What’s the purpose of investing in a hedge fund? Because “hedge fund manager” is almost synonymous with “fabulously wealthy” in the popular press, lots of people think hedge funds are all about high risk and high returns.

What’s the purpose of investing in a hedge fund? Because “hedge fund manager” is almost synonymous with “fabulously wealthy” in the popular press, lots of people think hedge funds are all about high risk and high returns.

Originally, though, hedge funds were thought to provide high returns simply by being consistent, if dull. The idea was that by “hedging” risk with investments whose value fluctuates independently from one another, a good manager could deliver solid but unspectacular results, but do so year after year.

Since the origination of these funds, more than 40 years ago, the industry has transformed from a handful of conservative investor funds in a relative backwater of the investor world to include funds that follow a much wider variety of strategies, and have trillions of dollars under management. In the process, the meaning of the term has changes, and these days, it just means any unregulated investment fund.

What’s that? Unregulated? Well, yes. The SEC, which regulates lots of other Wall Street activity, doesn’t have much to say about hedge funds, except that you have to be a “accredited investor” to invest in one. Essentially this just means you have to be rich enough.

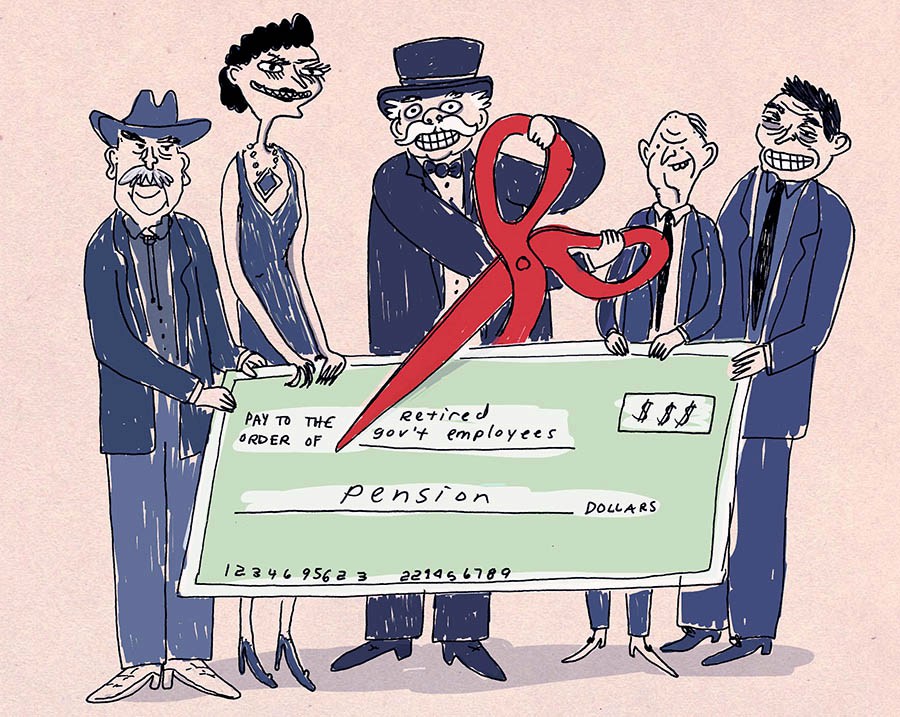

A mutual fund, open to anyone with a dollar, is regulated by the SEC, and is subject to various kinds of disclosure and reporting requirements. Hedge funds, by contrast, only give their clients (usually referred to as fund “partners”, which sounds chummy, doesn’t it?) the information they want to release. If they want to tell you what their returns were, they can. If they don’t, that’s your problem.

Fees are high, too. Where a mutual fund might charge a service charge of one percent or less to its customers’ accounts each year, the standard in the hedge fund industry is 2%, plus a 20% share of any investment gains. Naturally, they do not share in any losses.

Lack of information and high fees? Such a deal. The reason customers put up with this kind of abuse is the promise of high returns. That’s what makes it so shocking that over the past 20 years, most investors would have made substantially more money by investing in low-interest US government bonds. (This is not just a matter of the 2008-2009 downturn, though that plays a role.)

That’s the message of Simon Lack, whose book, “Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good To Be True“, describes his experiences in the hedge fund industry. Lack, a trader at JP Morgan, spent several years investing in hedge funds on behalf of the bank.

JP Morgan did its part to foster the recent flourishing of the hedge fund industry because in the 1990’s, astute traders there noticed the contrast between the weak returns of the industry and the wealth of the managers. The contrast led them to wonder whether they should try investing in a different way. Lack helped start their Capital Market Investment Program, which provided seed money to fledgling funds in exchange for a share of the fees as well as the investment returns. With one foot on the management side of the business and the other with the customers, Lack has a unique perspective on the business.

What he learned was this: The fabulous wealth of hedge fund managers serves as the best possible marketing tool for hedge funds. Look at me, the private jets and penthouse apartments say. I am successful and if you invest with me, you can be too. But he also asked this: where are the hedge fund investors who have become fabulously rich by trusting their money to such managers? And he’s still looking for them.

In his book, Lack points out that a manager can make money when the fund makes money, but that many managers make even more money when a fund’s early good returns inspire lots more people to invest in it. Taking a couple of percent off the flood of new money each year can be much more profitable than hoping for a fraction of the investment gains, and if the fund grows quickly, your wealth can, too, no matter what the returns. The incentives aren’t to nurture your customers money and make it grow, but to expand the business and bring in lots of new money.

What’s more, for a variety of reasons that Lack described, a fund’s growth usually decreases the rate of its returns. A large fund is somewhat more cumbersome and profitable opportunities are not always to scale. So you have managers becoming absurdly wealthy while overseeing a fund whose growth serves their interests, but not those of their customers.

Lack also puzzles over the problem of reporting investment gains. A fund will naturally report its gains in the most flattering light possible. What you might not realize is how much latitude there is for telling the story a fund manager wants you to hear. When reporting returns, a fund might report the growth of the investment pool. But the investment pool can grow both by getting new customers and by investment gains, so that’s not what will be experienced by any individual investor. Plus the shares of a hedge fund can be very challenging to value, and there’s a certain arbitrary nature to any answer to this question.

If a hedge fund invests in bonds, for example, do you value bonds at the price at which they were bought, or the price at which they can be sold? These prices are different at the very moment the bonds are bought, so we’re not talking about market movements, just about the difference between a bid price and and ask price. Depending on which price the fund manager chooses to use to value the portfolio, it will affect the calculation of the fund returns, though the actual amount of money won’t change.

Furthermore, a customer’s shares might be “worth” some specified net asset value, but they might not be redeemable at that value, due to redemption limitations, withdrawal fees, or some other clause in the “partnership” contract. As I’m sure you can imagine, this is just the beginning of the confusion. The point is that when you buy shares in a hedge fund, you are putting a great deal of trust in the management of that fund, and the management holds all the information in the relationship, and has incentives that are not perfectly aligned with yours. Does that sound like a recipe for success?

Read part II.

Candidate for Treasurer Seth Magaziner says that he has a history of standing up to big Wall Street firms, highlighting his work as the author of a shareholder proposal to break up Citigroup. He has worked at Trillium Asset Management, a socially responsible investment firm, for the last four years.

Candidate for Treasurer Seth Magaziner says that he has a history of standing up to big Wall Street firms, highlighting his work as the author of a shareholder proposal to break up Citigroup. He has worked at Trillium Asset Management, a socially responsible investment firm, for the last four years.