and the wealthy.As The New York Times reports, the state spends $300 million in annual tax expenditures – or more than $9 billion over 30 years. Those include the infamous expenditure that gave Boston Red Sox pitcher Curt Schilling a whopping $75 million worth of taxpayer monies to finance his failed video game scheme.Additionally, Rhode Island’s tax system is famously regressive, allowing the wealthiest 1 percent of its population to pay a tax rate half that of the poorest 20 percent. So the state clearly has plenty of ways to reform tax rates and end subsidies as a way to raise the revenue it owes to its public pension funds.